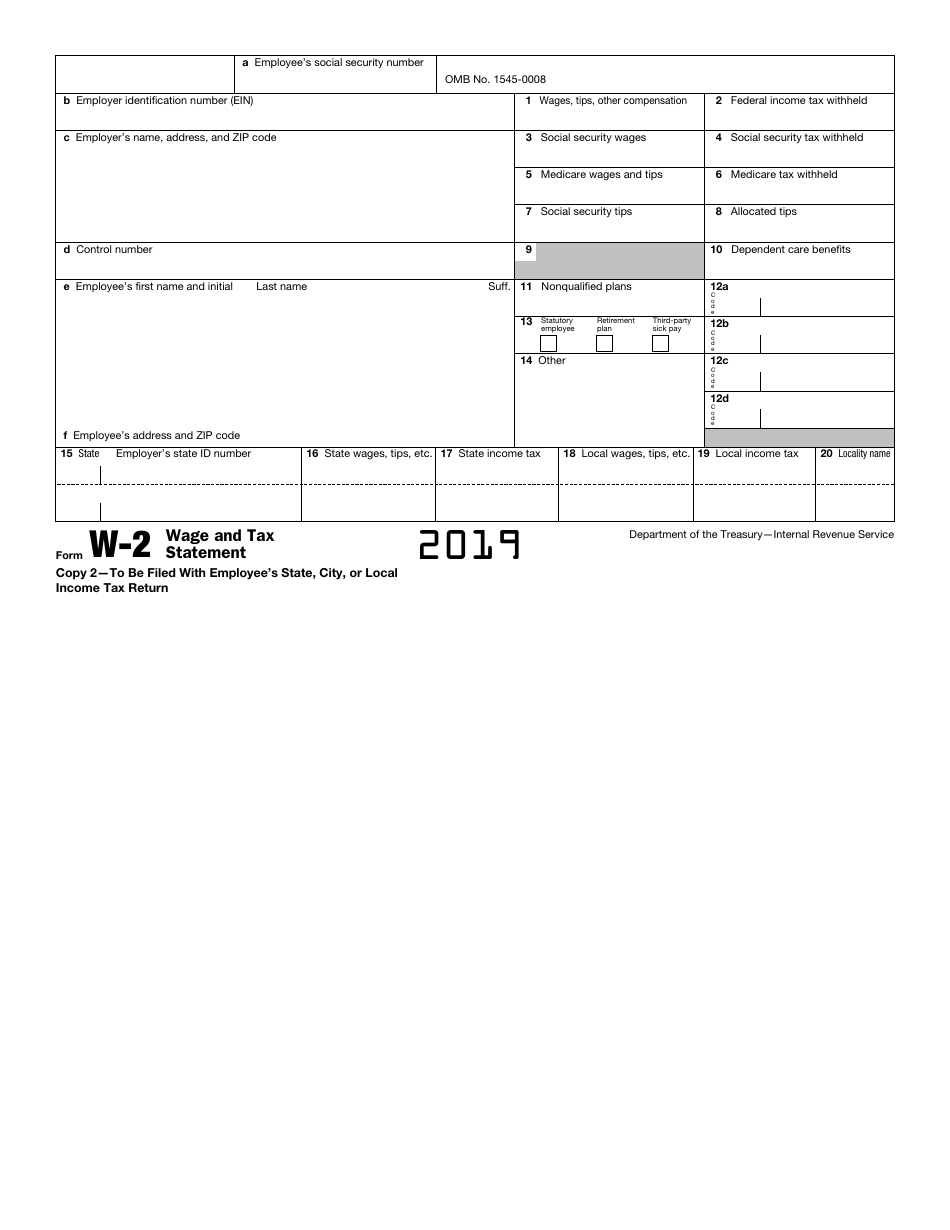

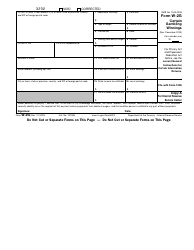

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form W-2

for the current year.

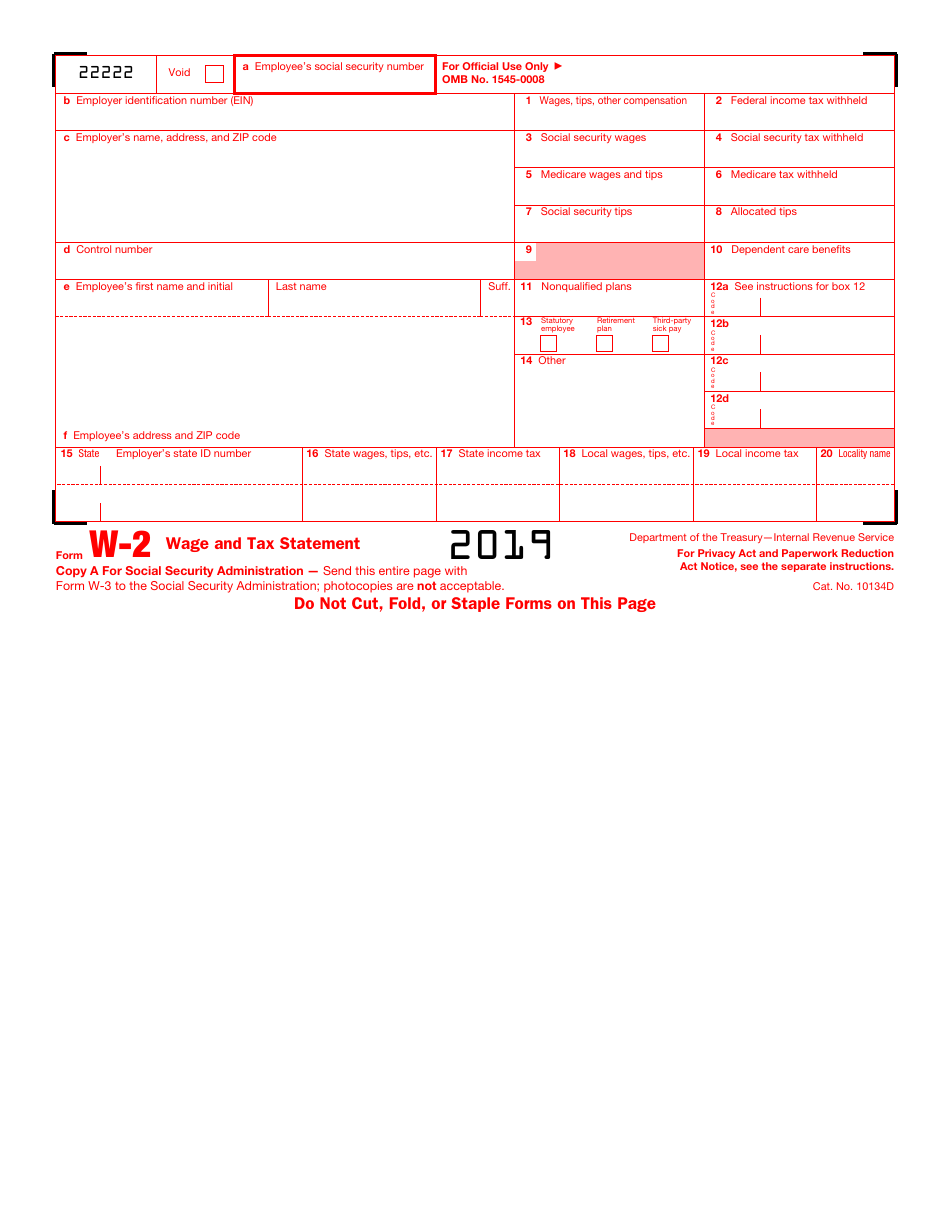

IRS Form W-2 Wage and Tax Statement

IRS Form W-2, Wage and Tax Statement is a document used to report the wages and tax withheld to the employee and the appropriate authorities. The form is issued annually by the Internal Revenue Service (IRS) . Download the latest version of the fillable W-2 Form through the link below.

What Is a Wage and Tax Statement?

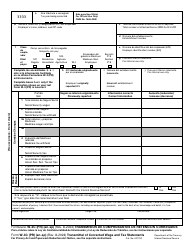

The W-2 Form is one of the crucial annual tax documents. This form contains information that discloses the employee's taxable income for the year, including gross wages, deferred compensation, tip income, dependent care benefits, and others.

You must complete this form for each employee you pay a wage, salary, or any other compensation in the course of your employment relationship if you withheld any Medicare, social security, or income taxes or if you paid $600 or more in wages (does not matter if you withheld any taxes).

What Is Form W-2 Used for?

IRS W-2 Form is used by the employers to provide the amount of their employees' earnings, as well as the amount of federal, state, and other tax deductions made from their paychecks. The employer fills out this form to report the mentioned information to the Social Security Administration (SSA) and to the employees at the end of every year.

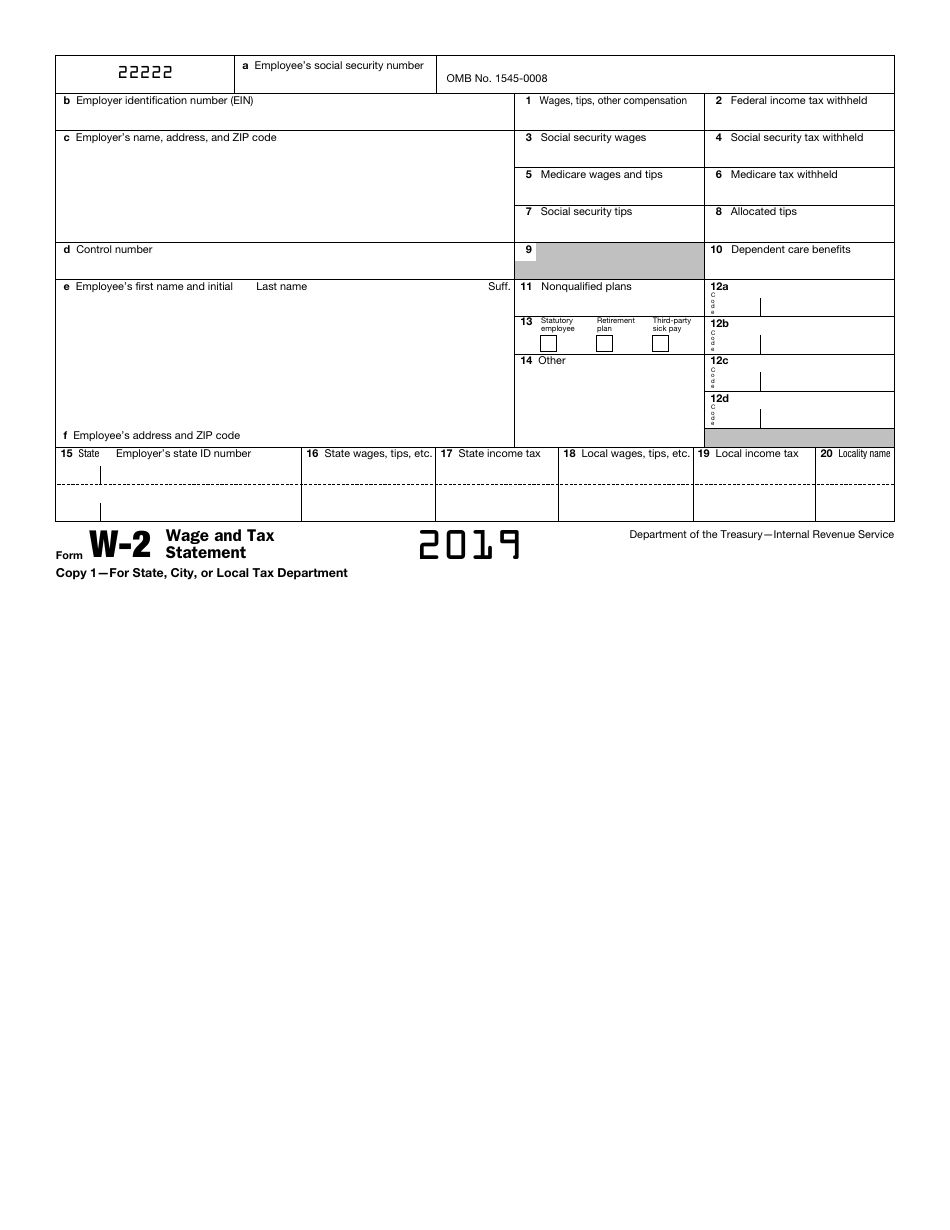

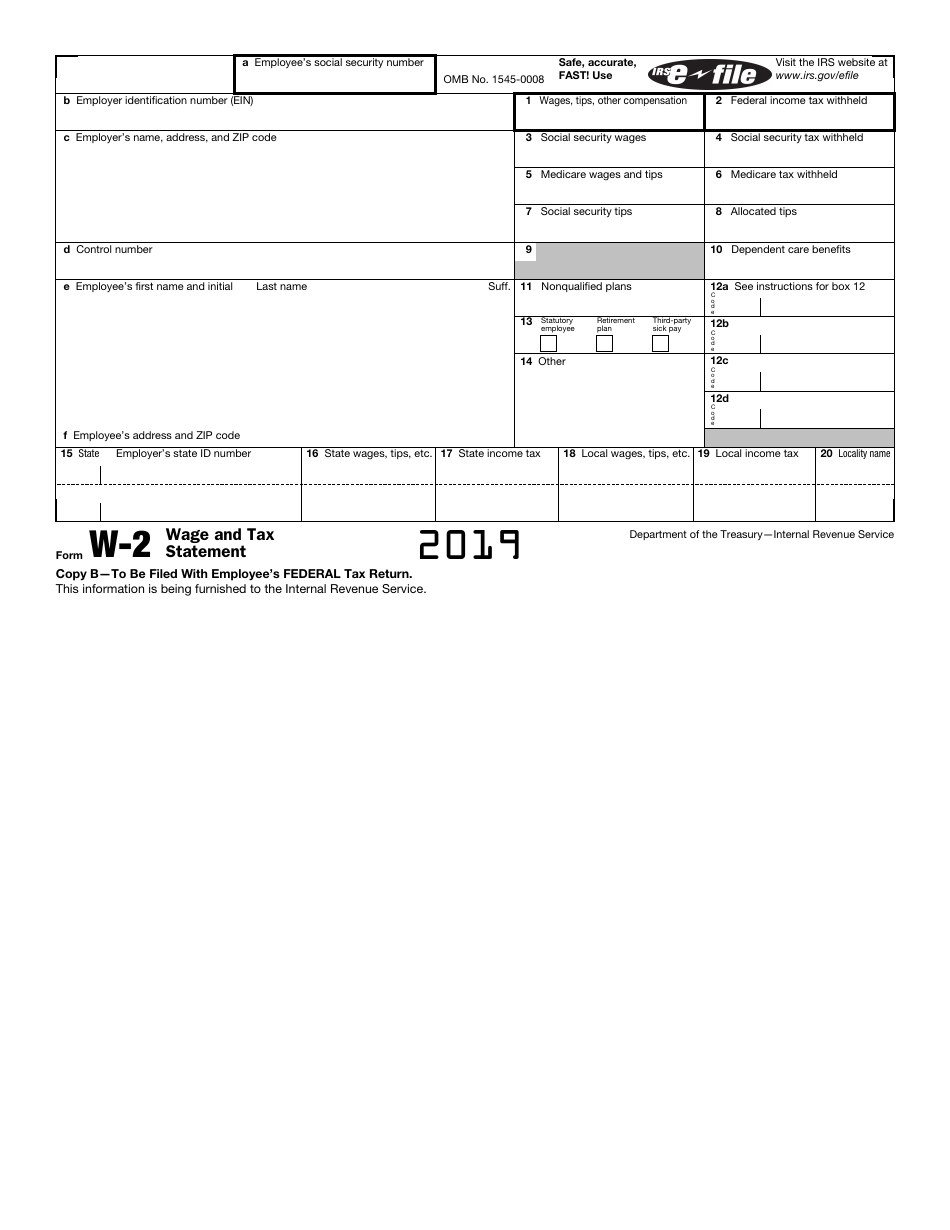

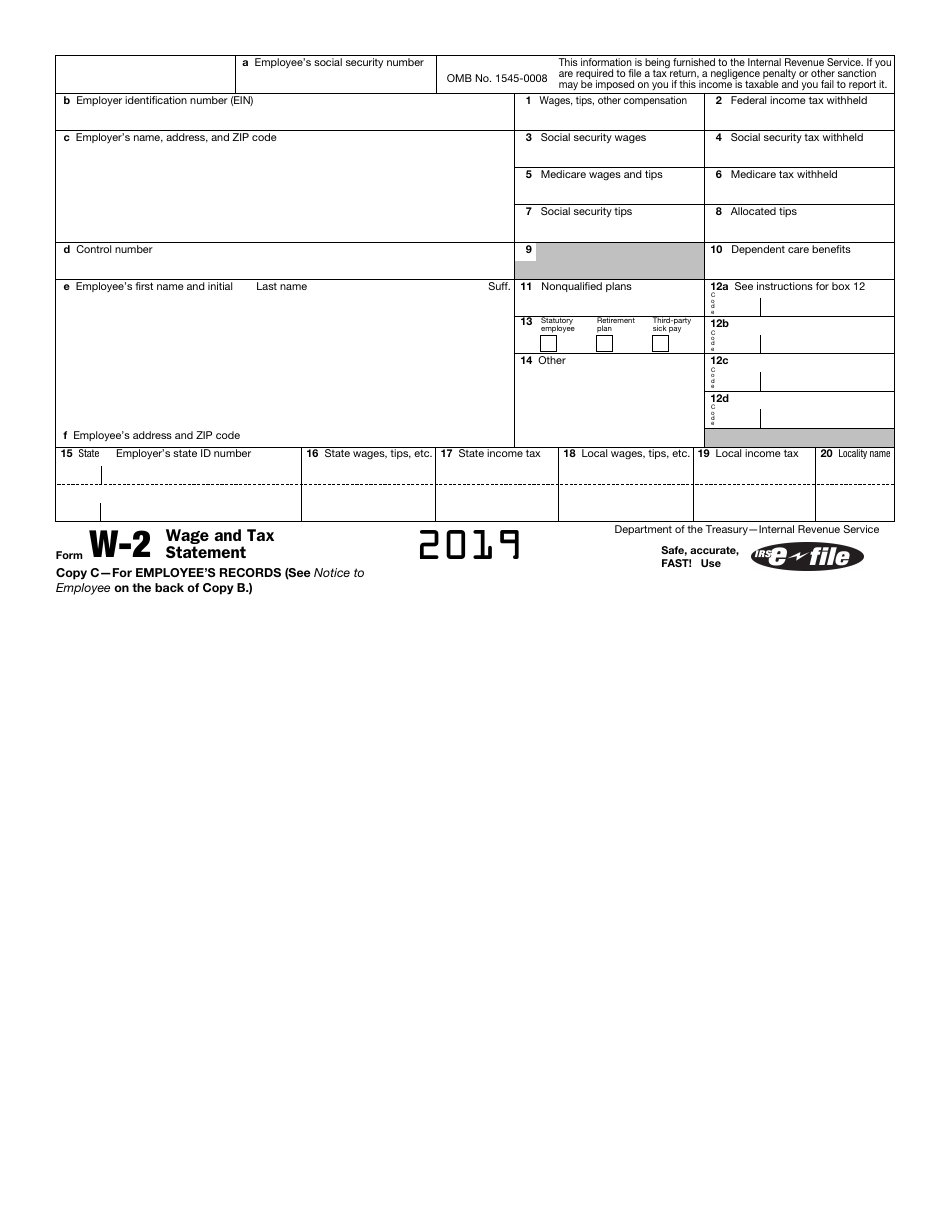

The employees use the information provided on the wage and tax statement form to prepare their individual tax return forms (Form 1040). The employees receive three copies of the form: Copy B, Copy C, and Copy 2. If you are an employee, use the copies you received in the following way: attach Copy B to the federal income tax return, attach Copy 2 to the state tax return, and keep Copy C for your records.

When Is Form W-2 Due?

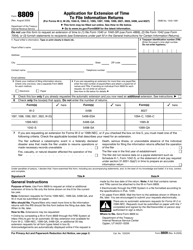

Form W-2 deadline is January 31 for both electronic and paper versions of the document. You cannot request an automatic extension for this form. You are allowed to apply for one 30-day extension to file the form with the SSA. For this purpose, submit the completed IRS Form 8809, Application for Extension of Time to File Information Returns before the Form W-2 due date. The IRS grants an extension to file the form only in extraordinary circumstances, like a natural disaster, fire, or other similar situations and no additional extension will be allowed.

Even if you were granted an extension to file the form with the SSA, you still need to provide it to your employees before January 31. To request the extension to furnish the form to your employees, send the letter containing your name, address, employer identification number, and the proper explanations to the Internal Revenue Service, Attn: Extension of Time Coordinator, 240 Murall Drive, Mail Stop 4360, Kearneysville, WV 25430

This extension is usually granted for up to 15 days unless you provide a reasonable cause of need up to 30 days from the due date.

The amount of Form W-2 late filing penalty is based on the duration of the delay:

- If you file the form within 30 days after the due date, you have to pay $50 per form (max. $556,500 per year, or $194,500 for small businesses);

- If you file more than 30 days after the due date but before August 1, the fine amount is $110 per form (max. $1,669,500 per year, or $556,500 for small businesses);

- If you file after August 1, the penalty is $270 per form (max. $3,339,000 per year, or $1,113,000 for small businesses).

Note, that the amount of penalty is indexed for inflation.

IRS Form W-2 Instructions

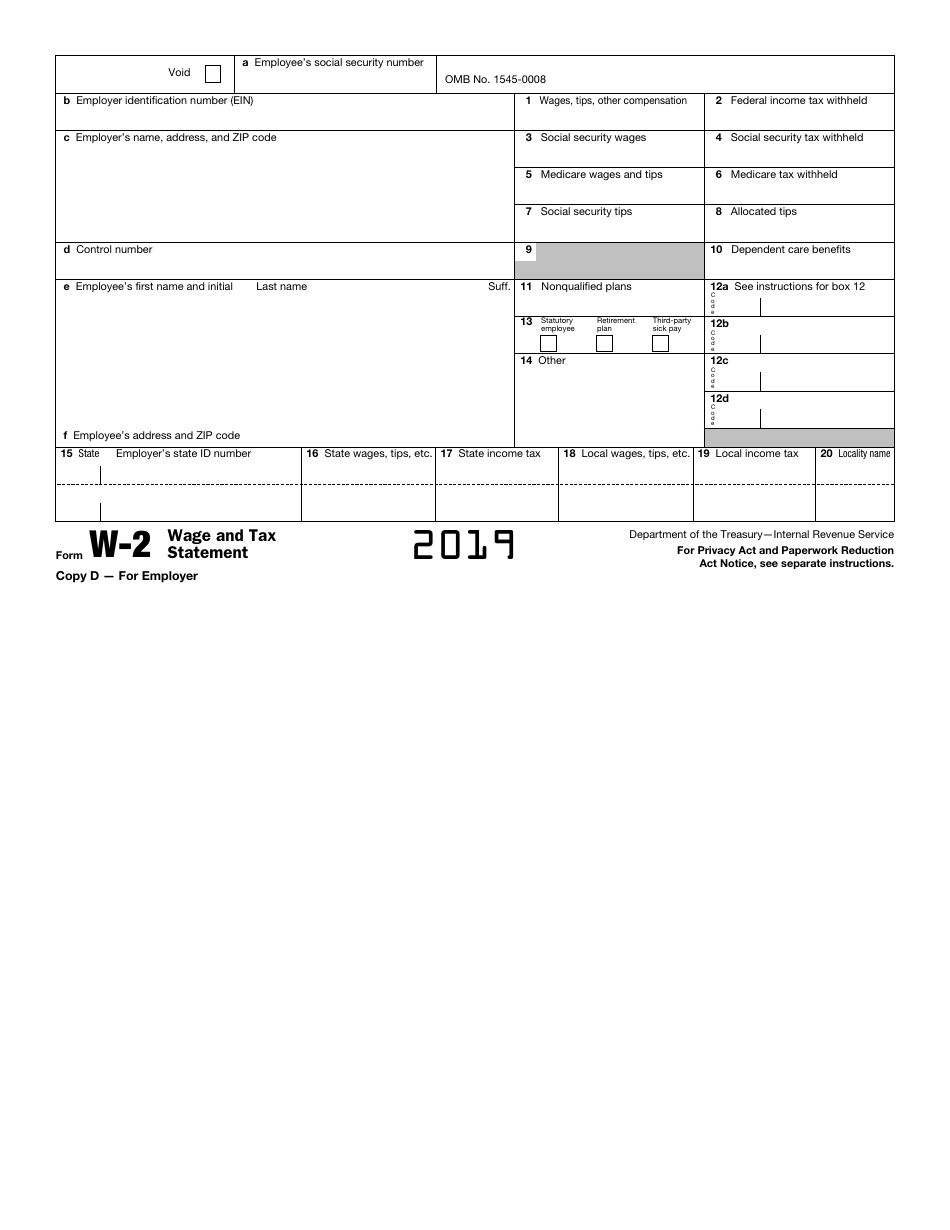

You can find complete instructions for the form through this link. The IRS Form W-2 includes six copies. File Copy A with the SSA. Furnish Copies B, C, and 2 to your employee. File Copy 1 with the local tax department if necessary. Keep Copy D with your records for four years. Pay attention to the following instructions when you complete the IRS wage and tax statement:

- Do not print Copy A and file it with the SSA. Order either a scannable paper version from the IRS or submit the wage and tax statement using the e-filing service. However, you are allowed to print all the other copies of the form;

- Do not fold, cut, or staple the paper version of the Copy A;

- Use only black ink when filling out the Copy A. Type all the entries clearly with no corrections. The entries should not exceed the size of the boxes. Do not fill out the Copy A form by hand, in a script or italic font, because the machine will not be able to read it;

- Never omit decimal points and cents from your entries;

- Do not use the dollar sign;

- Leave boxes that do not apply blank;

- If you have to file 250 and more forms, use e-filing only. Otherwise, you may be subject to penalties;

- Do not send any payments with the IRS W-2 Forms, including checks, cash, or money orders;

- Arrange all the Forms W-2 you send in alphabetical (by employees' last names) or numerical (by employees' SSNs) order.

Mail the paper version of the form to the Social Security Administration Direct Operations Center, Wilkes-Barre, PA 18769-0001. Change the ZIP-code to 18769-0002 if you send the documents using the Certified Mail service. Add the phrase "Attn: W-2 Process, 1150 E. Mountain Dr." and change the ZIP-code to 18702-7997 if you send the forms using the IRS-approved private delivery service. Detailed information is provided in the IRS-distributed Form W-2 and W-3 instructions.

How to File a Corrected W-2 Form?

To correct errors on the form, fill out the IRS Form W-2C, Corrected Wage and Tax Statements. Submit this form as soon as possible after discovering an error. Use Form W-2C to furnish the corrected Form W-2 to the SSA and to your employees.

IRS W-2 Related Forms

- IRS Form W-2AS, American Samoa Wage and Tax Statement. Fill out this document to report American Samoa wages;

- IRS Form W-2GU, Guam Wage and Tax Statement. Complete this version of the form to provide the information about the Guam wages;

- IRS Form W-2VI, U.S. Virgin Islands Wage and Tax Statement. Use this form to provide the required information about the U.S. Virgin Islands salaries;

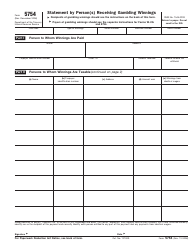

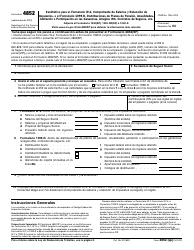

- IRS Form W-2G, Certain Gambling Winnings. Submit this document to report gambling winnings and taxes withheld on these winnings;

- IRS Form 5754, Statement by Person(s) Receiving Gambling Winnings. The information on this form is used to prepare the Form W-2G if the person receiving the gambling winnings is not an actual winner, or if a group of two or more individuals are sharing the winnings;

- IRS Form W-3, Transmittal of Wage and Tax Statements. Submit his form when filing a paper version of a Copy A of a Form W-2.