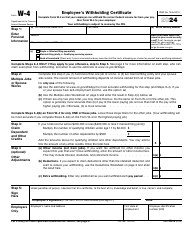

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form W-4S

for the current year.

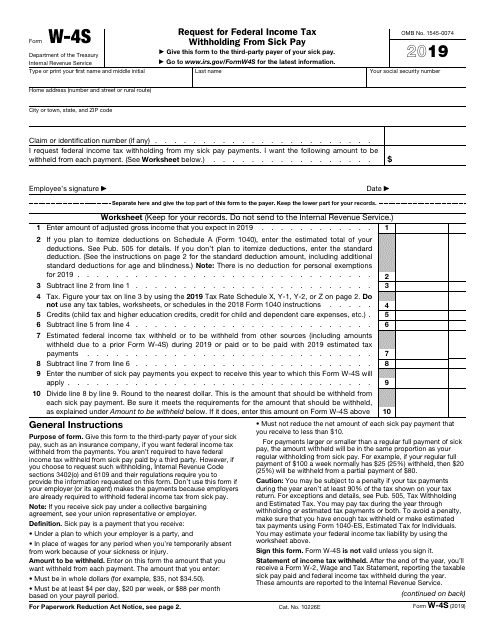

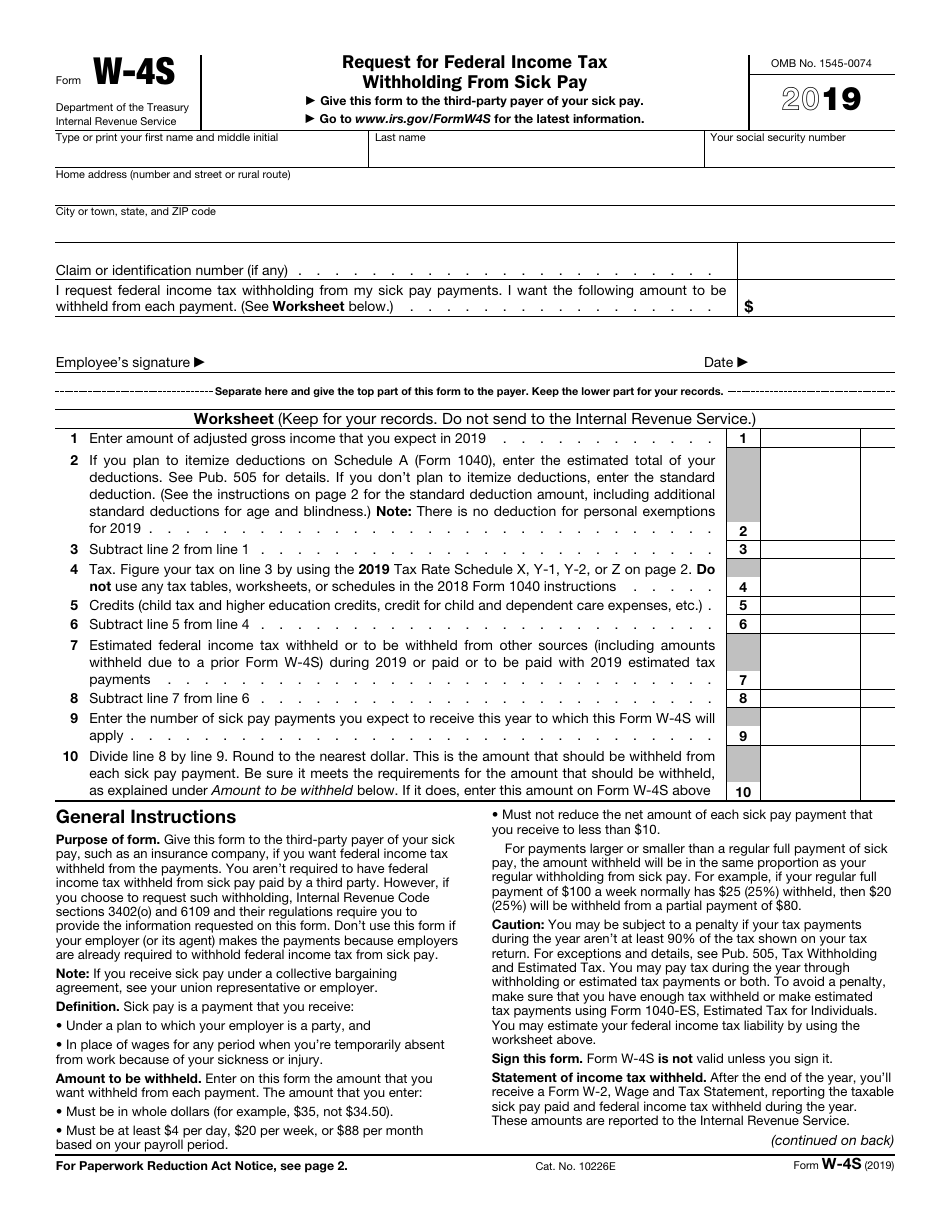

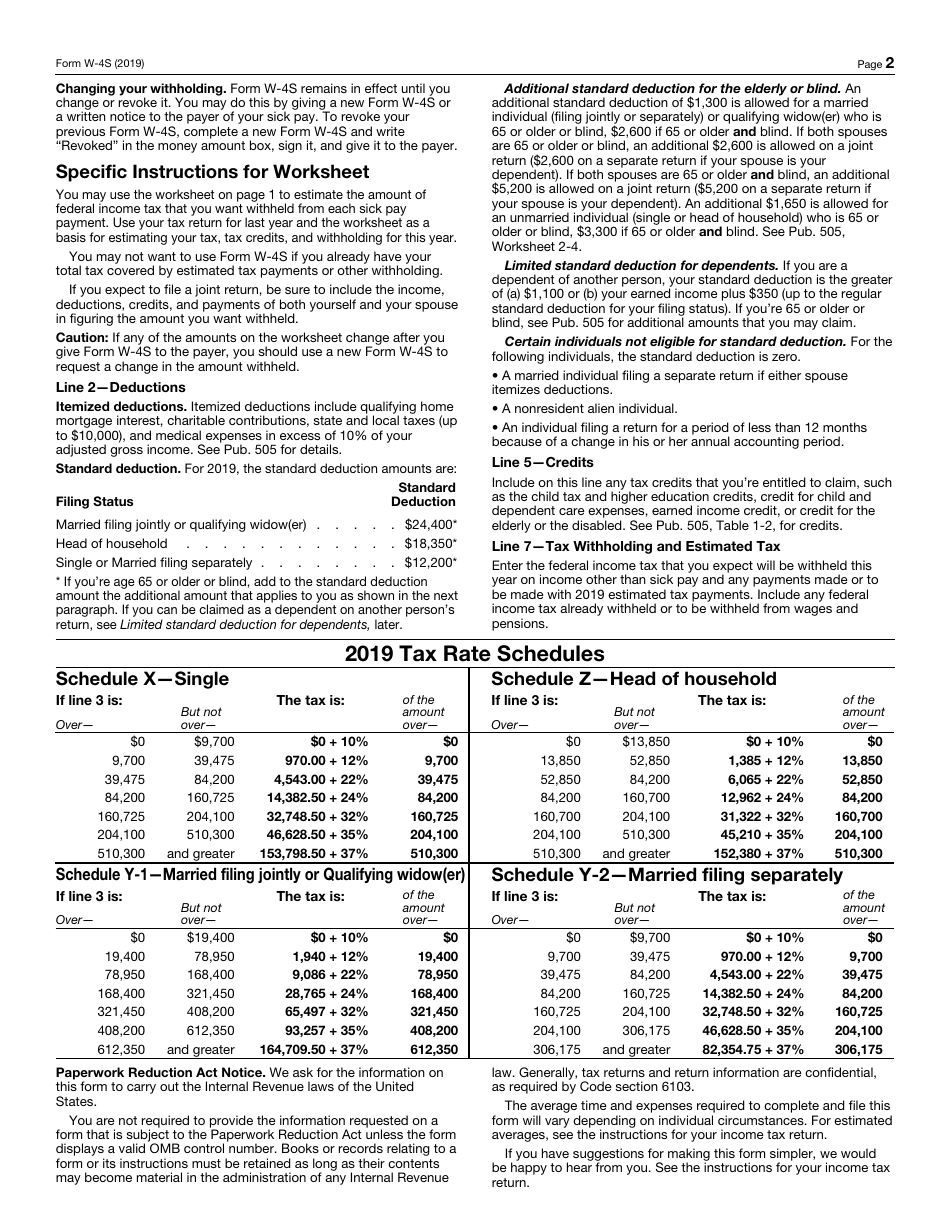

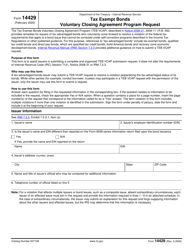

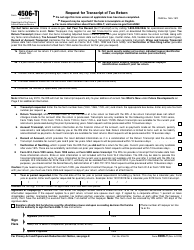

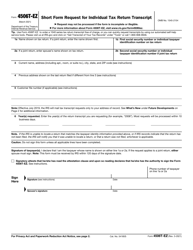

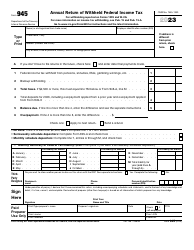

IRS Form W-4S Request for Federal Income Tax Withholding From Sick Pay

What Is IRS Form W-4S?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form W-4S?

A: IRS Form W-4S is a form used to request federal incometax withholding from sick pay.

Q: Who should use IRS Form W-4S?

A: Individuals who receive sick pay and want to have federal income tax withheld from it should use IRS Form W-4S.

Q: Why would someone want to use IRS Form W-4S?

A: Using IRS Form W-4S allows individuals to ensure that federal income tax is withheld from their sick pay, which can help them avoid a large tax bill at the end of the year.

Q: How do I fill out IRS Form W-4S?

A: To fill out IRS Form W-4S, you will need to provide your personal information, such as your name, address, and social security number, as well as details about your sick pay and the amount of federal income tax you would like to have withheld.

Q: When should I submit IRS Form W-4S?

A: You should submit IRS Form W-4S as soon as possible if you want to have federal income tax withheld from your sick pay. It's best to submit the form before you start receiving sick pay.

Q: Is IRS Form W-4S specific to sick pay?

A: Yes, IRS Form W-4S is specifically used for requesting federal income tax withholding from sick pay.

Q: Can I make changes to my withholding using IRS Form W-4S?

A: Yes, you can make changes to your federal income tax withholding by submitting a new IRS Form W-4S with the updated information.

Q: Do I need to file IRS Form W-4S every year?

A: No, you do not need to file IRS Form W-4S every year. Once you submit the form, it will remain in effect until you submit a new one or the withholding no longer applies.

Q: What happens if I do not submit IRS Form W-4S?

A: If you do not submit IRS Form W-4S, federal income tax will not be withheld from your sick pay by default. However, you may still owe taxes on the sick pay when you file your annual tax return.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form W-4S through the link below or browse more documents in our library of IRS Forms.