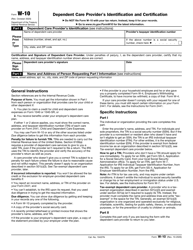

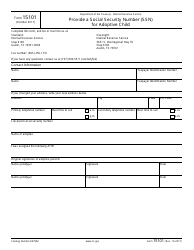

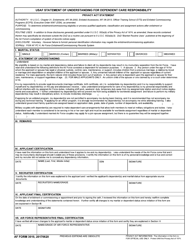

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 2441

for the current year.

Instructions for IRS Form 2441 Child and Dependent Care Expenses

This document contains official instructions for IRS Form 2441 , Child and Dependent Care Expenses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 2441 is available for download through this link.

FAQ

Q: What is form IRS Form 2441?

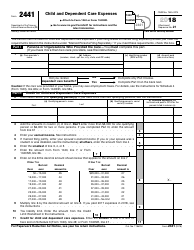

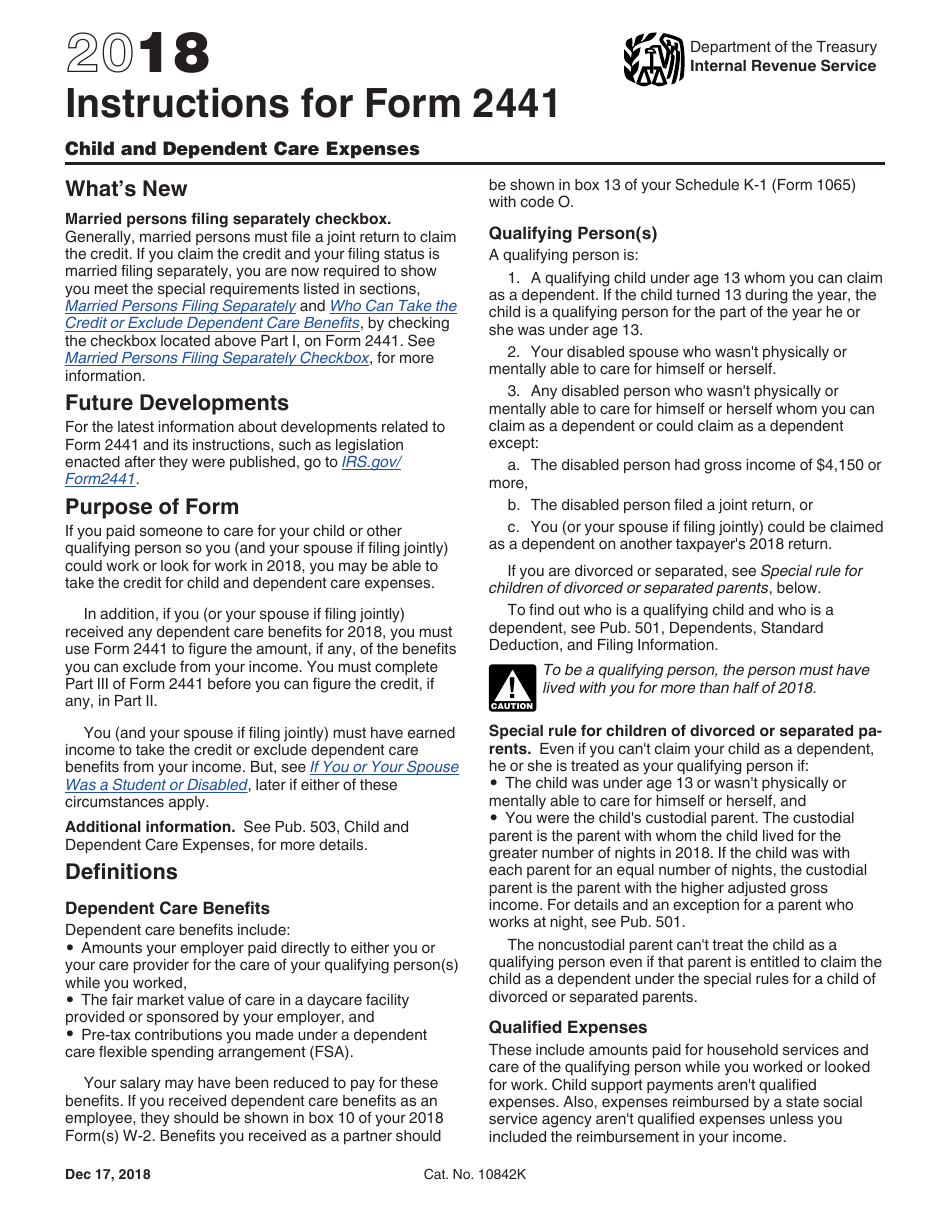

A: IRS Form 2441 is used to claim child and dependent care expenses.

Q: Who can claim child and dependent care expenses?

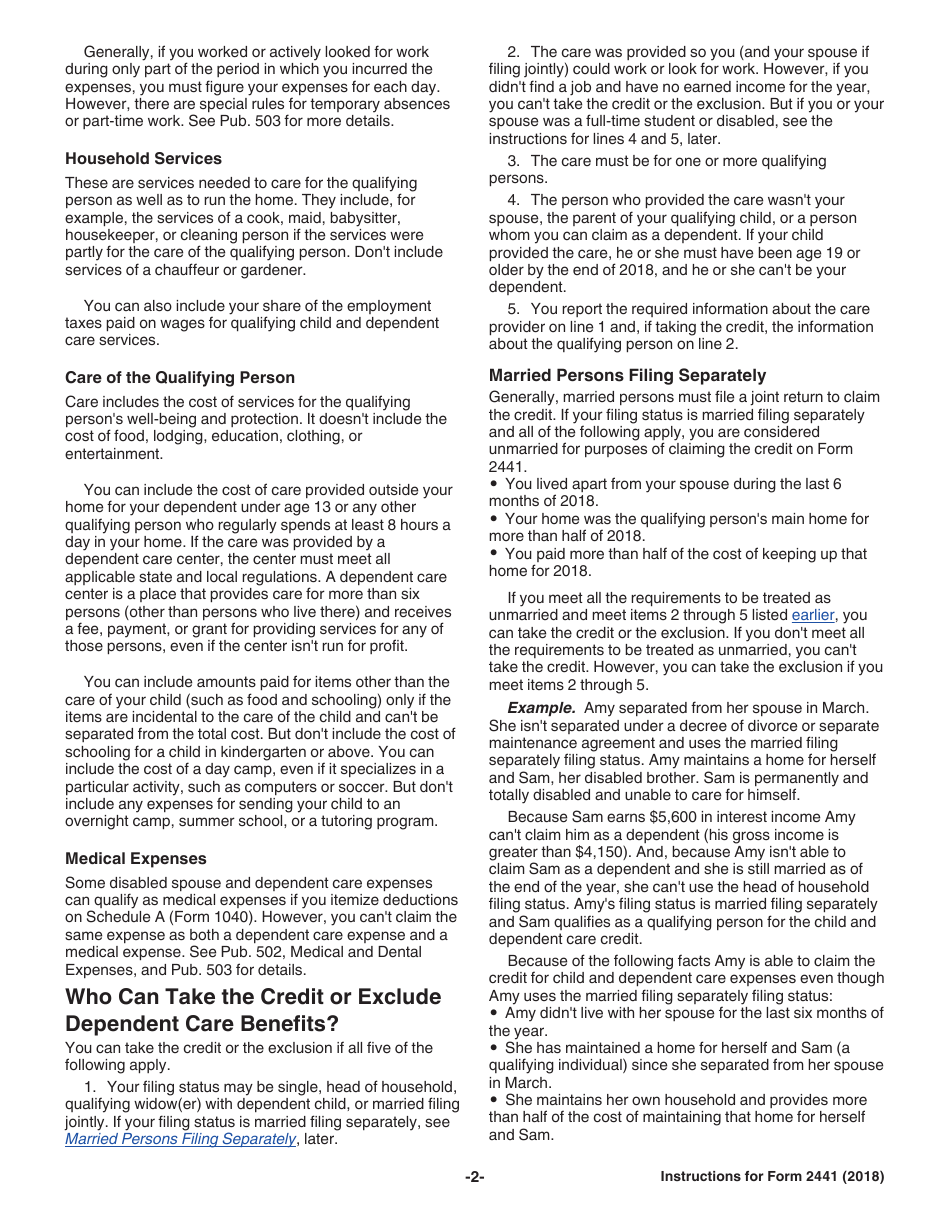

A: Parents or guardians who have incurred expenses for child or dependent care may be eligible to claim these expenses.

Q: What expenses can be claimed on Form 2441?

A: Expenses for the care of a child under the age of 13, or a disabled dependent, can be claimed. This includes expenses for a daycare center, babysitter, or summer day camp.

Q: Is there a limit on the amount that can be claimed?

A: Yes, there are limits on the amount of child and dependent care expenses that can be claimed. The maximum amount for one qualifying individual is $3,000, or $6,000 for two or more qualifying individuals.

Q: Can I claim expenses paid to a relative?

A: Yes, you can claim expenses paid to a relative, as long as they are not your spouse or dependent.

Q: What documents should I keep for my records?

A: You should keep records of your child and dependent care expenses, including receipts, statements, and any other supporting documentation.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.