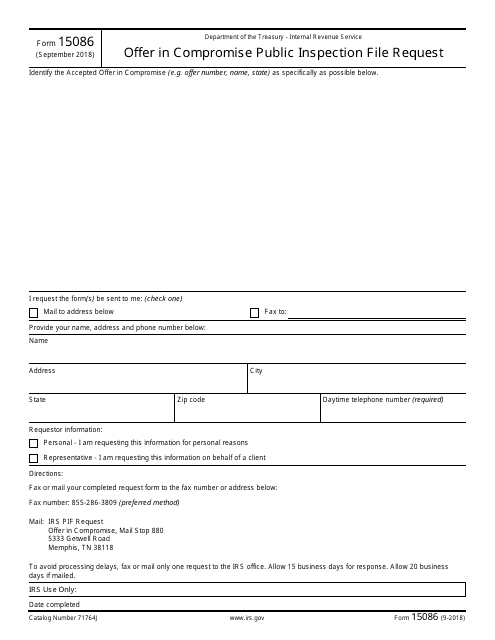

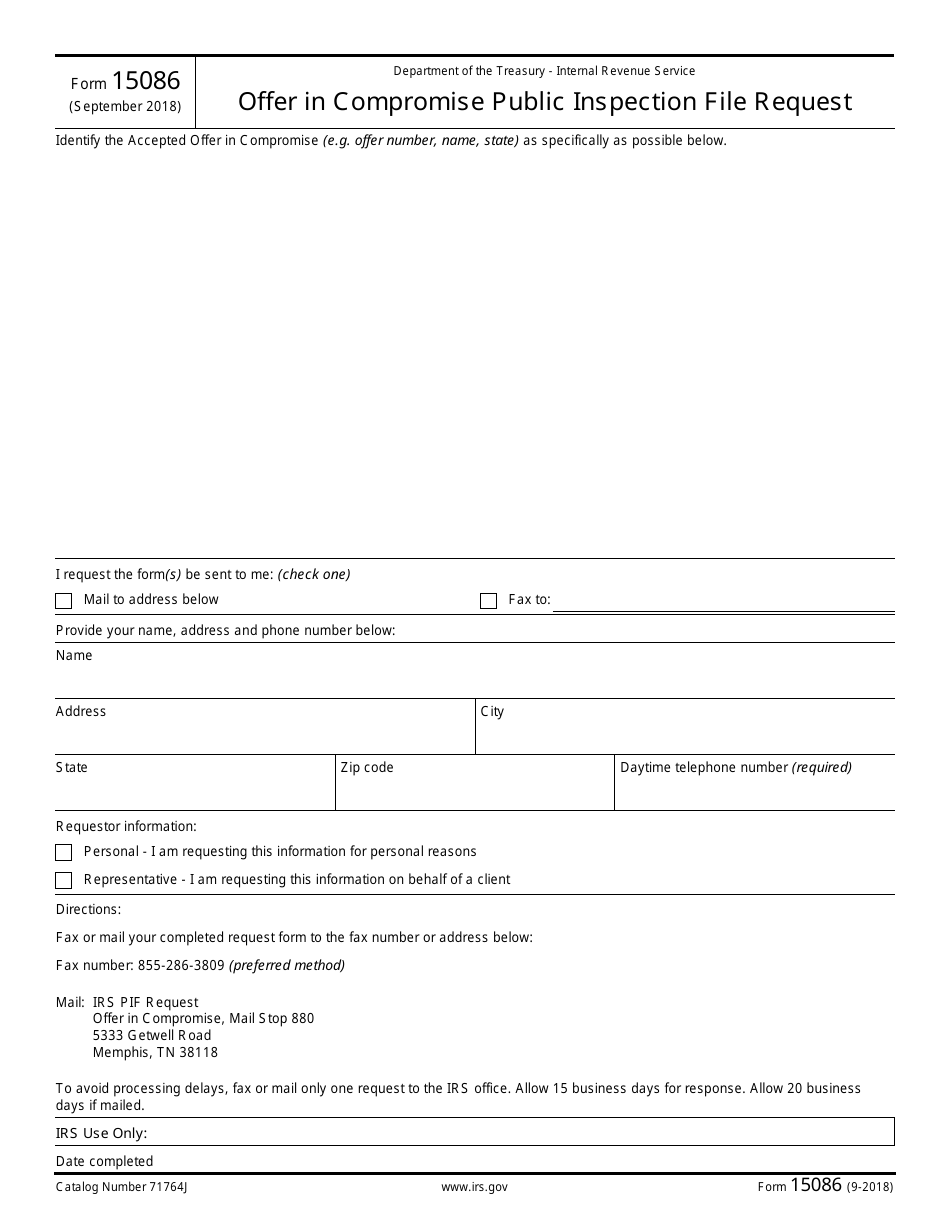

IRS Form 15086 Offer in Compromise Public Inspection File Request

What Is IRS Form 15086?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 15086?

A: IRS Form 15086 is used to request access to the Public Inspection File for Offers in Compromise.

Q: What is an Offer in Compromise?

A: An Offer in Compromise is an option to settle tax debt with the IRS for less than the full amount owed.

Q: Who can request access to the Public Inspection File?

A: Anyone can request access to the Public Inspection File by filing IRS Form 15086.

Q: What information is contained in the Public Inspection File?

A: The Public Inspection File contains information related to Offers in Compromise, such as taxpayer names, addresses, and the terms of the accepted offers.

Q: Is there a fee to request access to the Public Inspection File?

A: No, there is no fee to request access to the Public Inspection File.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 15086 through the link below or browse more documents in our library of IRS Forms.