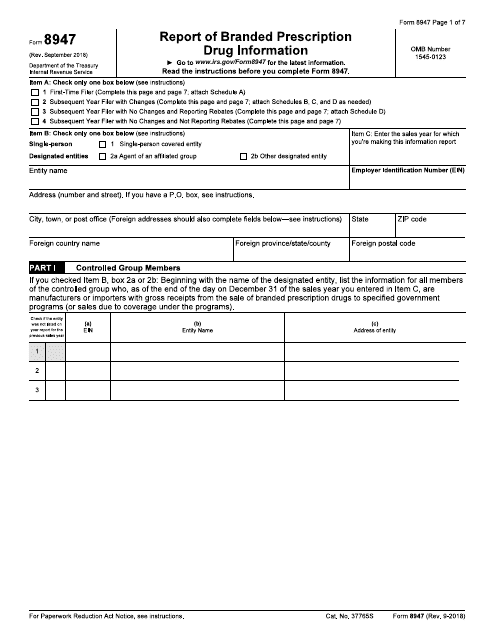

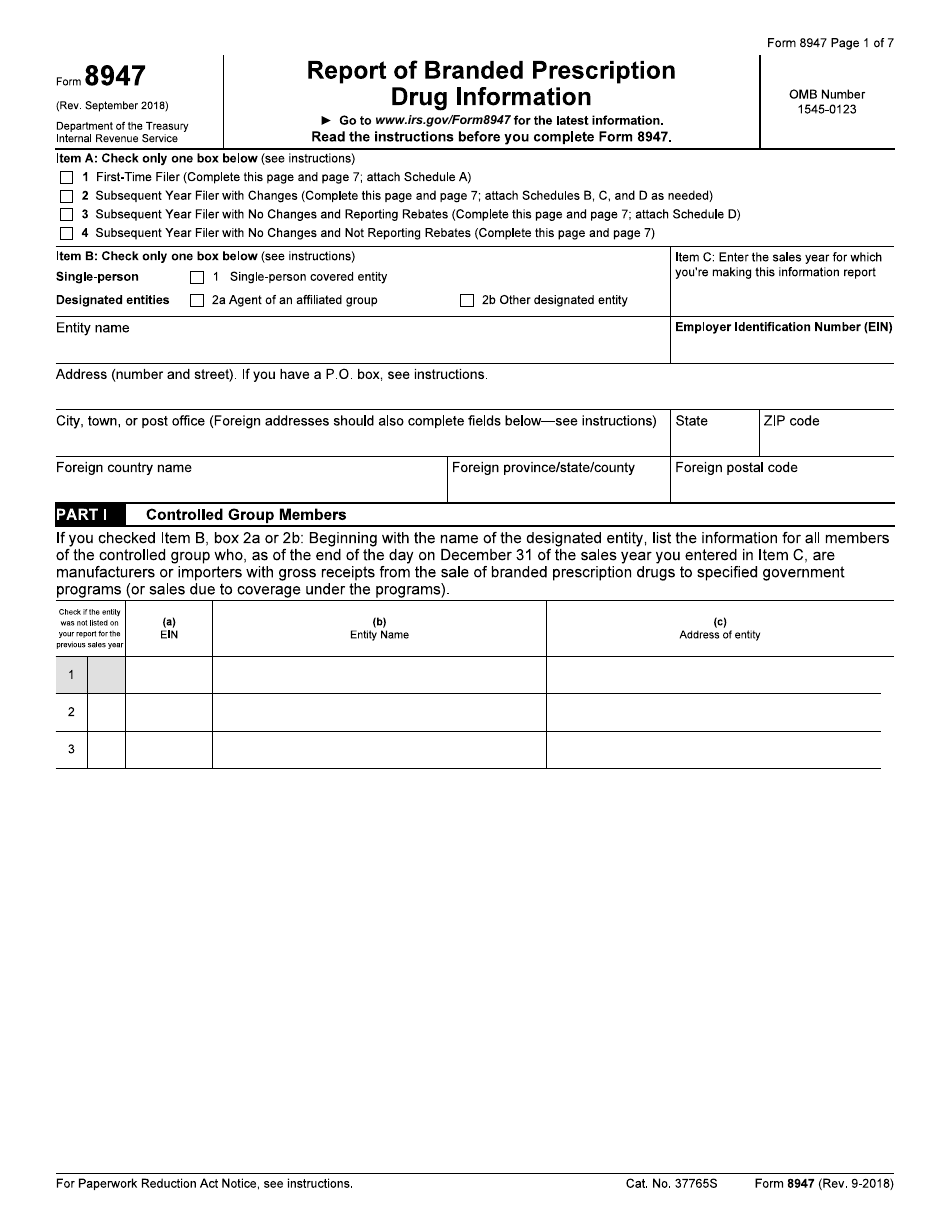

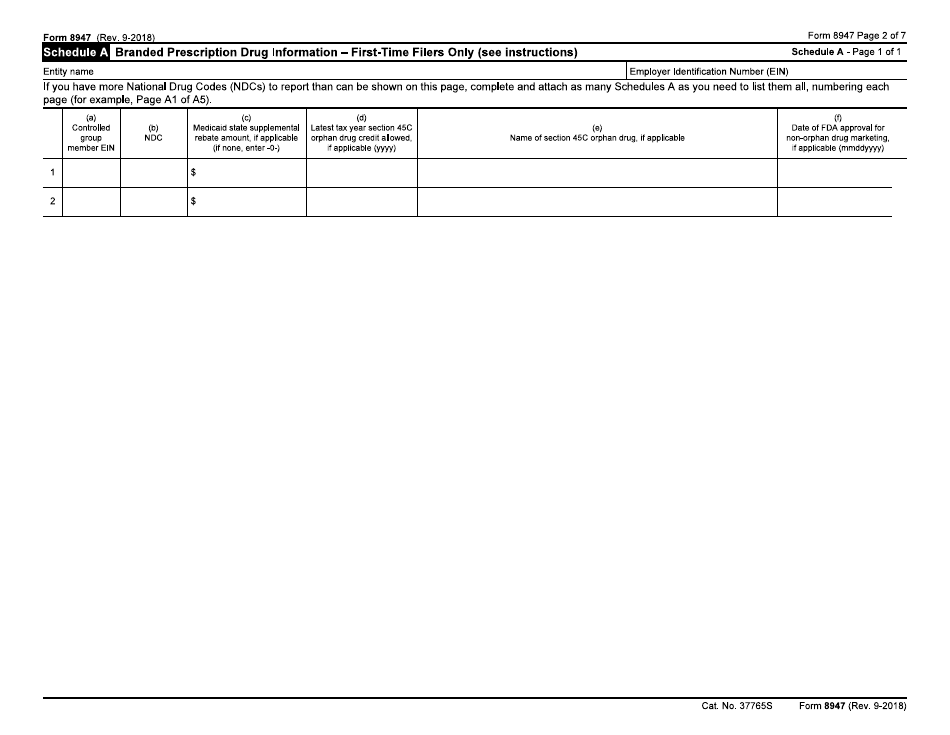

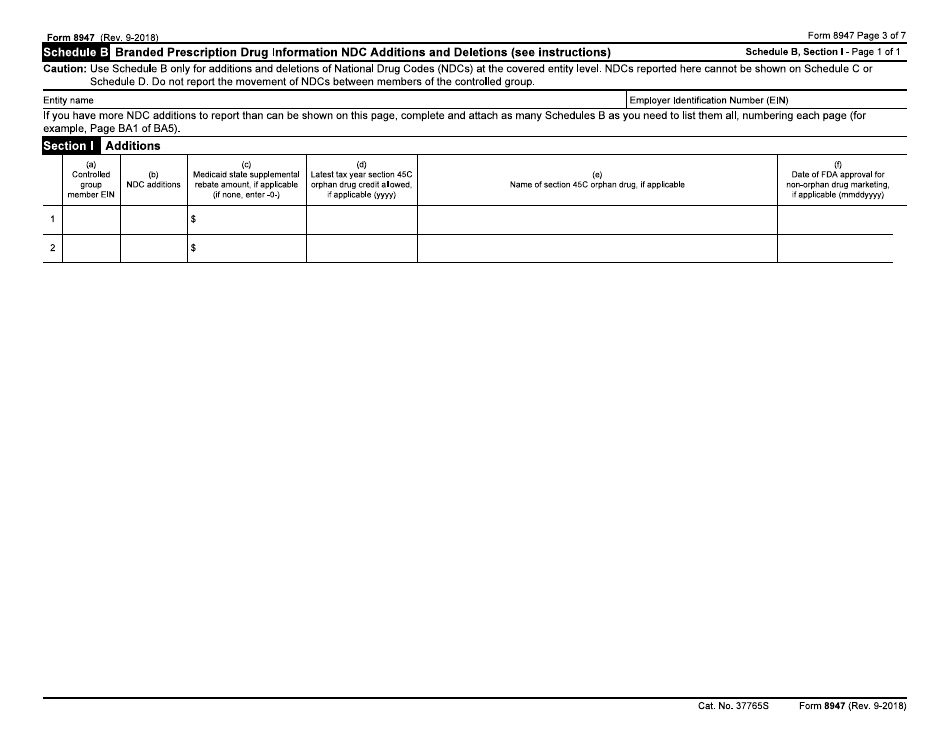

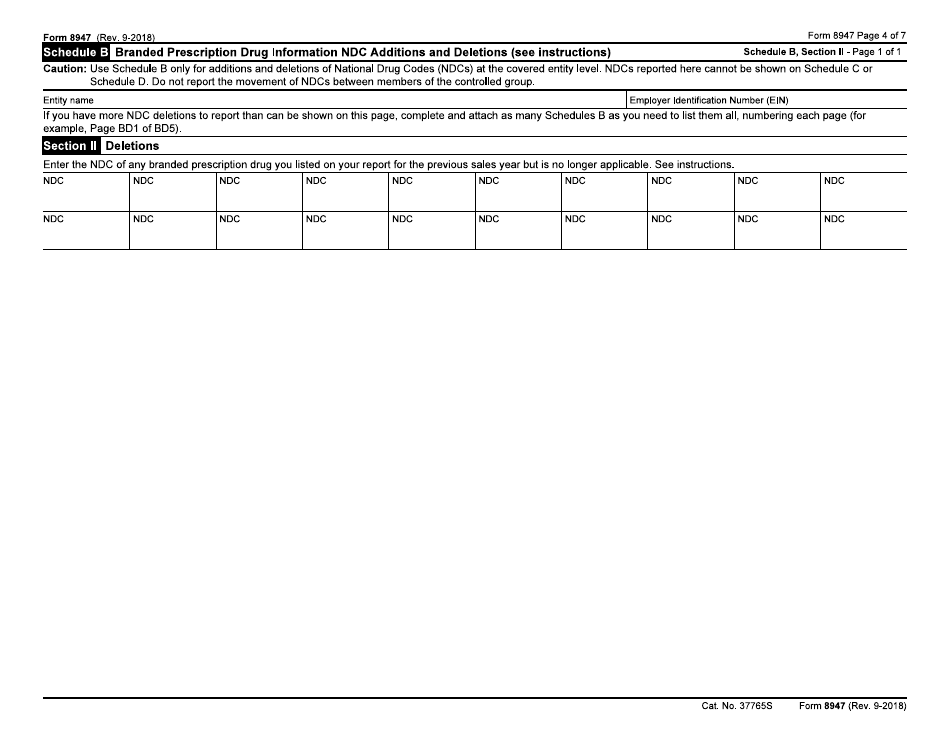

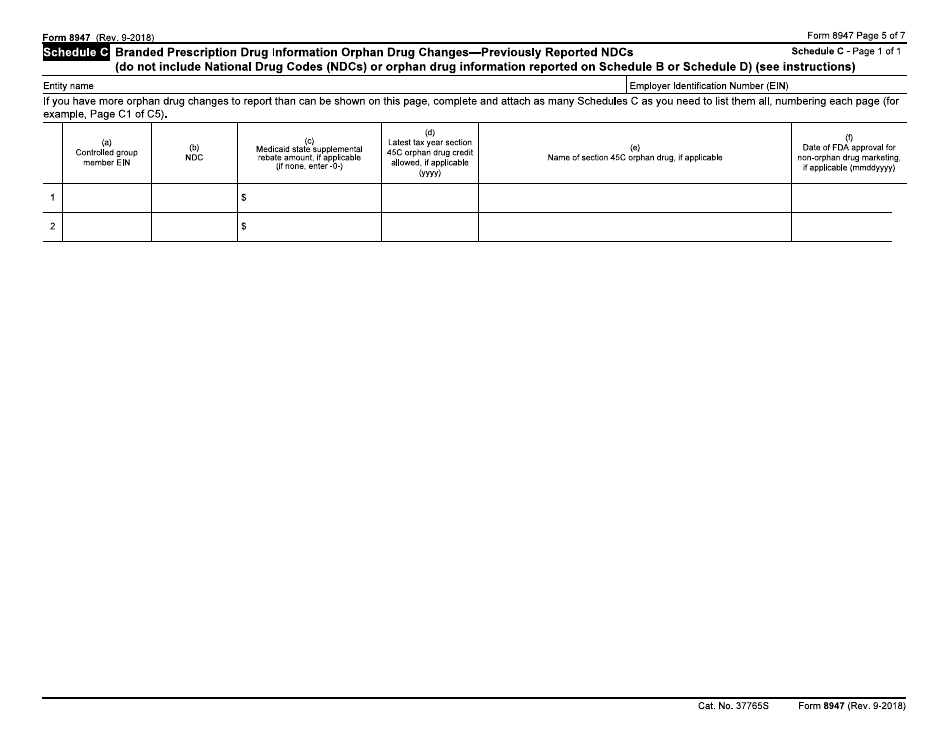

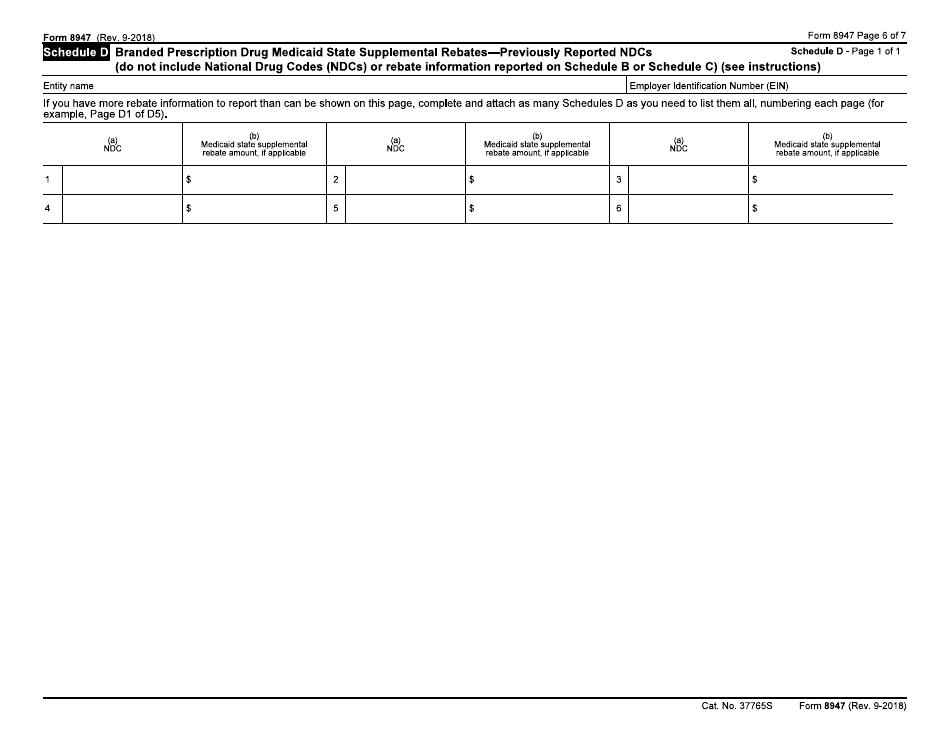

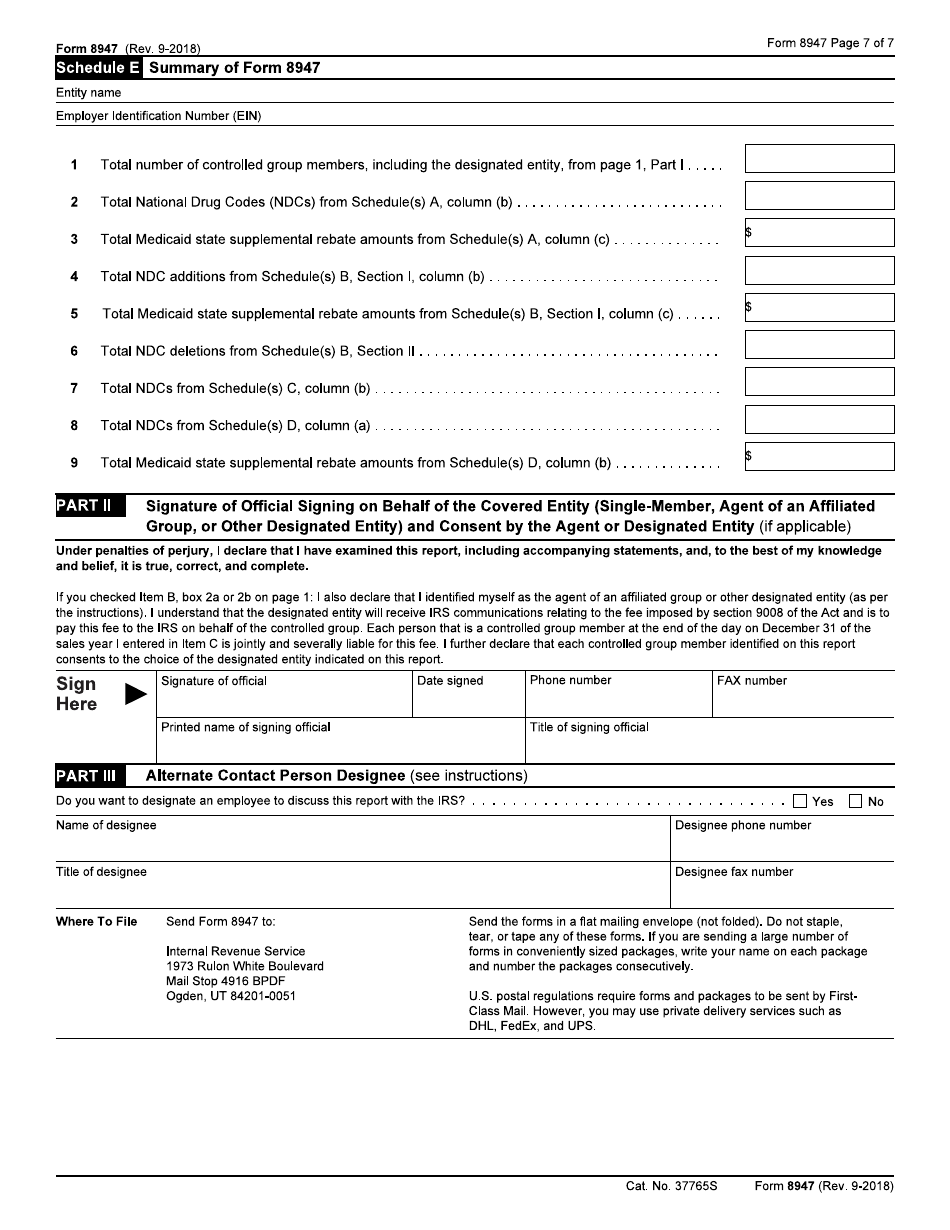

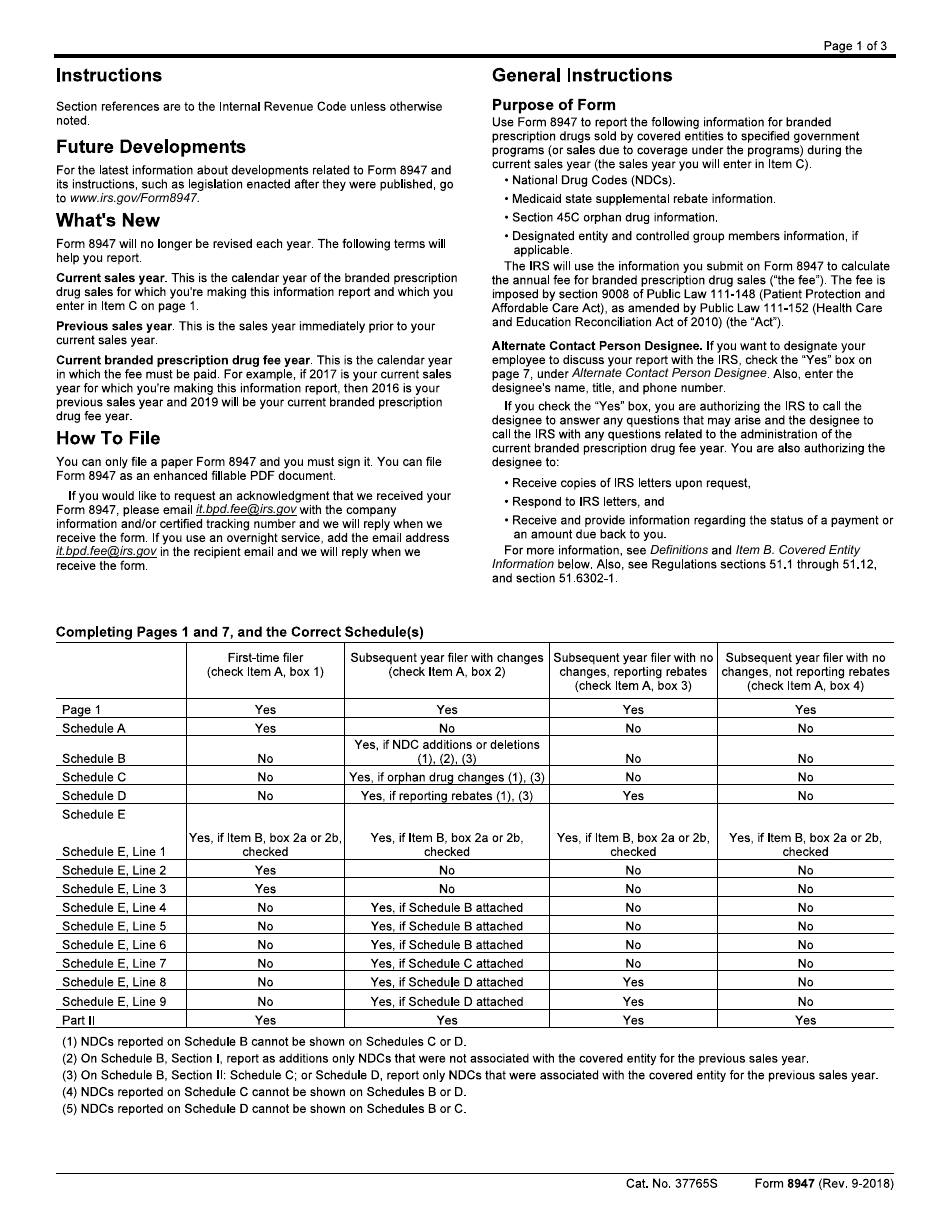

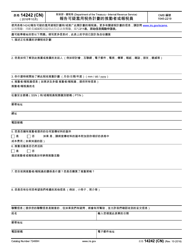

IRS Form 8947 Report of Branded Prescription Drug Information

What Is IRS Form 8947?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8947?

A: IRS Form 8947 is the Report of Branded Prescription Drug Information.

Q: What is the purpose of Form 8947?

A: The purpose of Form 8947 is to report the sales of branded prescription drugs by specified tax-exempt organizations.

Q: Who needs to file Form 8947?

A: Specified tax-exempt organizations that sell branded prescription drugs need to file Form 8947.

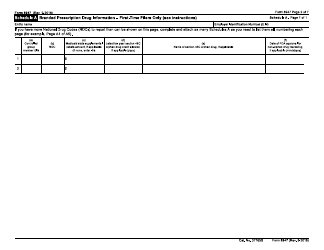

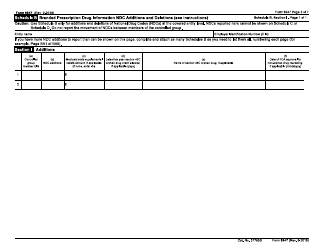

Q: What information is reported on Form 8947?

A: Form 8947 reports the total number of units sold, the total revenue from sales, and certain additional information for each drug sold.

Q: When is Form 8947 due?

A: Form 8947 is generally due by the 15th day of the 5th month after the close of the organization's tax year.

Q: Are there any penalties for not filing Form 8947?

A: Yes, there are penalties for not filing Form 8947 or for filing an incomplete or inaccurate form. It is important to file the form correctly and on time.

Q: Are there any other forms that may need to be filed along with Form 8947?

A: Depending on the organization's tax status and activities, there may be other forms that need to be filed along with Form 8947. It is recommended to consult a tax professional or the IRS for specific requirements.

Q: Can Form 8947 be filed electronically?

A: Yes, Form 8947 can be filed electronically using the IRS's e-file system.

Q: Is there a fee for filing Form 8947?

A: No, there is no fee for filing Form 8947.

Form Details:

- A 10-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8947 through the link below or browse more documents in our library of IRS Forms.