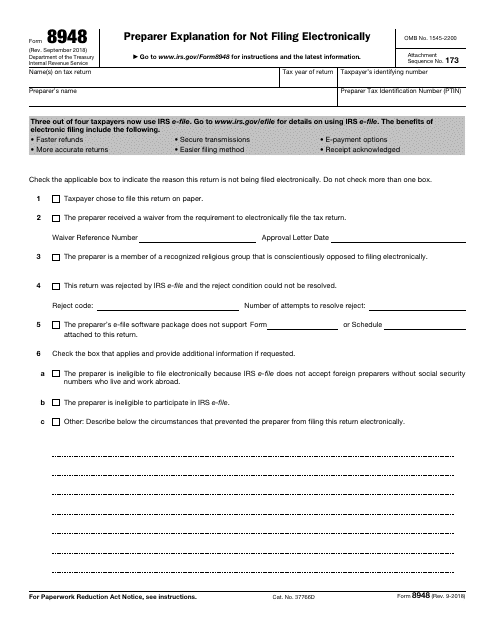

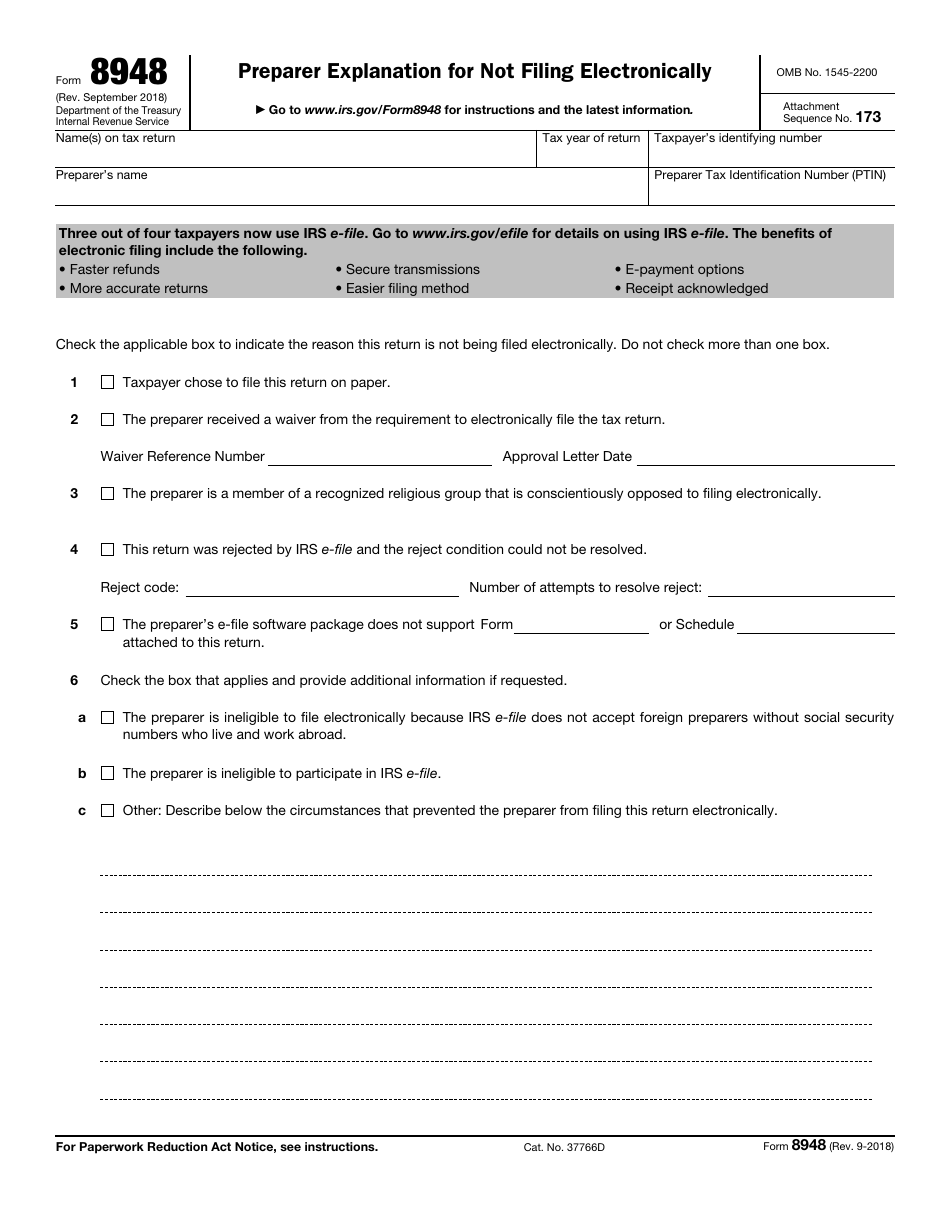

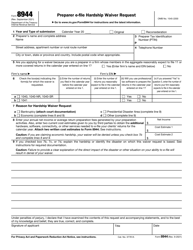

IRS Form 8948 Preparer Explanation for Not Filing Electronically

What Is IRS Form 8948?

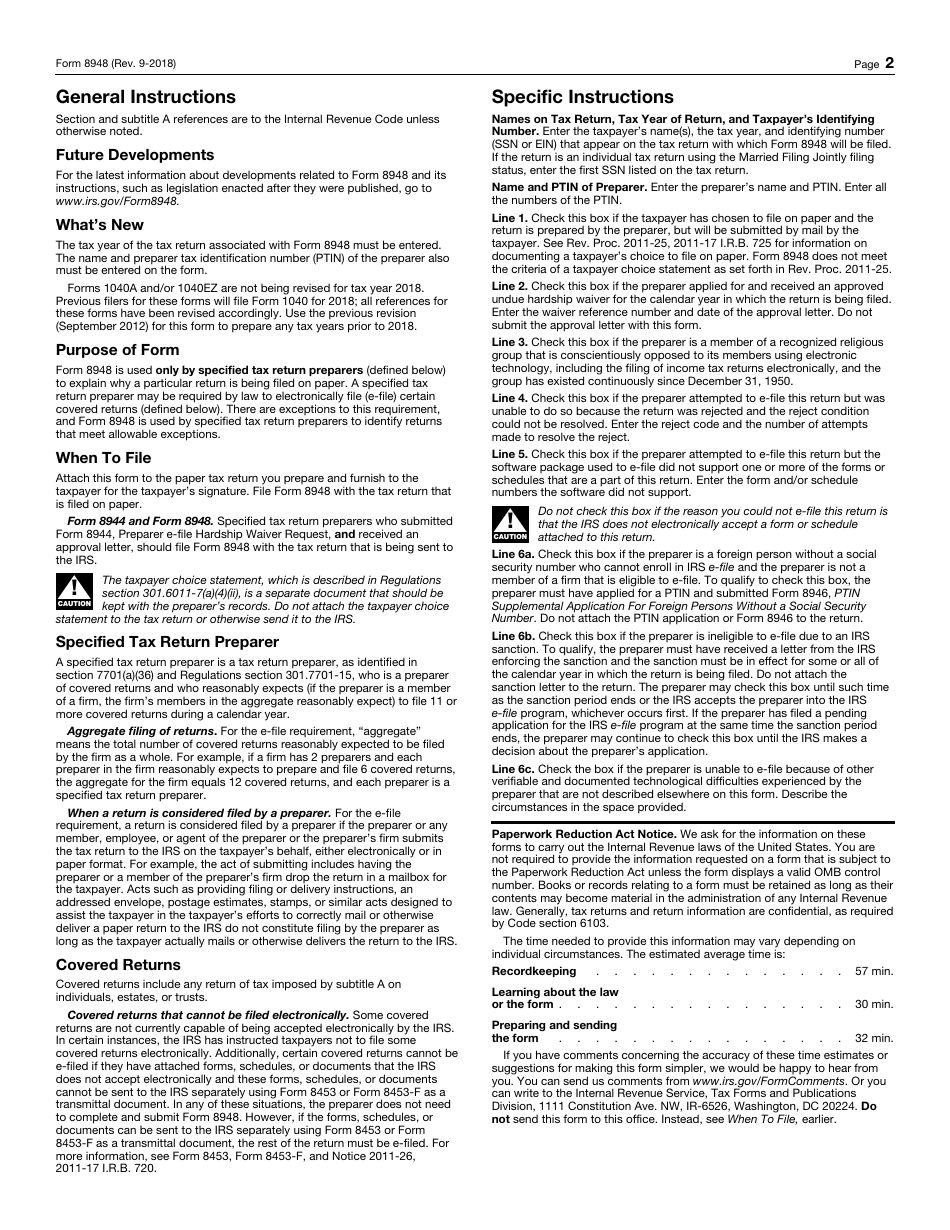

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8948?

A: IRS Form 8948 is the Preparer Explanation for Not Filing Electronically.

Q: Who needs to file IRS Form 8948?

A: Tax preparers who are unable to file tax returns electronically need to file IRS Form 8948.

Q: Why would a tax preparer not file electronically?

A: There could be various reasons for a tax preparer not filing electronically, such as technical issues or an exemption granted by the IRS.

Q: What information is required on IRS Form 8948?

A: IRS Form 8948 requires the tax preparer's information, including their name, address, and Preparer Tax Identification Number (PTIN), along with an explanation for not filing electronically.

Q: Is there a deadline for filing IRS Form 8948?

A: Yes, IRS Form 8948 should be filed by the tax preparer with the annual tax return or extension request.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8948 through the link below or browse more documents in our library of IRS Forms.