This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-C

for the current year.

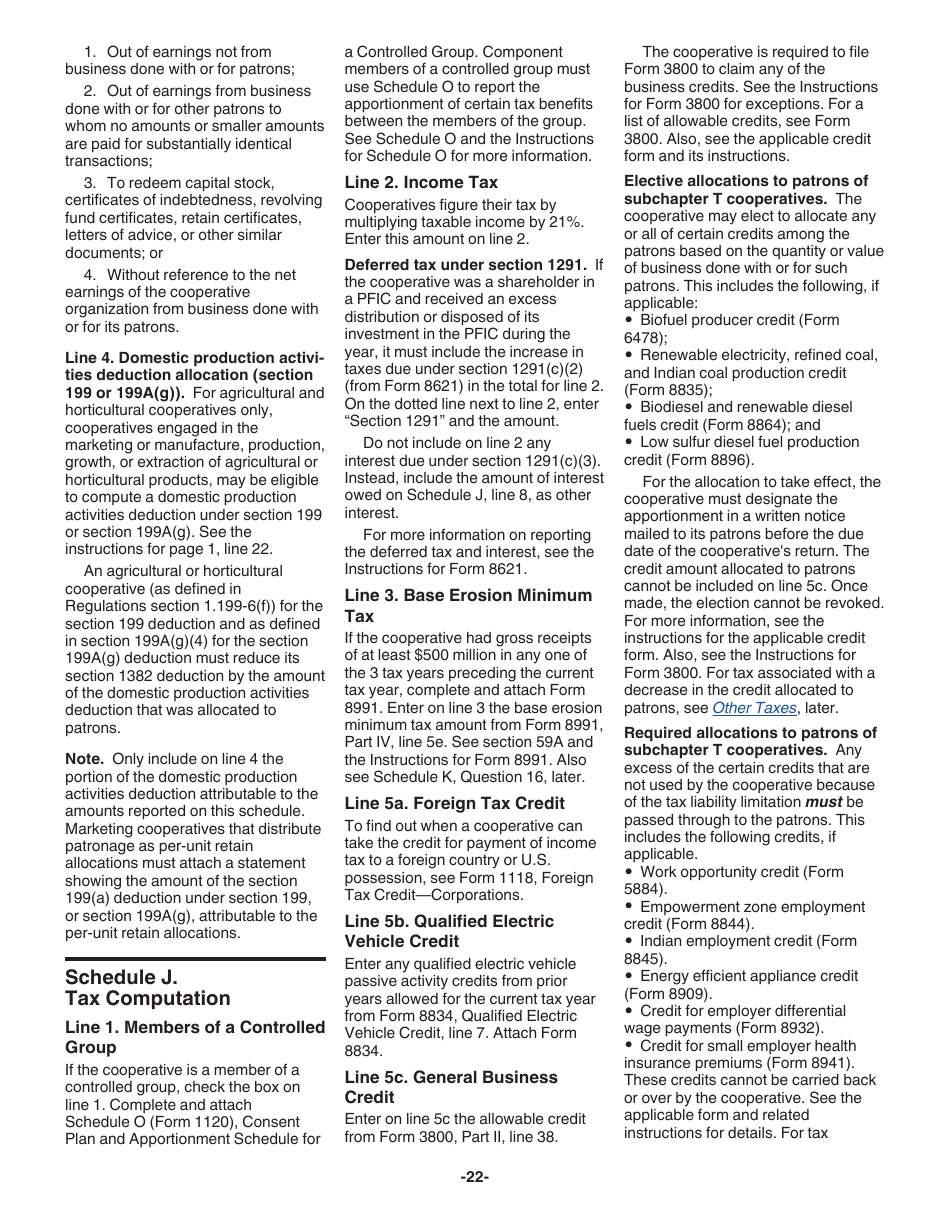

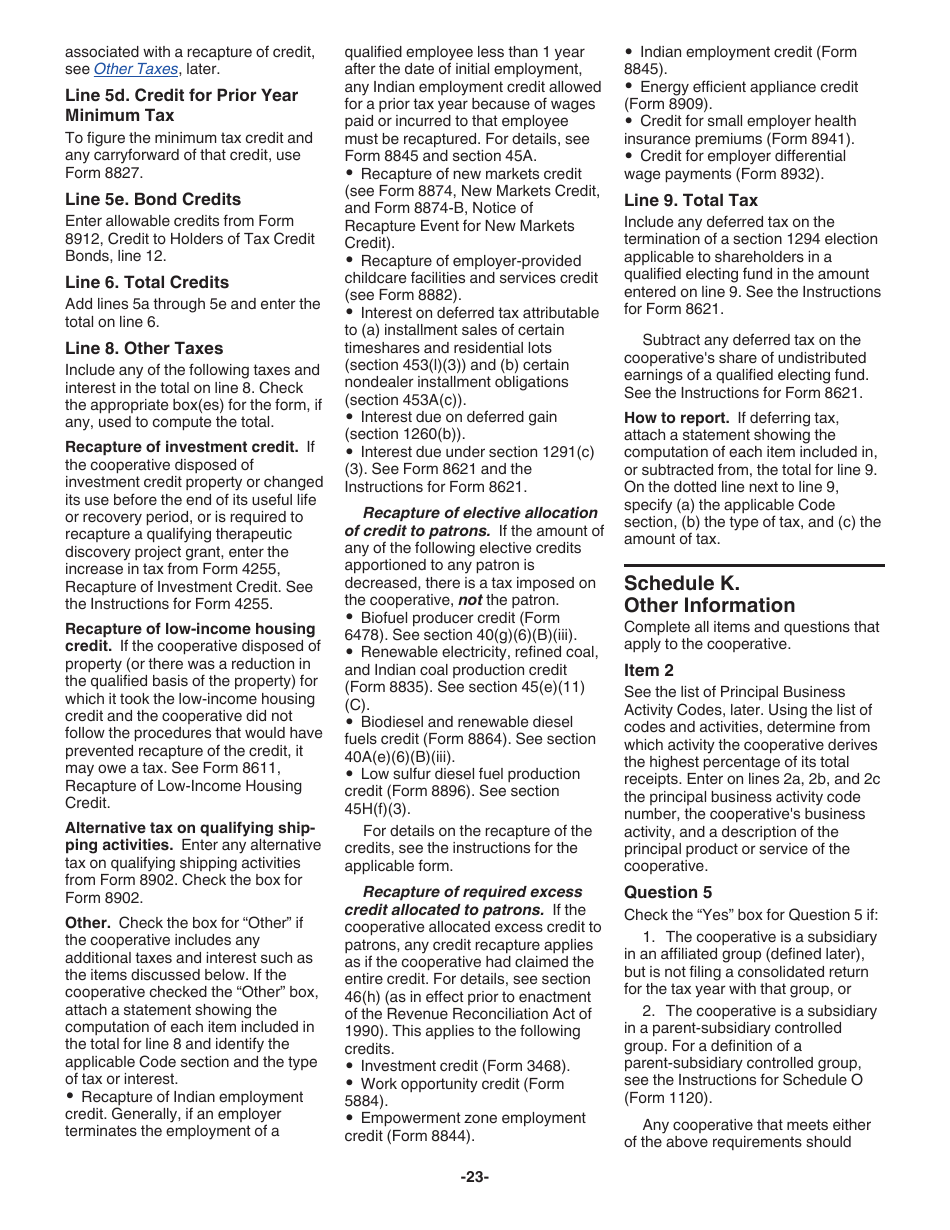

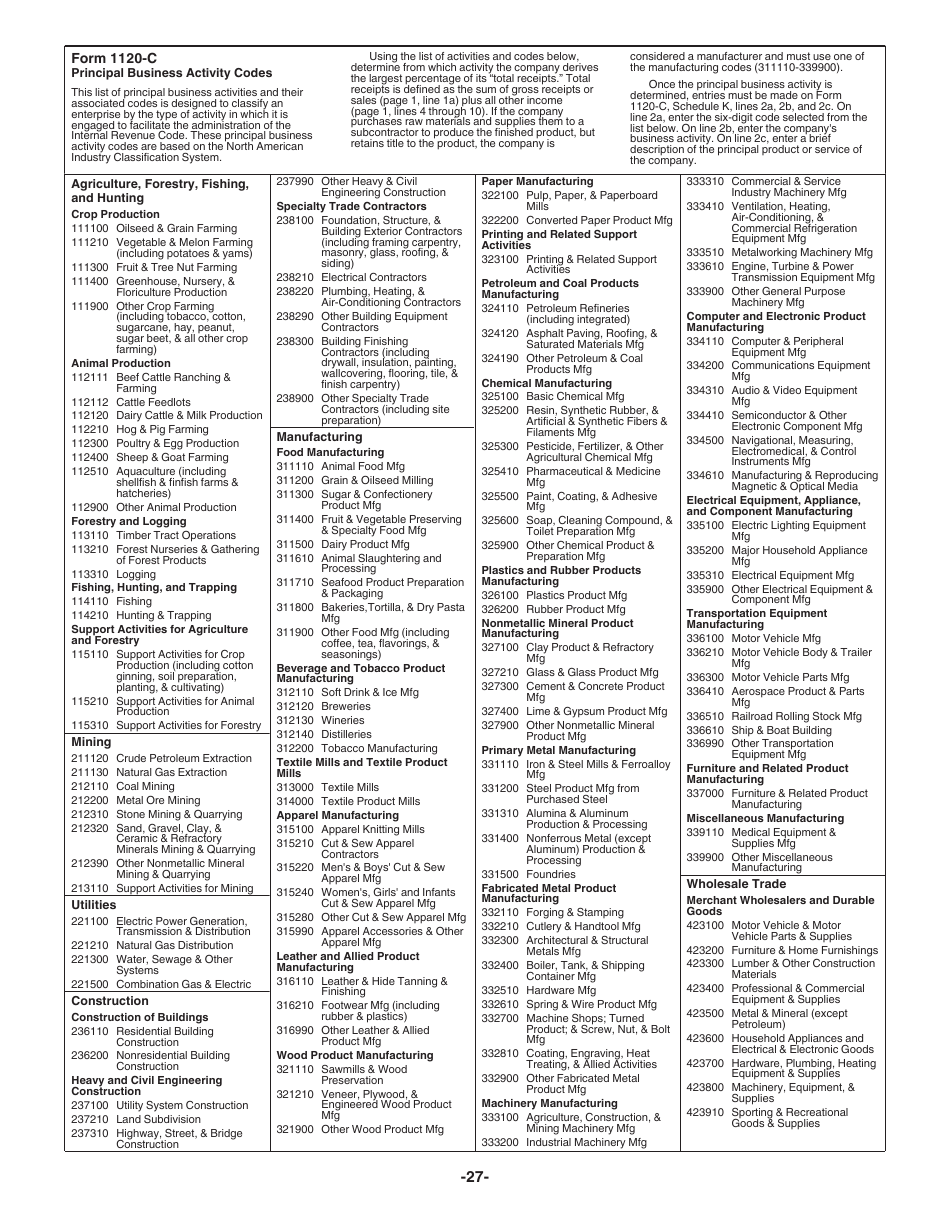

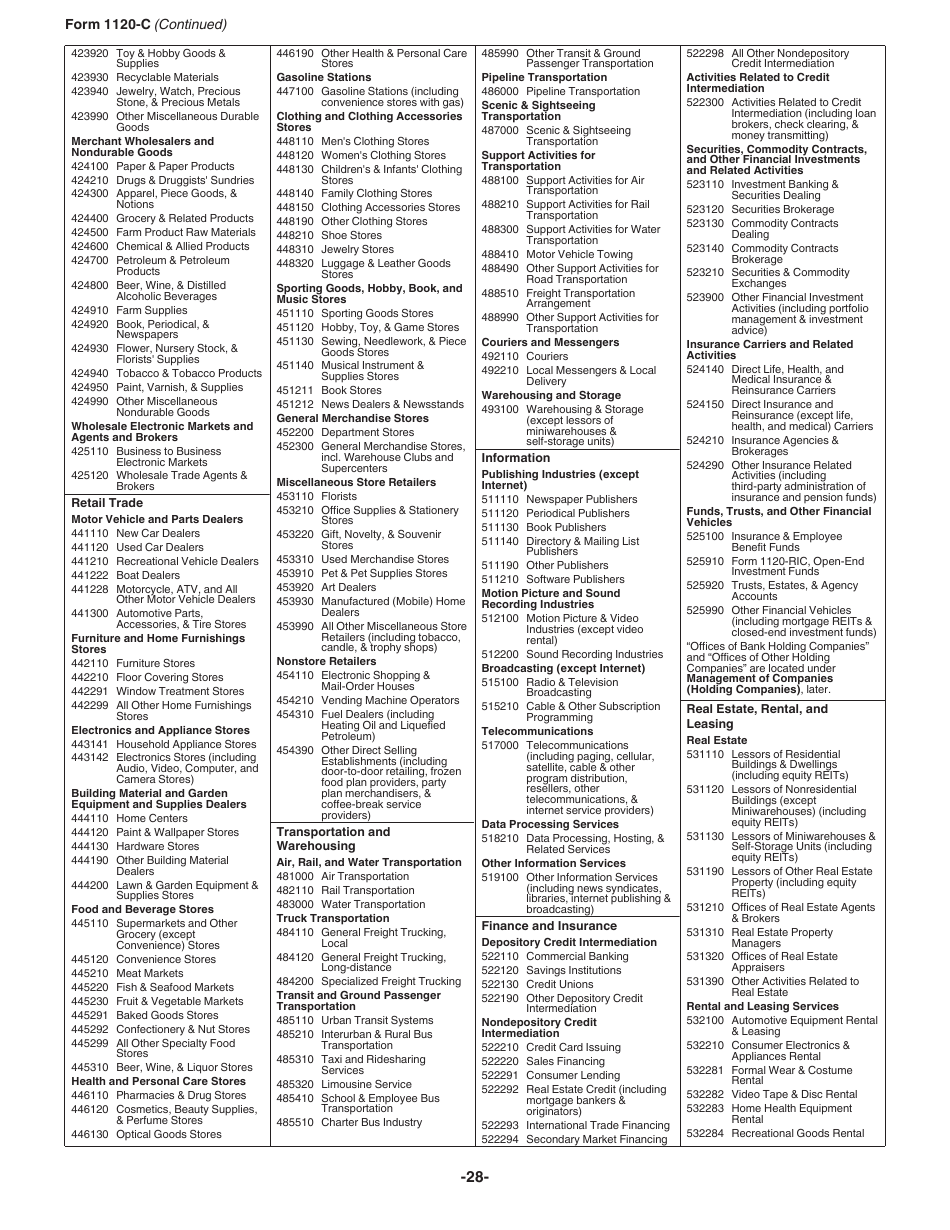

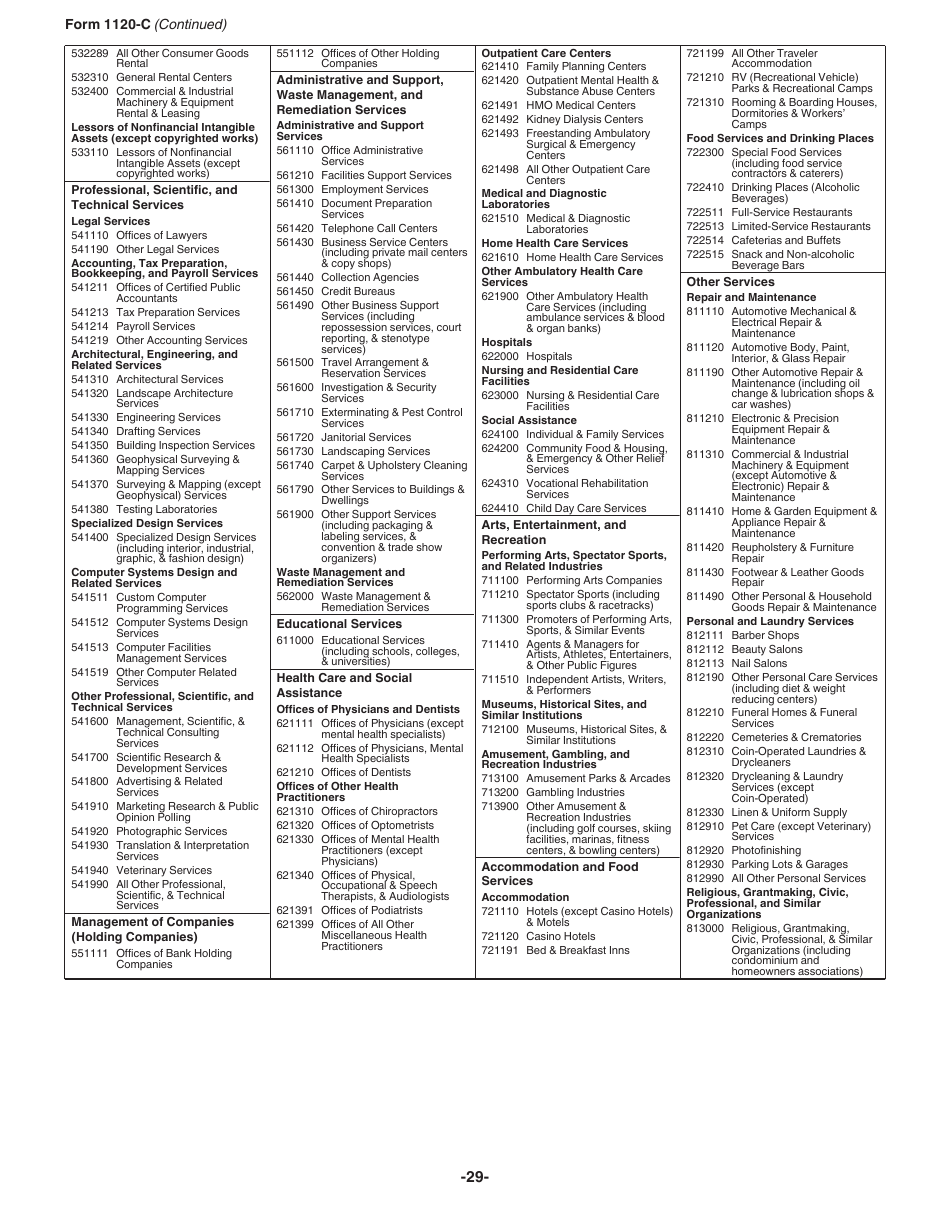

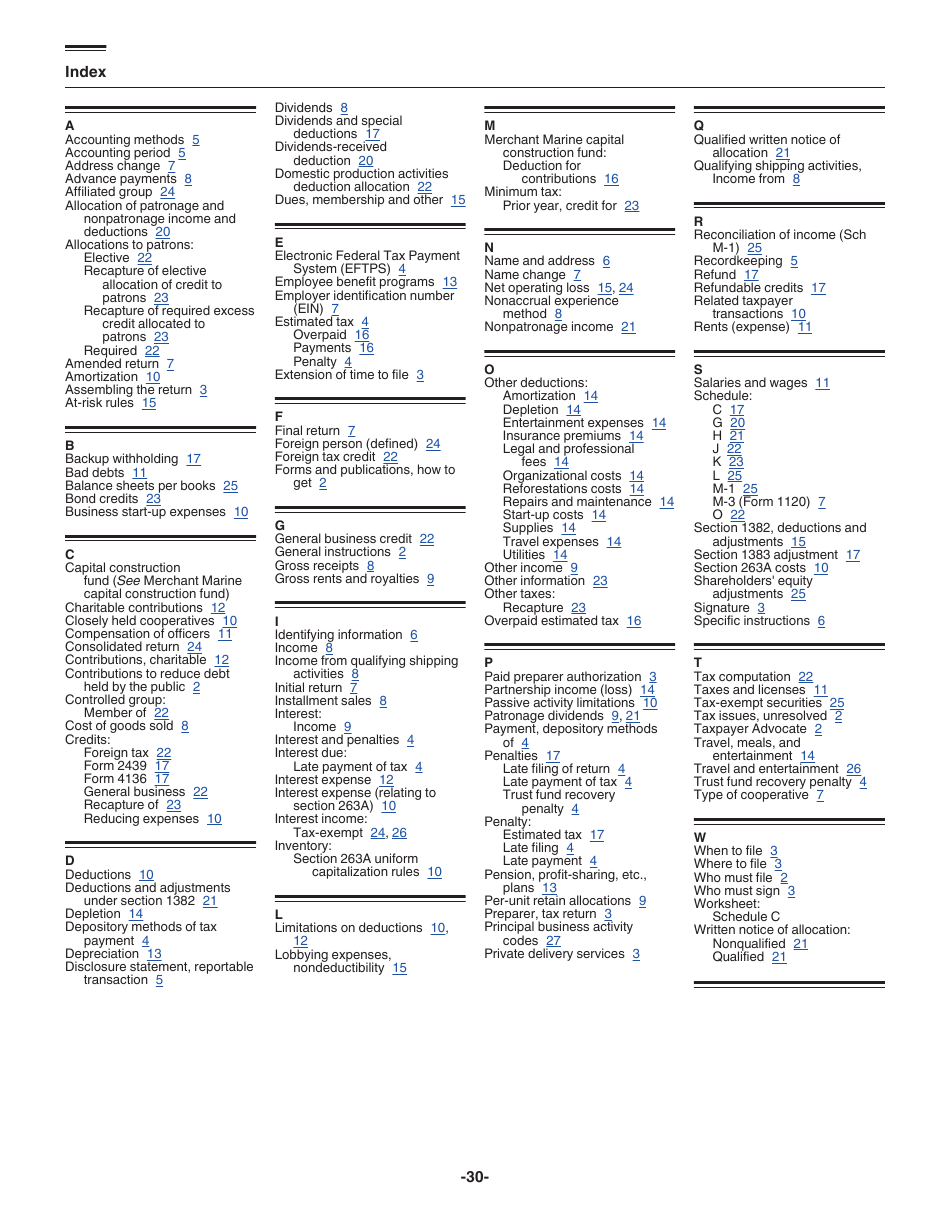

Instructions for IRS Form 1120-C U.S. Income Tax Return for Cooperative Associations

This document contains official instructions for IRS Form 1120-C , U.S. Income Tax Return for Cooperative Associations - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-C is available for download through this link.

FAQ

Q: What is IRS Form 1120-C?

A: IRS Form 1120-C is the U.S. Income Tax Return form specifically for Cooperative Associations.

Q: Who needs to file Form 1120-C?

A: Cooperative Associations, defined as organizations operating on a cooperative basis and engaged in certain business activities, need to file Form 1120-C.

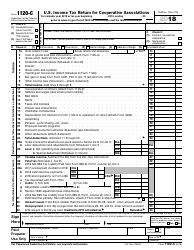

Q: What information is required on Form 1120-C?

A: Form 1120-C requires information about the cooperative association's income, deductions, credits, and other details related to its tax liability.

Q: When is the deadline to file Form 1120-C?

A: The deadline to file Form 1120-C is typically the 15th day of the 4th month following the end of the cooperative association's tax year.

Instruction Details:

- This 30-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.