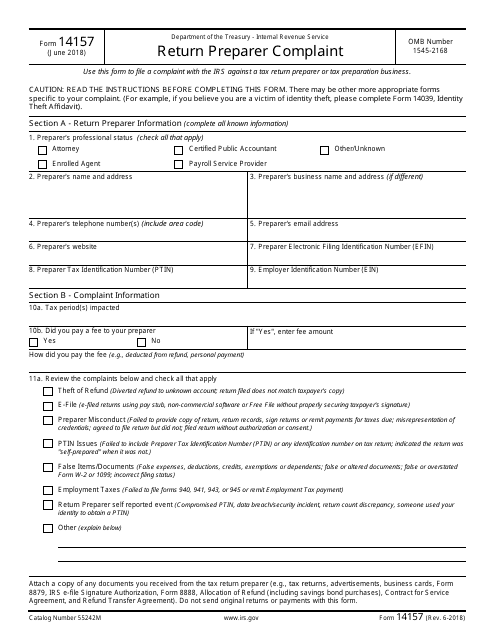

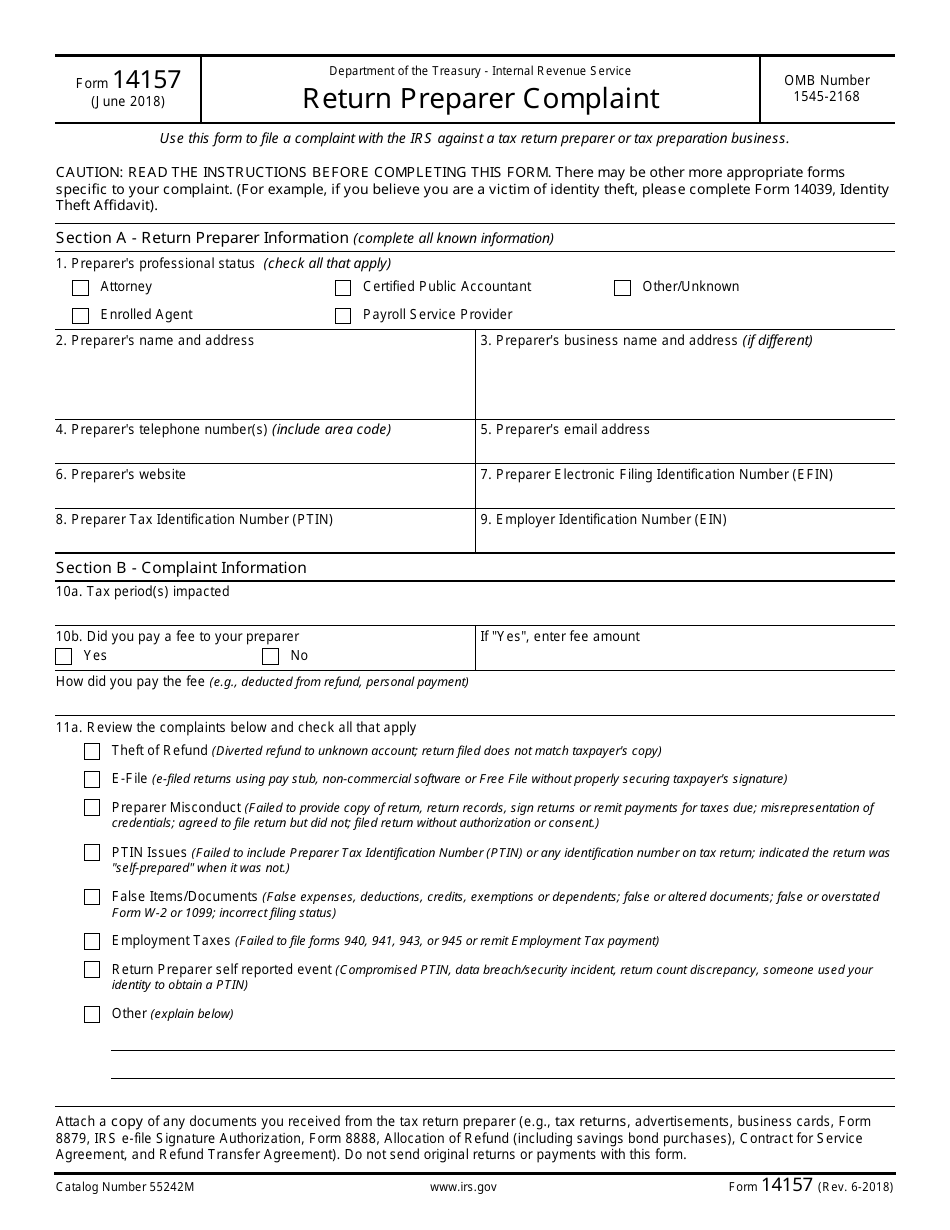

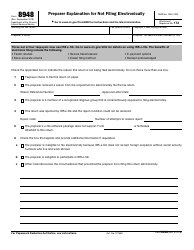

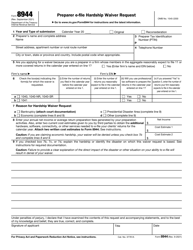

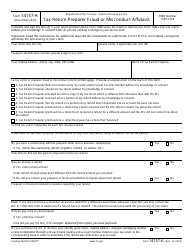

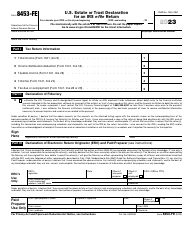

IRS Form 14157 Return Preparer Complaint

What Is IRS Form 14157?

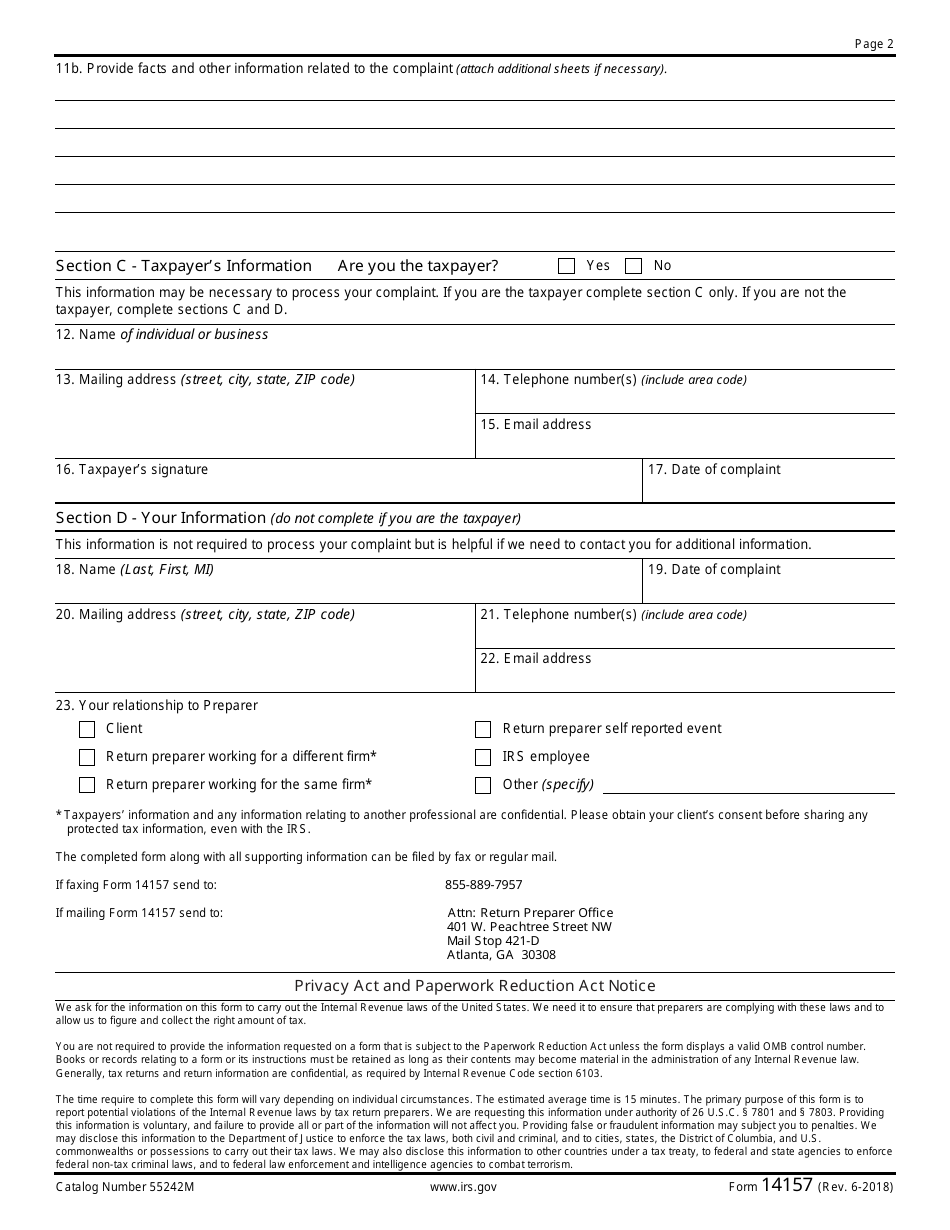

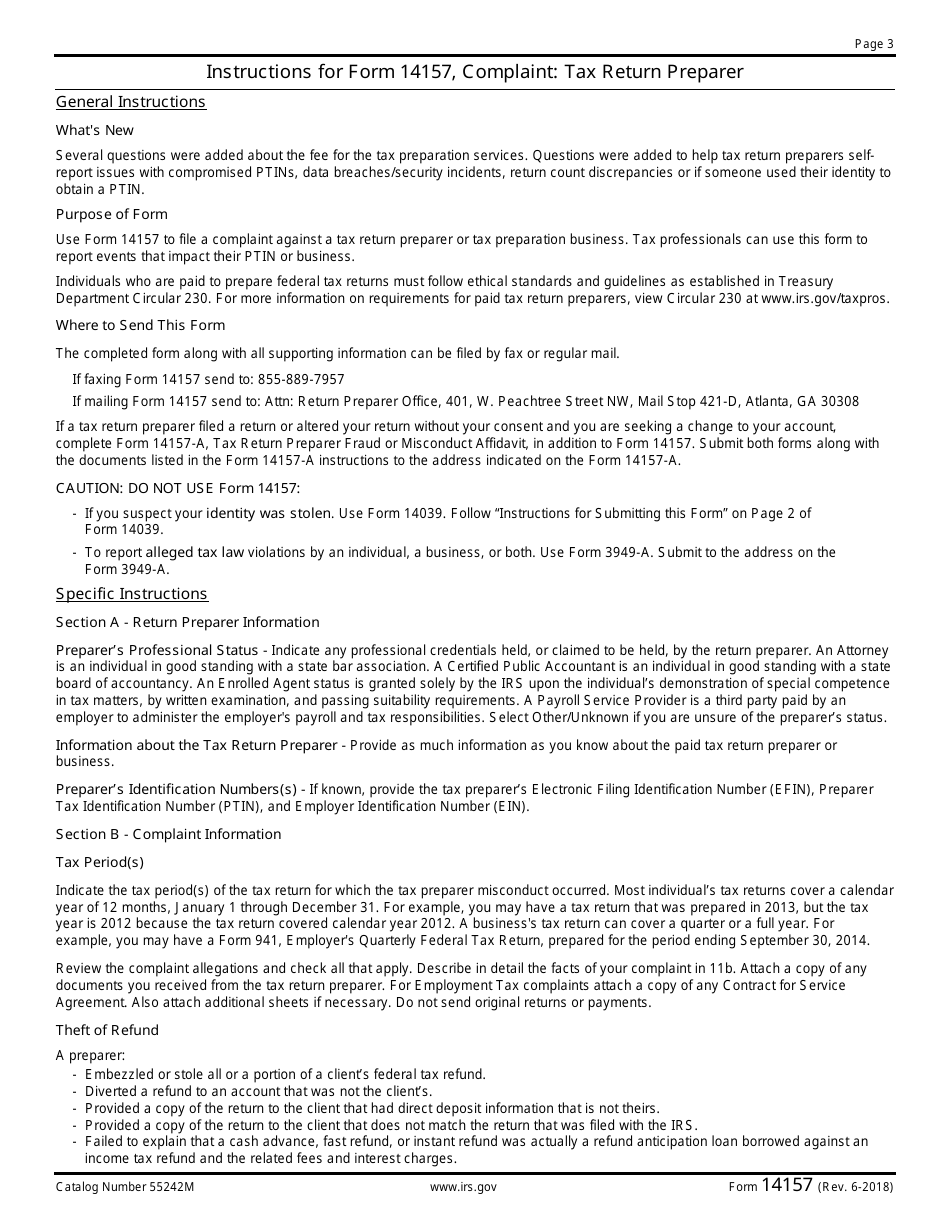

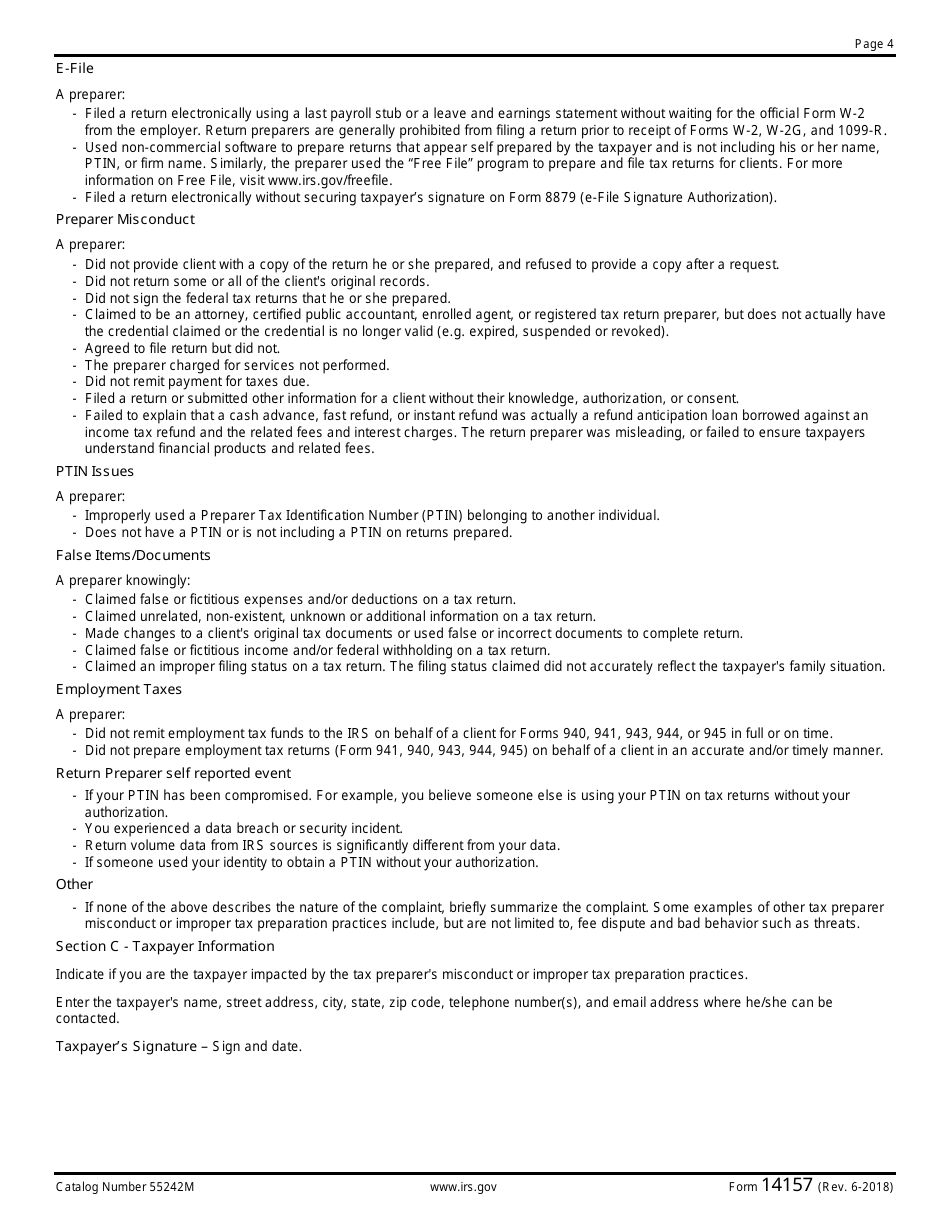

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14157?

A: IRS Form 14157 is a form used to file a complaint against a tax return preparer.

Q: Why would I need to file IRS Form 14157?

A: You would need to file IRS Form 14157 if you have a complaint or concern about a tax return preparer's conduct.

Q: How should I submit IRS Form 14157?

A: You can submit IRS Form 14157 by mail or fax to the appropriate IRS office.

Q: What information should I include in IRS Form 14157?

A: You should provide details about the tax return preparer, the nature of your complaint, and any supporting documentation.

Q: Is there a deadline for filing IRS Form 14157?

A: There is no specific deadline for filing IRS Form 14157, but it is recommended to file it as soon as possible.

Q: Is there a fee to file IRS Form 14157?

A: No, there is no fee to file IRS Form 14157.

Q: What happens after I file IRS Form 14157?

A: The IRS will review your complaint and take appropriate action, which may include investigating the tax return preparer.

Q: Will I be notified of the outcome of my complaint?

A: The IRS generally does not provide updates on the status or outcome of individual complaints.

Form Details:

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14157 through the link below or browse more documents in our library of IRS Forms.