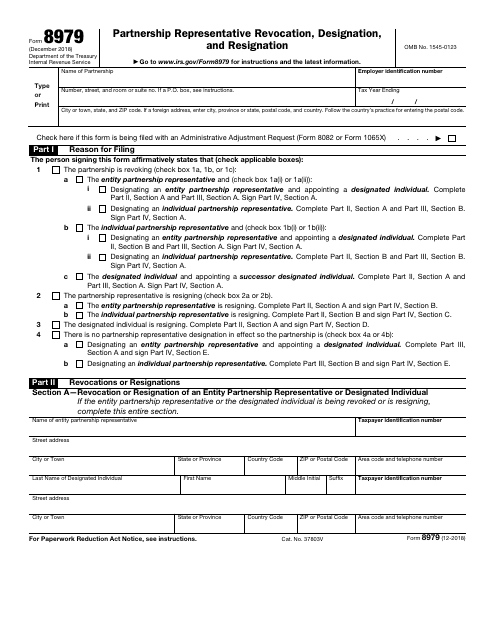

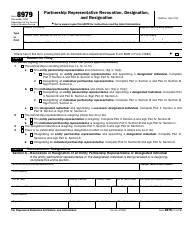

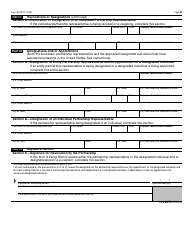

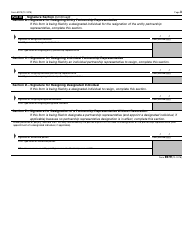

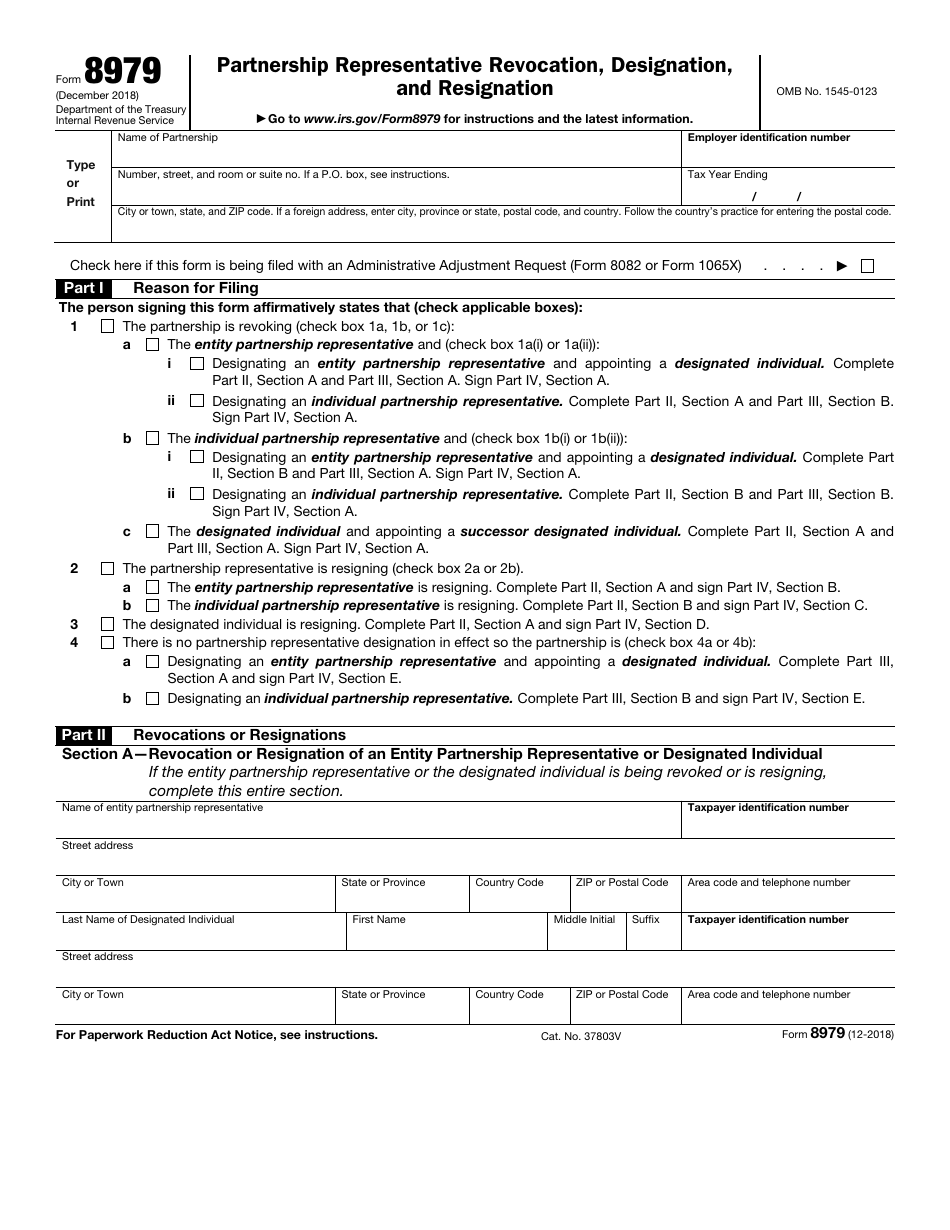

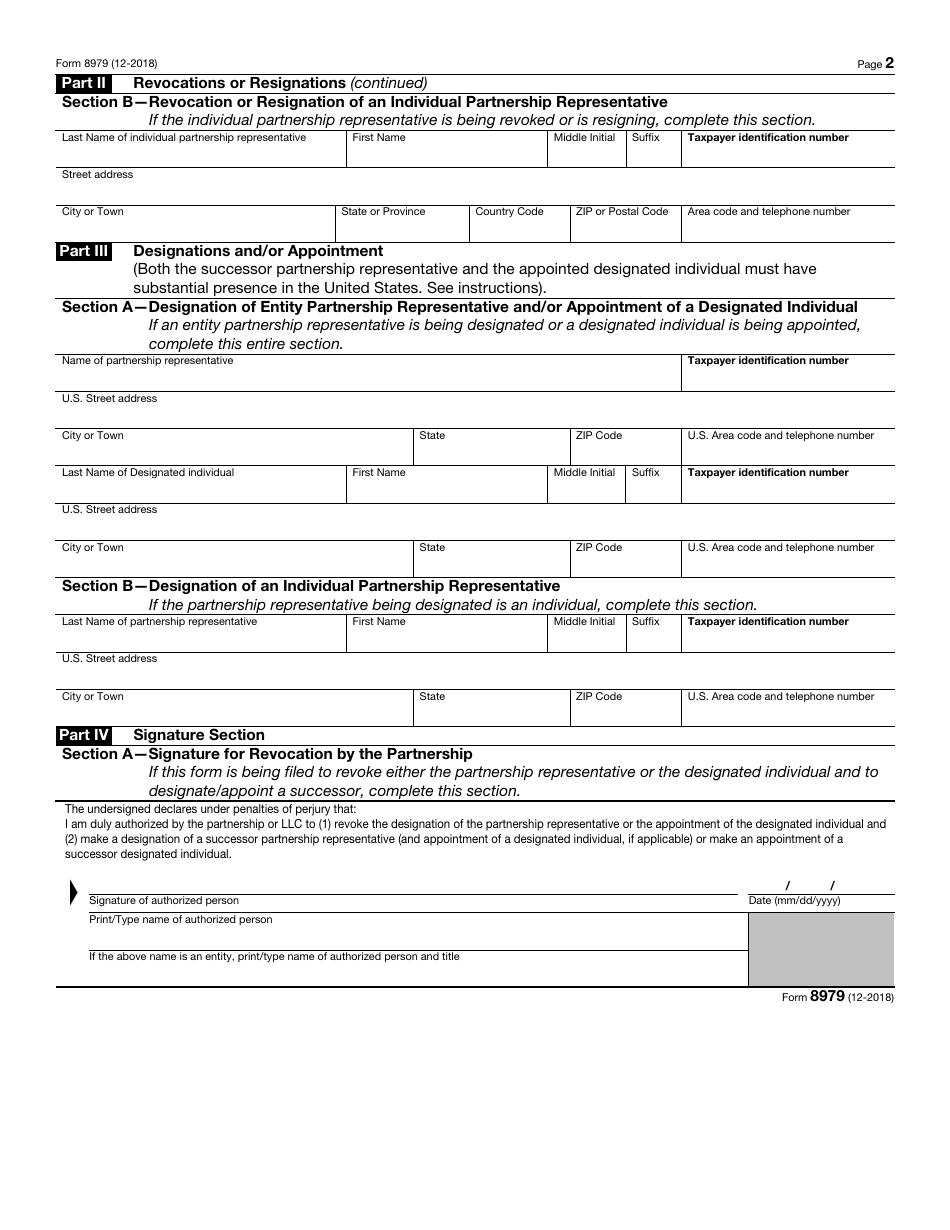

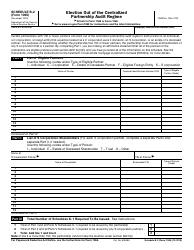

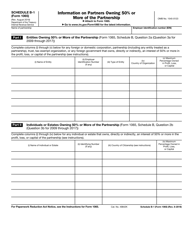

IRS Form 8979 Partnership Representative Revocation, Designation, and Resignation

What Is IRS Form 8979?

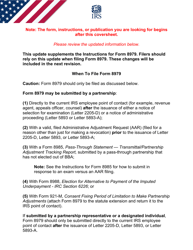

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8979?

A: IRS Form 8979 is used to revoke, designate, or resign as a partnership representative.

Q: What is a partnership representative?

A: A partnership representative is a person who represents the partnership in IRS tax matters.

Q: When would I use Form 8979?

A: You would use Form 8979 to revoke, designate, or resign as a partnership representative.

Q: How do I revoke my designation as a partnership representative?

A: You can use Form 8979 to revoke your designation as a partnership representative.

Q: Can I designate someone else as a partnership representative?

A: Yes, you can use Form 8979 to designate someone else as a partnership representative.

Q: Can I resign as a partnership representative?

A: Yes, you can use Form 8979 to resign as a partnership representative.

Q: Are there any fees associated with filing Form 8979?

A: There are no fees associated with filing Form 8979.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8979 through the link below or browse more documents in our library of IRS Forms.