This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 941-SS

for the current year.

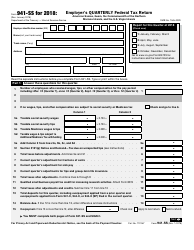

Instructions for IRS Form 941-SS Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands

This document contains official instructions for IRS Form 941-SS , Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 941-SS?

A: IRS Form 941-SS is the Employer's Quarterly Federal Tax Return specifically for businesses in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands.

Q: Who needs to file IRS Form 941-SS?

A: Businesses located in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands that have employees need to file IRS Form 941-SS.

Q: What information is required on IRS Form 941-SS?

A: IRS Form 941-SS requires information about the number of employees, wages, tips, and other compensation paid, as well as federal income tax withheld and the employer's share of Social Security and Medicare taxes.

Q: How often do I need to file IRS Form 941-SS?

A: IRS Form 941-SS is filed quarterly, meaning it needs to be filed four times a year.

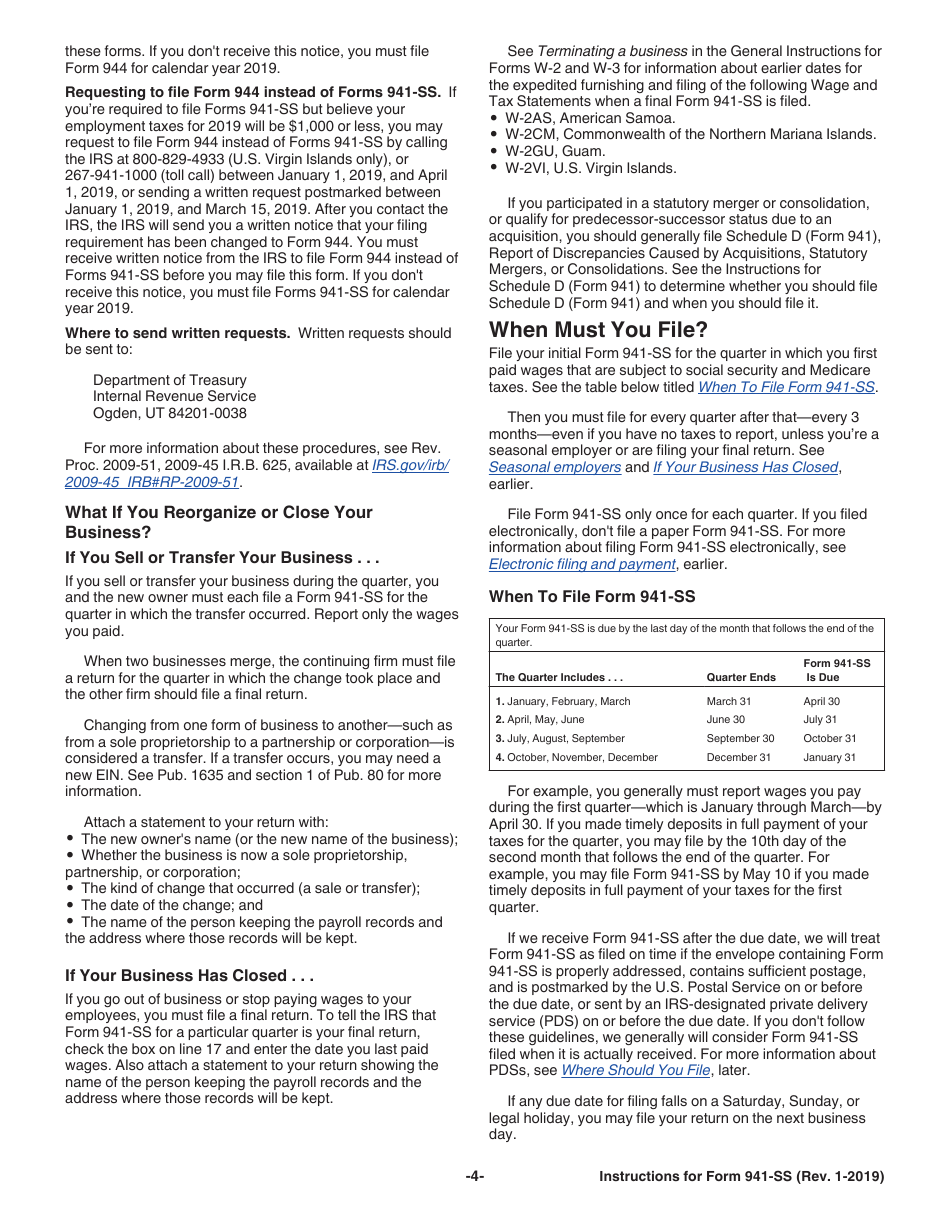

Q: What is the deadline for filing IRS Form 941-SS?

A: The deadline for filing IRS Form 941-SS is the end of the month following the end of each quarter. For example, the deadline for the first quarter is April 30th.

Q: Can I file IRS Form 941-SS electronically?

A: Yes, you can file IRS Form 941-SS electronically through the IRS e-file system.

Q: What happens if I don't file IRS Form 941-SS?

A: If you fail to file IRS Form 941-SS or file it late, you may be subject to penalties and interest on any unpaid taxes.

Instruction Details:

- This 11-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.