This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1041 Schedule D

for the current year.

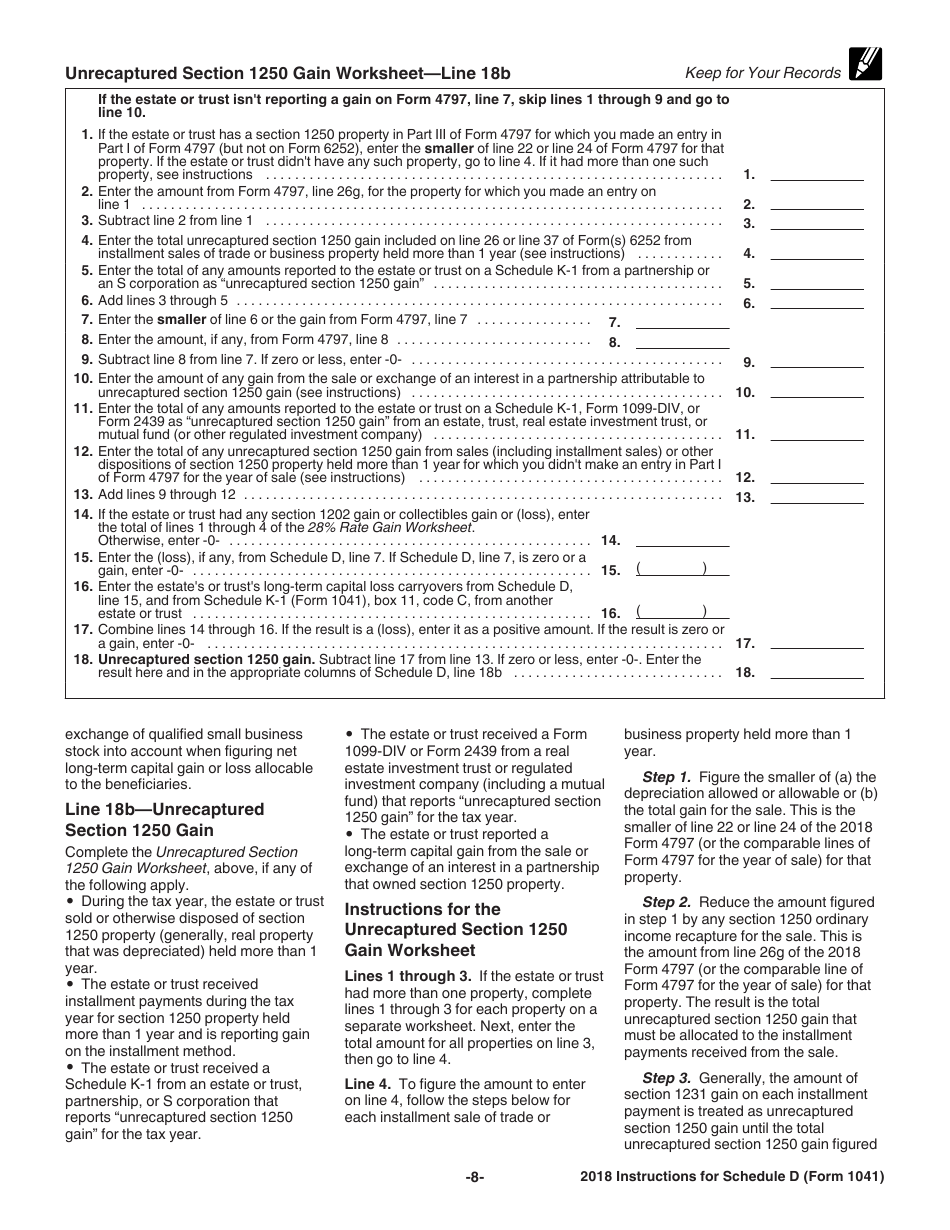

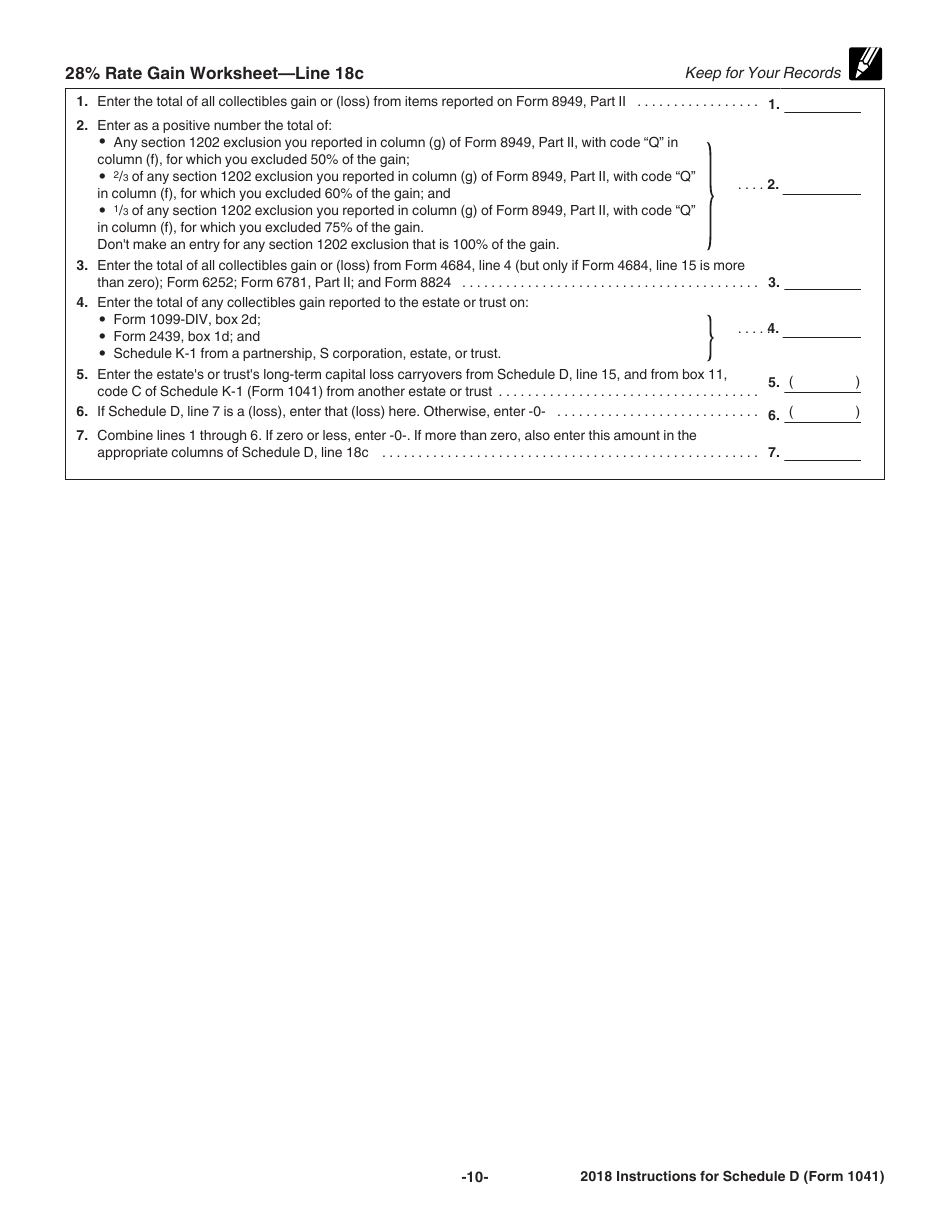

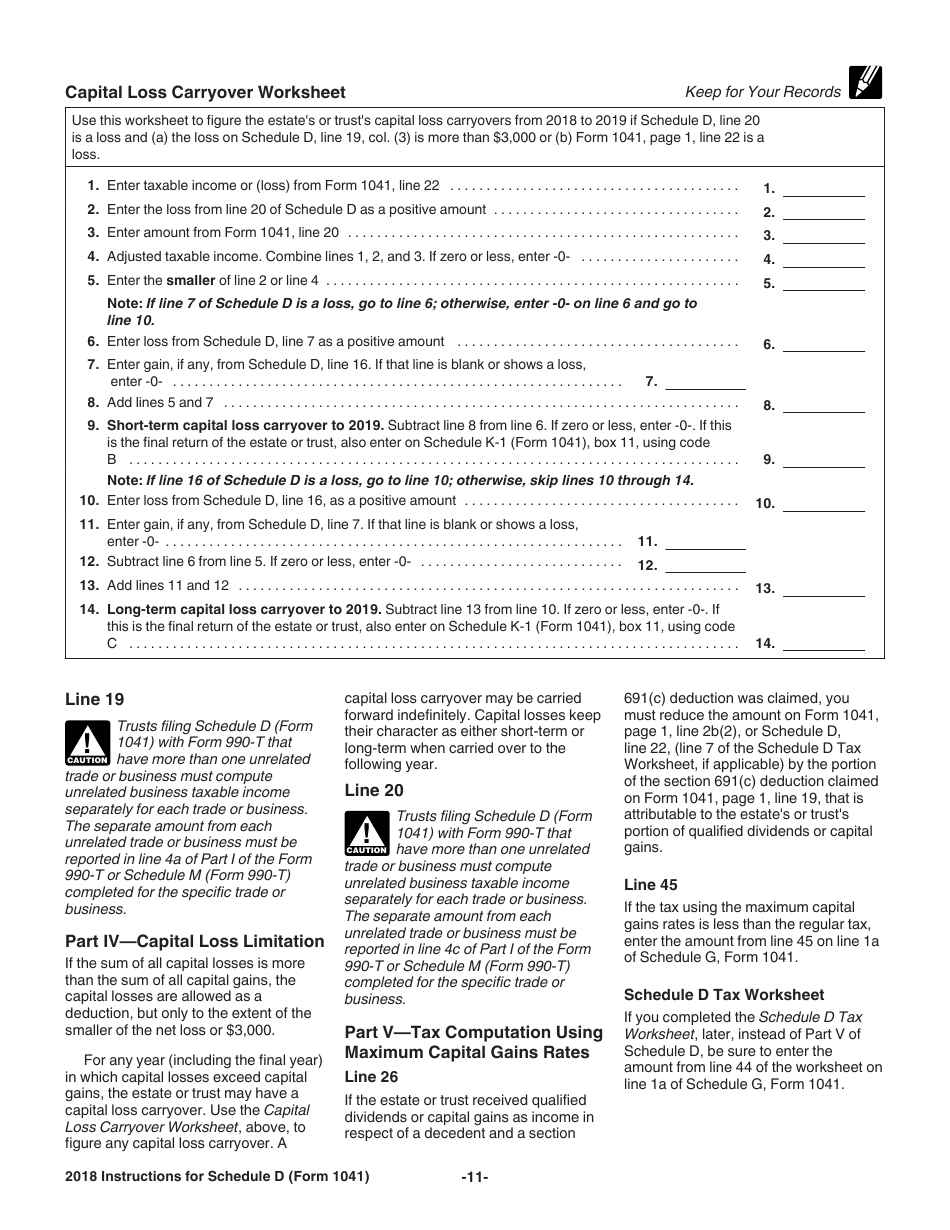

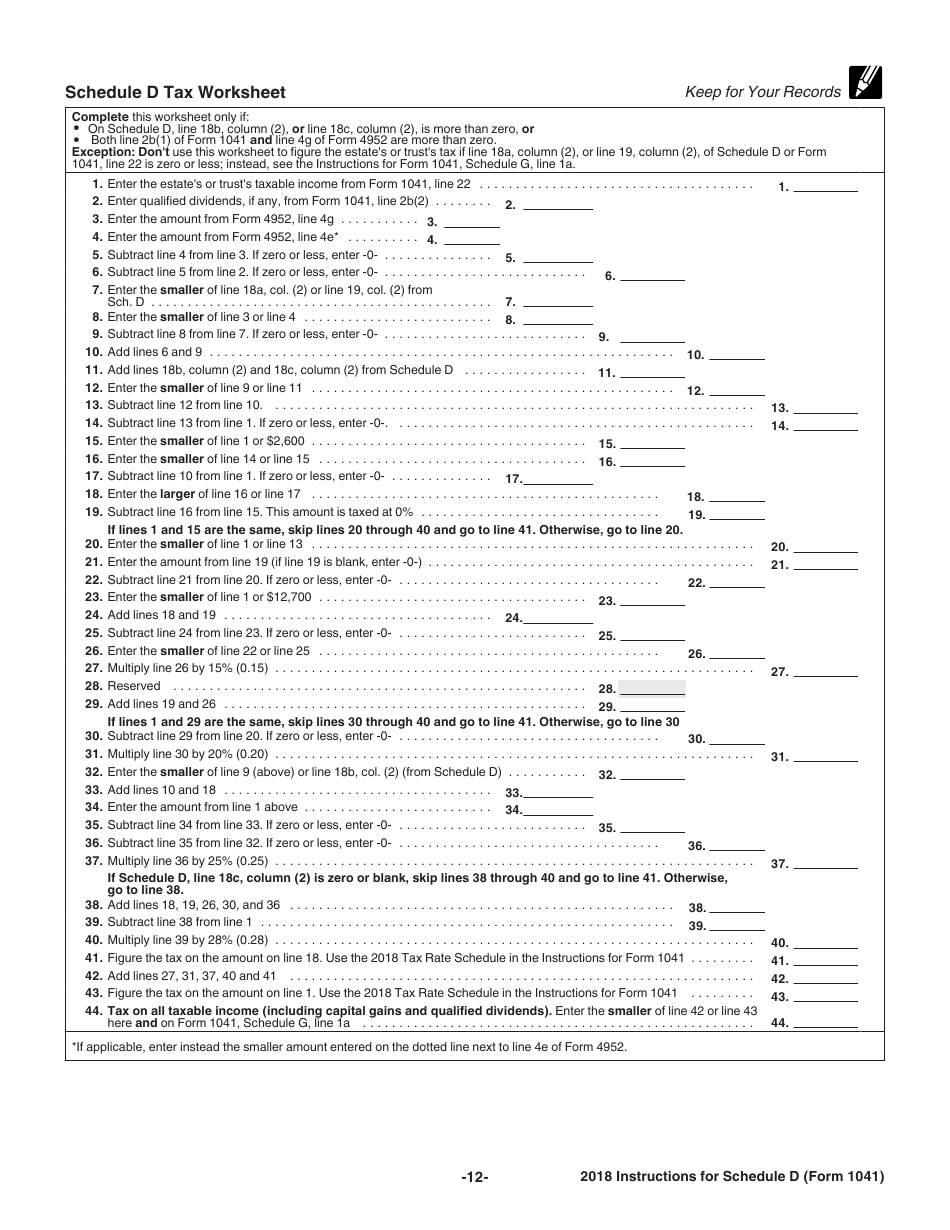

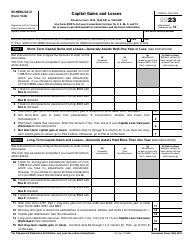

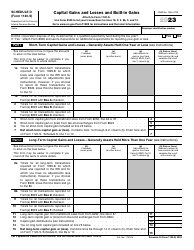

Instructions for IRS Form 1041 Schedule D Capital Gains and Losses

This document contains official instructions for IRS Form 1041 Schedule D, Capital Gains and Losses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1041 Schedule D is available for download through this link.

FAQ

Q: What is IRS Form 1041 Schedule D?

A: IRS Form 1041 Schedule D is a tax form used to report capital gains and losses for estates and trusts.

Q: Who needs to file IRS Form 1041 Schedule D?

A: Estates and trusts that have capital gains or losses during the tax year need to file IRS Form 1041 Schedule D.

Q: What is the purpose of IRS Form 1041 Schedule D?

A: The purpose of IRS Form 1041 Schedule D is to calculate and report the capital gains and losses of an estate or trust.

Q: What information is required to complete IRS Form 1041 Schedule D?

A: To complete IRS Form 1041 Schedule D, you will need information about the assets that were sold or disposed of, the dates of acquisition and disposition, and the cost basis of each asset.

Q: When is the deadline to file IRS Form 1041 Schedule D?

A: The deadline to file IRS Form 1041 Schedule D is the same as the deadline to file Form 1041, which is generally April 15th of the following year.

Q: Are there any penalties for not filing IRS Form 1041 Schedule D?

A: Yes, if you do not file IRS Form 1041 Schedule D or file it late, you may be subject to penalties and interest on any unpaid tax balance.

Q: Can I e-file IRS Form 1041 Schedule D?

A: No, currently e-filing is not available for IRS Form 1041 Schedule D. It must be filed by mail.

Q: Do I need to attach any other forms or documents when filing IRS Form 1041 Schedule D?

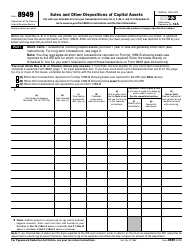

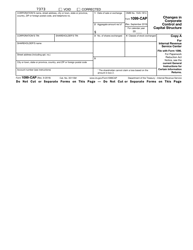

A: Yes, you may need to attach supporting documents such as Form 8949 and Schedule K-1 if applicable.

Q: Is there a different version of IRS Form 1041 Schedule D for individuals?

A: No, IRS Form 1041 Schedule D is specifically for reporting capital gains and losses for estates and trusts, not for individuals.

Instruction Details:

- This 12-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.