This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 4684

for the current year.

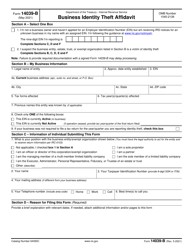

Instructions for IRS Form 4684 Casualties and Thefts

This document contains official instructions for IRS Form 4684 , Casualties and Thefts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 4684 is available for download through this link.

FAQ

Q: What is IRS Form 4684 used for?

A: IRS Form 4684 is used to report losses from casualties and thefts.

Q: What types of losses can be reported on Form 4684?

A: Form 4684 can be used to report losses from natural disasters, accidents, fires, thefts, and other similar events.

Q: Is IRS Form 4684 applicable for personal losses only?

A: No, it can be used to report both personal and business losses.

Q: Are there any specific requirements for filling out Form 4684?

A: Yes, you will need to provide specific details about the loss, including the date, description, and the amount of damage or loss.

Q: Do I need to attach any supporting documents with Form 4684?

A: Yes, you should attach any applicable supporting documents such as insurance claims, police reports, or other evidence of the loss.

Q: How should I file Form 4684?

A: You can file Form 4684 with your individual tax return (Form 1040) or your business tax return (Form 1120 or Form 1065), depending on your situation.

Q: Is there a deadline for filing Form 4684?

A: Yes, you should generally file Form 4684 in the year the loss occurred or within a reasonable period after the loss.

Q: What do I do if I need help filling out Form 4684?

A: If you need assistance with filling out Form 4684, you can consult a tax professional or contact the IRS for guidance.

Instruction Details:

- This 8-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.