This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8955-SSA

for the current year.

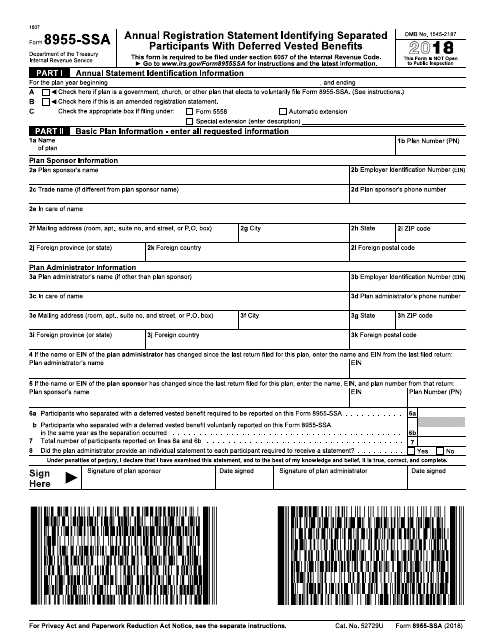

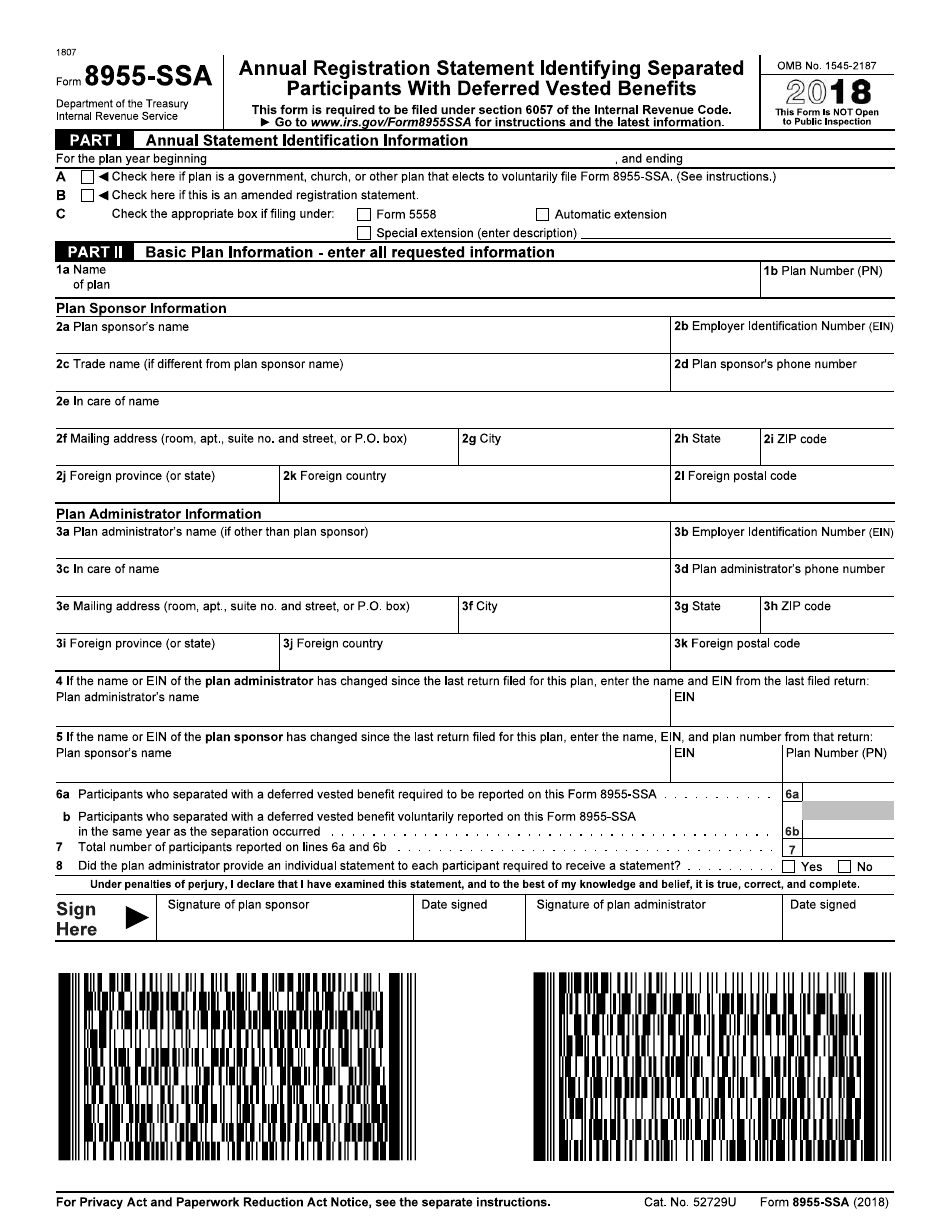

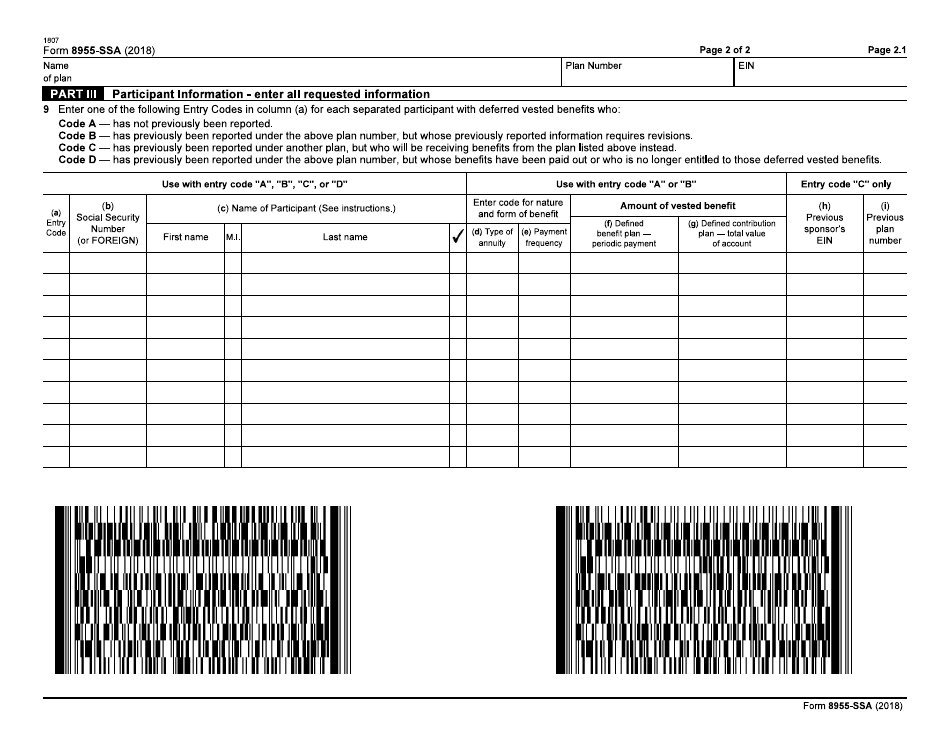

IRS Form 8955-SSA Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits

What Is IRS Form 8955-SSA?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8955-SSA?

A: IRS Form 8955-SSA is the Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits.

Q: Who needs to file IRS Form 8955-SSA?

A: Plan administrators of certain retirement plans, such as pension plans, need to file IRS Form 8955-SSA.

Q: What is the purpose of IRS Form 8955-SSA?

A: The purpose of IRS Form 8955-SSA is to report information about separated participants with deferred vested benefits to the Internal Revenue Service (IRS).

Q: What information is required on IRS Form 8955-SSA?

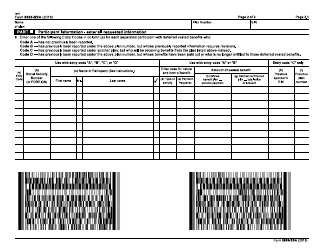

A: IRS Form 8955-SSA requires information about the separated participants, including their names, Social Security numbers, and the amounts of their deferred vested benefits.

Q: When is IRS Form 8955-SSA due?

A: IRS Form 8955-SSA is generally due by the last day of the seventh month after the plan year ends.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8955-SSA through the link below or browse more documents in our library of IRS Forms.