Instructions for IRS Form 1098-Q Qualifying Longevity Annuity Contract Information

This document contains official instructions for IRS Form 1098-Q , Qualifying Longevity Annuity Contract Information - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1098-Q is available for download through this link.

FAQ

Q: What is IRS Form 1098-Q?

A: IRS Form 1098-Q is a form used to report information about qualifying longevity annuity contracts (QLACs) to the Internal Revenue Service (IRS).

Q: What is a qualifying longevity annuity contract (QLAC)?

A: A qualifying longevity annuity contract (QLAC) is a type of annuity that is designed to provide a guaranteed income stream to the annuitant in later years, typically starting at age 85.

Q: Who should file IRS Form 1098-Q?

A: Insurance companies or issuers of qualifying longevity annuity contracts (QLACs) are required to file IRS Form 1098-Q.

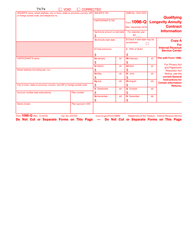

Q: What information is required to be reported on IRS Form 1098-Q?

A: IRS Form 1098-Q requires the insurance company or issuer to report the name, address, and taxpayer identification number of the annuity contract owner, as well as information about the QLAC itself.

Q: When is the deadline to file IRS Form 1098-Q?

A: IRS Form 1098-Q must be filed by the last day of February of the year following the calendar year in which the QLAC was purchased.

Q: Are there any penalties for not filing IRS Form 1098-Q?

A: Yes, there are penalties for not filing or for filing an incorrect or incomplete IRS Form 1098-Q. Penalties can be imposed by the IRS.

Q: Do I need to attach IRS Form 1098-Q to my tax return?

A: No, you do not need to attach IRS Form 1098-Q to your tax return. It is for informational purposes only.

Q: Can I e-file IRS Form 1098-Q?

A: Yes, you can e-file IRS Form 1098-Q if you meet the requirements for e-filing.

Q: What if the information on IRS Form 1098-Q is incorrect?

A: If you believe the information on IRS Form 1098-Q is incorrect, you should contact the issuer of the QLAC and request a corrected form.

Instruction Details:

- This 3-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.