This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 5695

for the current year.

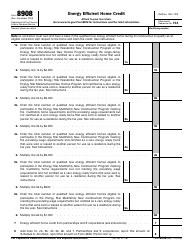

Instructions for IRS Form 5695 Residential Energy Credit

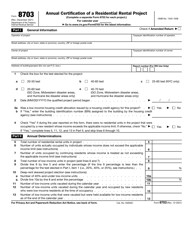

This document contains official instructions for IRS Form 5695 , Residential Energy Credit - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 5695 is available for download through this link.

FAQ

Q: What is IRS Form 5695?

A: IRS Form 5695 is a tax form used to claim the Residential Energy Credit.

Q: What is the Residential Energy Credit?

A: The Residential Energy Credit is a tax credit provided by the IRS for certain energy-efficient improvements made to a taxpayer's home.

Q: Who is eligible to claim the Residential Energy Credit?

A: Homeowners who have made qualified energy-efficient improvements to their main home are eligible to claim the Residential Energy Credit.

Q: What are qualified energy-efficient improvements?

A: Qualified energy-efficient improvements include the installation of certain energy-saving equipment or systems, such as solar panels or energy-efficient windows.

Q: How much is the Residential Energy Credit?

A: The Residential Energy Credit is a non-refundable credit that can be for up to 30% of the cost of the qualified energy-efficient improvements, subject to certain limits.

Q: How do I claim the Residential Energy Credit?

A: To claim the Residential Energy Credit, you must complete and attach IRS Form 5695 to your federal tax return.

Q: What documentation do I need to support my claim for the Residential Energy Credit?

A: You should keep records of your energy-efficient improvements, including receipts, to support your claim for the Residential Energy Credit.

Q: Is there a deadline for claiming the Residential Energy Credit?

A: Yes, you must claim the Residential Energy Credit on your federal tax return for the tax year in which the improvements were made.

Q: Can I claim the Residential Energy Credit for rental properties?

A: No, the Residential Energy Credit is only available for improvements made to your main home, not rental properties.

Instruction Details:

- This 3-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.