This version of the form is not currently in use and is provided for reference only. Download this version of

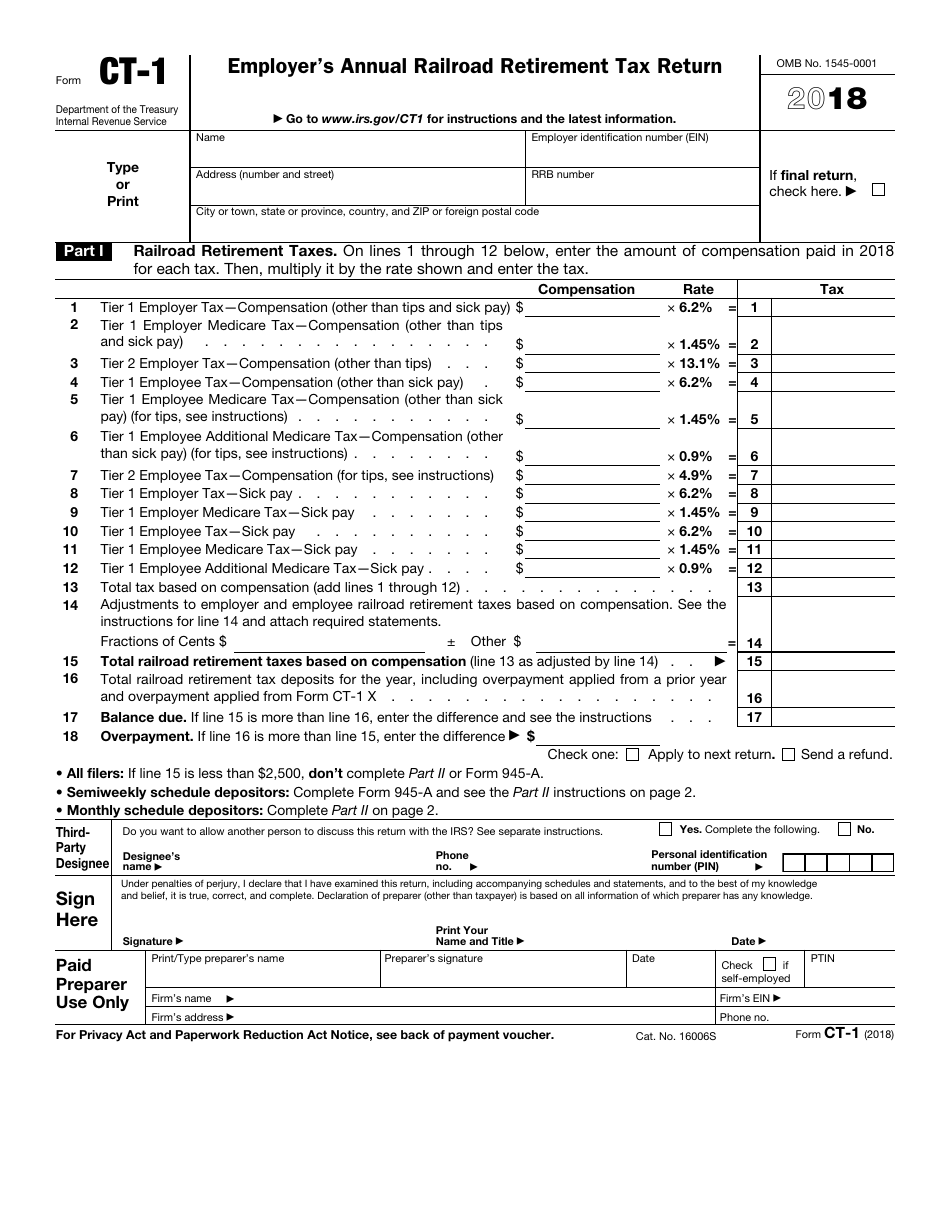

IRS Form CT-1

for the current year.

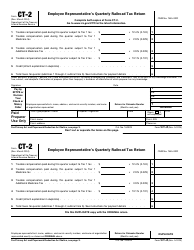

IRS Form CT-1 Employer's Annual Railroad Retirement Tax Return

What Is IRS Form CT-1?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form CT-1?

A: Form CT-1 is the Employer's Annual Railroad Retirement Tax Return.

Q: Who needs to file Form CT-1?

A: Employers who are required to pay the railroad retirement tax must file Form CT-1.

Q: What is the purpose of Form CT-1?

A: Form CT-1 is used to report and pay the railroad retirement tax.

Q: When is Form CT-1 due?

A: Form CT-1 is generally due by the last day of February following the calendar year for which the tax is due.

Q: Are there any penalties for not filing Form CT-1?

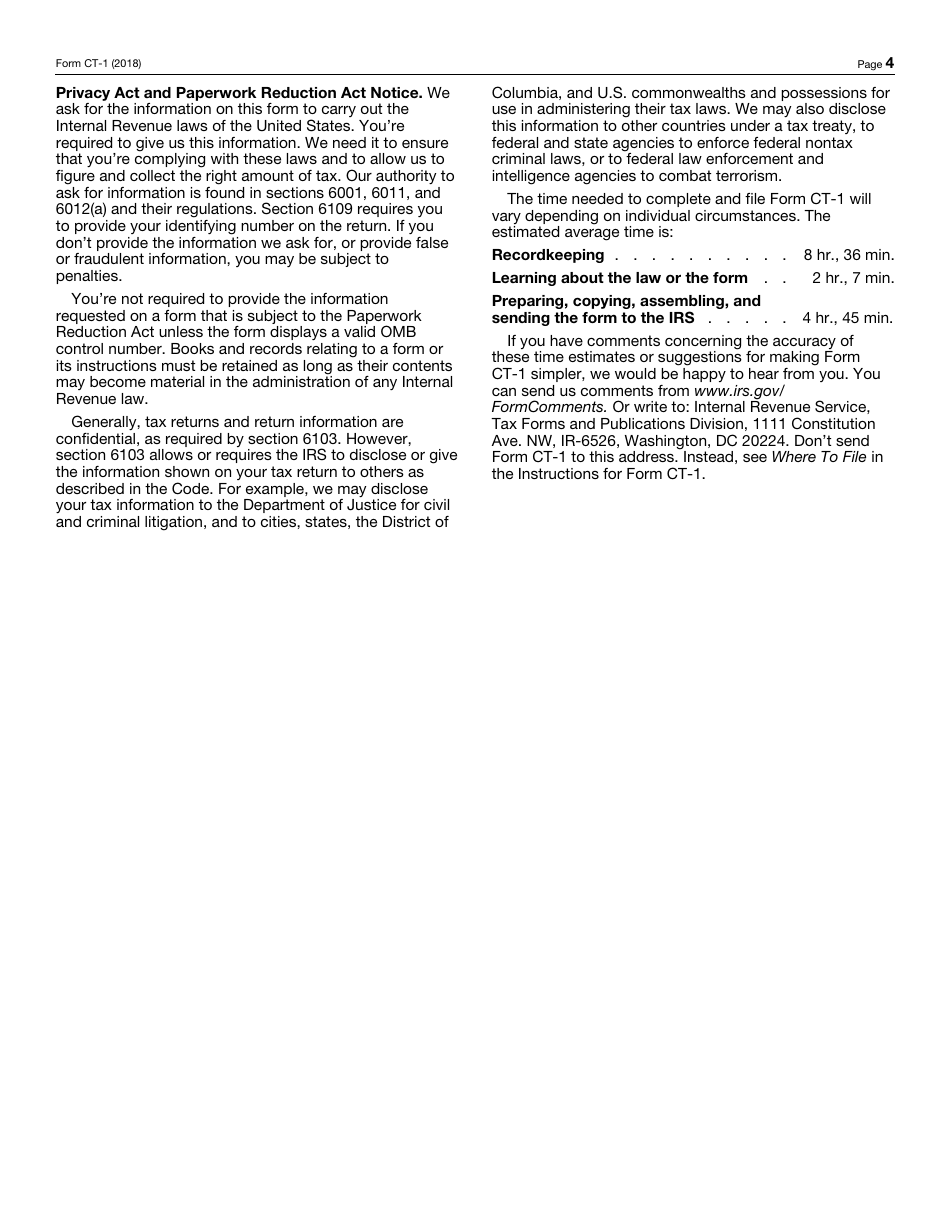

A: Yes, failure to file Form CT-1 or pay the railroad retirement tax can result in penalties and interest.

Q: Is Form CT-1 similar to other employment tax forms?

A: Yes, Form CT-1 is similar to other employment tax forms, such as Form 941 for federal incometax withholding.

Q: Are there any exemptions from filing Form CT-1?

A: There are exemptions available for certain types of employers, such as government employers.

Q: Can Form CT-1 be filed electronically?

A: Yes, employers can file Form CT-1 electronically using the Electronic Federal Tax Payment System (EFTPS) or through approved payroll software.

Q: What should I do if I have questions about Form CT-1?

A: If you have questions about Form CT-1, you can contact the IRS or consult a tax professional for assistance.

Form Details:

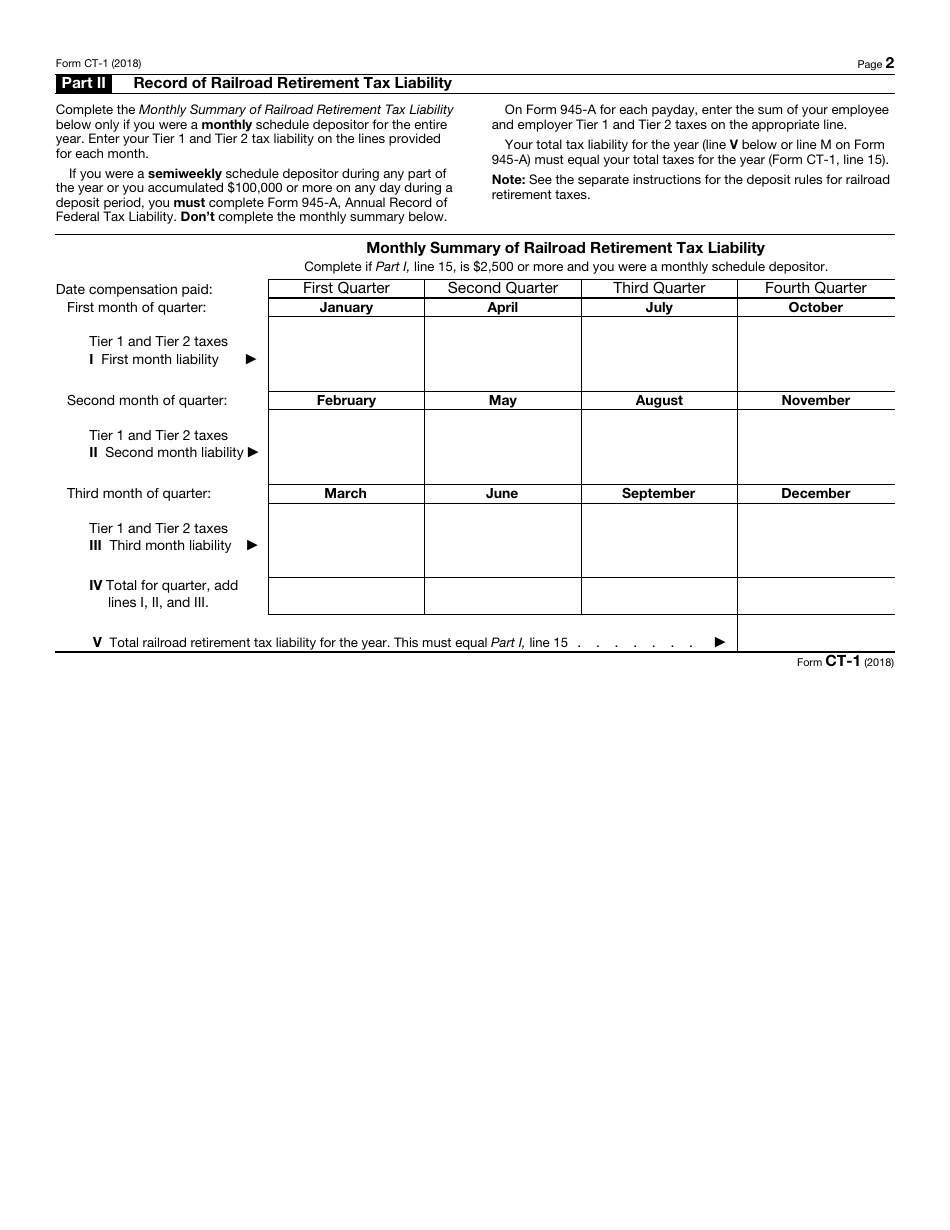

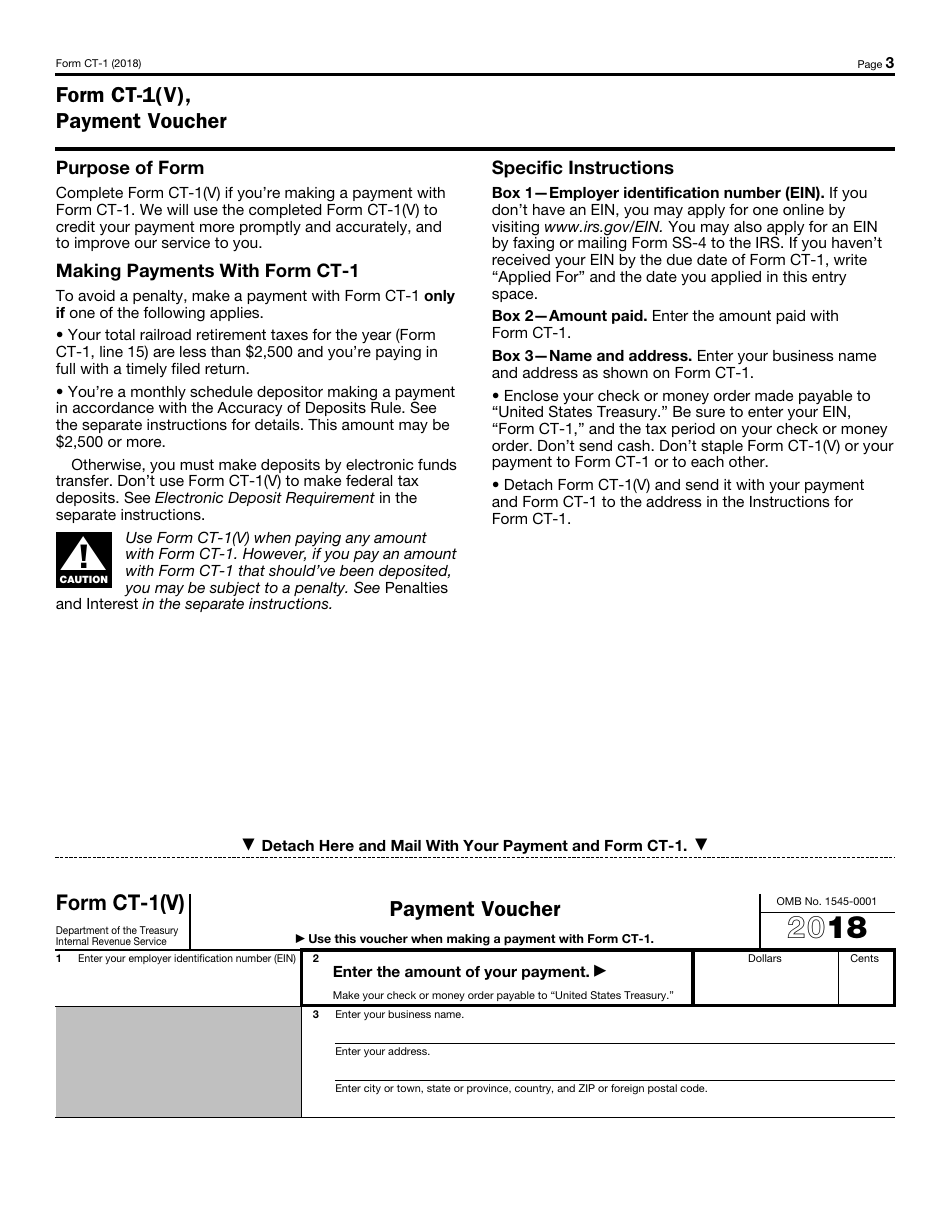

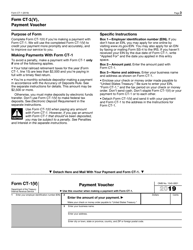

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form CT-1 through the link below or browse more documents in our library of IRS Forms.