This version of the form is not currently in use and is provided for reference only. Download this version of

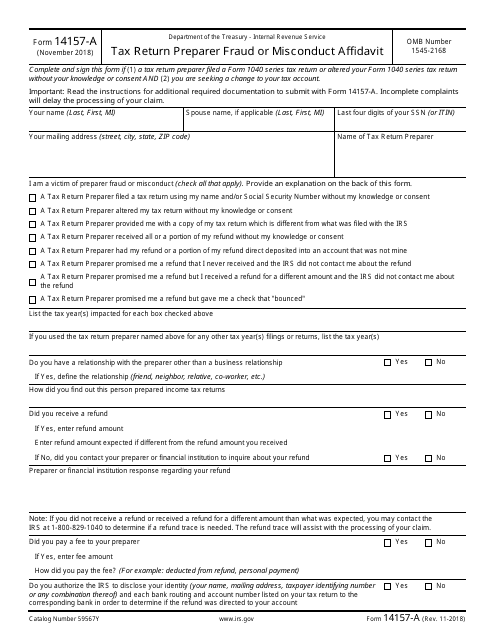

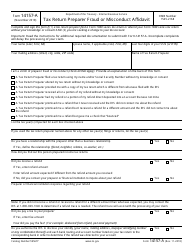

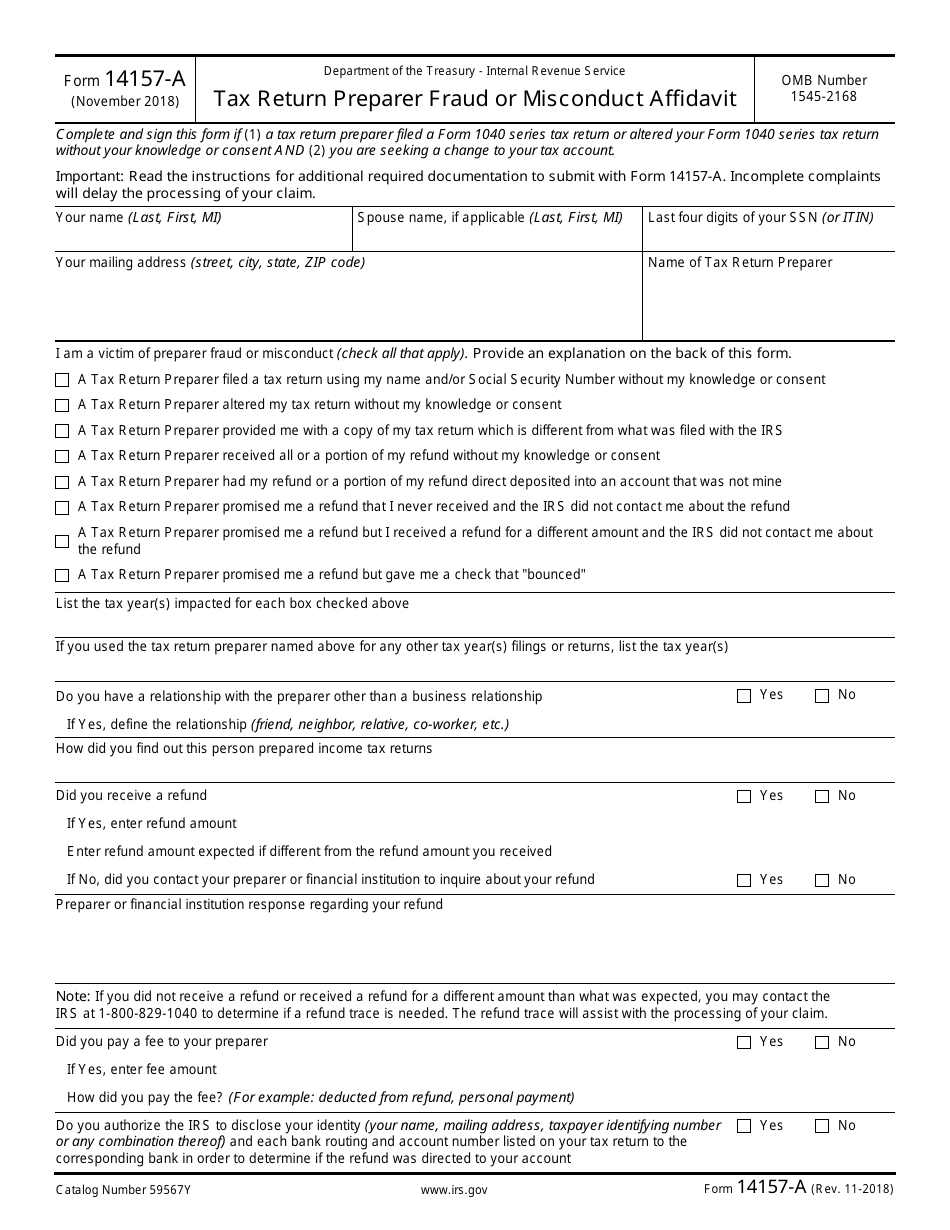

IRS Form 14157-A

for the current year.

IRS Form 14157-A Tax Return Preparer Fraud or Misconduct Affidavit

What Is IRS Form 14157-A?

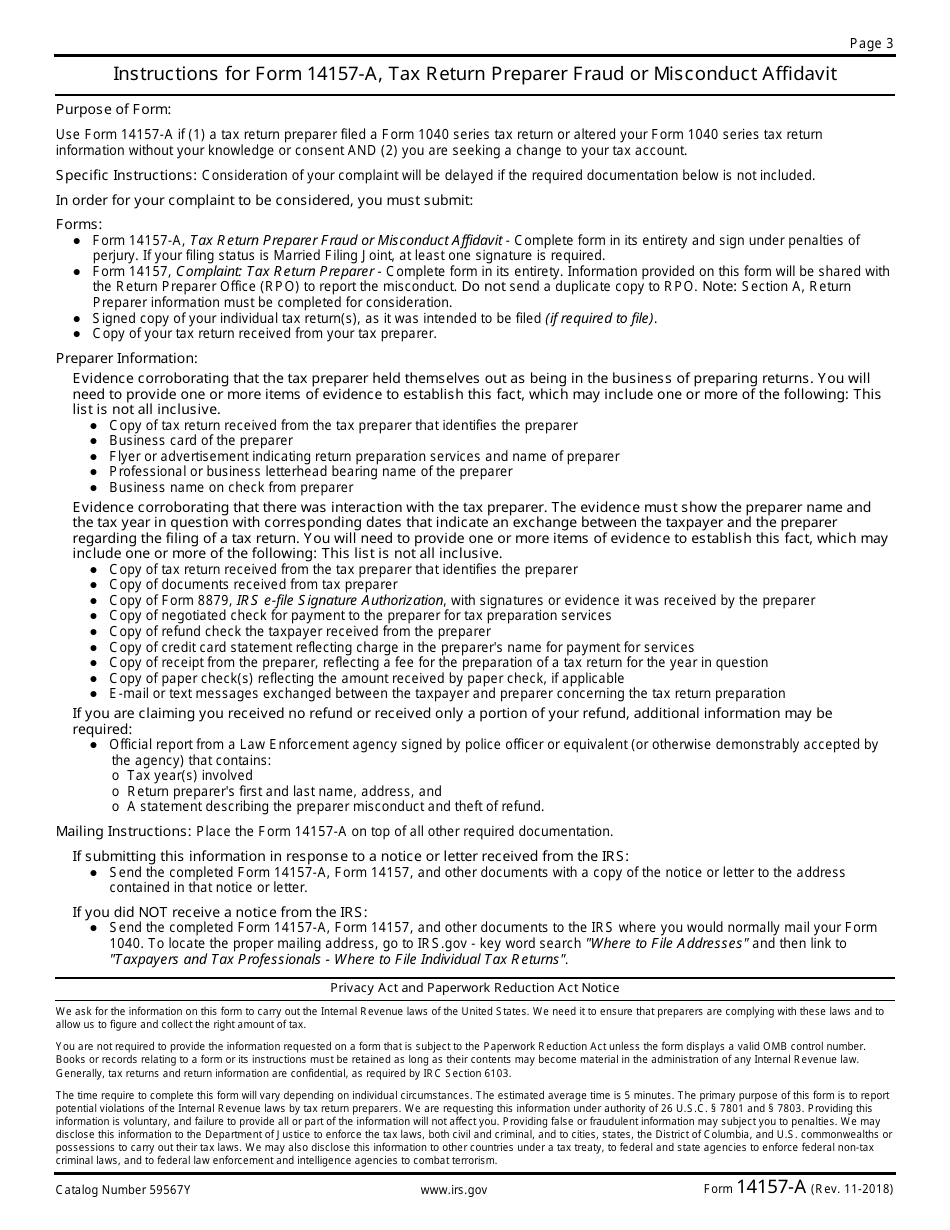

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14157-A?

A: IRS Form 14157-A is the Tax Return Preparer Fraud or Misconduct Affidavit.

Q: What is the purpose of IRS Form 14157-A?

A: The purpose of IRS Form 14157-A is to report fraud or misconduct by a tax return preparer.

Q: Who can use IRS Form 14157-A?

A: Anyone who believes a tax return preparer has committed fraud or misconduct can use IRS Form 14157-A.

Q: Can I submit IRS Form 14157-A anonymously?

A: Yes, you can submit IRS Form 14157-A anonymously if you wish to remain anonymous.

Q: What information should be included in IRS Form 14157-A?

A: IRS Form 14157-A requires information about the tax return preparer and details of the fraud or misconduct.

Q: Is there a deadline to submit IRS Form 14157-A?

A: There is no specific deadline to submit IRS Form 14157-A, but it is recommended to file it as soon as possible.

Form Details:

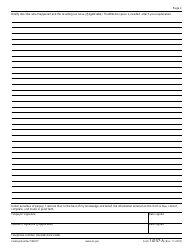

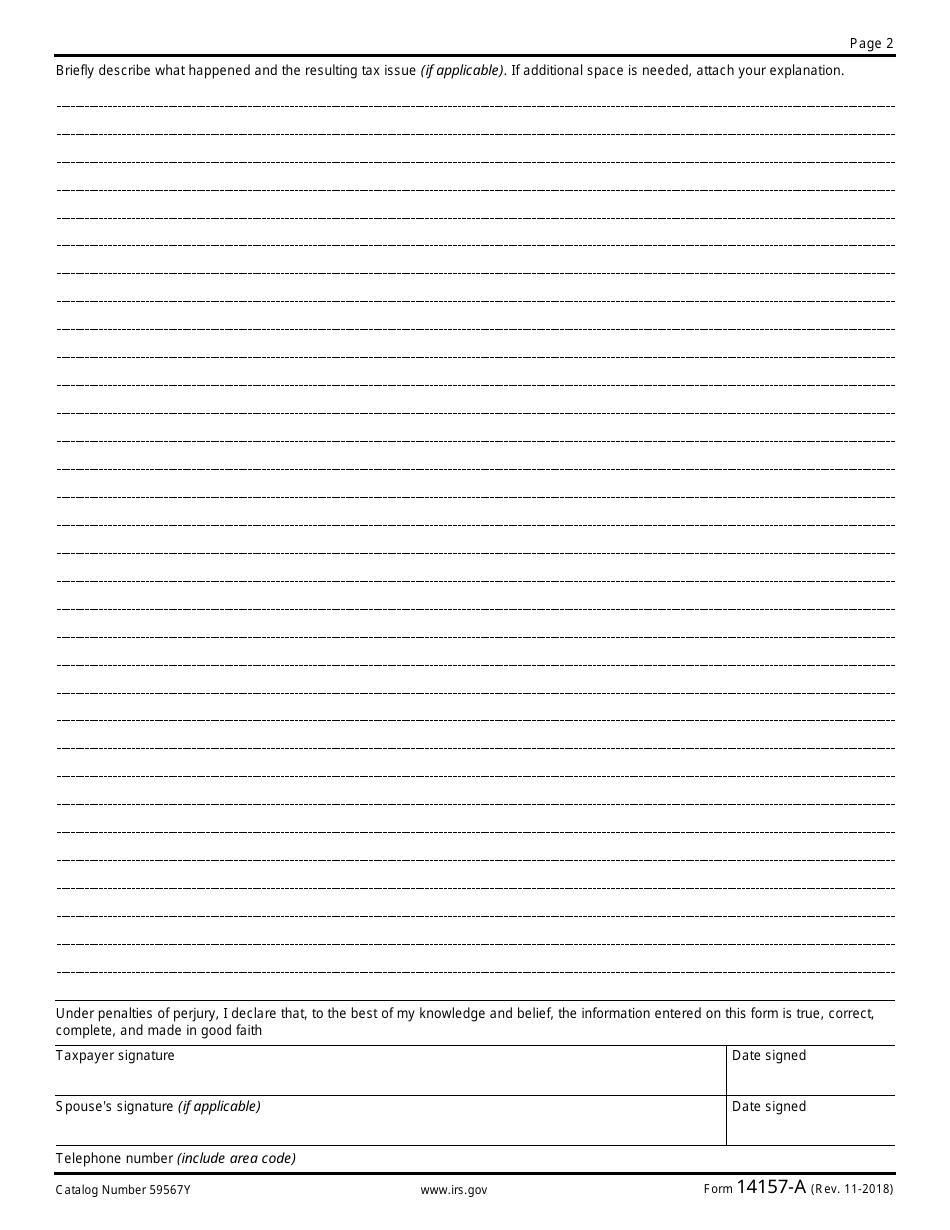

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14157-A through the link below or browse more documents in our library of IRS Forms.