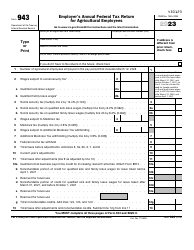

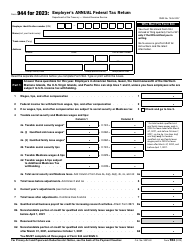

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1042

for the current year.

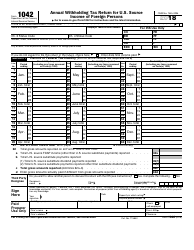

Instructions for IRS Form 1042 Annual Withholding Tax Return for U.S. Source Income of Foreign Persons

This document contains official instructions for IRS Form 1042 , Annual Source Income of Foreign Persons - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1042 is available for download through this link.

FAQ

Q: What is IRS Form 1042?

A: IRS Form 1042 is the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons.

Q: Who should file IRS Form 1042?

A: This form should be filed by any withholding agent who withheld taxes on U.S. source income paid to foreign persons.

Q: What is U.S. source income?

A: U.S. source income includes income earned within the United States, such as wages, salaries, royalties, dividends, and rental income.

Q: What are the reporting requirements for IRS Form 1042?

A: Form 1042 must be submitted annually, reporting the amount of U.S. source income paid to foreign persons and the taxes withheld.

Q: What is the due date for filing IRS Form 1042?

A: The due date for filing Form 1042 is generally March 15th of the following year, unless an extension is granted.

Q: How can I file IRS Form 1042?

A: Form 1042 can be filed electronically using the IRS's e-file system or by mailing a paper copy to the designated address.

Q: Are there any penalties for not filing IRS Form 1042?

A: Yes, there are penalties for not filing or failing to report the correct information on Form 1042. The penalties can vary based on the amount of income and the length of time the failure continues.

Q: Can I claim a refund of withheld taxes on Form 1042?

A: Yes, foreign persons who have had taxes withheld on their U.S. source income may be eligible to claim a refund by filing Form 1042-S.

Q: What is Form 1042-S?

A: Form 1042-S is used to report income paid to foreign persons, including the amount of income and the taxes withheld.

Instruction Details:

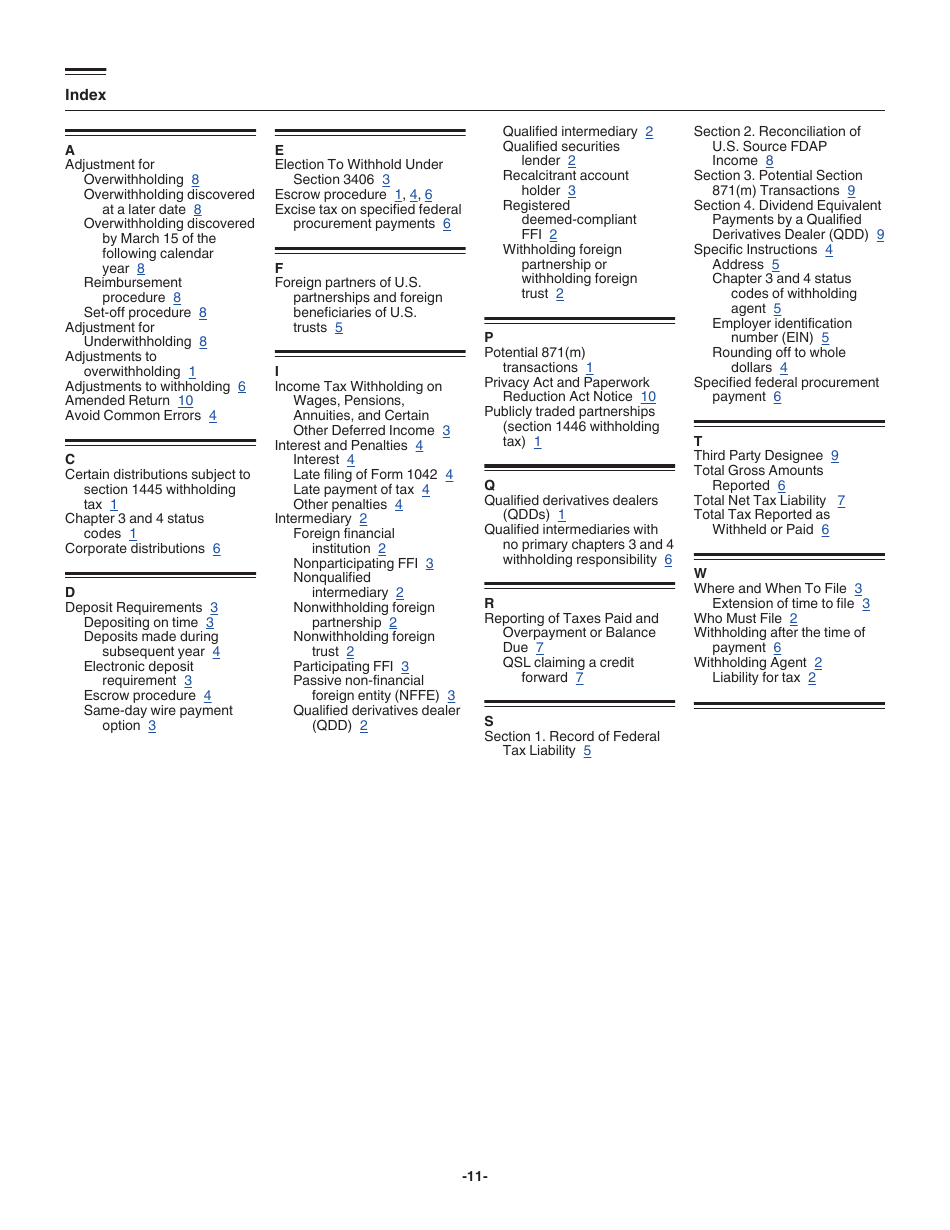

- This 11-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.