This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 5500-EZ

for the current year.

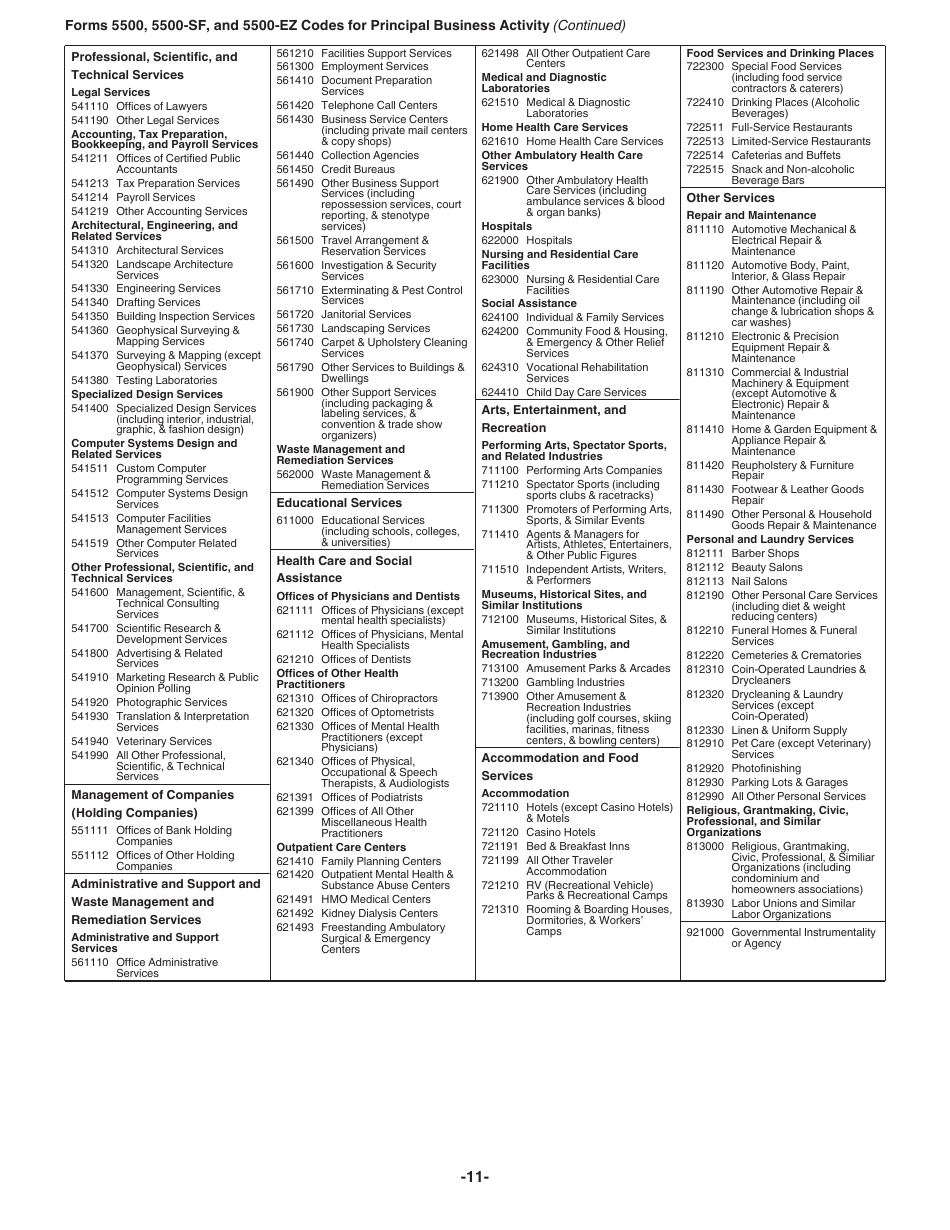

Instructions for IRS Form 5500-EZ Annual Return of a One-Participant (Owners / Partners and Their Spouses) Retirement Plan or a Foreign Plan

This document contains official instructions for IRS Form 5500-EZ , Annual Return of a One-Participant (Owners/Partners and Their Spouses) Retirement Plan or a Foreign Plan - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 5500-EZ is available for download through this link.

FAQ

Q: What is Form 5500-EZ?

A: Form 5500-EZ is an annual return form for one-participant retirement plans or foreign plans.

Q: Who needs to file Form 5500-EZ?

A: Owners/partners and their spouses of one-participant retirement plans or foreign plans need to file Form 5500-EZ.

Q: What information is required on Form 5500-EZ?

A: Form 5500-EZ requires information about the plan, its sponsors, contributions, and benefits.

Q: When is the deadline to file Form 5500-EZ?

A: The deadline to file Form 5500-EZ is the last day of the seventh month after the plan year ends.

Instruction Details:

- This 11-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.