This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form W-3SS

for the current year.

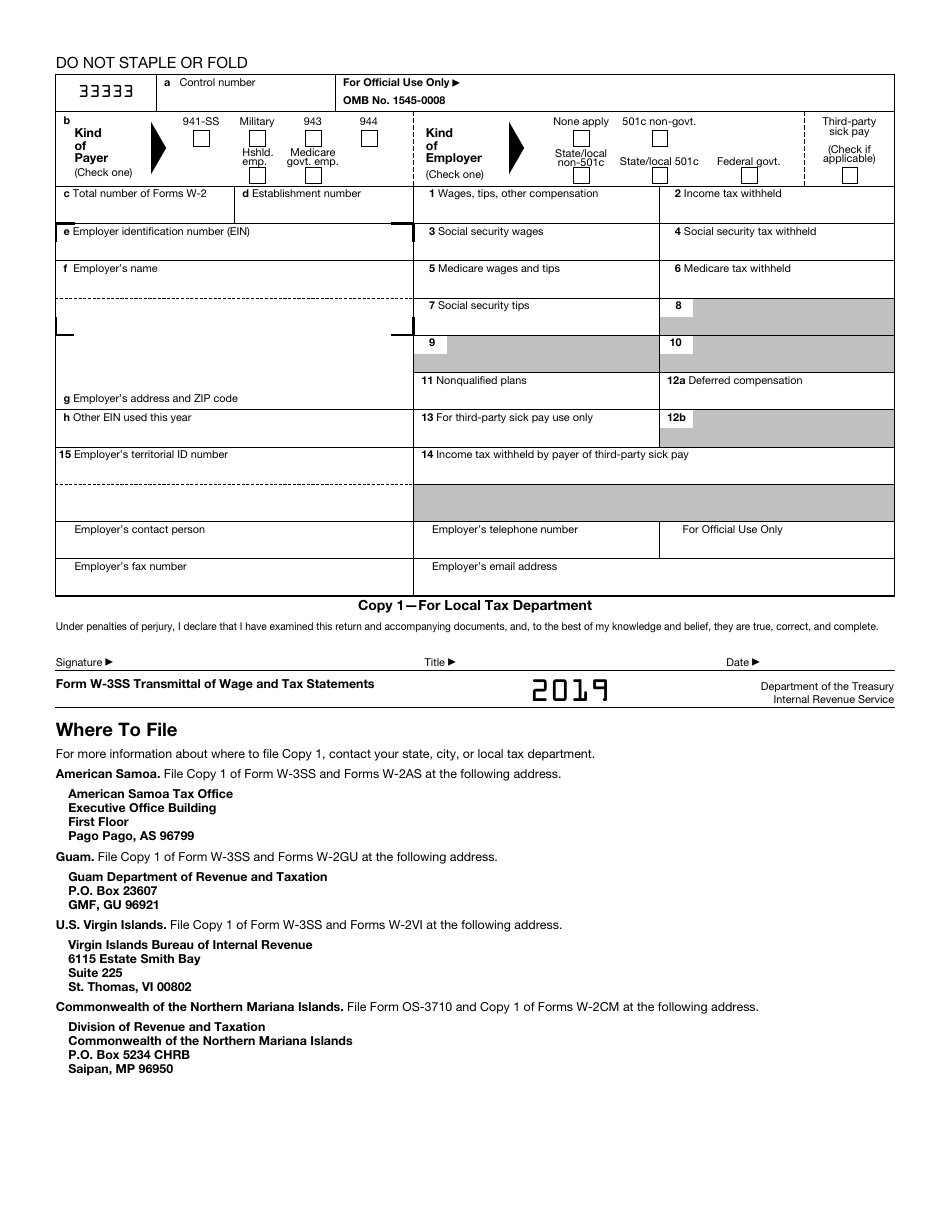

IRS Form W-3SS Transmittal of Wage and Tax Statements

What Is Form W-3SS?

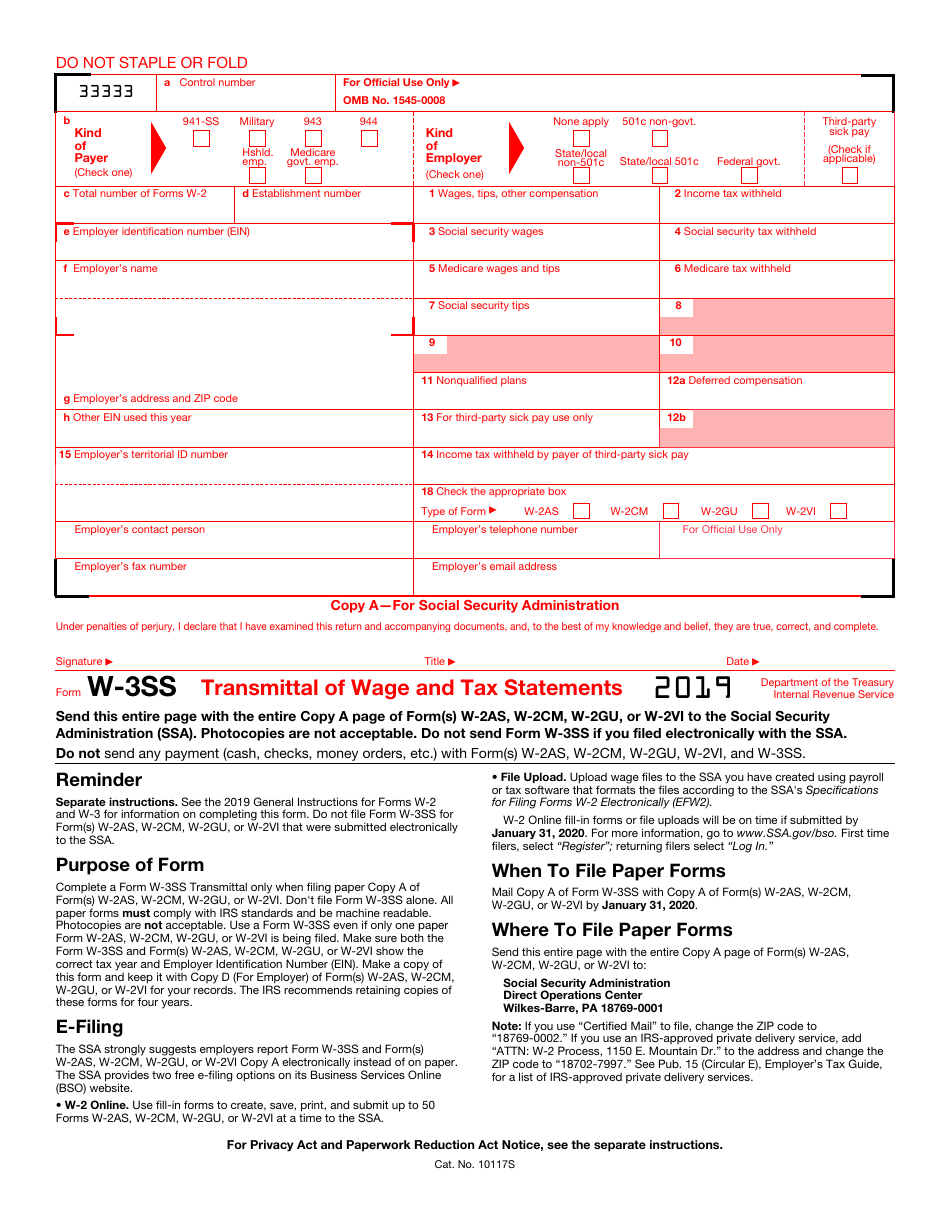

Form W-3SS, Transmittal of Wage and Tax Statements , is a form that must be filed with the Social Security Administration (SSA) by any payer or employer who needs to transmit a paper Copy A of Form W-2AS, Form W-2CM, Form W-2GU, and Form W-2VI to the SSA.

Form W-2AS is filed to report wages that American Samoa employers pay to the employees of that territory. Form W-2CM is filed to report wages that Commonwealth of the Northern Mariana Islands (CNMI) employers pay to the employees of that territory. Form W-2GU is filed to report wages paid by Guam employers to Guam employees. Form W-2VI is filed to report wages paid by the U.S. Virgin Islands (USVI) employers to USVI employees.

IRS Form W-3SS is issued by the Internal Revenue Service (IRS) every year and was last revised in 2019 . Use the link below to download IRS Form W-3SS to file for 2019.

Instructions for Form W-3SS

IRS W-3SS Form is comprised of two pages. The first page, in red, is called "Copy A," and it must be filed with the SSA. Employers must send this entire page along with Copy A of Forms W-2AS, W-2CM, W-2GU, or W-2VI to the following address: Social Security Administration Direct Operations Center Wilkes-Barre, PA 18769-0001 If you use "Certified Mail" to file, note that the ZIP code must be changed to "18769-0002." The IRS also approves some private delivery services; if you use them, add "ATTN: W-2 Process, 1150 E. Mountain Dr." and write ZIP code "18702-7997."

The second page, in black, is called "Copy 1," and it must be filed with the local tax department. You will find the addresses below:

- American Samoa: American Samoa Tax Office Executive Office Building First Floor Pago Pago, AS 96799.

- Guam: Guam Department of Revenue and Taxation P.O. Box 23607 GMF, GU 96921

- United States Virgin Islands: Virgin Islands Bureau of Internal Revenue 6115 Estate Smith Bay Suite 225 St. Thomas, VI 00802.

The due date for filing 2019 Form W-3SS with the SSA is January 31, 2020, whether you file using paper forms or electronically.

Penalties for failure to file forms by the due date and failure to furnish are imposed on employers who cannot show a reasonable cause of failure. Penalty amounts have been increased for inflation, and this adjusted amount applies to returns required to be filed after December 31, 2019. Based on the date of filing, the amounts are as follows:

- $50 per form if it is correctly filed within 30 days of the due date.

- $110 per form if it is correctly filed more than 30 days after the due date but by August 1.

- $270 per form if it is filed after August 1, or if it is not filed or corrected.

The IRS provides general instructions for Form W‑3 (SS) on their website.

IRS W-3SS Related Forms:

- IRS Form W-3, Transmittal of Wage and Tax Statements, is a form that employers complete in order to file a paper Form W-2, Wage and Tax Statement, with the SSA;

- IRS Form W-3C, Transmittal of Corrected Wage and Tax Statements, is a form used for transmitting Copy A of Form W-2C, Corrected Wage and Tax Statements, which is filed to correct errors on the following forms: W-2, W-2 (AS), W-2 (CM), W-2 (GU), W-2 (VI), and W‑2C that were sent to the SSA.