This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1098-E, 1098-T

for the current year.

Instructions for IRS Form 1098-E, 1098-T Student Loan Interest Statement and Tuition Statement

This document contains official instructions for IRS Form 1098-E , and IRS Form 1098-T . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1098-E is available for download through this link. The latest available IRS Form 1098-T can be downloaded through this link.

FAQ

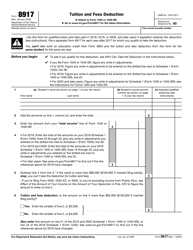

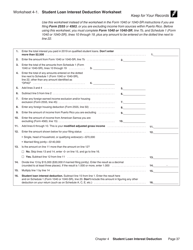

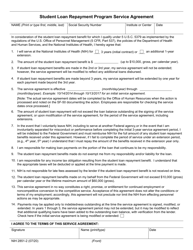

Q: What is IRS Form 1098-E?

A: IRS Form 1098-E is a statement used to report the amount of student loan interest paid during the tax year.

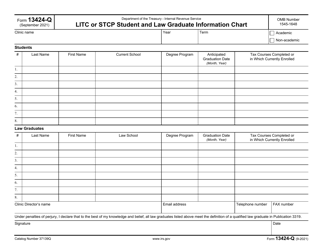

Q: What is IRS Form 1098-T?

A: IRS Form 1098-T is a statement used to report qualified tuition expenses paid during the tax year.

Q: Who receives IRS Form 1098-E?

A: If you paid $600 or more in student loan interest to a lender during the tax year, you will receive IRS Form 1098-E.

Q: Who receives IRS Form 1098-T?

A: Educational institutions are required to send an IRS Form 1098-T to eligible students who paid qualified tuition expenses.

Q: What information is included on IRS Form 1098-E?

A: IRS Form 1098-E includes the amount of student loan interest paid, the name and address of the lender, and the student's identifying information.

Q: What information is included on IRS Form 1098-T?

A: IRS Form 1098-T includes the amount of qualified tuition expenses paid, the name and address of the educational institution, and the student's identifying information.

Q: Do I need to include IRS Form 1098-E or 1098-T with my tax return?

A: No, you do not need to attach these forms to your tax return. However, you should keep them for your records.

Q: Can I deduct student loan interest or tuition expenses on my tax return?

A: Yes, depending on your income and other factors, you may be eligible to deduct student loan interest or claim educational tax credits for qualified tuition expenses.

Q: Are there any income limits or restrictions for deducting student loan interest or claiming educational tax credits?

A: Yes, there are income limits and other restrictions that determine eligibility for these deductions and credits. It is best to consult the IRS guidelines or a tax professional for specific details.

Q: What is the deadline for receiving IRS Form 1098-E and 1098-T?

A: Lenders and educational institutions must send out these forms to recipients by January 31st each year.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.