This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040 Schedule SE

for the current year.

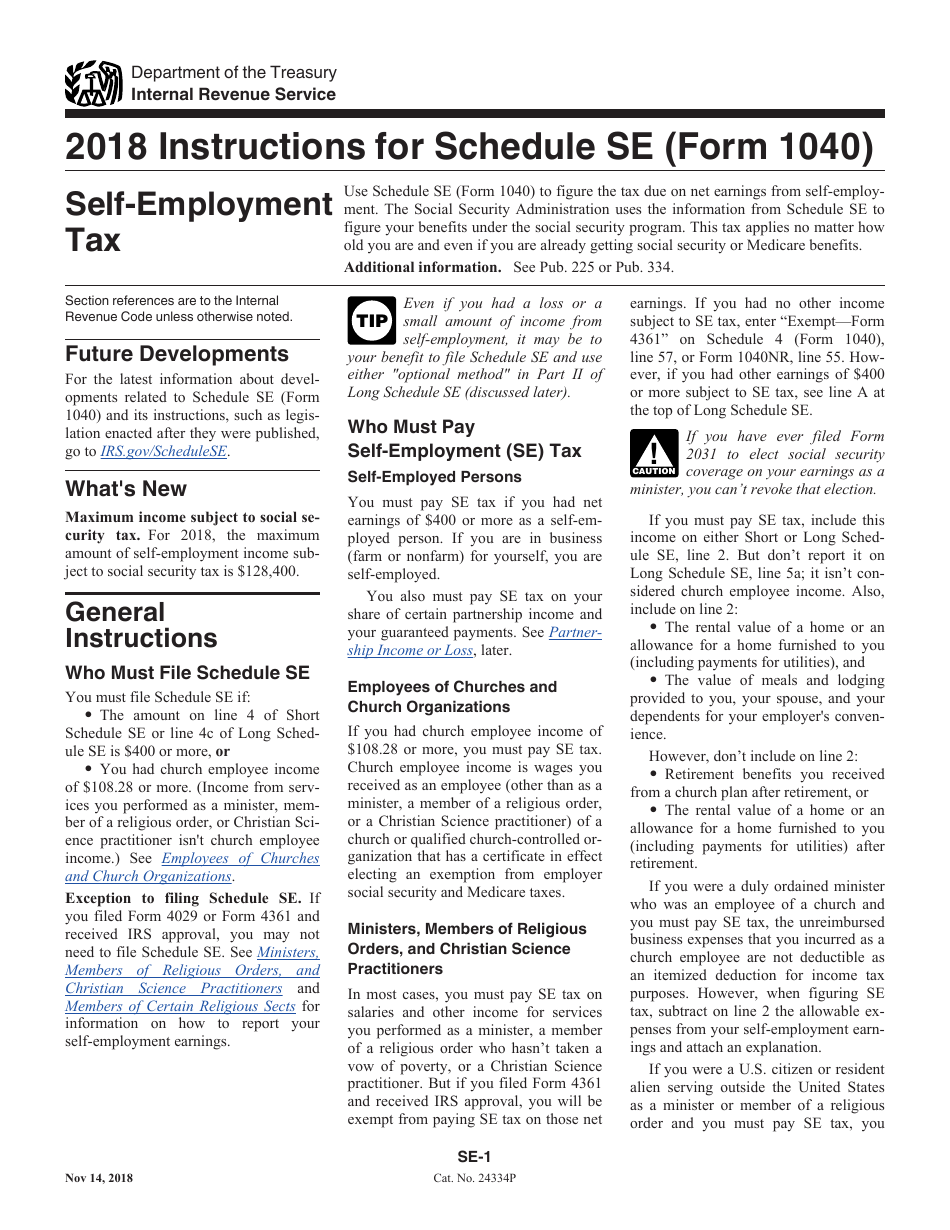

Instructions for IRS Form 1040 Schedule SE Self-employment Tax

This document contains official instructions for IRS Form 1040 Schedule SE, Self-employment Tax - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule SE is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule SE?

A: IRS Form 1040 Schedule SE is a tax form used to calculate and report self-employment tax.

Q: Who needs to file IRS Form 1040 Schedule SE?

A: Individuals who have self-employment income and meet the filing requirements must file IRS Form 1040 Schedule SE.

Q: What is self-employment tax?

A: Self-employment tax is a tax that self-employed individuals must pay to fund their Social Security and Medicare benefits.

Q: How is self-employment tax calculated?

A: Self-employment tax is calculated by multiplying net self-employment income by the self-employment tax rate.

Q: What is the self-employment tax rate?

A: The self-employment tax rate is 15.3%, which consists of 12.4% for Social Security and 2.9% for Medicare.

Q: What information is needed to fill out IRS Form 1040 Schedule SE?

A: You will need to know your net self-employment income, as well as any other relevant information such as deductions or credits.

Q: When is the deadline to file IRS Form 1040 Schedule SE?

A: The deadline to file IRS Form 1040 Schedule SE is the same as the deadline for filing your individual income tax return, which is usually April 15th.

Q: Can I file IRS Form 1040 Schedule SE electronically?

A: Yes, you can file IRS Form 1040 Schedule SE electronically using tax preparation software or through the IRS Free File program.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.