This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1045

for the current year.

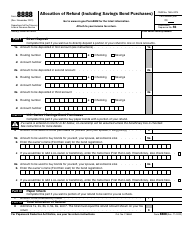

Instructions for IRS Form 1045 Application for Tentative Refund

This document contains official instructions for IRS Form 1045 , Application for Tentative Refund - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1045 is available for download through this link.

FAQ

Q: What is IRS Form 1045?

A: IRS Form 1045 is an Application for Tentative Refund.

Q: What is the purpose of filing Form 1045?

A: The purpose of filing Form 1045 is to claim a tentative refund for certain tax credits or net operating losses.

Q: Who can file Form 1045?

A: Individuals, estates, and trusts can file Form 1045.

Q: What are the requirements to file Form 1045?

A: To file Form 1045, you must have an eligible tax credit or a net operating loss.

Q: When should Form 1045 be filed?

A: Form 1045 should be filed within one year of the end of the tax year in which the credit or loss occurred.

Q: How can Form 1045 be filed?

A: Form 1045 can be filed electronically or by mail.

Q: Is there a fee for filing Form 1045?

A: There is no fee for filing Form 1045.

Q: What documents should be attached to Form 1045?

A: Supporting documents, such as schedules and forms, should be attached to Form 1045.

Q: How long does it take to receive a refund after filing Form 1045?

A: The time to receive a refund after filing Form 1045 can vary, but it is generally within 90 days.

Instruction Details:

- This 9-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.