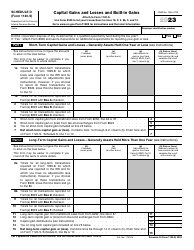

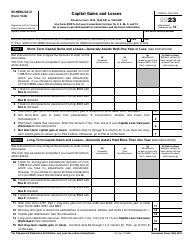

Instructions for IRS Form 1120S Schedule D Capital Gains and Losses and Built-In Gains

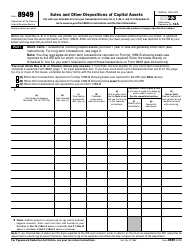

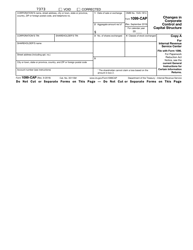

This document contains official instructions for IRS Form 1120S Schedule D, Capital Gains and Losses and Built-In Gains - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120S Schedule D is available for download through this link.

FAQ

Q: What is IRS Form 1120S Schedule D?

A: IRS Form 1120S Schedule D is a form used by S corporations to report capital gains, losses, and built-in gains.

Q: What are capital gains and losses?

A: Capital gains are the profits made from selling assets such as stocks or real estate. Capital losses are the losses incurred from the sale of these assets.

Q: What is a built-in gain?

A: A built-in gain is a gain from the sale of a depreciated asset that would be subject to a higher tax rate if it had been sold immediately after the S corporation was formed.

Q: Who needs to file IRS Form 1120S Schedule D?

A: S corporations that have capital gains, losses, or built-in gains need to file IRS Form 1120S Schedule D.

Q: What information is required on IRS Form 1120S Schedule D?

A: IRS Form 1120S Schedule D requires the S corporation to report its capital gains, losses, and built-in gains, as well as calculate the tax due on these amounts.

Q: When is the deadline to file IRS Form 1120S Schedule D?

A: The deadline to file IRS Form 1120S Schedule D is the same as the deadline for filing the S corporation's tax return, which is usually March 15th.

Q: Can I file IRS Form 1120S Schedule D electronically?

A: Yes, you can file IRS Form 1120S Schedule D electronically using tax software or through the IRS e-file system.

Q: What are the consequences of not filing IRS Form 1120S Schedule D?

A: Failure to file IRS Form 1120S Schedule D or reporting incorrect information can result in penalties and interest charges.

Q: Is there a fee for filing IRS Form 1120S Schedule D?

A: There is no fee for filing IRS Form 1120S Schedule D, but there may be fees associated with tax software or professional tax preparation.

Instruction Details:

- This 7-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.