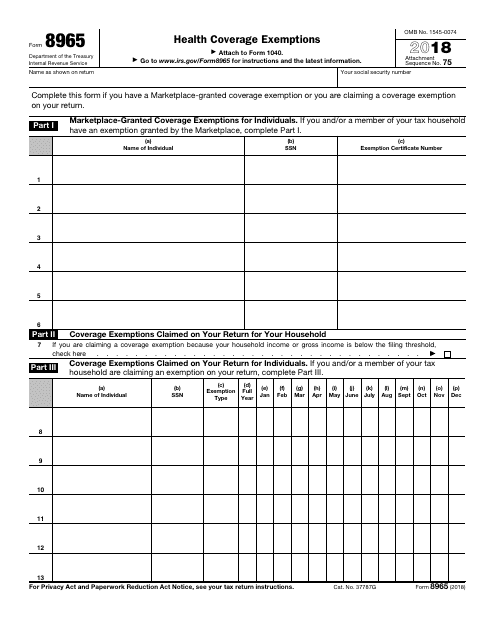

IRS Form 8965 Health Coverage Exemptions

What Is IRS Form 8965?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8965?

A: IRS Form 8965 is a form used to report and claim exemptions from the requirement to have health insurance.

Q: Who needs to file IRS Form 8965?

A: You need to file IRS Form 8965 if you are claiming a health coverage exemption.

Q: What are health coverage exemptions?

A: Health coverage exemptions are reasons that qualify you for an exemption from the requirement to have health insurance.

Q: How do I claim a health coverage exemption?

A: You can claim a health coverage exemption by completing IRS Form 8965 and attaching it to your tax return.

Q: What happens if I don't file Form 8965?

A: If you are required to file IRS Form 8965 and you don't do so, you may be subject to a penalty.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8965 through the link below or browse more documents in our library of IRS Forms.