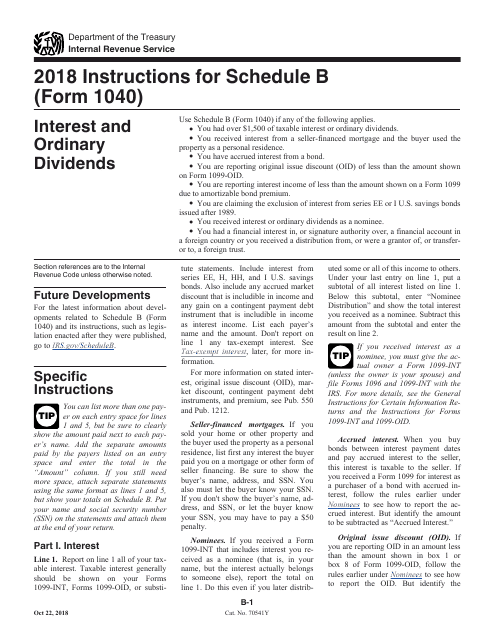

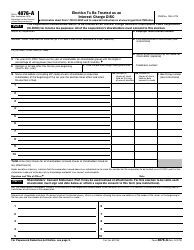

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040 Schedule B

for the current year.

Instructions for IRS Form 1040 Schedule B Interest and Ordinary Dividends

This document contains official instructions for IRS Form 1040 Schedule B, Interest and Ordinary Dividends - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule B is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule B?

A: IRS Form 1040 Schedule B is a tax form used to report interest and ordinary dividends.

Q: Who needs to file IRS Form 1040 Schedule B?

A: You need to file IRS Form 1040 Schedule B if any of the following applies to you:

- You received more than $1,500 of taxable interest or ordinary dividends.

- You had a foreign bank account with a balance of $10,000 or more at any time during the year.

- You are filing Form 2555 or 2555-EZ (related to foreign income).

Q: What information is required on IRS Form 1040 Schedule B?

A: Some of the information required on IRS Form 1040 Schedule B includes:

- Name of the financial institution(s)

- Account numbers

- Type of income (interest or dividends)

- Amount of income

- Whether the account was located in the United States or foreign country

Q: When is the deadline for filing IRS Form 1040 Schedule B?

A: The deadline for filing IRS Form 1040 Schedule B is the same as the deadline for filing your federal income tax return, which is typically April 15th.

Q: Can I e-file IRS Form 1040 Schedule B?

A: Yes, you can e-file IRS Form 1040 Schedule B along with your federal income tax return.

Q: Do I need to include supporting documents with IRS Form 1040 Schedule B?

A: Generally, you do not need to include supporting documents with IRS Form 1040 Schedule B. However, you should keep them for your records in case of an audit.

Q: What happens if I don't file IRS Form 1040 Schedule B when required?

A: If you are required to file IRS Form 1040 Schedule B but fail to do so, you may face penalties and interest on the unreported income.

Q: Can I amend IRS Form 1040 Schedule B if I made a mistake?

A: Yes, if you made a mistake on your IRS Form 1040 Schedule B, you can file an amended return using Form 1040X.

Q: Is IRS Form 1040 Schedule B the same as Form 1099?

A: No, IRS Form 1040 Schedule B is not the same as Form 1099. Form 1099 is used by the payer to report the income they paid you, while Schedule B is used by you to report that income on your tax return.

Instruction Details:

- This 3-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.