This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 5329

for the current year.

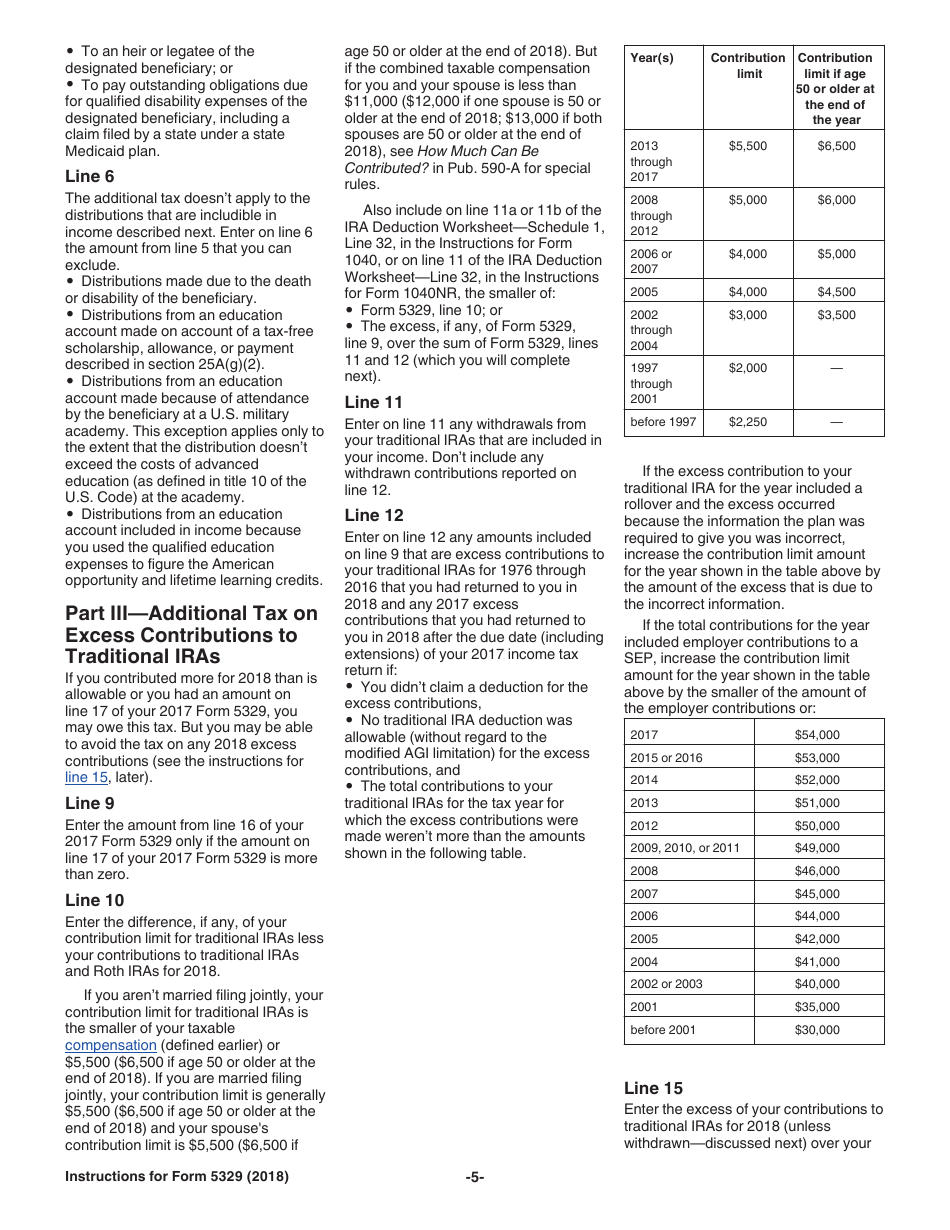

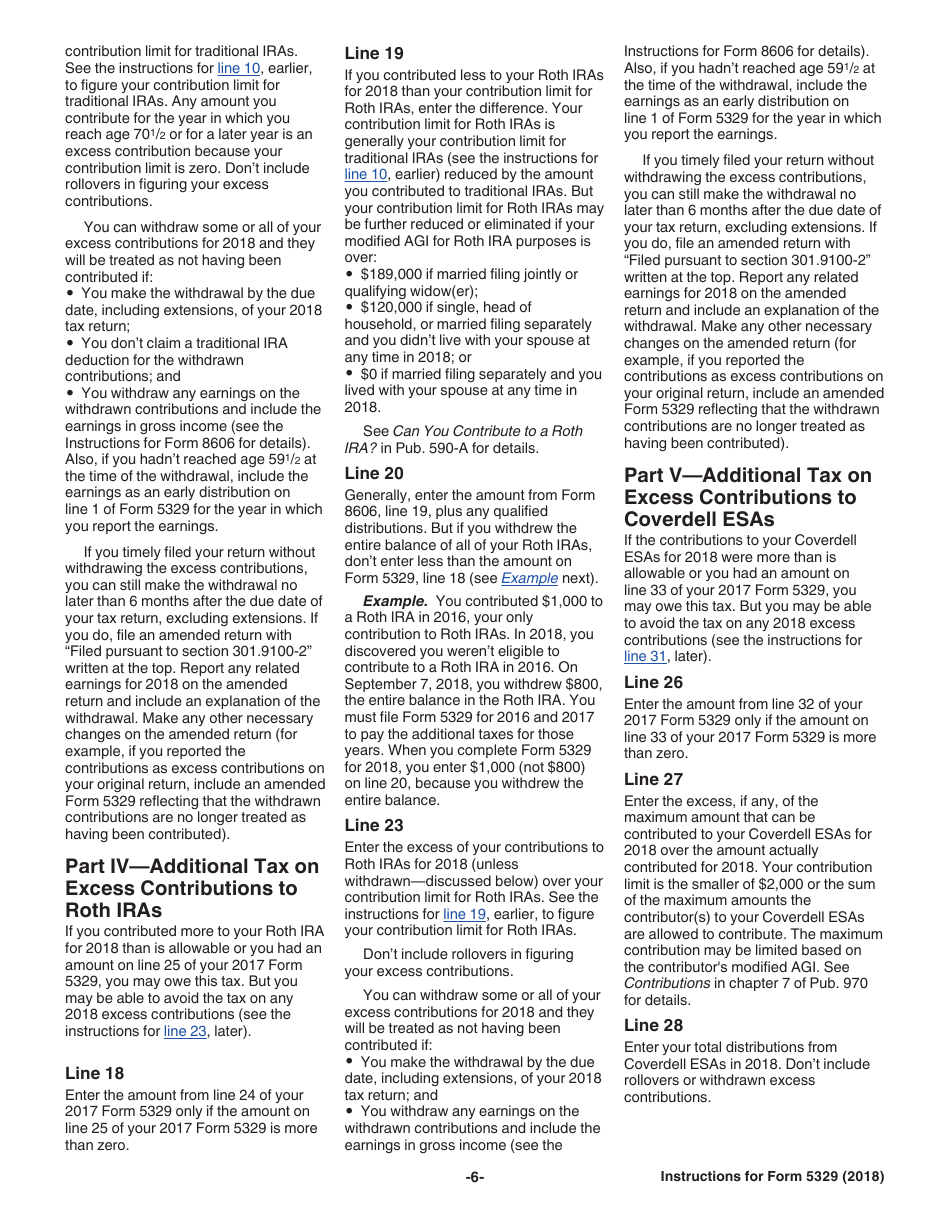

Instructions for IRS Form 5329 Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts

This document contains official instructions for IRS Form 5329 , Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 5329 is available for download through this link.

FAQ

Q: What is IRS Form 5329?

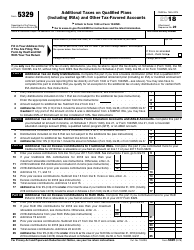

A: IRS Form 5329 is a form used to report additional taxes on qualified plans (including IRAs) and other tax-favored accounts.

Q: Why would I need to use IRS Form 5329?

A: You would need to use IRS Form 5329 to report and pay any additional taxes or penalties associated with your qualified plans or tax-favored accounts.

Q: What are qualified plans and tax-favored accounts?

A: Qualified plans and tax-favored accounts include traditional IRAs, Roth IRAs, 401(k) plans, 403(b) plans, and other similar retirement savings accounts.

Q: What additional taxes or penalties may I need to report on IRS Form 5329?

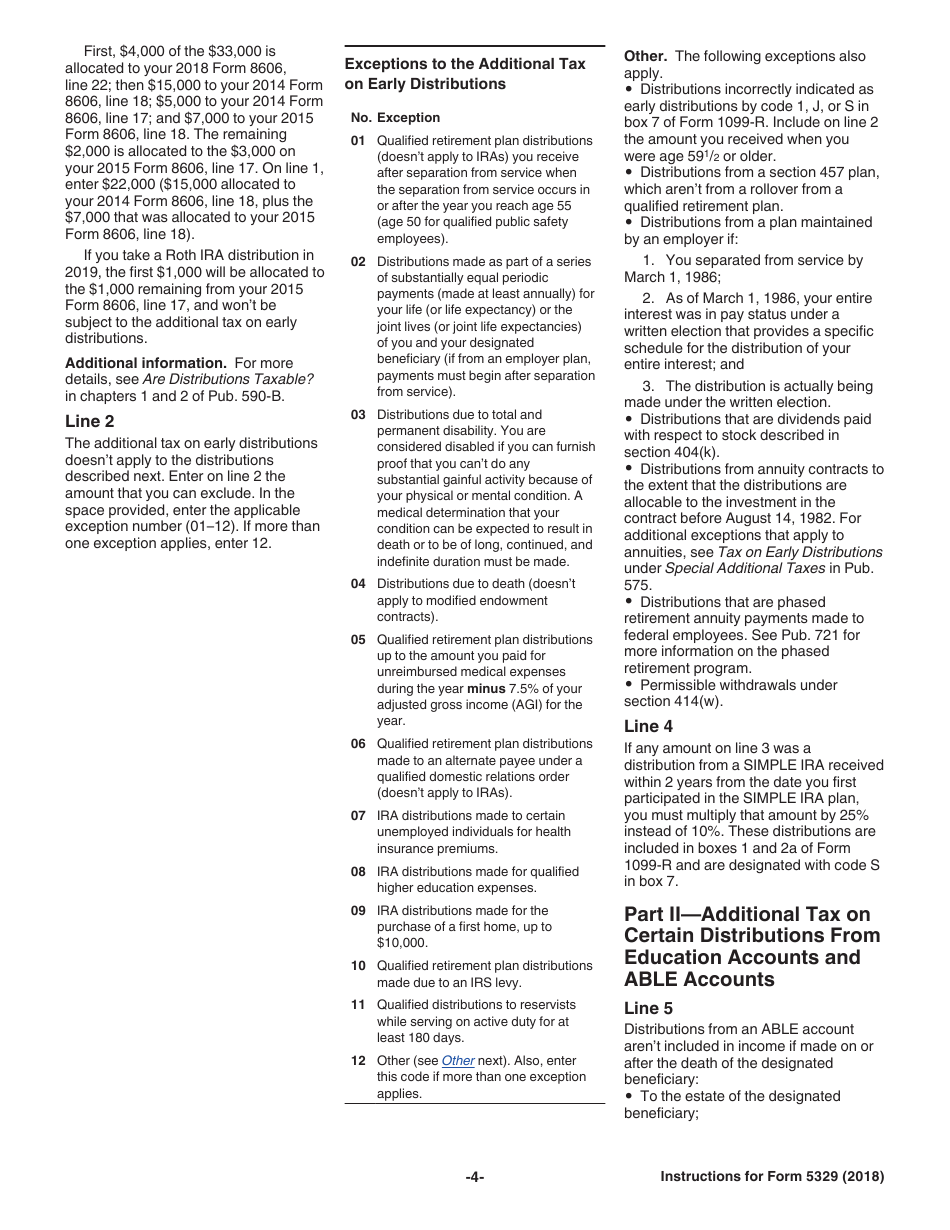

A: You may need to report additional taxes or penalties for things like early distributions from your retirement accounts, excess contributions, or failure to take required minimum distributions.

Q: How do I fill out IRS Form 5329?

A: You will need to provide information about the type of tax or penalty you are reporting, the amount, and any applicable exceptions or waivers.

Q: When is the deadline to file IRS Form 5329?

A: The deadline to file IRS Form 5329 is generally the same as your federal income tax return deadline, which is usually April 15th.

Instruction Details:

- This 9-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.