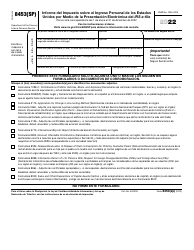

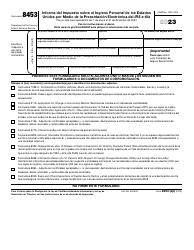

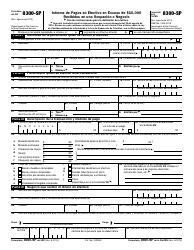

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Formulario W-3PR

for the current year.

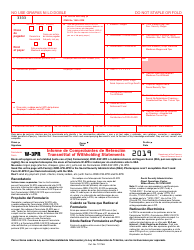

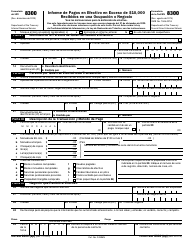

IRS Formulario W-3PR Informe De Comprobantes De Retencion (Puerto Rican Spanish)

Qué es IRS Formulario W-3PR?

Esta es un formulario legal relacionado con impuestos que fue publicado por los Servicios de Ingresos Internos (IRS), una subdivisión del Departamento del Tesoro. A partir de hoy, el departamento emisor no proporciona en separado pautas de presentación para el formulario.

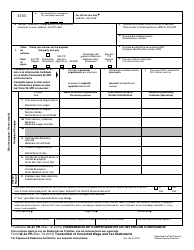

Detalles del formulario:

- La última versión proporcionada por el Servicios de Ingresos Internos (IRS);

- Este formulario no puede usarse para presentar impuestos para el año en curso. Elija una versión más reciente para presentar en el año fiscal actual;

- Lista para utilizar e imprimir;

- Fácil de personalizar;

- Compatible con la mayoría de las aplicaciones para visualizar PDF;

- Complete este formulario en línea.

Descargue una versión del IRS Formulario W-3PR haciendo clic en el enlace debajo haciendo clic en el enlace debajo Servicios de Ingresos Internos (IRS).

FAQ

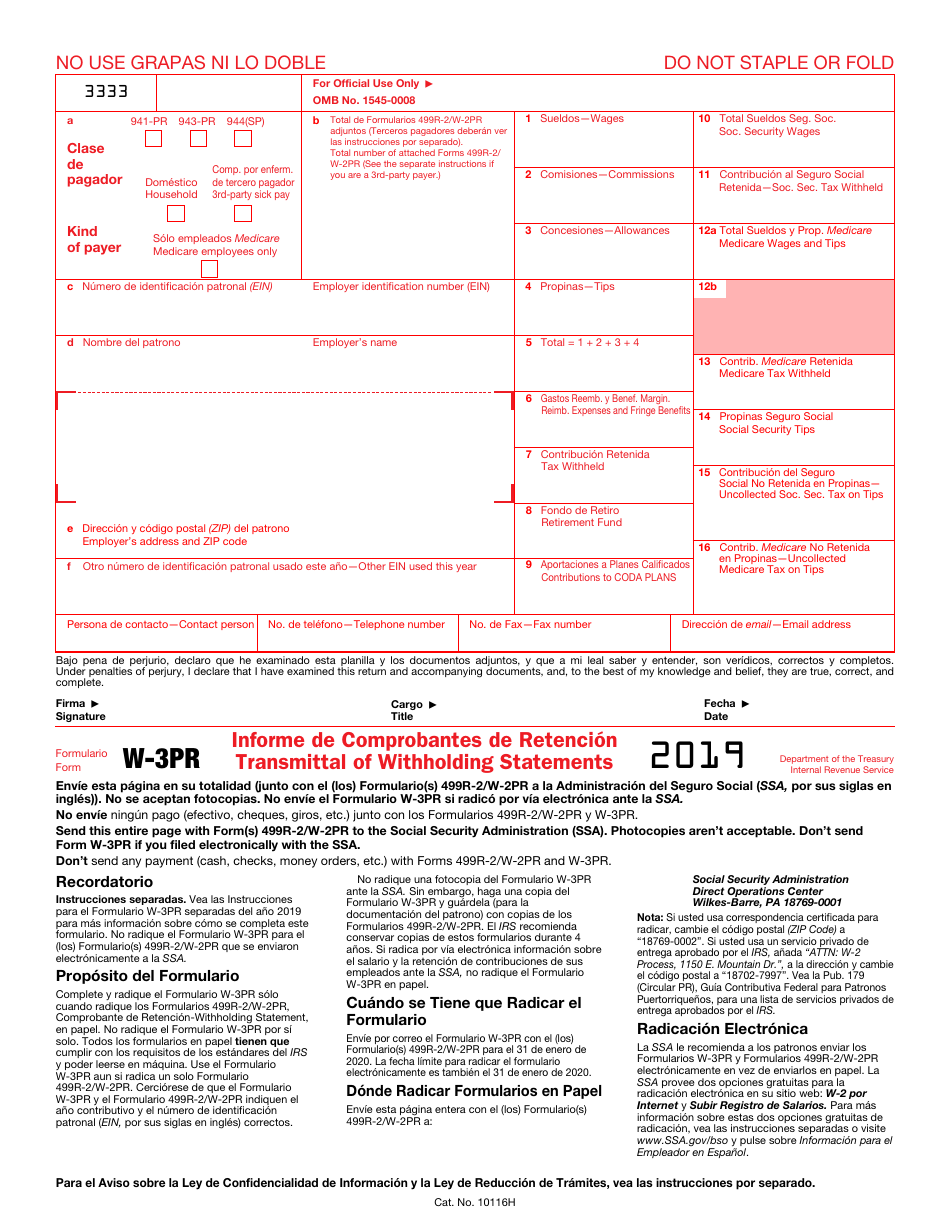

Q: What is IRS Formulario W-3PR?

A: IRS Formulario W-3PR is a form used to report withholding statements for Puerto Rican residents.

Q: Who needs to file IRS Formulario W-3PR?

A: Puerto Rican employers who withhold income taxes from their employees' wages need to file this form.

Q: What information is reported on IRS Formulario W-3PR?

A: The form reports information about the income taxes withheld from employees' wages.

Q: When is IRS Formulario W-3PR due?

A: The form is generally due by January 31st of the year following the tax year for which it is being filed.

Q: Are there any penalties for failing to file IRS Formulario W-3PR?

A: Yes, penalties may be imposed for late or incomplete filings. It is important to file the form accurately and on time.