This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 3903

for the current year.

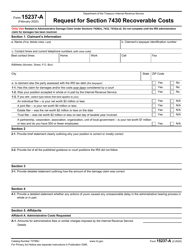

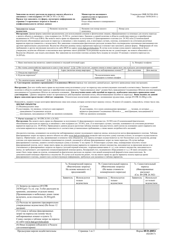

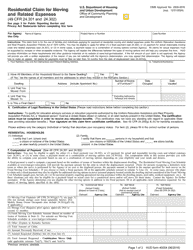

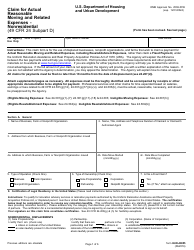

Instructions for IRS Form 3903 Moving Expenses

This document contains official instructions for IRS Form 3903 , Moving Expenses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 3903 is available for download through this link.

FAQ

Q: What is IRS Form 3903?

A: IRS Form 3903 is used to claim moving expenses on your federal tax return.

Q: Who can use IRS Form 3903?

A: Individuals who have moved due to a change in their job or business location and meet certain distance and time requirements can use IRS Form 3903.

Q: What expenses can be claimed on IRS Form 3903?

A: Qualified moving expenses such as transportation, lodging, and storage costs can be claimed on IRS Form 3903.

Q: What distance requirement must be met to claim moving expenses?

A: Your new job location must be at least 50 miles farther from your old home than your old job location was.

Q: What time requirement must be met to claim moving expenses?

A: You must work full-time in the general vicinity of your new job location for at least 39 weeks during the 12 months following your move.

Q: Can moving expenses be deducted if reimbursed by your employer?

A: If your employer reimbursed you for your moving expenses, you can still deduct them on your tax return, but you must report the reimbursement as income.

Instruction Details:

- This 2-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.