This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1116

for the current year.

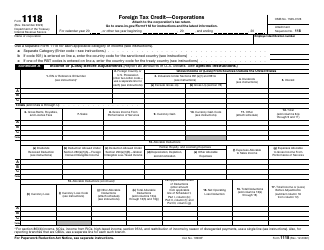

Instructions for IRS Form 1116 Foreign Tax Credit (Individual, Estate, or Trust)

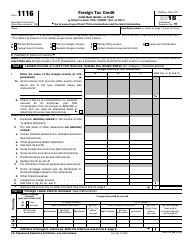

This document contains official instructions for IRS Form 1116 , Foreign Tax Credit (Individual, Estate, or Trust) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1116 is available for download through this link.

FAQ

Q: What is IRS Form 1116?

A: IRS Form 1116 is used to claim a foreign tax credit.

Q: Who needs to file IRS Form 1116?

A: Individuals, estates, or trusts who have paid foreign income taxes and want to claim a credit on their U.S. tax return need to file Form 1116.

Q: What is the purpose of IRS Form 1116?

A: The purpose of Form 1116 is to prevent double taxation by allowing taxpayers to offset their U.S. tax liability with foreign taxes paid on income earned abroad.

Q: What information is needed to complete IRS Form 1116?

A: To complete Form 1116, you will need to know the amount of foreign income taxes paid, foreign source income, and the applicable exchange rates.

Q: When is the deadline to file IRS Form 1116?

A: The deadline to file IRS Form 1116 is the same as the regular tax filing deadline, which is typically April 15th.

Q: Are there any penalties for not filing IRS Form 1116?

A: If you are eligible for the foreign tax credit but fail to file Form 1116, you may miss out on potential tax savings and could face penalties for underpayment of taxes.

Q: Can I claim a foreign tax credit for taxes paid to any country?

A: You can claim a foreign tax credit for taxes paid to any country that is recognized by the United States as having a tax system.

Q: Is there a limit to the amount of foreign tax credit that can be claimed?

A: Yes, there is a limit to the amount of foreign tax credit that can be claimed. The limit is based on the foreign income earned and the taxpayer's U.S. tax liability.

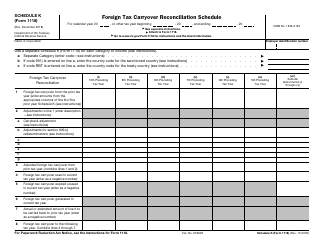

Q: Can I carry over unused foreign tax credits to future years?

A: Yes, unused foreign tax credits can be carried over to future years if they are not fully utilized in the current year.

Instruction Details:

- This 24-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.