This version of the form is not currently in use and is provided for reference only. Download this version of

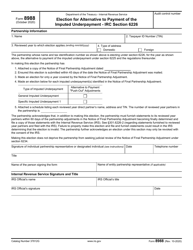

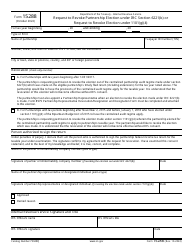

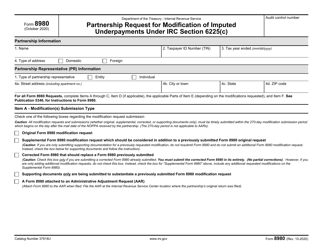

IRS Form 8989

for the current year.

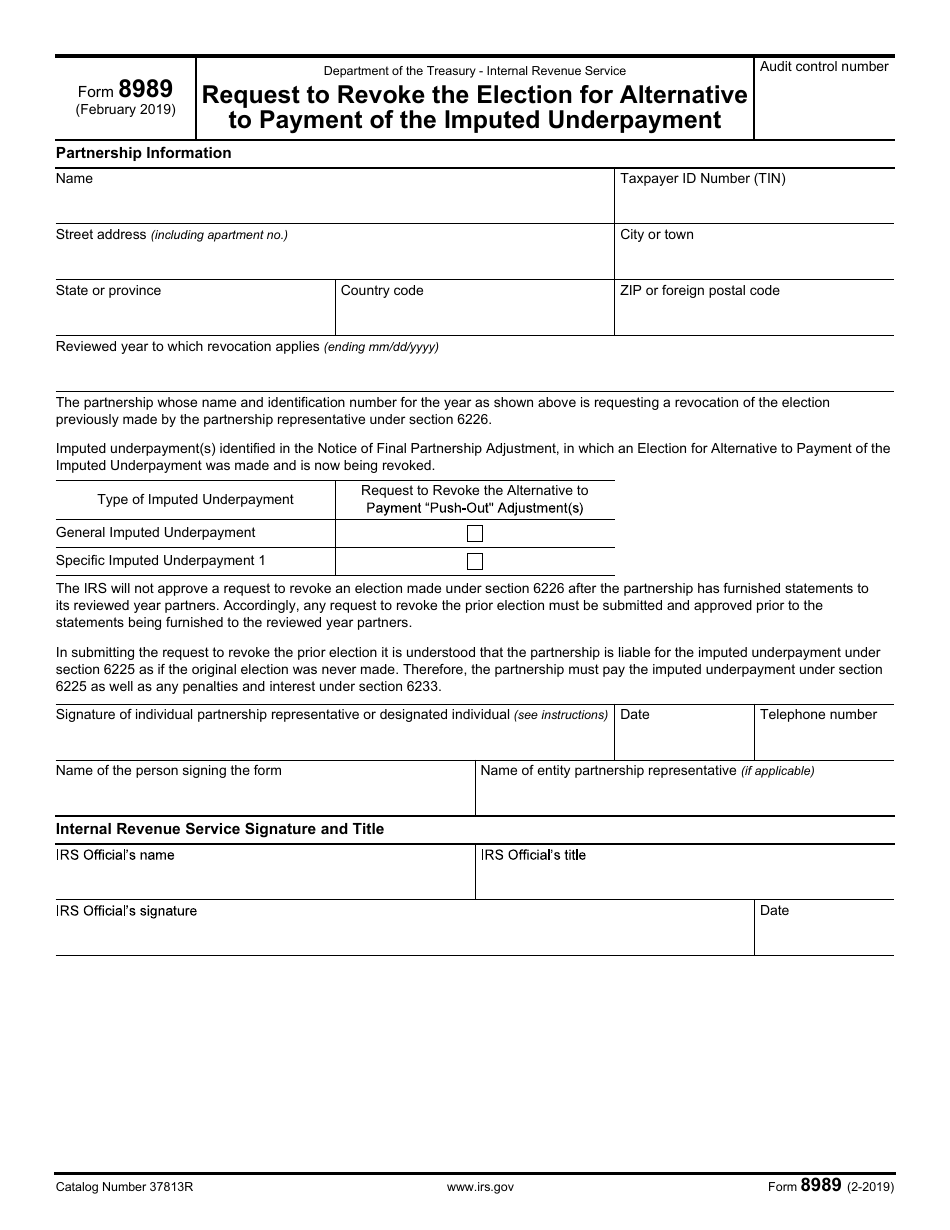

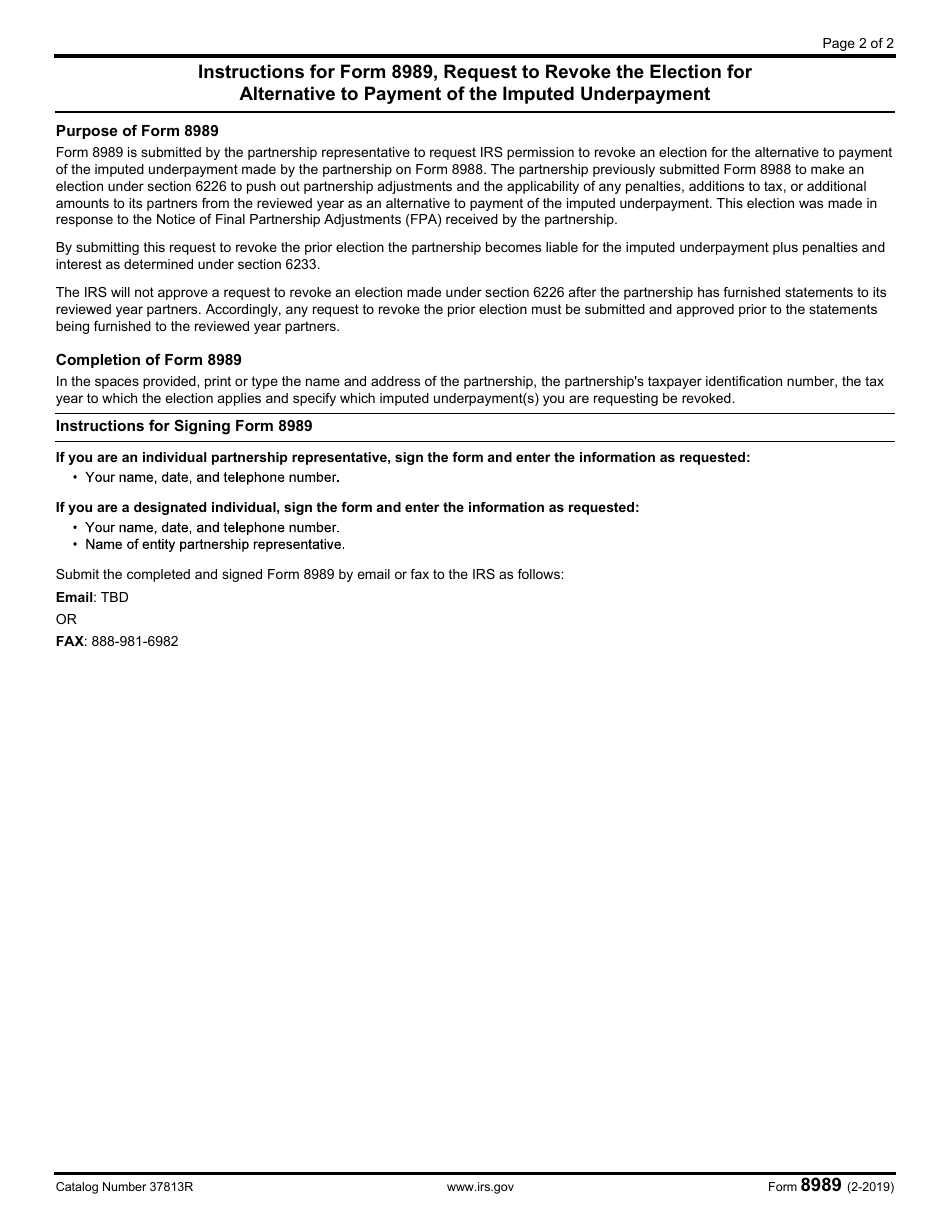

IRS Form 8989 Request to Revoke the Election for Alternative to Payment of the Imputed Underpayment

What Is IRS Form 8989?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8989?

A: IRS Form 8989 is a form used to request the revocation of the election for an alternative to payment of the imputed underpayment.

Q: What is the purpose of IRS Form 8989?

A: The purpose of IRS Form 8989 is to request the revocation of the election for an alternative way to pay the imputed underpayment.

Q: Who needs to use IRS Form 8989?

A: Taxpayers who previously elected an alternative way to pay the imputed underpayment and now want to revoke that election need to use IRS Form 8989.

Q: What is an imputed underpayment?

A: An imputed underpayment is an amount of additional tax determined by the IRS in connection with the partnership return.

Q: How do I fill out IRS Form 8989?

A: You need to provide your personal information, partnership information, and an explanation for the revocation request. You may need to consult with a tax professional for assistance.

Q: Are there any fees associated with filing IRS Form 8989?

A: No, there are no fees associated with filing IRS Form 8989.

Q: What happens after I submit IRS Form 8989?

A: The IRS will review your request and determine whether to approve or deny the revocation of the election for an alternative to payment of the imputed underpayment.

Q: Can I file IRS Form 8989 electronically?

A: As of now, IRS Form 8989 cannot be filed electronically. It must be mailed to the IRS.

Q: Can I amend or modify my request after submitting IRS Form 8989?

A: Once you have submitted IRS Form 8989, you cannot amend or modify your request. If there are any changes or updates, you would need to submit a new form.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8989 through the link below or browse more documents in our library of IRS Forms.