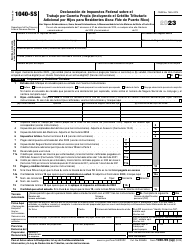

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040-SS

for the current year.

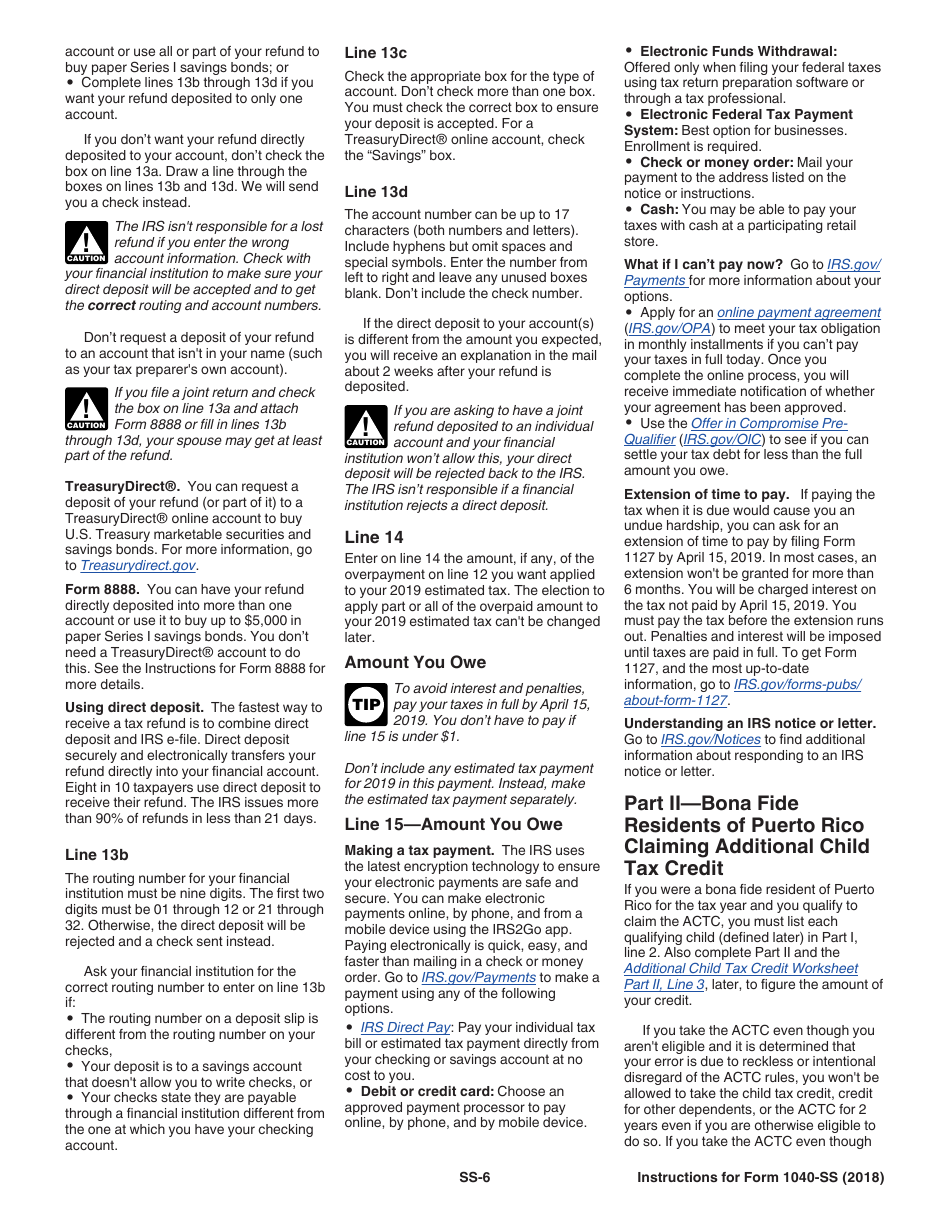

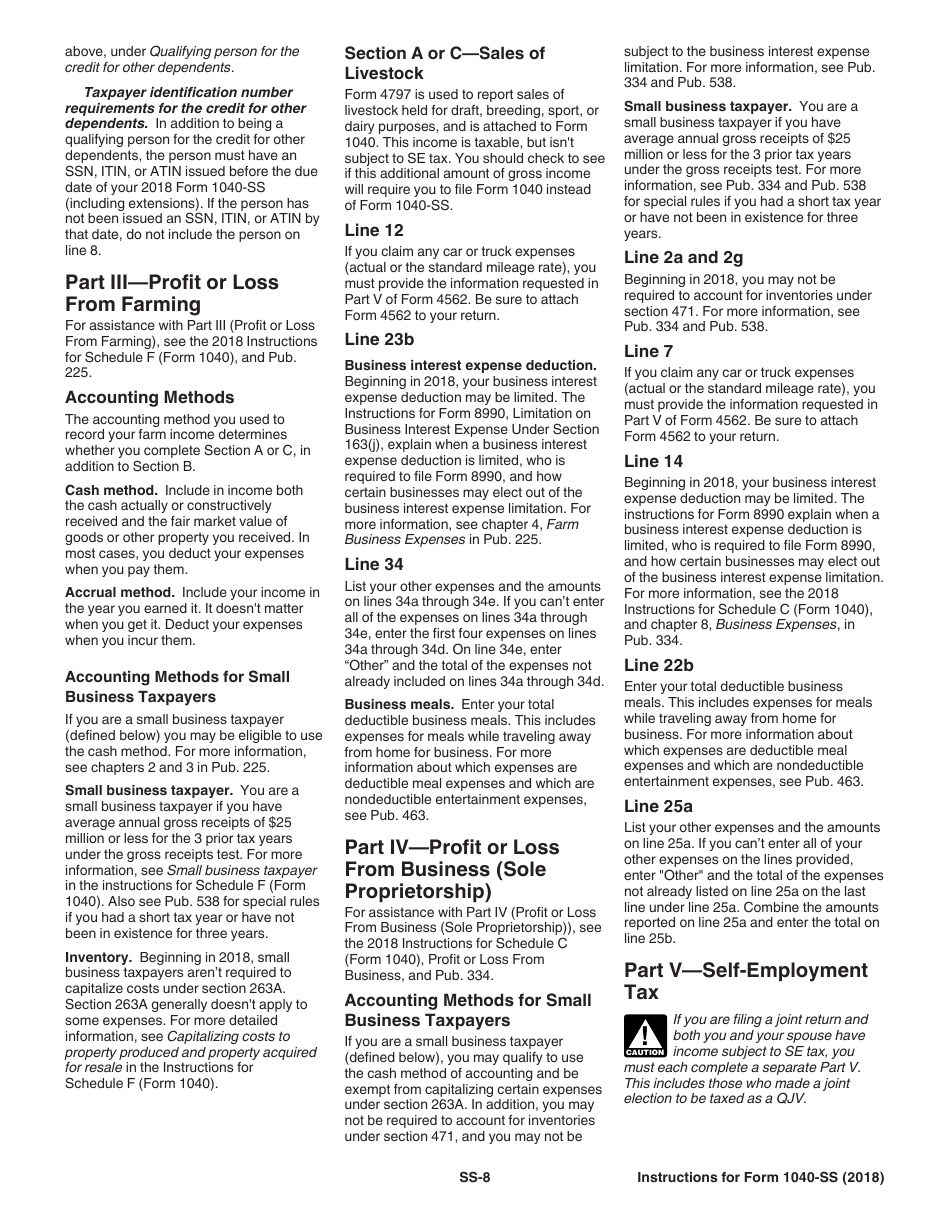

Instructions for IRS Form 1040-SS U.S. Self-employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico)

This document contains official instructions for IRS Form 1040-SS , U.S. Self-employment Tax Return (Including the Bona Fide Residents of Puerto Rico) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040-SS is available for download through this link.

FAQ

Q: What is IRS Form 1040-SS?

A: IRS Form 1040-SS is a U.S. self-employment tax return form.

Q: Who needs to file IRS Form 1040-SS?

A: Individuals who are self-employed and residents of Puerto Rico need to file IRS Form 1040-SS.

Q: What is the purpose of IRS Form 1040-SS?

A: IRS Form 1040-SS is used to report self-employment income and calculate self-employment tax.

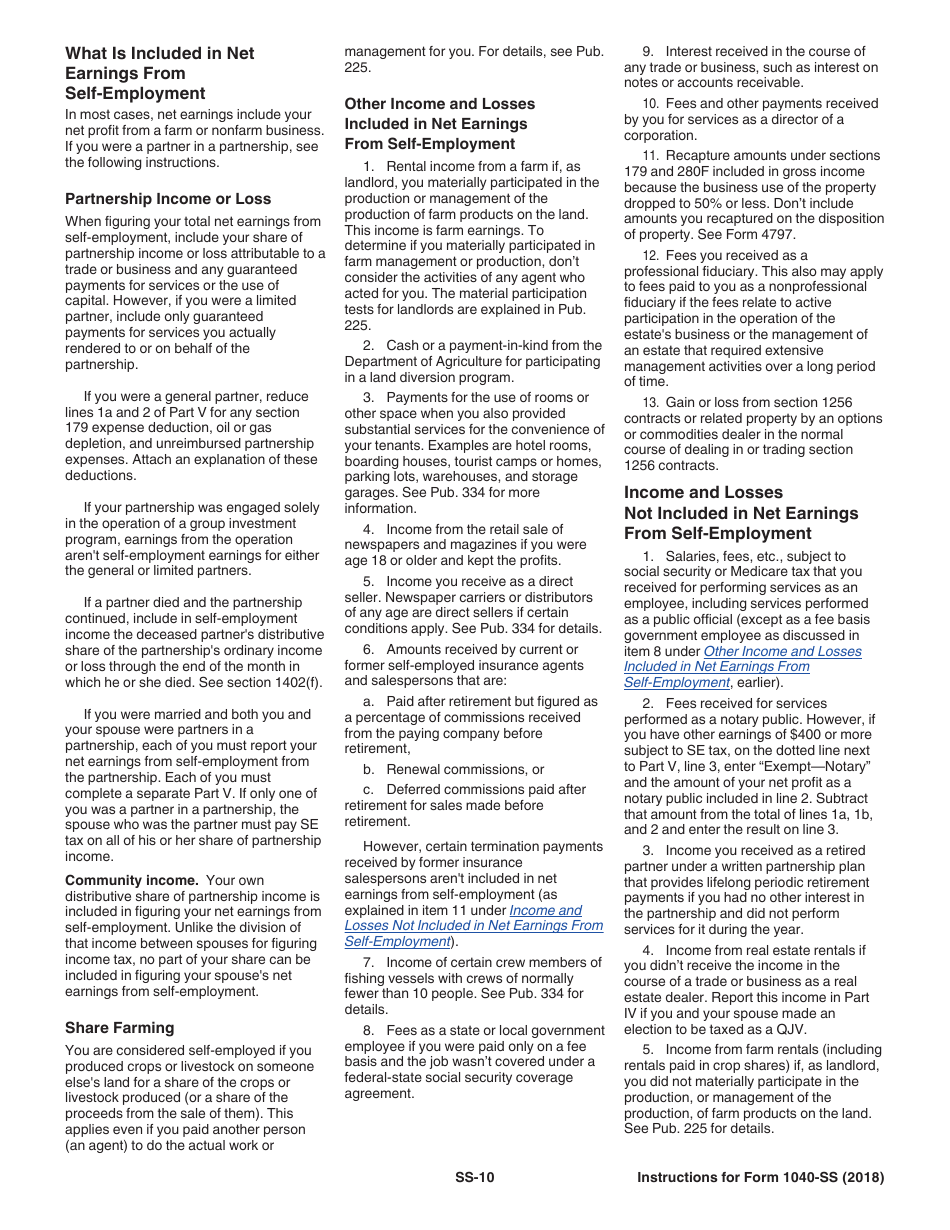

Q: What is self-employment tax?

A: Self-employment tax is a tax imposed on individuals who earn income from self-employment.

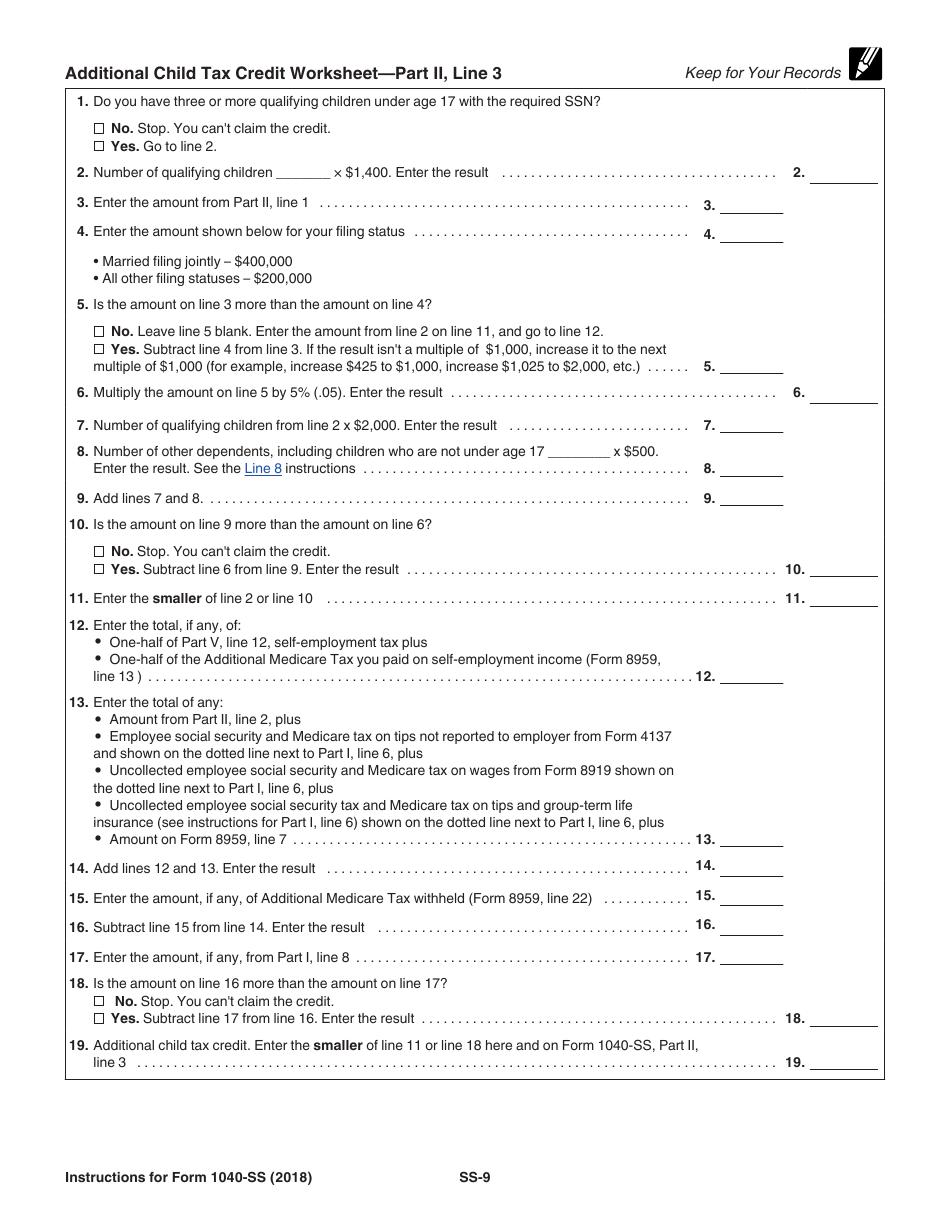

Q: What is the Additional Child Tax Credit?

A: The Additional Child Tax Credit is a credit available to eligible individuals with qualifying children to reduce their tax liability.

Q: Who is considered a bona fide resident of Puerto Rico?

A: A bona fide resident of Puerto Rico is an individual who meets the requirements set by the IRS for residency in Puerto Rico.

Q: Is Form 1040-SS applicable to residents of other U.S. states?

A: No, Form 1040-SS is specifically for residents of Puerto Rico.

Q: Are there any income limits for filing Form 1040-SS?

A: There are no income limits for filing Form 1040-SS.

Q: When is the due date for filing Form 1040-SS?

A: The due date for filing Form 1040-SS is typically April 15th, unless an extension is requested.

Instruction Details:

- This 14-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.