This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120 Schedule D

for the current year.

Instructions for IRS Form 1120 Schedule D Capital Gains and Losses

This document contains official instructions for IRS Form 1120 Schedule D, Capital Gains and Losses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120 Schedule D is available for download through this link.

FAQ

Q: What is IRS Form 1120 Schedule D?

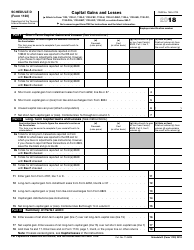

A: IRS Form 1120 Schedule D is a form used by corporations to report capital gains and losses.

Q: What are capital gains and losses?

A: Capital gains are profits made from the sale of assets or investments, while capital losses are the losses incurred.

Q: When is IRS Form 1120 Schedule D used?

A: Form 1120 Schedule D is used when a corporation has realized capital gains or losses during the tax year.

Q: What information is required on the form?

A: The form requires the corporation to provide details of the assets sold, the date of sale, the purchase price, the sale price, and any related expenses.

Q: How are capital gains and losses calculated?

A: Capital gains are calculated by subtracting the purchase price from the sale price, while capital losses are calculated by subtracting the sale price from the purchase price.

Q: Are there any special rules or provisions for reporting capital gains and losses?

A: Yes, there may be special rules and provisions depending on the type of asset or investment and the duration of ownership. It is recommended to consult the instructions for Form 1120 Schedule D for further guidance.

Q: When is the deadline to file IRS Form 1120 Schedule D?

A: The deadline to file Form 1120 Schedule D is usually the same as the deadline to file IRS Form 1120, which is the 15th day of the 3rd month after the end of the corporation's tax year.

Instruction Details:

- This 5-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.