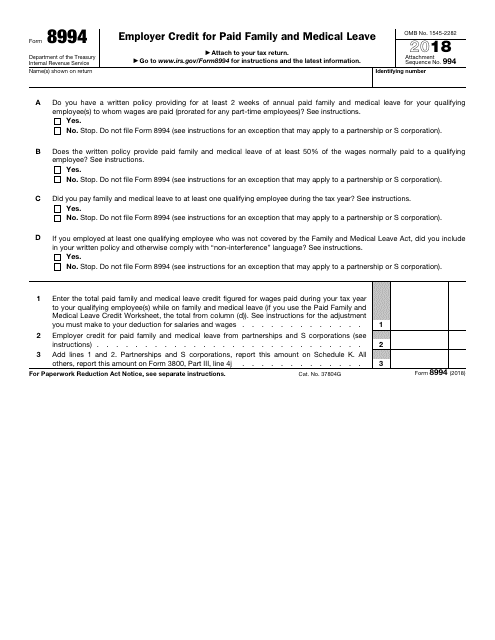

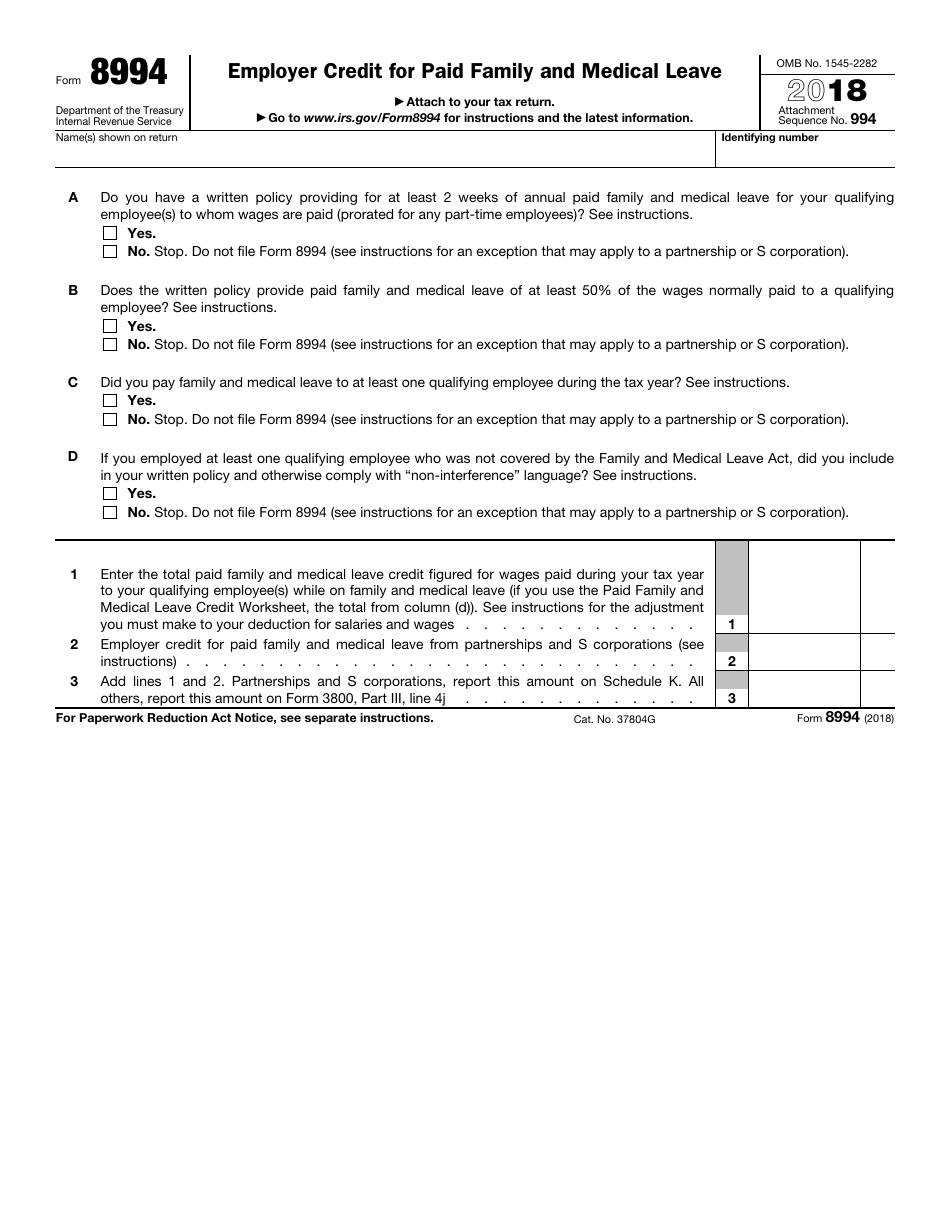

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8994

for the current year.

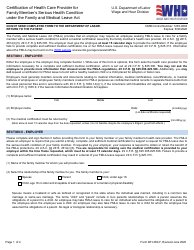

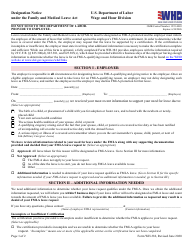

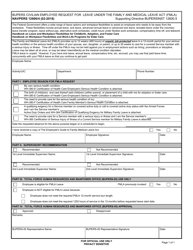

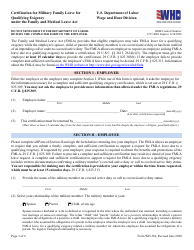

IRS Form 8994 Employer Credit for Paid Family and Medical Leave

What Is IRS Form 8994?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8994?

A: IRS Form 8994 is the form used to claim the Employer Credit for Paid Family and Medical Leave.

Q: What is the Employer Credit for Paid Family and Medical Leave?

A: The Employer Credit for Paid Family and Medical Leave is a tax credit available to employers who provide paid family and medical leave to their employees.

Q: Who is eligible to claim the Employer Credit for Paid Family and Medical Leave?

A: Employers who have a written policy in place that meets certain requirements and provide paid family and medical leave to their employees may be eligible to claim the credit.

Q: What are the requirements for claiming the Employer Credit for Paid Family and Medical Leave?

A: To claim the credit, employers must have a written policy that provides at least two weeks of paid family and medical leave to full-time employees (pro-rated for part-time employees), and the leave must be at least 50% of the employee's normal wages.

Q: How much is the credit for the Employer Credit for Paid Family and Medical Leave?

A: The credit is generally equal to a percentage of the wages paid to employees during their leave period, up to a maximum of 12 weeks per employee, per year.

Q: How do employers claim the Employer Credit for Paid Family and Medical Leave?

A: Employers must complete and file IRS Form 8994 along with their annual tax return to claim the credit.

Q: Are there any limitations or restrictions for claiming the Employer Credit for Paid Family and Medical Leave?

A: Yes, there are certain limitations and restrictions for claiming the credit. Employers should consult the instructions for IRS Form 8994 or seek professional tax advice for more information.

Q: Can I claim the Employer Credit for Paid Family and Medical Leave for self-employed individuals?

A: No, the credit is only available to employers who have employees and provide paid family and medical leave to them. It does not apply to self-employed individuals.

Q: Is the Employer Credit for Paid Family and Medical Leave a refundable credit?

A: Yes, the credit is a general business credit and may be carried forward to future tax years if it exceeds the employer's tax liability for the current year.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8994 through the link below or browse more documents in our library of IRS Forms.