This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-W

for the current year.

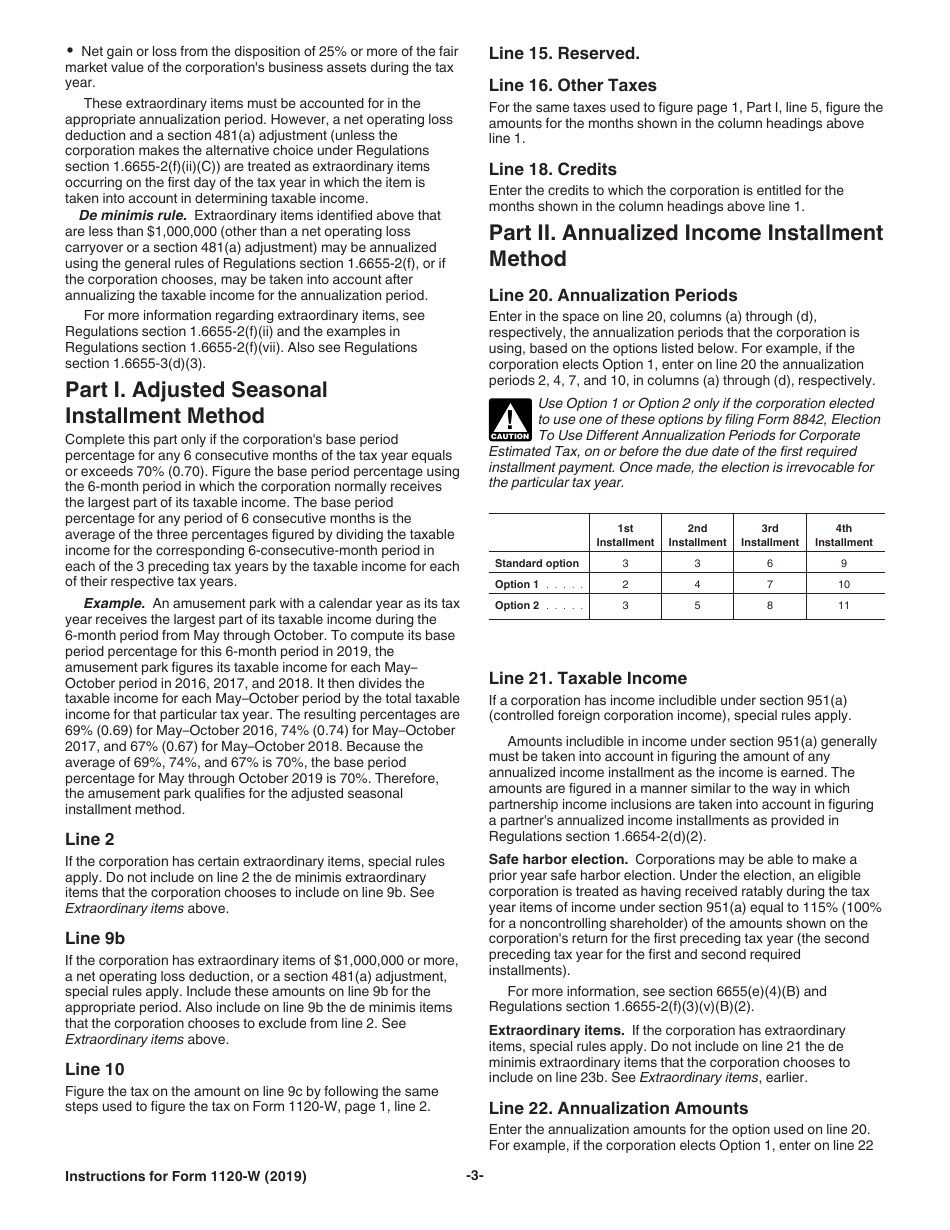

Instructions for IRS Form 1120-W Estimated Tax for Corporations

This document contains official instructions for IRS Form 1120-W , Estimated Tax for Corporations - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-W is available for download through this link.

FAQ

Q: What is IRS Form 1120-W?

A: IRS Form 1120-W is a form used by corporations to calculate and pay their estimated taxes.

Q: Who needs to file IRS Form 1120-W?

A: Corporations that are required to pay estimated taxes must file IRS Form 1120-W.

Q: What are estimated taxes?

A: Estimated taxes are quarterly tax payments made by corporations throughout the year to account for their tax liability.

Q: How do I calculate my estimated taxes?

A: You can calculate your estimated taxes using the instructions provided with IRS Form 1120-W.

Q: When are estimated taxes due?

A: Estimated taxes are due four times a year on specific dates. Consult the instructions of IRS Form 1120-W for the exact due dates.

Q: What happens if I don't pay estimated taxes?

A: Failing to pay estimated taxes can result in penalties and interest from the IRS.

Q: Can I make changes to my estimated tax payments?

A: Yes, you can make changes to your estimated tax payments if your circumstances change throughout the year. Use IRS Form 1120-W to adjust your estimated tax payments.

Q: Do I need to file IRS Form 1120-W if my corporation doesn't have any taxable income?

A: If your corporation doesn't have any taxable income, you may not need to file IRS Form 1120-W. Consult the instructions or a tax professional for guidance.

Q: Can I e-file IRS Form 1120-W?

A: Yes, you can e-file IRS Form 1120-W using approved tax software or through a tax professional.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.