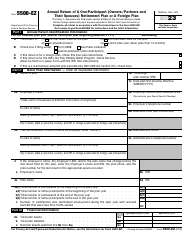

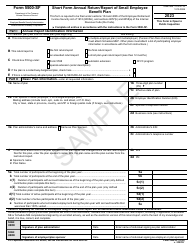

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 3520

for the current year.

Instructions for IRS Form 3520 Annual Return to Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts

This document contains official instructions for IRS Form 3520 , Annual Return to Foreign Trusts and Receipt of Certain Foreign Gifts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 3520 is available for download through this link.

FAQ

Q: What is IRS Form 3520?

A: IRS Form 3520 is an annual return used to report transactions with foreign trusts and receipt of certain foreign gifts.

Q: Who needs to file IRS Form 3520?

A: US taxpayers who have received certain foreign gifts or have transactions with foreign trusts need to file IRS Form 3520.

Q: What are foreign trusts?

A: Foreign trusts are legal entitiesset up outside of the United States that are used for various financial purposes.

Q: What type of transactions with foreign trusts need to be reported on IRS Form 3520?

A: Transactions such as creation of a foreign trust, contributions to a foreign trust, and distributions from a foreign trust need to be reported on IRS Form 3520.

Q: What type of foreign gifts need to be reported on IRS Form 3520?

A: Foreign gifts that exceed a certain threshold, both in terms of value received from an individual or entity and aggregate value received from a foreign estate or trust, need to be reported on IRS Form 3520.

Q: Is there a deadline for filing IRS Form 3520?

A: Yes, IRS Form 3520 must be filed by the due date of the taxpayer's income tax return.

Q: What are the penalties for not filing IRS Form 3520?

A: Penalties for not filing IRS Form 3520 can be severe and may include monetary penalties and interest charges.

Q: Can I get an extension to file IRS Form 3520?

A: Yes, an extension of time to file IRS Form 3520 can be requested.

Q: Do I need to attach supporting documents with IRS Form 3520?

A: Yes, certain supporting documents may be required to be attached with IRS Form 3520, depending on the specific transactions or gifts being reported.

Instruction Details:

- This 14-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.