This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040 Schedule C

for the current year.

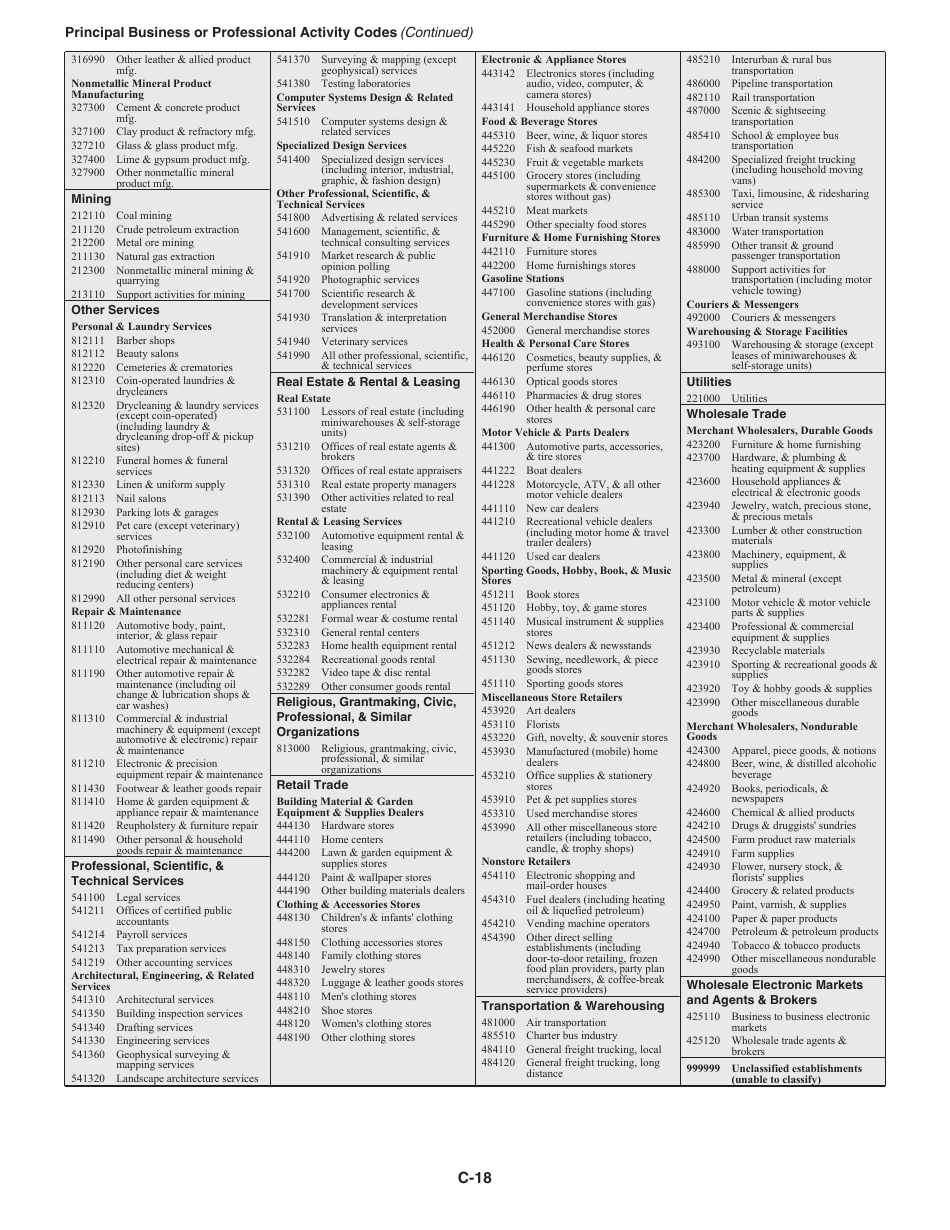

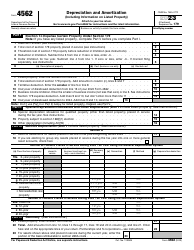

Instructions for IRS Form 1040 Schedule C Profit or Loss From Business (Sole Proprietorship)

This document contains official instructions for IRS Form 1040 Schedule C, Profit or Loss From Business (Sole Proprietorship) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule C is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule C?

A: IRS Form 1040 Schedule C is a tax form used to report the profit or loss from a business operated as a sole proprietorship.

Q: Who needs to file IRS Form 1040 Schedule C?

A: Anyone who operates a business as a sole proprietorship and has a profit or loss from that business needs to file IRS Form 1040 Schedule C.

Q: What information is required to complete IRS Form 1040 Schedule C?

A: You will need to provide information about your business income, expenses, and deductions to complete IRS Form 1040 Schedule C.

Q: What is the purpose of IRS Form 1040 Schedule C?

A: The purpose of IRS Form 1040 Schedule C is to calculate the net profit or loss from a sole proprietorship business, which is then reported on your individual tax return.

Q: Is there a deadline to file IRS Form 1040 Schedule C?

A: Yes, IRS Form 1040 Schedule C is filed along with your individual tax return, so the deadline to file is typically April 15th of each year.

Q: Are there any special rules or considerations for filing IRS Form 1040 Schedule C?

A: Yes, there are certain rules and considerations for filing IRS Form 1040 Schedule C, such as keeping detailed records of your business income and expenses, and understanding what can be deducted as business expenses.

Q: What happens if I make a mistake on IRS Form 1040 Schedule C?

A: If you make a mistake on IRS Form 1040 Schedule C, you may need to file an amended return to correct the error. It's important to review your completed form carefully before submitting it to the IRS.

Q: Do I need to include any additional documentation with IRS Form 1040 Schedule C?

A: You may need to include additional documentation, such as receipts or records of your business income and expenses, to support the information reported on IRS Form 1040 Schedule C.

Instruction Details:

- This 18-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.