This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040-C

for the current year.

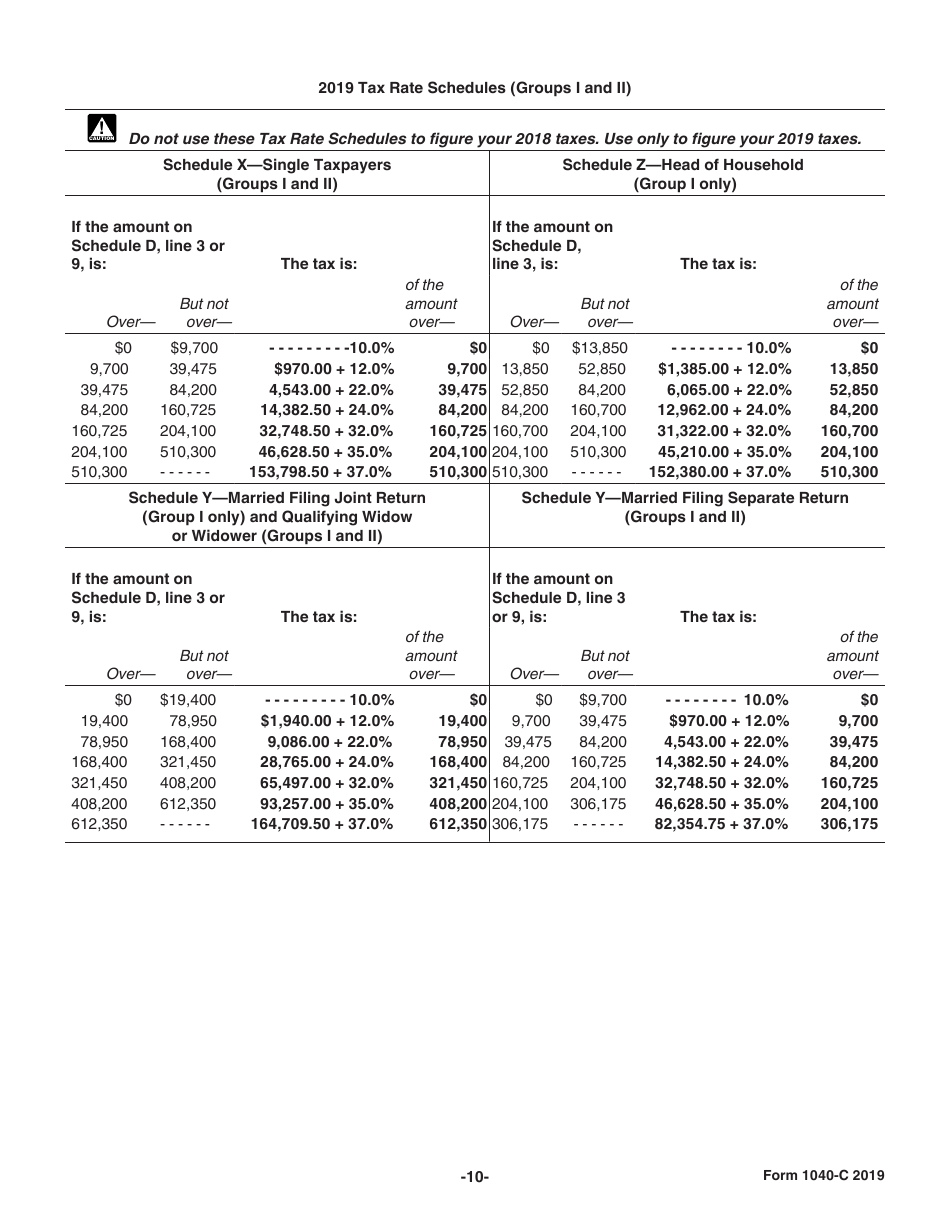

Instructions for IRS Form 1040-C U.S. Departing Alien Income Tax Return

This document contains official instructions for IRS Form 1040-C , U.S. Departing Alien Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040-C is available for download through this link.

FAQ

Q: What is Form 1040-C?

A: Form 1040-C is the U.S. Departing Alien Income Tax Return.

Q: Who needs to file Form 1040-C?

A: Nonresident aliens who are leaving the United States for good or are not planning to return.

Q: Why do I need to file Form 1040-C?

A: Form 1040-C is used to report any income received from U.S. sources before leaving the country.

Q: What is the deadline for filing Form 1040-C?

A: The deadline for filing Form 1040-C is generally the day before leaving the United States.

Q: Can I e-file Form 1040-C?

A: No, Form 1040-C cannot be e-filed. It must be filed by mail.

Q: What should I include with Form 1040-C?

A: You should include any necessary supporting documents, such as W-2s or 1099s, with your Form 1040-C.

Q: Will I get a refund if I file Form 1040-C?

A: It depends on your individual circumstances. Some departing aliens may be eligible for a refund.

Q: What happens if I don't file Form 1040-C?

A: Failing to file Form 1040-C may result in penalty or interest charges from the IRS.

Q: Can I use Form 1040-C if I have a U.S. visa?

A: Yes, as long as you are a nonresident alien who is leaving the United States for good or are not planning to return.

Instruction Details:

- This 10-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.