This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1065 Schedule M-3

for the current year.

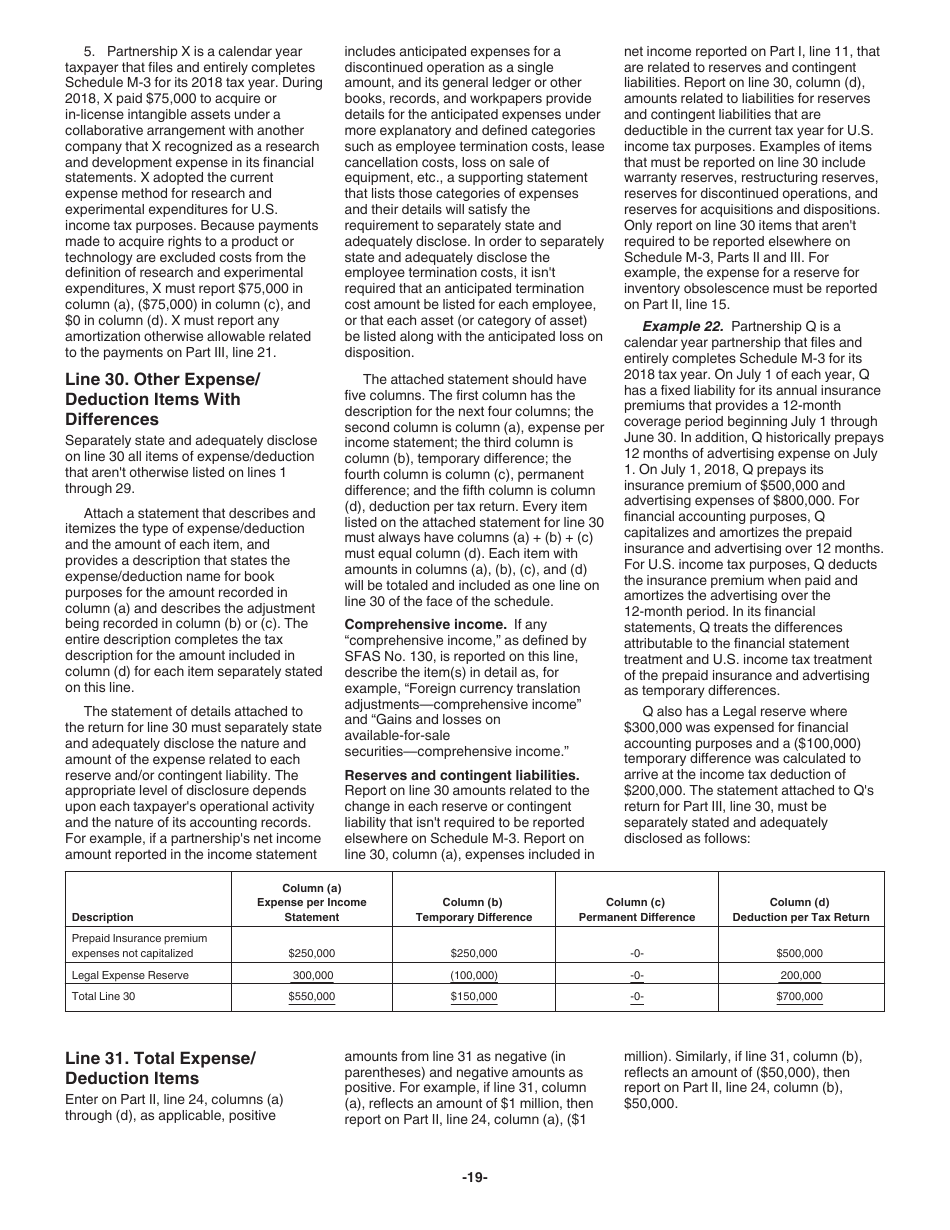

Instructions for IRS Form 1065 Schedule M-3 Net Income (Loss) Reconciliation for Certain Partnerships

This document contains official instructions for IRS Form 1065 Schedule M-3, Net Income (Loss) Reconciliation for Certain Partnerships - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1065 Schedule M-3 is available for download through this link.

FAQ

Q: What is IRS Form 1065 Schedule M-3?

A: IRS Form 1065 Schedule M-3 is a form used by certain partnerships to reconcile their net income (loss) with the amounts reported on their tax return.

Q: Why is Schedule M-3 required?

A: Schedule M-3 is required by the IRS to provide additional information and reconciliation of net income (loss) for certain partnerships.

Q: Which partnerships need to file Schedule M-3?

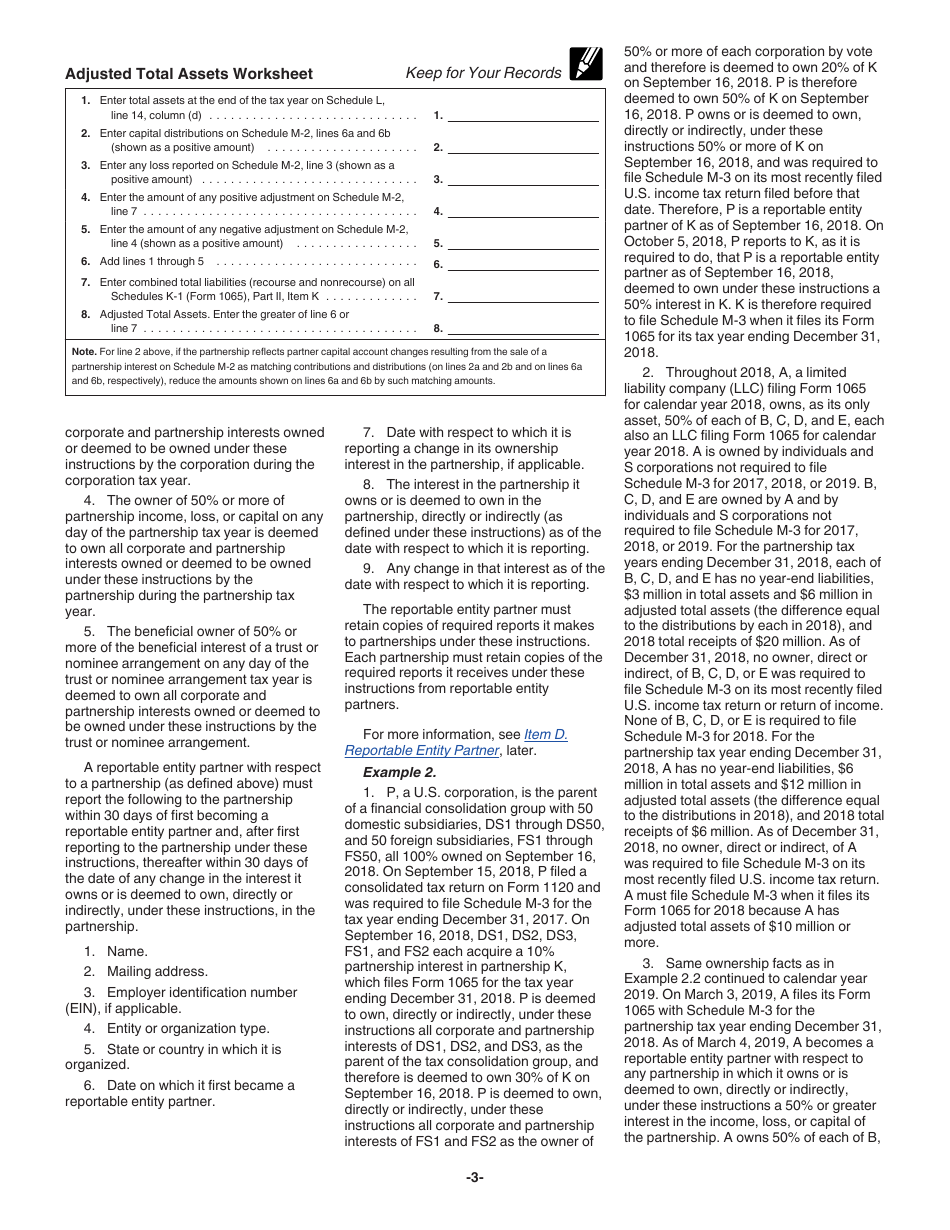

A: Partnerships that meet certain criteria, such as those with total assets of $10 million or more, are generally required to file Schedule M-3.

Q: What information does Schedule M-3 require?

A: Schedule M-3 requires detailed information on the composition of net income (loss), including reconciling temporary and permanent differences between book and tax income.

Q: How do I fill out Schedule M-3?

A: You should follow the instructions provided by the IRS for filling out Schedule M-3. It is recommended to consult a tax professional or use tax preparation software to ensure accuracy.

Q: What happens if I don't file Schedule M-3 when required?

A: Failure to file Schedule M-3 when required may result in penalties or additional scrutiny from the IRS during an audit.

Q: Are there any exceptions to filing Schedule M-3?

A: Certain partnerships may qualify for exceptions to filing Schedule M-3. It is important to review the IRS instructions and consult a tax professional to determine if an exception applies.

Instruction Details:

- This 19-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.