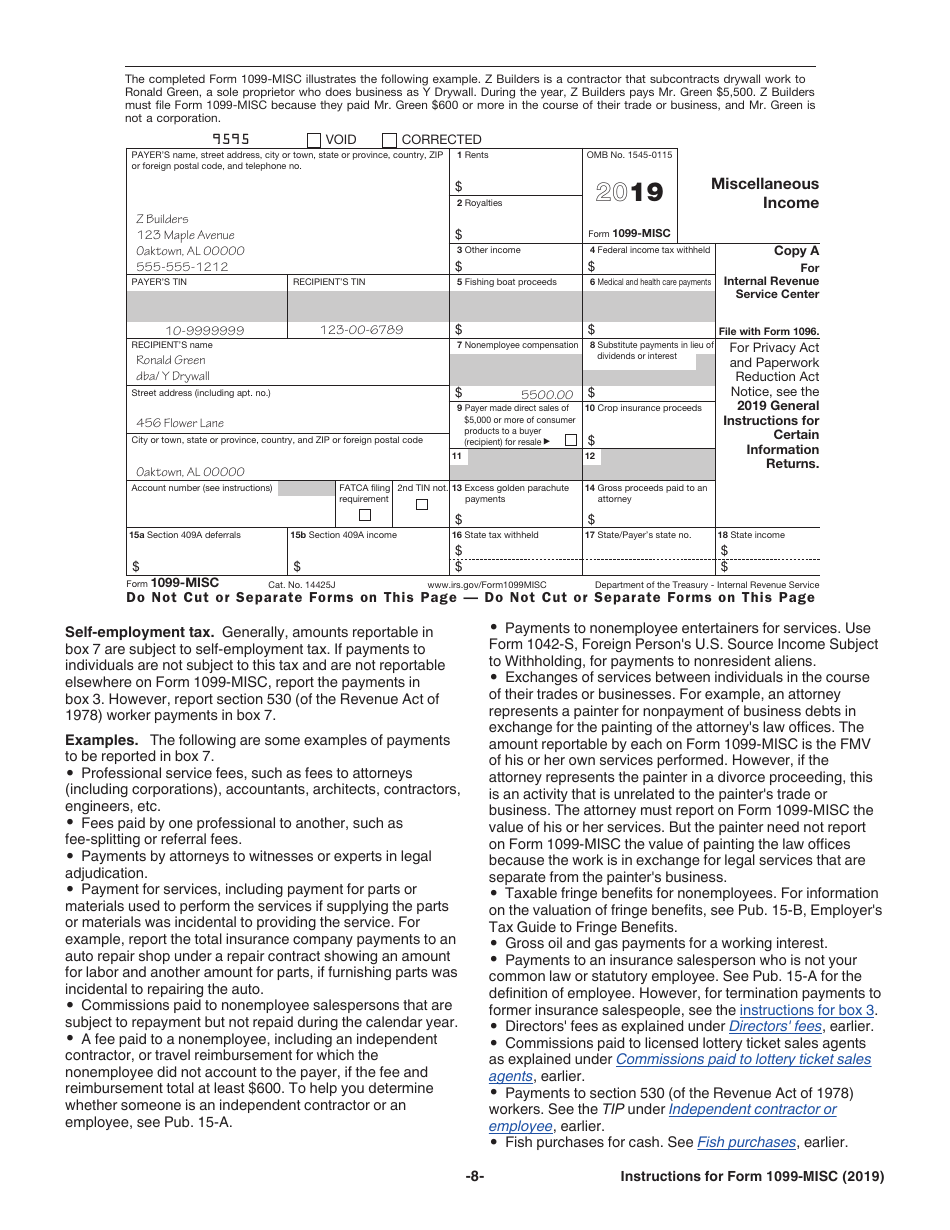

Instructions for IRS Form 1099-MISC Miscellaneous Income

This document contains official instructions for IRS Form 1099-MISC , Miscellaneous Income - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-MISC is available for download through this link.

FAQ

Q: What is IRS Form 1099-MISC?

A: IRS Form 1099-MISC is used to report income received that is not salary or wages.

Q: Who needs to file IRS Form 1099-MISC?

A: Businesses and individuals who paid at least $600 in miscellaneous income to another person or entity during the tax year are required to file Form 1099-MISC.

Q: When is the deadline for filing Form 1099-MISC?

A: The deadline for filing Form 1099-MISC is January 31st.

Q: What happens if I don't file Form 1099-MISC?

A: Failure to file Form 1099-MISC can result in penalties from the IRS.

Q: Are there any exceptions to filing Form 1099-MISC?

A: There are various exceptions to filing Form 1099-MISC, such as payments made to corporations or payments for personal or household services.

Q: Do I need to send copies of Form 1099-MISC to the state tax department?

A: The requirement to send copies of Form 1099-MISC to the state tax department varies depending on the state. You should check the requirements for your specific state.

Instruction Details:

- This 11-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.