This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040 Schedule R

for the current year.

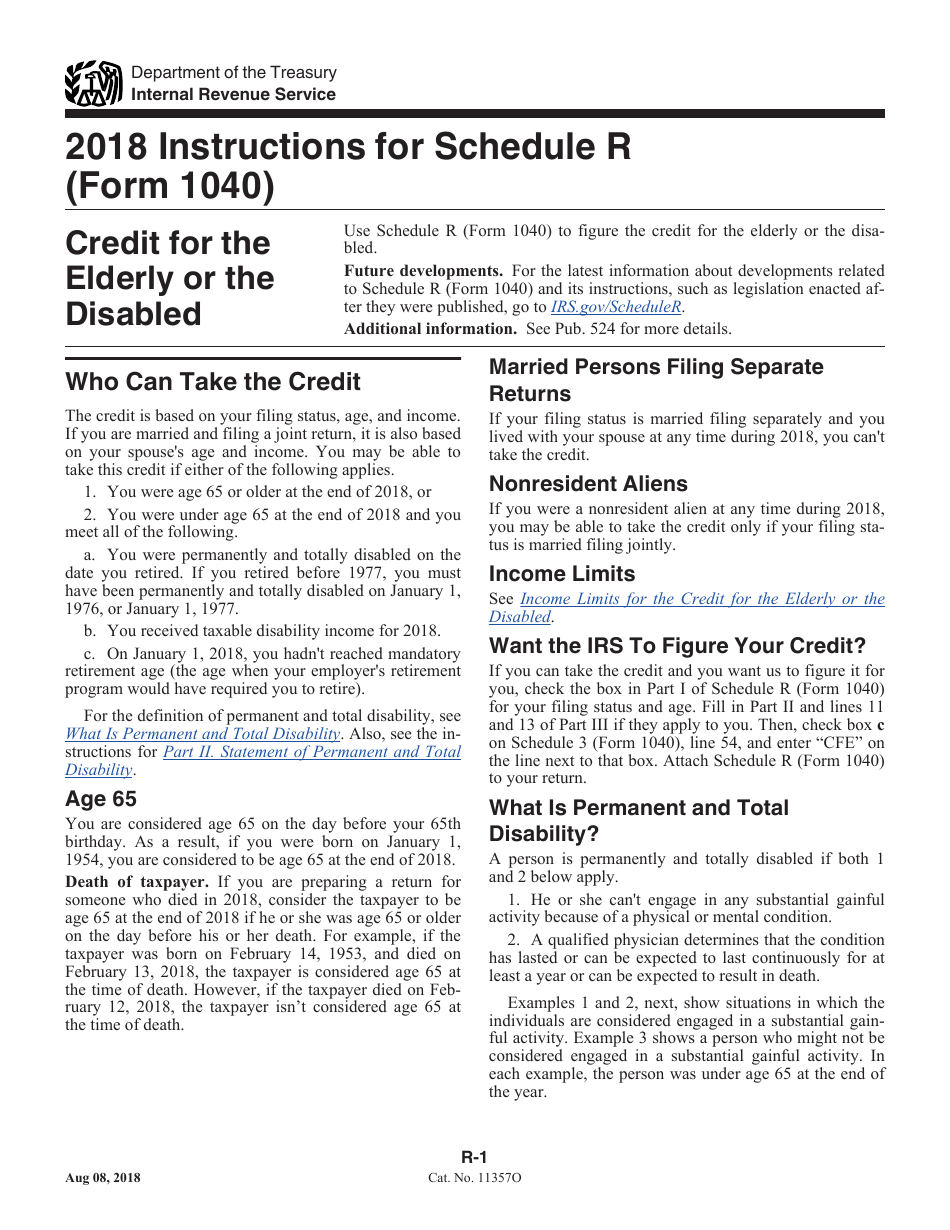

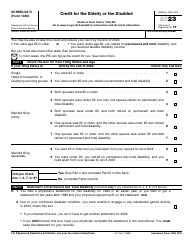

Instructions for IRS Form 1040 Schedule R Credit for the Elderly or the Disabled

This document contains official instructions for IRS Form 1040 Schedule R, Credit for the Elderly or the Disabled - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule R is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule R?

A: IRS Form 1040 Schedule R is a form used to claim the Credit for the Elderly or the Disabled.

Q: Who is eligible for the Credit for the Elderly or the Disabled?

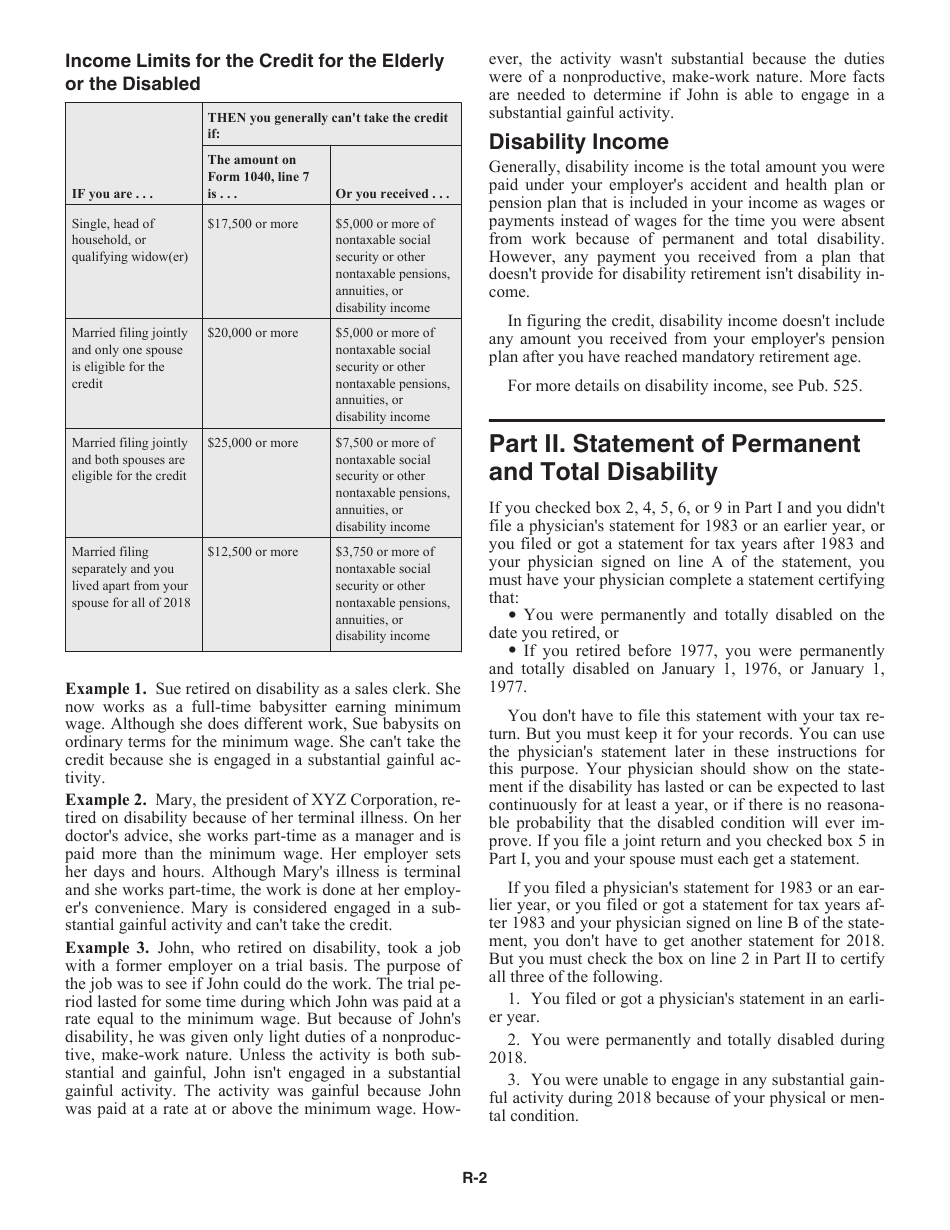

A: Individuals who are 65 years or older, or those under 65 who are retired on permanent disability, may be eligible for this credit.

Q: What documentation is needed to claim the credit?

A: You may need to provide proof of age or disability status, as well as proof of income.

Q: How much is the credit?

A: The credit amount varies based on income and filing status.

Q: Can I claim this credit if I am married filing separately?

A: No, you cannot claim this credit if you are married filing separately.

Q: When is the deadline to file IRS Form 1040 Schedule R?

A: The deadline to file this form is generally the same as the deadline to file your federal income tax return, which is April 15th.

Q: Is the credit refundable?

A: No, the credit for the elderly or disabled is not refundable.

Q: Can I claim this credit if I am claimed as a dependent on someone else's tax return?

A: No, you cannot claim this credit if you are claimed as a dependent.

Q: What if I have questions or need help with IRS Form 1040 Schedule R?

A: You can reach out to the IRS helpline or consult a tax professional for assistance with this form.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.