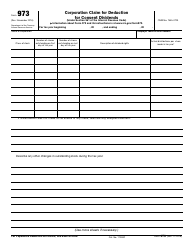

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1099-DIV

for the current year.

Instructions for IRS Form 1099-DIV Dividends and Distributions

This document contains official instructions for IRS Form 1099-DIV , Dividends and Distributions - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-DIV is available for download through this link.

FAQ

Q: What is IRS Form 1099-DIV?

A: IRS Form 1099-DIV is a tax form used to report dividends and distributions received by individual taxpayers.

Q: Who should file IRS Form 1099-DIV?

A: Financial institutions and other entities that pay dividends or distributions to individuals must file IRS Form 1099-DIV.

Q: What information is required to fill out IRS Form 1099-DIV?

A: You will need to provide the recipient's name, address, and tax identification number, as well as the total amount of dividends or distributions paid.

Q: When is the deadline for filing IRS Form 1099-DIV?

A: The deadline for filing IRS Form 1099-DIV is typically January 31st of the year following the tax year in which the dividends or distributions were paid.

Q: Are there any penalties for not filing IRS Form 1099-DIV?

A: Yes, there can be penalties for not filing IRS Form 1099-DIV or for filing it late. Penalties vary depending on the size of the entity and the length of the delay in filing.

Q: Do I need to send a copy of IRS Form 1099-DIV to the recipient?

A: Yes, you are required to send a copy of IRS Form 1099-DIV to the recipient by January 31st of the year following the tax year in which the dividends or distributions were paid.

Q: Can I e-file IRS Form 1099-DIV?

A: Yes, you can e-file IRS Form 1099-DIV using the IRS's FIRE (Filing Information Returns Electronically) system or through authorized e-file providers.

Q: Can I correct errors on IRS Form 1099-DIV?

A: Yes, if you discover an error on IRS Form 1099-DIV after filing, you should file a corrected form as soon as possible.

Q: What should I do if I don't receive IRS Form 1099-DIV?

A: If you are expecting to receive IRS Form 1099-DIV but haven't received it by February 15th, you should contact the payer to request a copy.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.