This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 3115

for the current year.

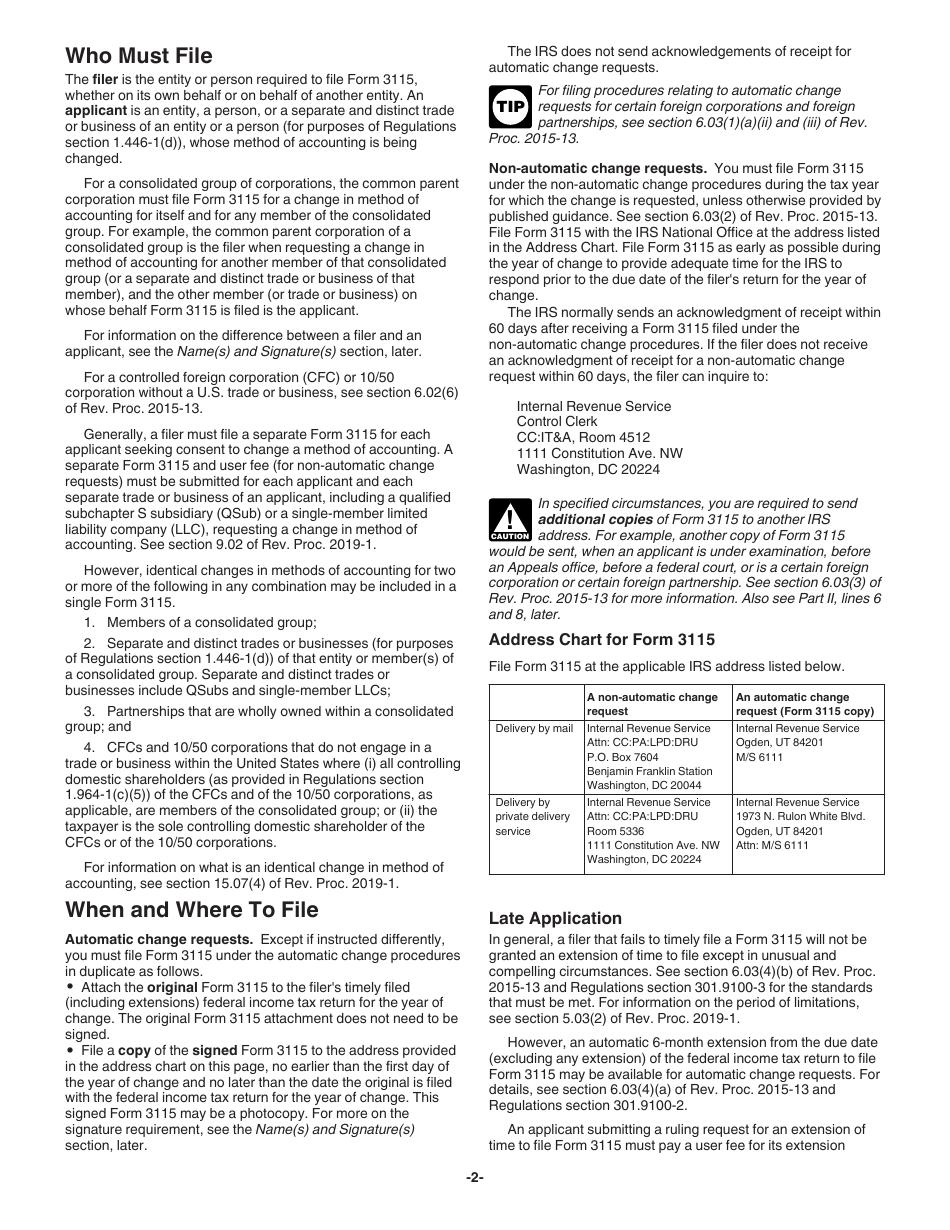

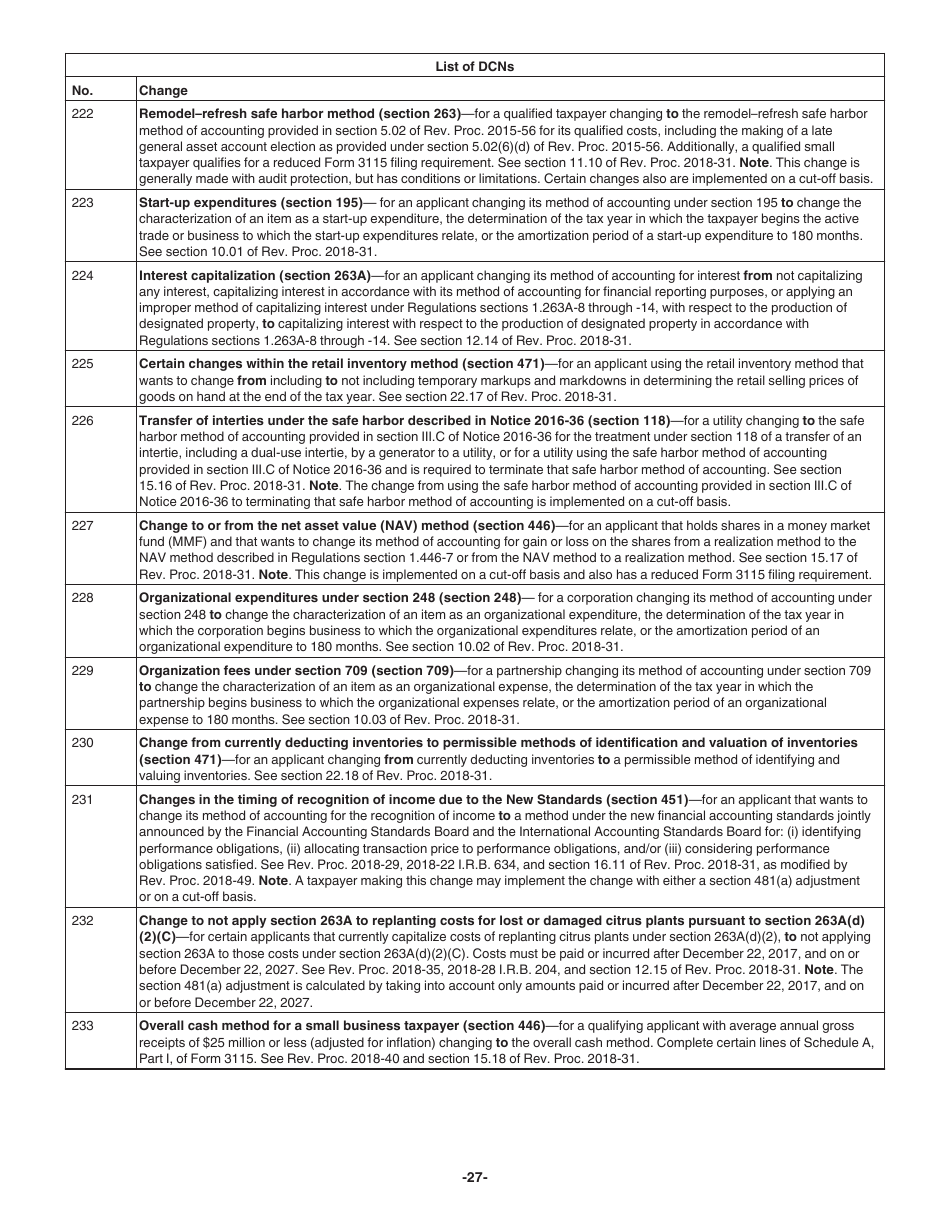

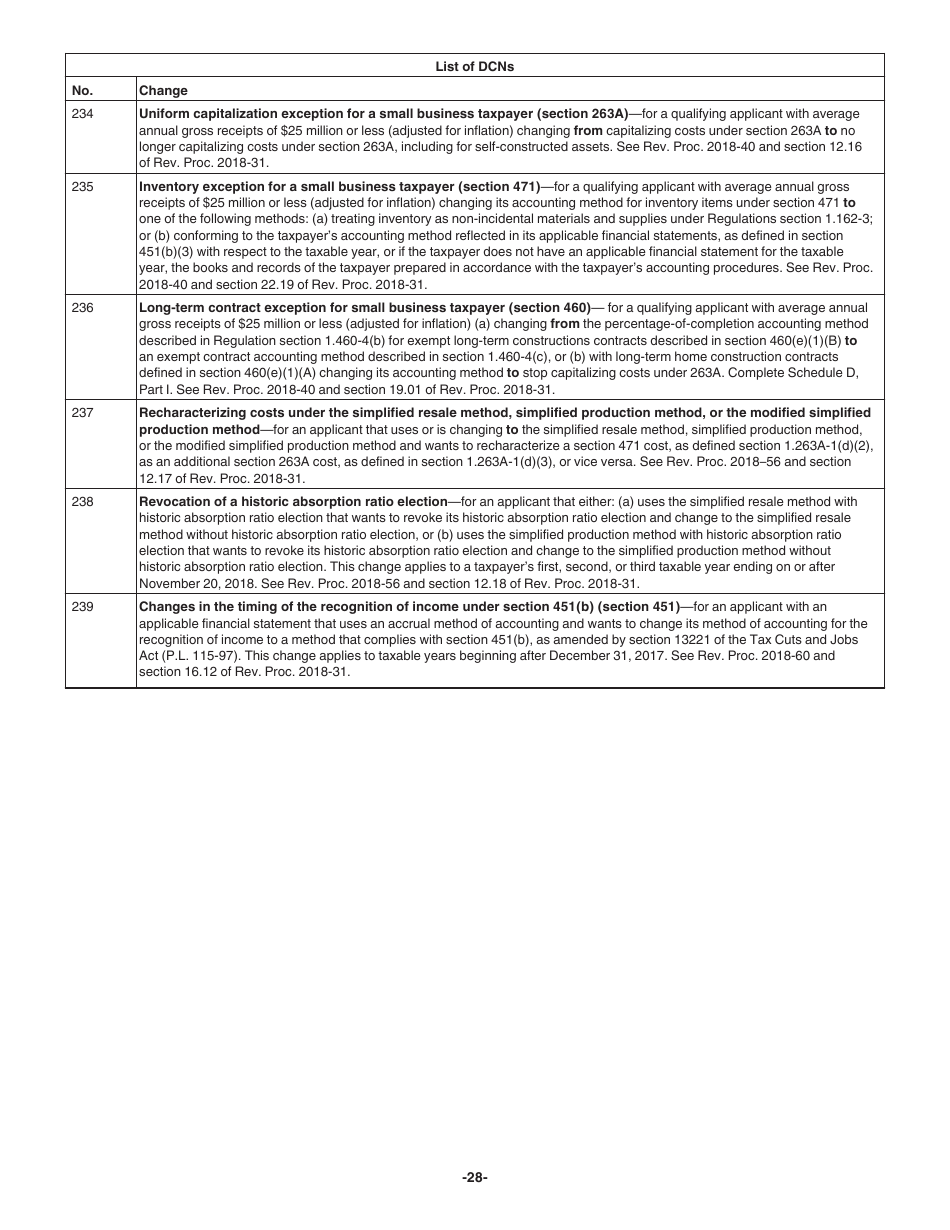

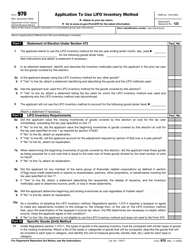

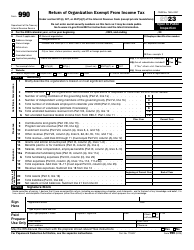

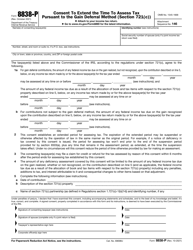

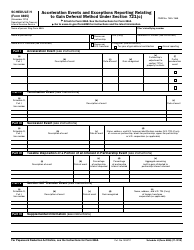

Instructions for IRS Form 3115 Application for Change in Accounting Method

This document contains official instructions for IRS Form 3115 , Application for Change in Accounting Method - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 3115 is available for download through this link.

FAQ

Q: What is IRS Form 3115?

A: IRS Form 3115 is an application for a change in accounting method.

Q: When should I use IRS Form 3115?

A: You should use IRS Form 3115 when you want to change the way you account for income, expenses, or other items on your tax return.

Q: How do I file IRS Form 3115?

A: You can file IRS Form 3115 by mail or electronically through the Modernized e-File (MeF) system.

Q: What information is required on IRS Form 3115?

A: IRS Form 3115 requires information about your business, details of the accounting method change, and the reason for the change.

Q: Are there any fees associated with filing IRS Form 3115?

A: Yes, there is a user fee associated with filing IRS Form 3115. The fee amount varies depending on the taxpayer's average annual gross receipts.

Q: Can I e-file IRS Form 3115?

A: Yes, you can e-file IRS Form 3115 using the Modernized e-File (MeF) system.

Q: Is it necessary to attach any supporting documents with IRS Form 3115?

A: Yes, you are required to attach certain supporting documents with IRS Form 3115, such as a description of the accounting method being changed and a statement of the adjustment resulting from the change.

Q: What happens after I file IRS Form 3115?

A: After you file IRS Form 3115, the IRS will review your application and may request additional information or clarification.

Q: Can I appeal the IRS's decision on my IRS Form 3115 application?

A: Yes, if the IRS denies your application for a change in accounting method, you have the right to appeal the decision.

Instruction Details:

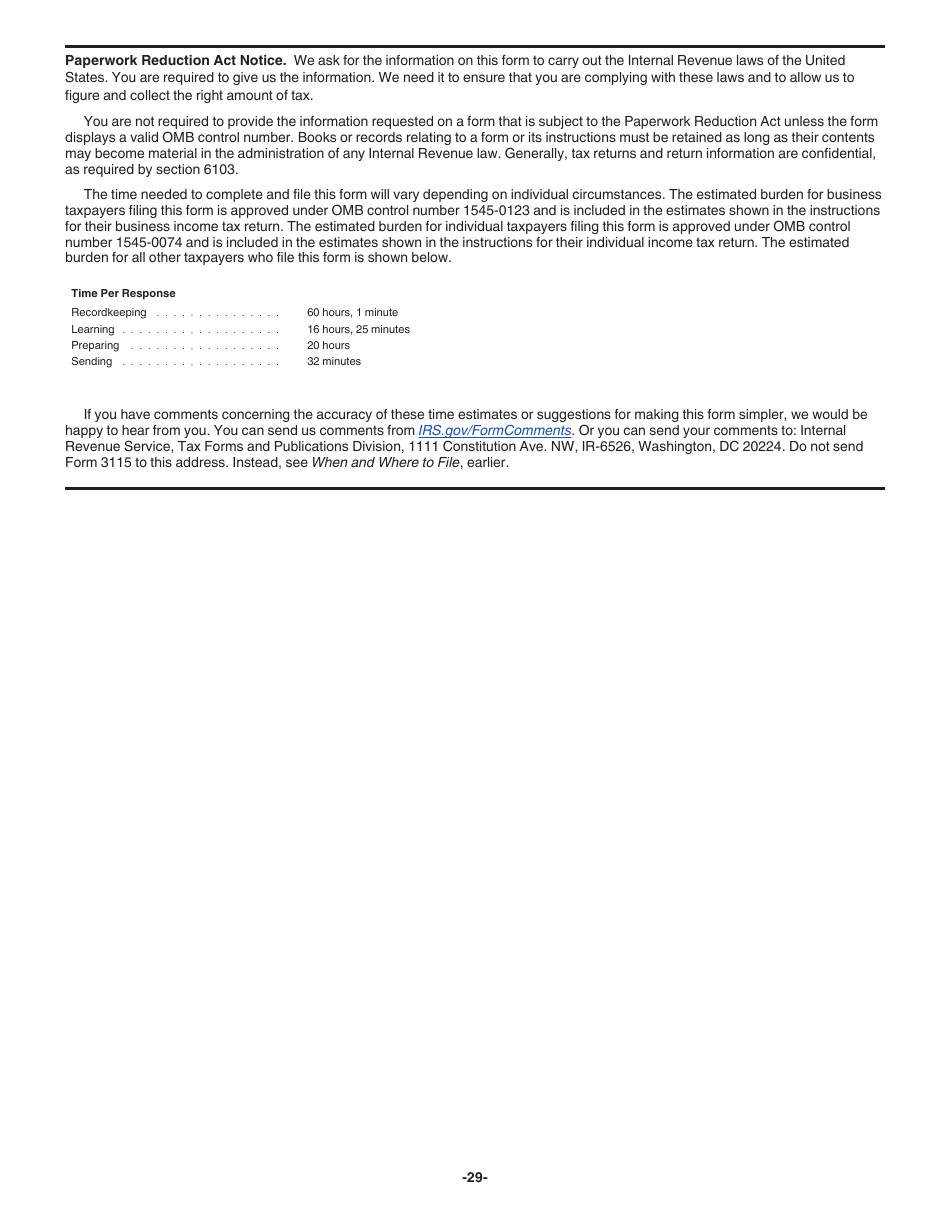

- This 29-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.