This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1098

for the current year.

Instructions for IRS Form 1098 Mortgage Interest Statement

This document contains official instructions for IRS Form 1098 , Mortgage Interest Statement - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1098 is available for download through this link.

FAQ

Q: What is IRS Form 1098?

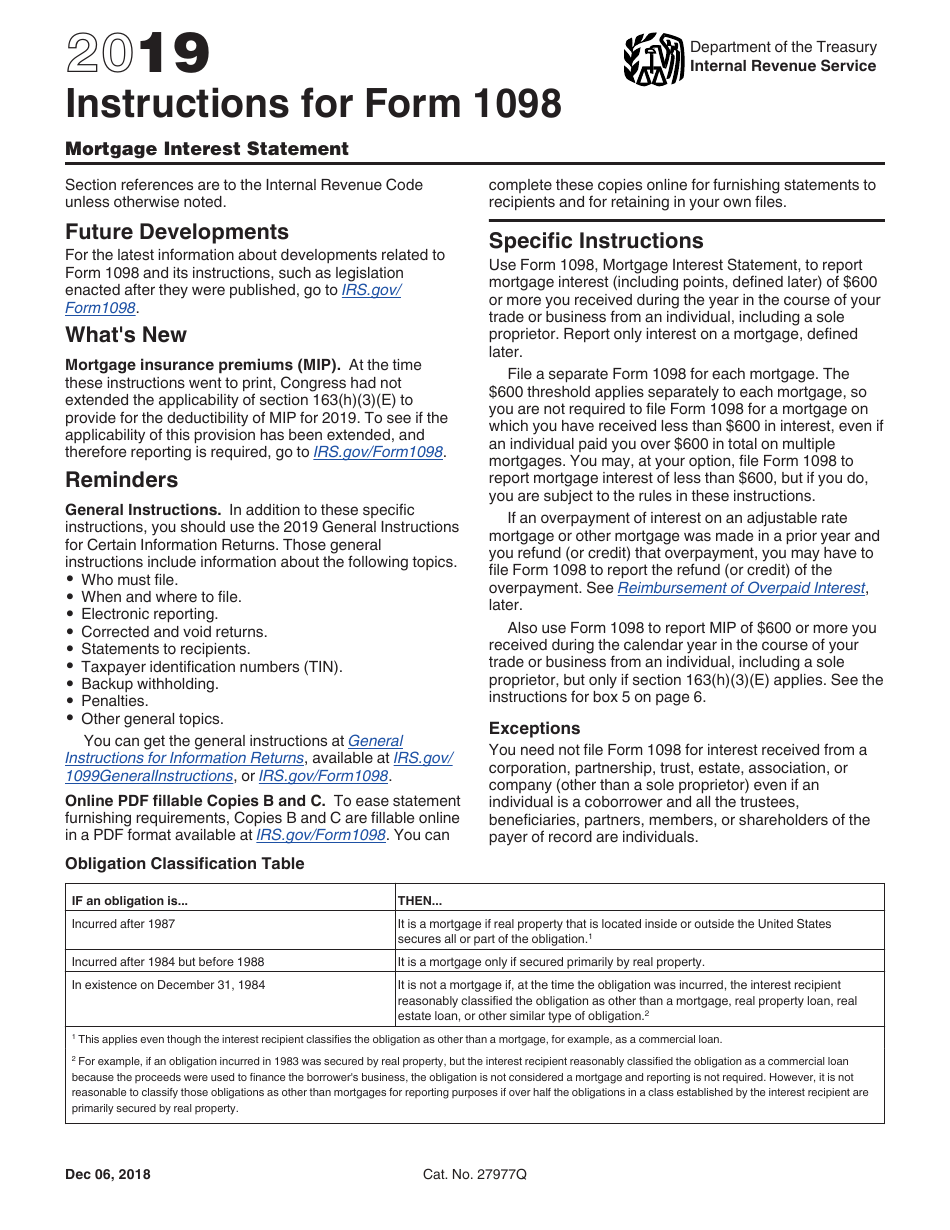

A: IRS Form 1098 is a statement provided by your mortgage lender that shows the amount of mortgage interest you paid in a year.

Q: Why is IRS Form 1098 important?

A: IRS Form 1098 is important for tax purposes. It allows you to deduct the mortgage interest you paid from your taxable income.

Q: Who should receive an IRS Form 1098?

A: If you paid $600 or more in mortgage interest to a mortgage lender, they are required to provide you with IRS Form 1098.

Q: What information is included in IRS Form 1098?

A: IRS Form 1098 includes the name and address of the mortgage lender, the amount of mortgage interest you paid, and the points paid on the mortgage if applicable.

Q: When should I expect to receive IRS Form 1098?

A: Mortgage lenders are required to send out IRS Form 1098 by January 31st of the following year.

Q: Do I need to attach IRS Form 1098 to my tax return?

A: No, you don't need to attach IRS Form 1098 to your tax return. Keep it for your records in case of an audit.

Q: Can I deduct all the mortgage interest shown on IRS Form 1098?

A: In most cases, you can deduct all the mortgage interest shown on IRS Form 1098. However, there are certain limitations based on your specific circumstances.

Q: What if there are errors on IRS Form 1098?

A: If you notice any errors on IRS Form 1098, contact your mortgage lender to have them issue a corrected form.

Q: What should I do if I didn't receive IRS Form 1098?

A: If you didn't receive IRS Form 1098, contact your mortgage lender to request a copy. They are required to provide it to you.

Q: Can I use IRS Form 1098 if I refinanced my mortgage?

A: If you refinanced your mortgage, you may receive multiple IRS Form 1098s. Make sure to review them all for accurate information.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.