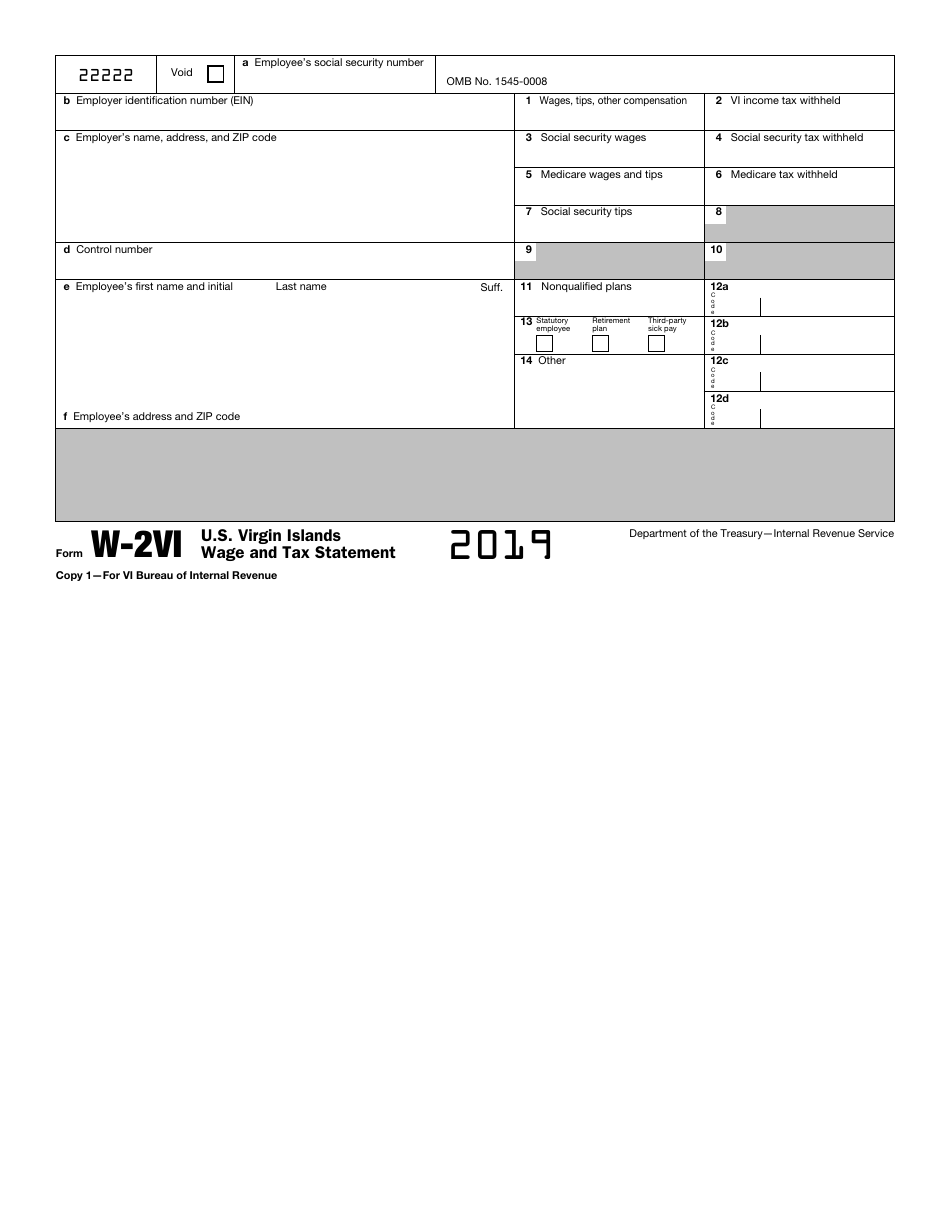

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form W-2VI

for the current year.

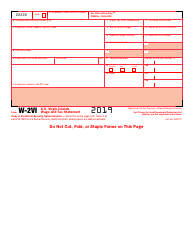

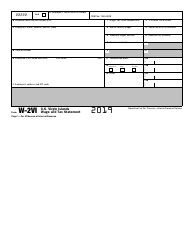

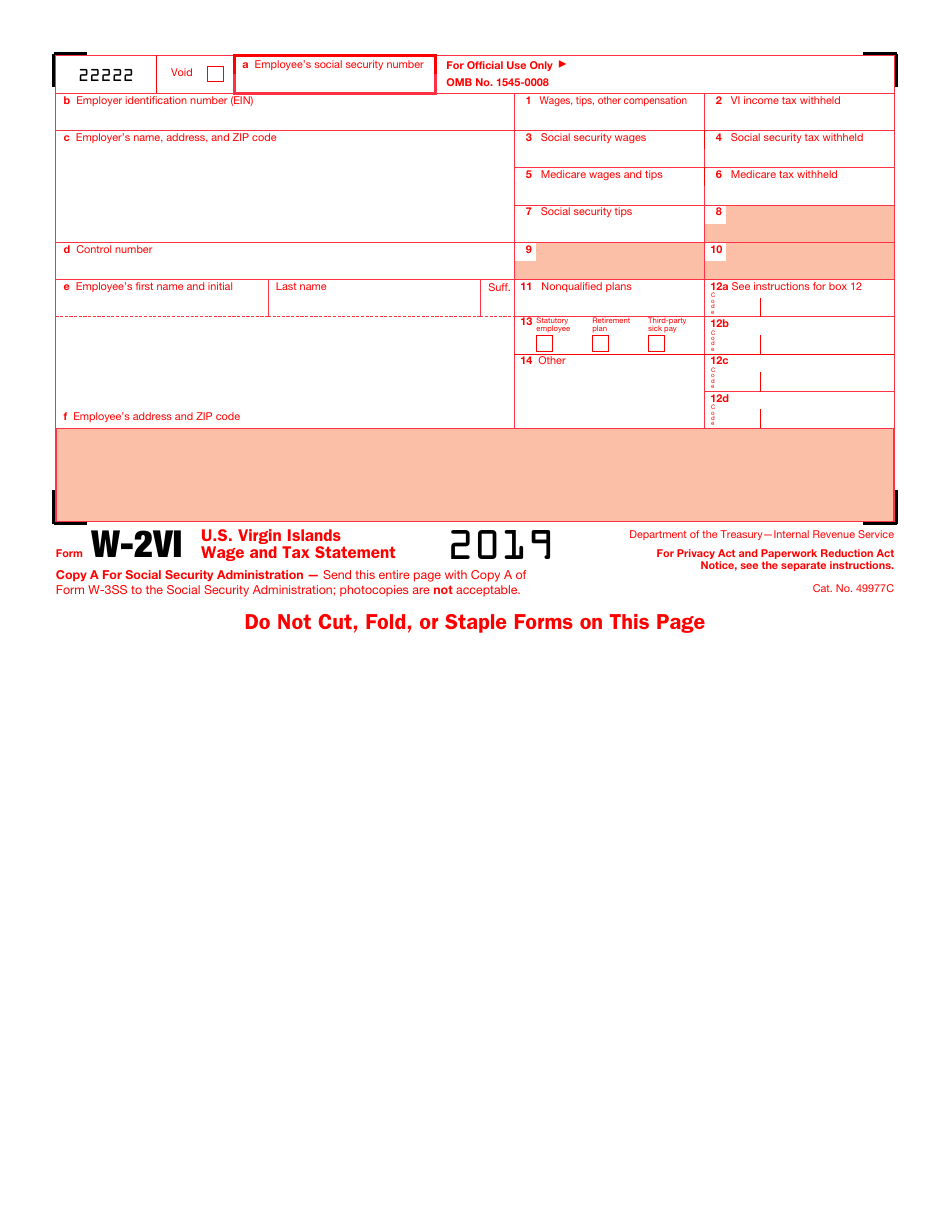

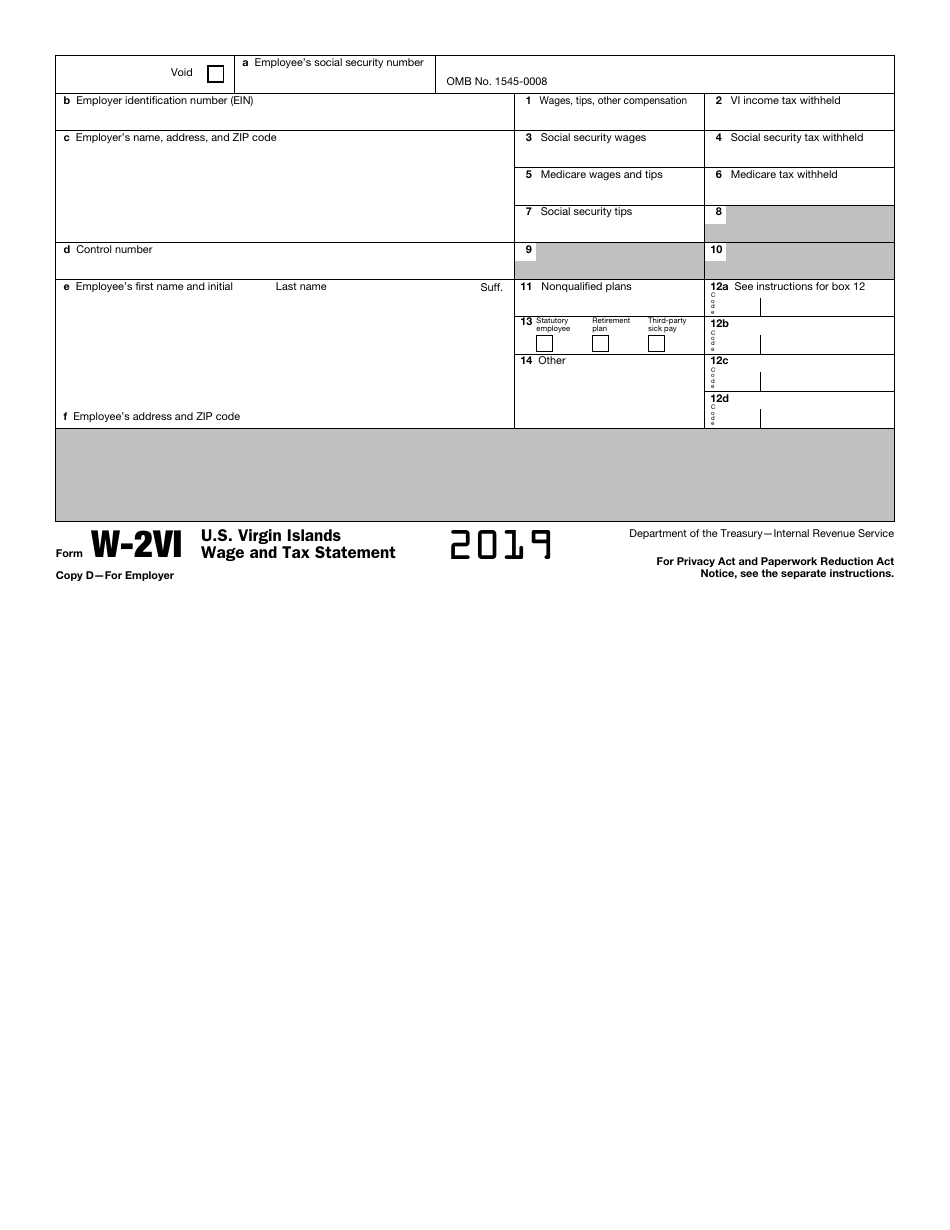

IRS Form W-2VI U.S. Virgin Islands Wage and Tax Statement

What Is W-2VI Form?

IRS Form W-2VI, U.S. Virgin Islands Wage and Tax Statement is a document designed to report the salaries of the United States Virgin Islands residents and the amount of taxes deducted from these salaries. The issuing department of this document is the Internal Revenue Service (IRS) .

The due date for Form W-2VI is January 31. Failure to file the form on time will result in the following penalties:

- $50 per form (max. $556,500 or $194,500 for small businesses per year) for filing within 30 days after the due date;

- $110 per form (max. $1,669,500 or $556,500 for small businesses per year) for filing more than 30 days after the deadline but before August 1;

- $270 per form (max. $3,339,000 or $1,113,000 for small businesses per year) for filing after August 1 or not filing; and

- $550 for failing to file due to intentional disregard of the requirements.

Click on the link below to download the most recent version of Form W-2VI. The IRS can also send you a paper version of the form within 10 days after receiving your written request.

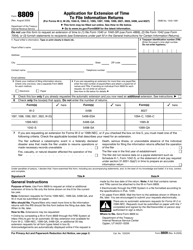

If you cannot file the necessary forms on time, submit IRS Form 8809 to ask for an additional 30 days to file the Form W-2VI with the IRS. Note that the extension is not automatic and is granted in exceptional circumstances only.

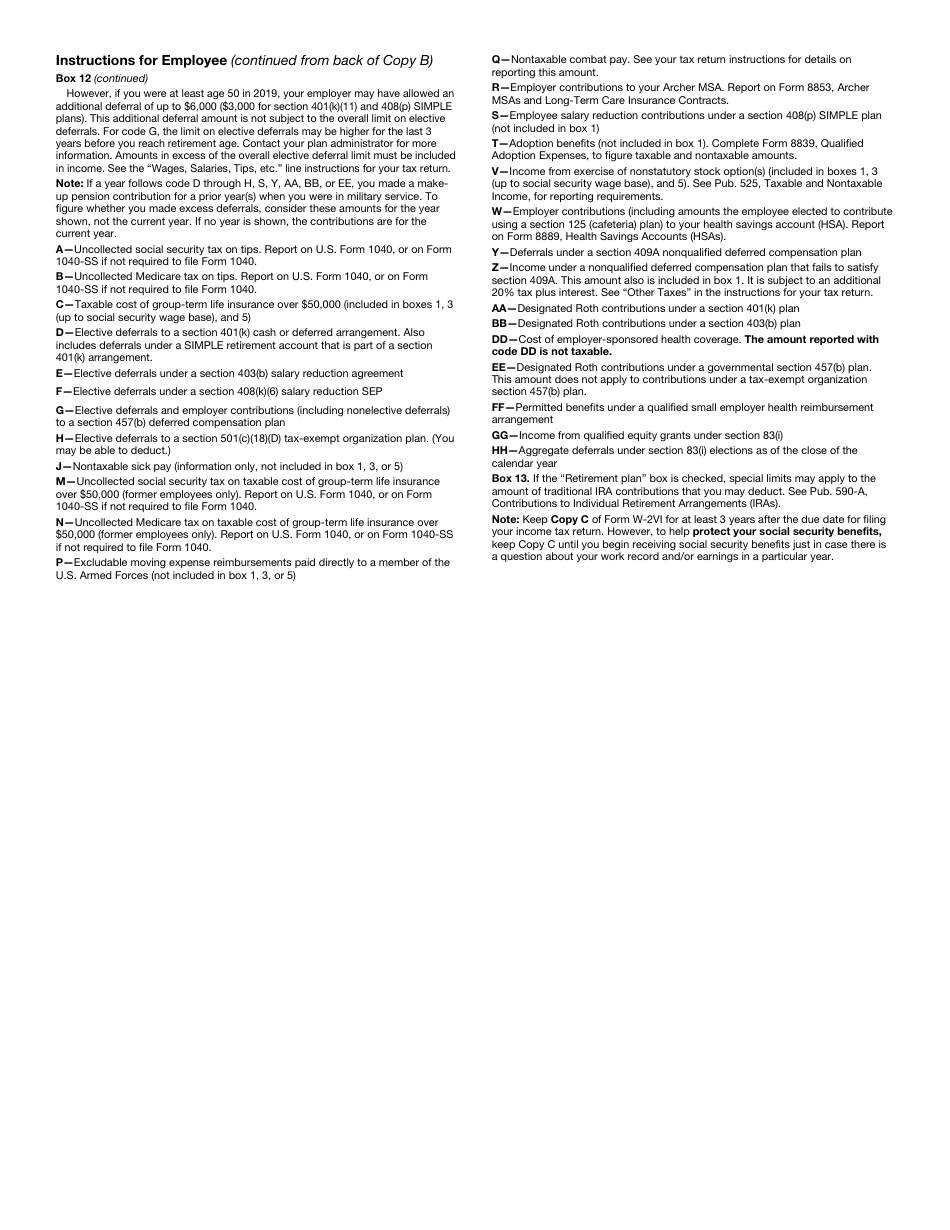

Form W-2VI Instructions

Fill out the U.S. Virgin Islands wage and tax statement if you are an employer required to provide information about your employees' wages and withheld taxes. Do not submit this document to report salaries subject to the U.S. income tax withholdings. Complete the IRS Form W-2, Wage and Tax Statement instead.

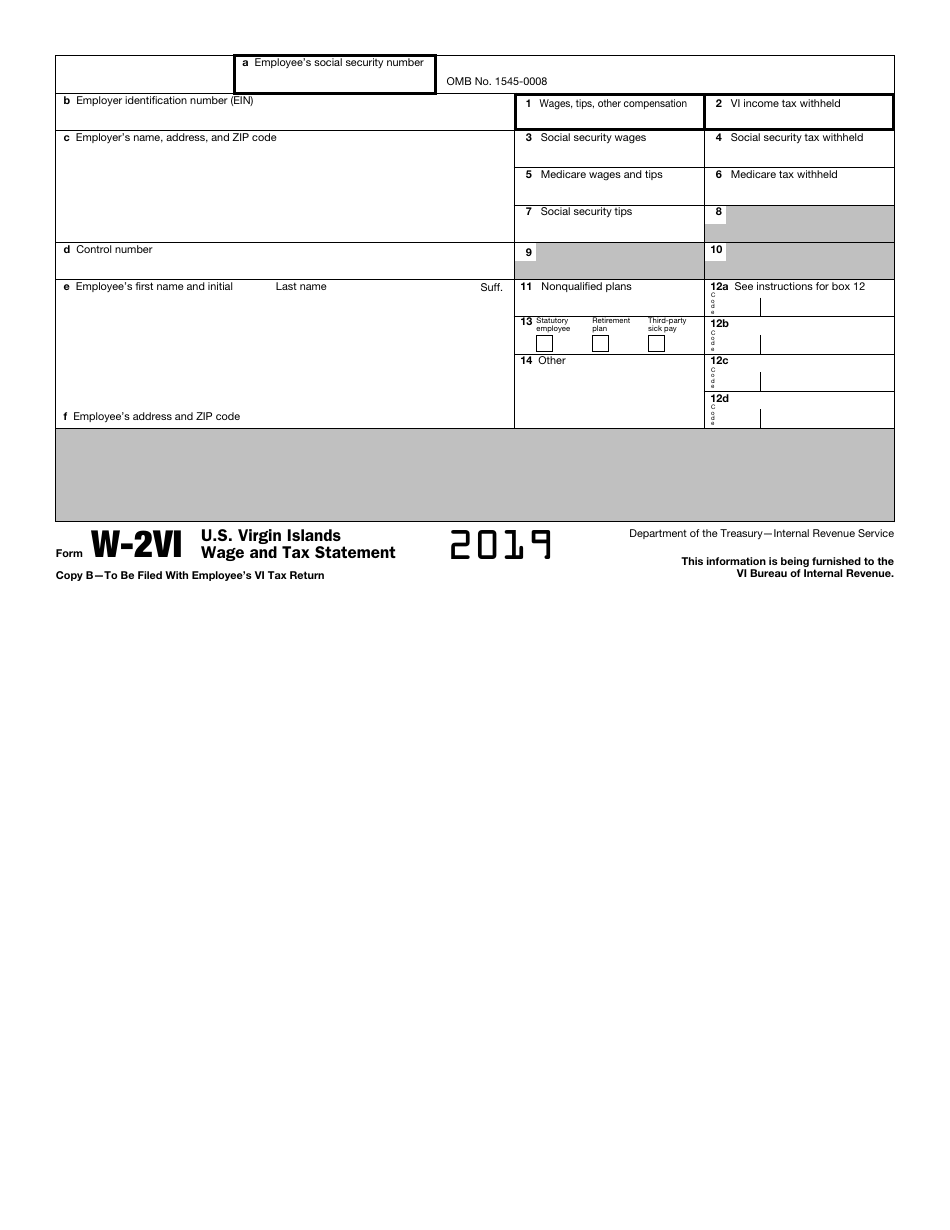

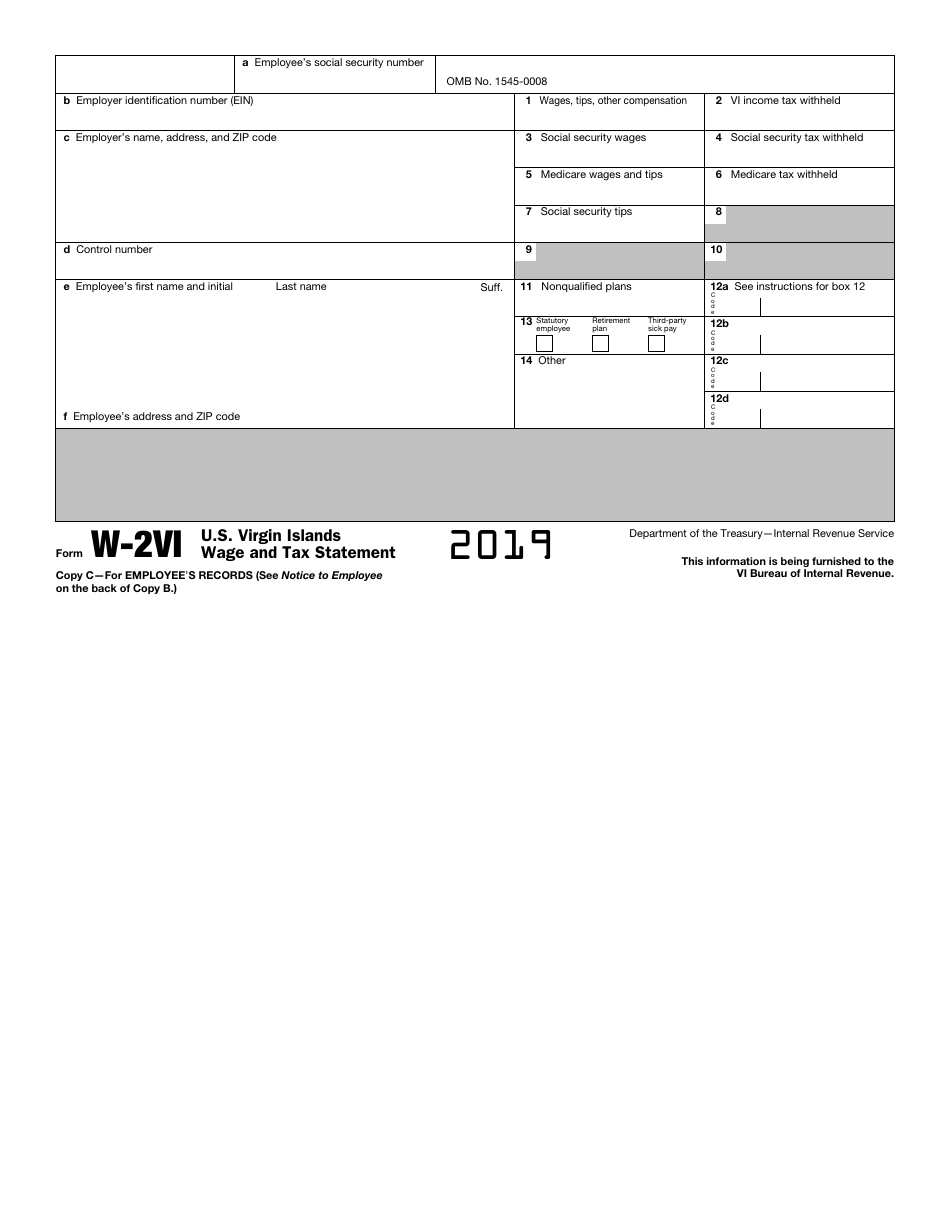

The form consists of five copies. Complete all of them and distribute in the following way:

- Copy A. File it with the Social Security Administration (SSA);

- Copy 1. Submit it to the Virgin Islands Bureau of Internal Revenue;

- Copy B and Copy C. Furnish these copies to your employees. One they will submit with their Virgin Islands Tax Return, the other will keep for their records; and

- Copy D. Keep this copy with your records for at least four years.

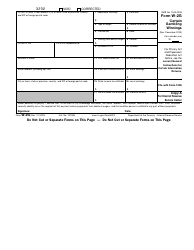

The IRS W-2VI Form must be submitted to the appropriate authorities together with IRS Form W-3SS. Mail Copies A of these forms to the Social Security Administration Direct Operations Center, Wilkes-Barre, Pennsylvania 18769-0001. If you need to submit 250+ forms, use the e-filing service. Otherwise, a fine may be applied. The SSA recommends you file the forms electronically even if you have to submit less than 250 forms.

Mail Copies 1 of the forms to the Virgin Islands Bureau of Internal Revenue, 6115 Estate Smith Bay, Suite 225, St. Thomas, Virgin Islands 00802. The Virgin Islands Bureau of Internal Revenue allows submitting paper versions only if the number of your employees is below 100. If not, submit the data on CD labeled with the following information: the name of the company, employer identification number, tax year, and type of the form you submit.

IRS W-2VI Related Forms:

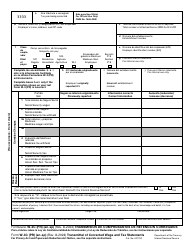

- IRS Form W-2, Wage and Tax Statement. Complete this statement if you have one or more employees you made payments to during the previous calendar year and these payments exceed $600;

- IRS Form W-2C, Corrected Wage and Tax Statements. Fill out this form if you have discovered an error in any of the IRS Forms W-2, W-2GU, W-2VI, or W-2AS already filed with the SSA;

- IRS Form W-2AS, American Samoa Wage and Tax Statement. File this document to provide information about American Samoa wages and taxes to your employees and to the appropriate authorities;

- IRS Form W-2GU, Guam Wage and Tax Statement. Use this document to report Guam salaries and tax deductions; and

- IRS Form W-2G, Certain Gambling Winnings. Submit this form to provide information about the amount of gambling winnings and federal taxes deducted.