This version of the form is not currently in use and is provided for reference only. Download this version of

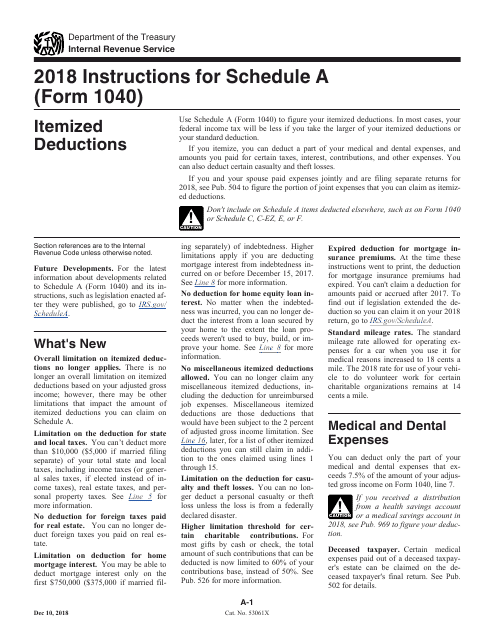

Instructions for IRS Form 1040 Schedule A

for the current year.

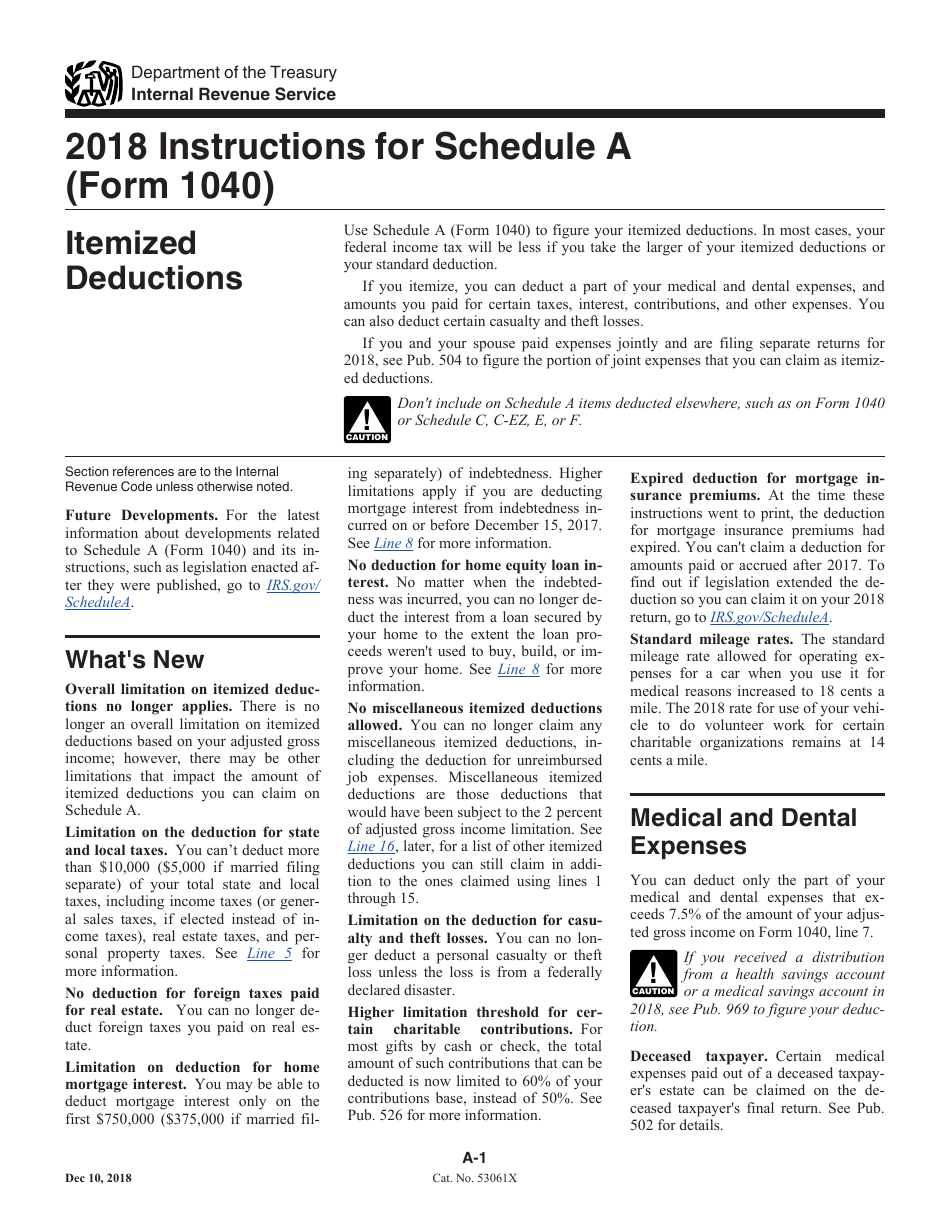

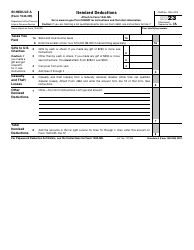

Instructions for IRS Form 1040 Schedule A Itemized Deductions

This document contains official instructions for IRS Form 1040 Schedule A, Itemized Deductions - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule A is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule A?

A: IRS Form 1040 Schedule A is a form used to itemize deductions on your federal income tax return.

Q: What are itemized deductions?

A: Itemized deductions are expenses that you can subtract from your taxable income to lower your tax liability.

Q: What expenses can be itemized on Schedule A?

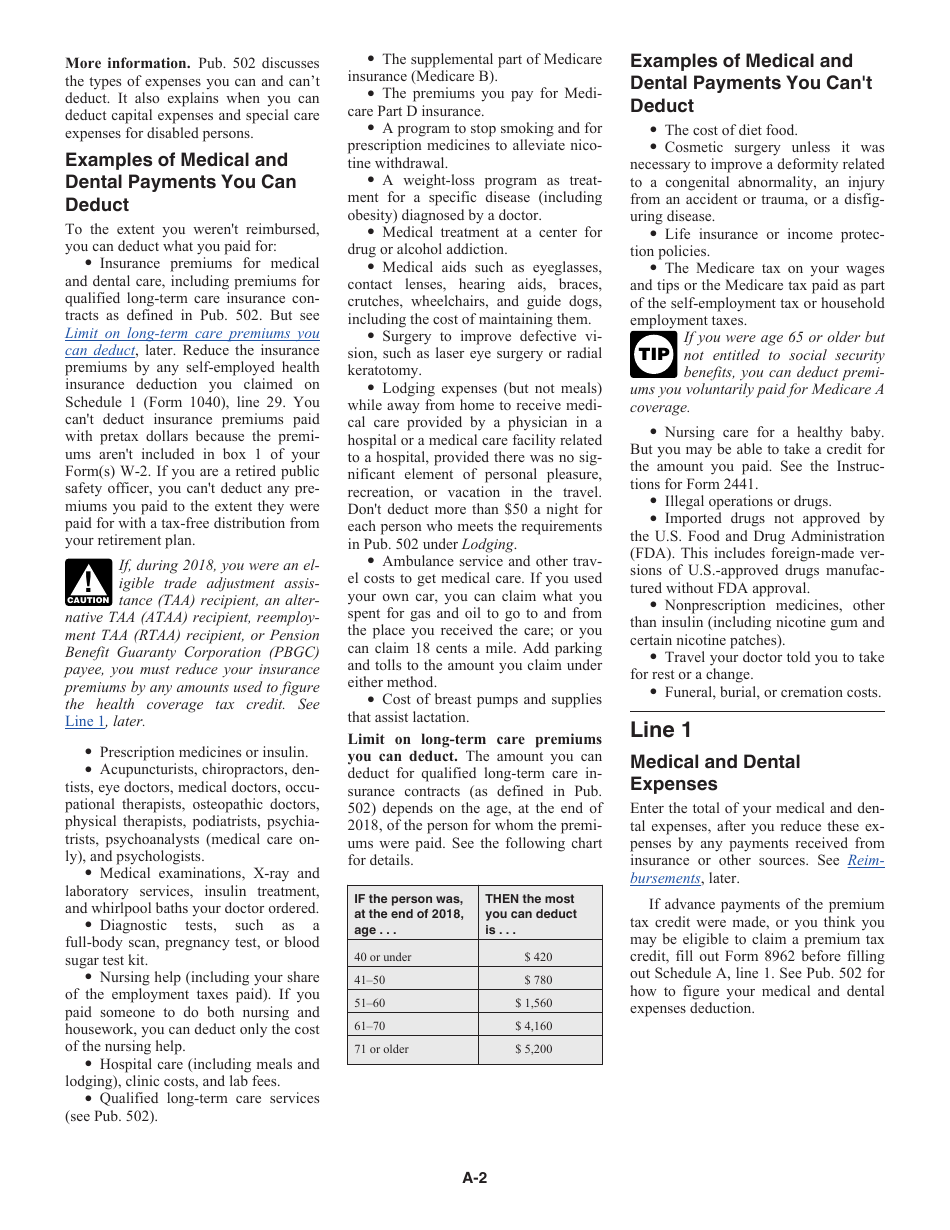

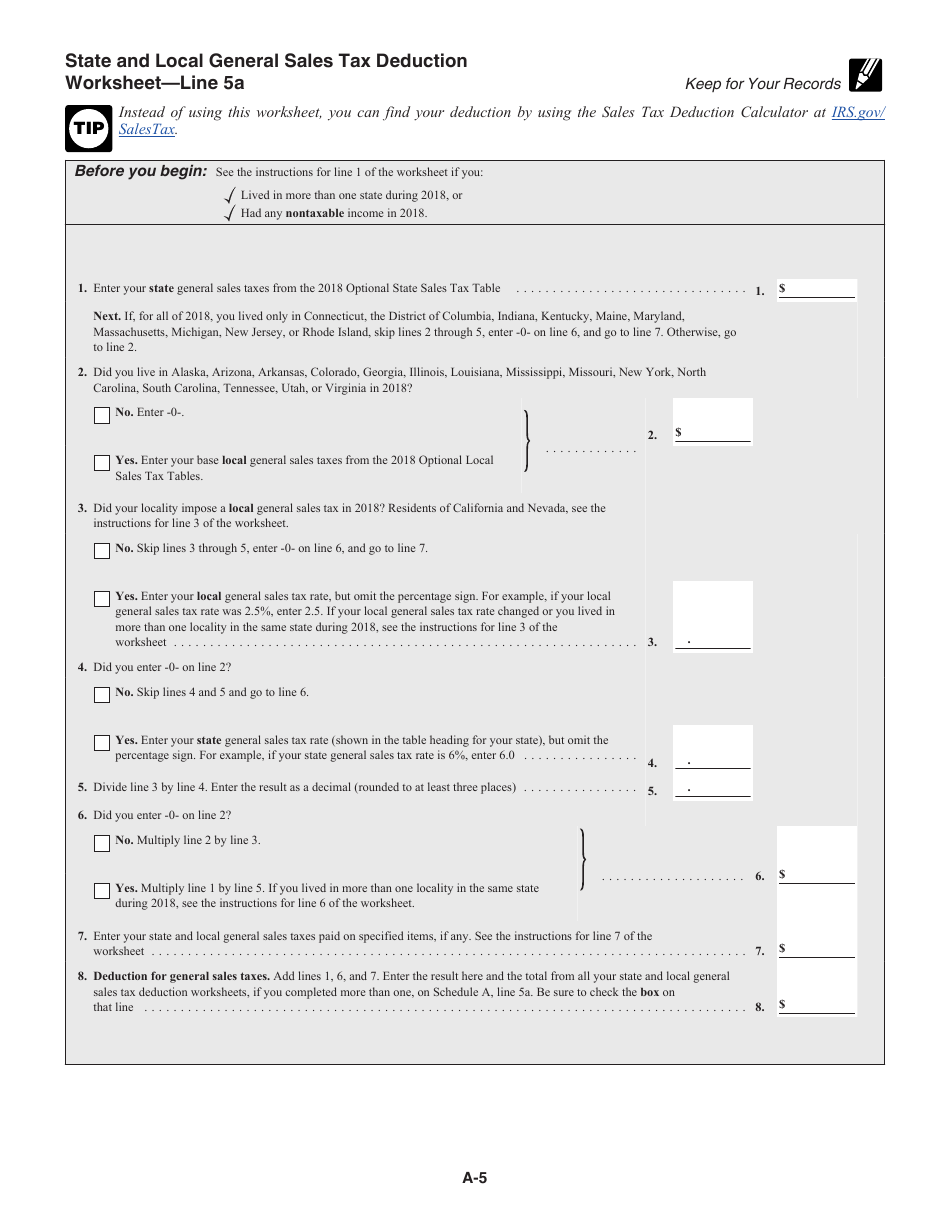

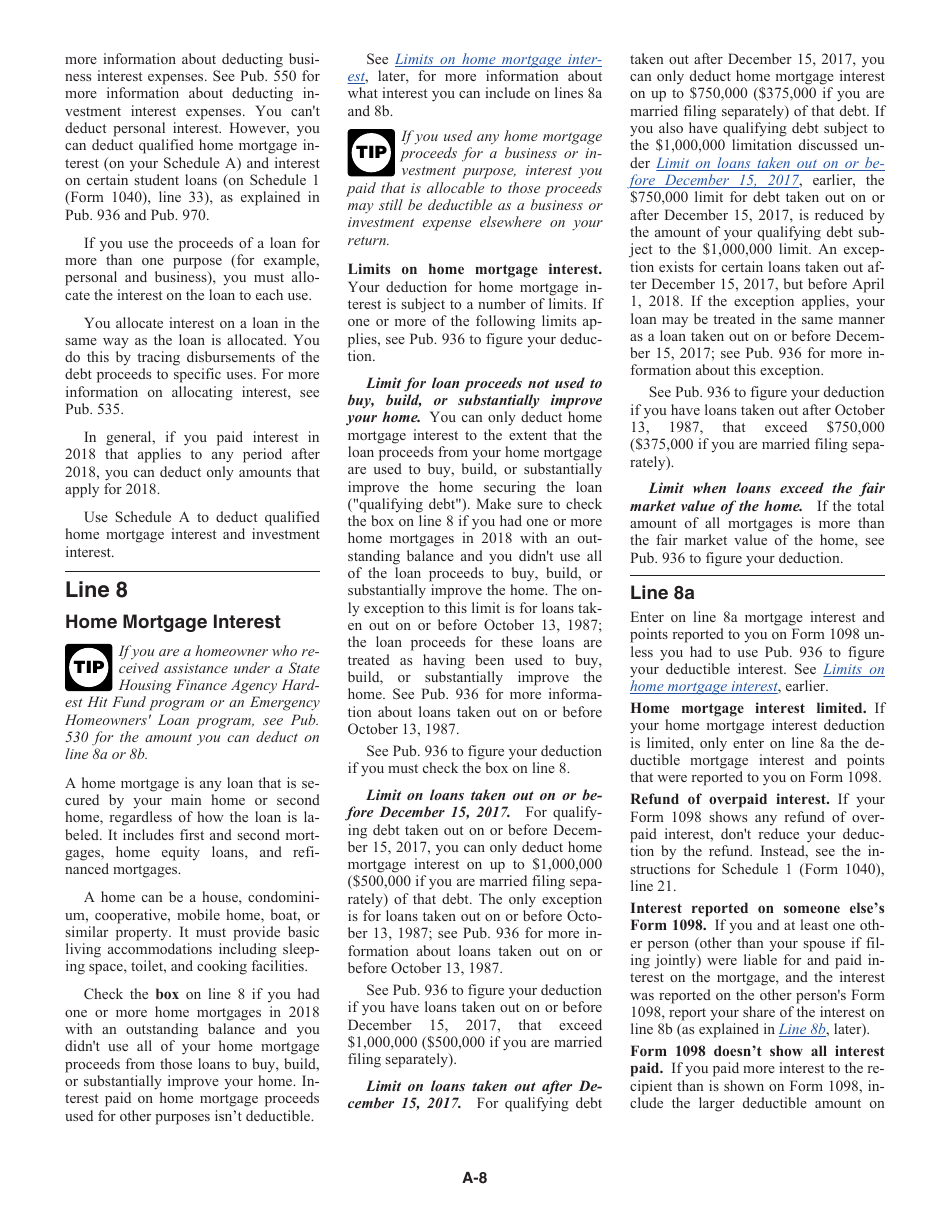

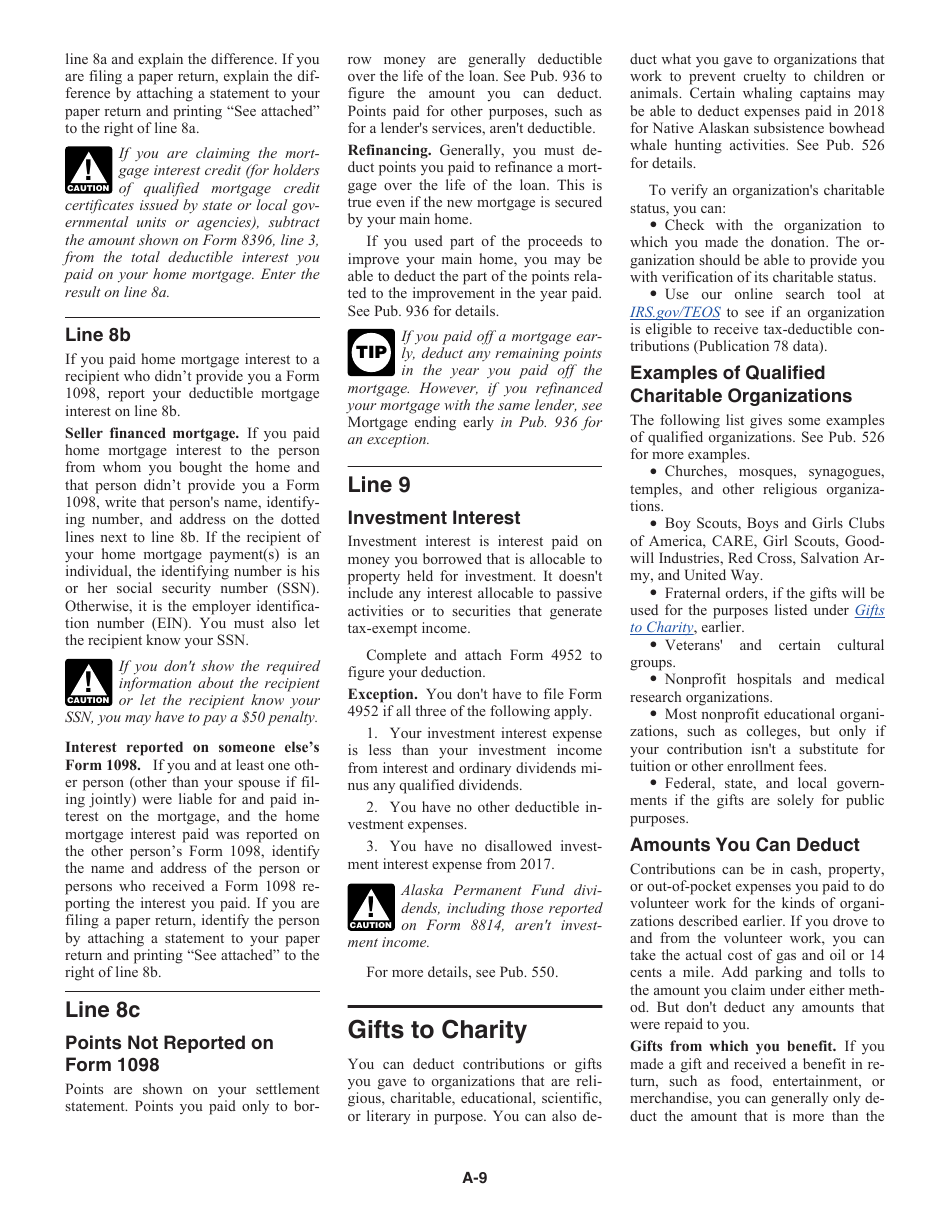

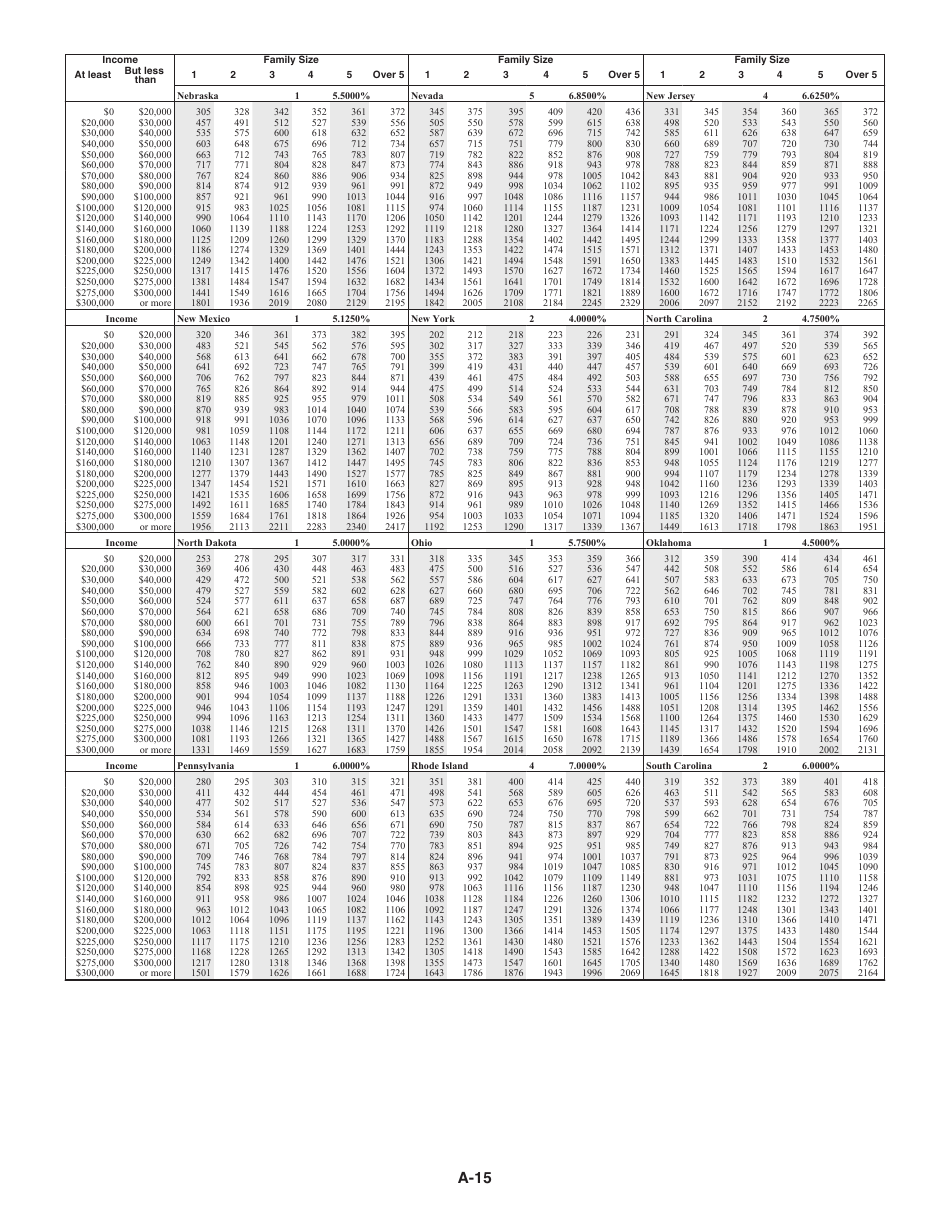

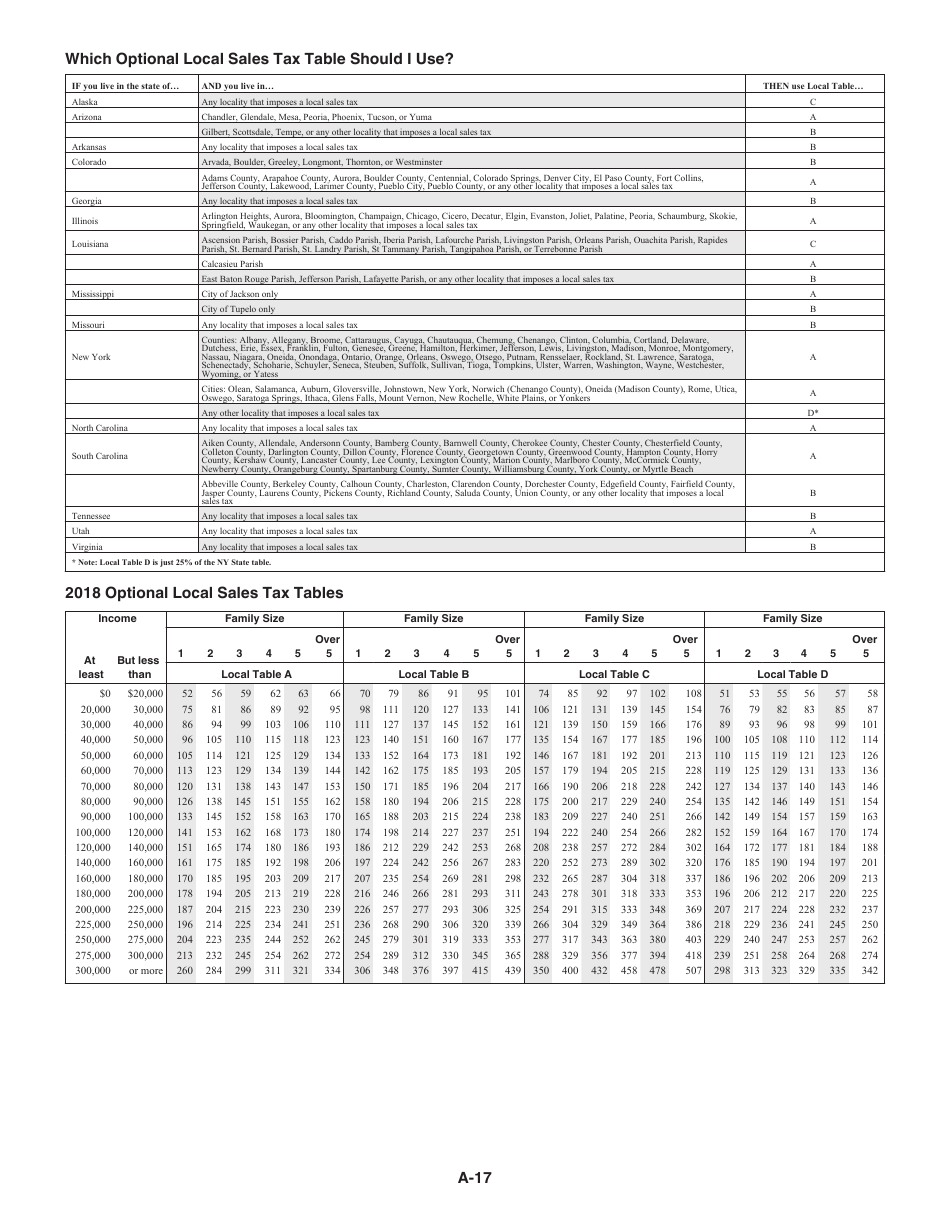

A: Common expenses that can be itemized on Schedule A include medical expenses, state and local taxes, mortgage interest, charitable contributions, and certain miscellaneous deductions.

Q: Do I have to use Schedule A to itemize deductions?

A: No, you can choose to take the standard deduction instead of itemizing deductions if it results in a larger tax benefit for you.

Q: What is the standard deduction for 2021?

A: For the tax year 2021, the standard deduction is $12,550 for single individuals and married individuals filing separately, $25,100 for married individuals filing jointly, and $18,800 for heads of household.

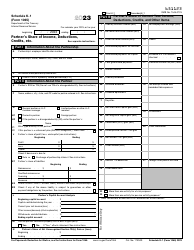

Q: How do I fill out Schedule A?

A: To fill out Schedule A, you will need to enter the amounts of your itemized deductions, such as medical expenses, state and local taxes, mortgage interest, and charitable contributions, and calculate the total.

Q: Can I e-file Schedule A?

A: Yes, you can e-file Schedule A along with your Form 1040.

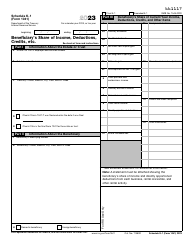

Q: What documentation do I need to support my itemized deductions?

A: You should keep documentation, such as receipts, statements, and records, to support your itemized deductions in case of an audit by the IRS.

Instruction Details:

- This 17-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.