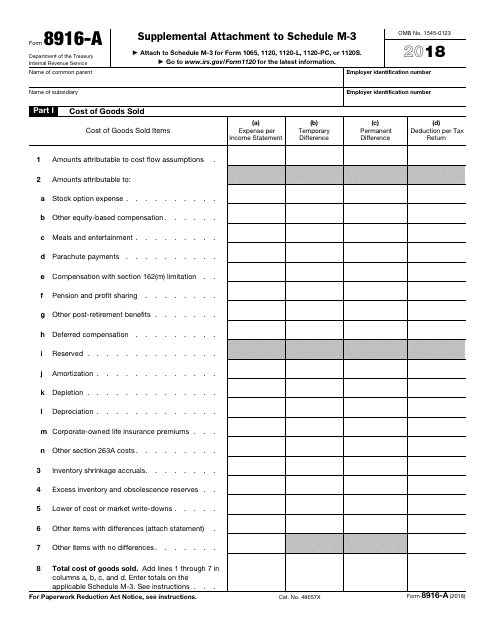

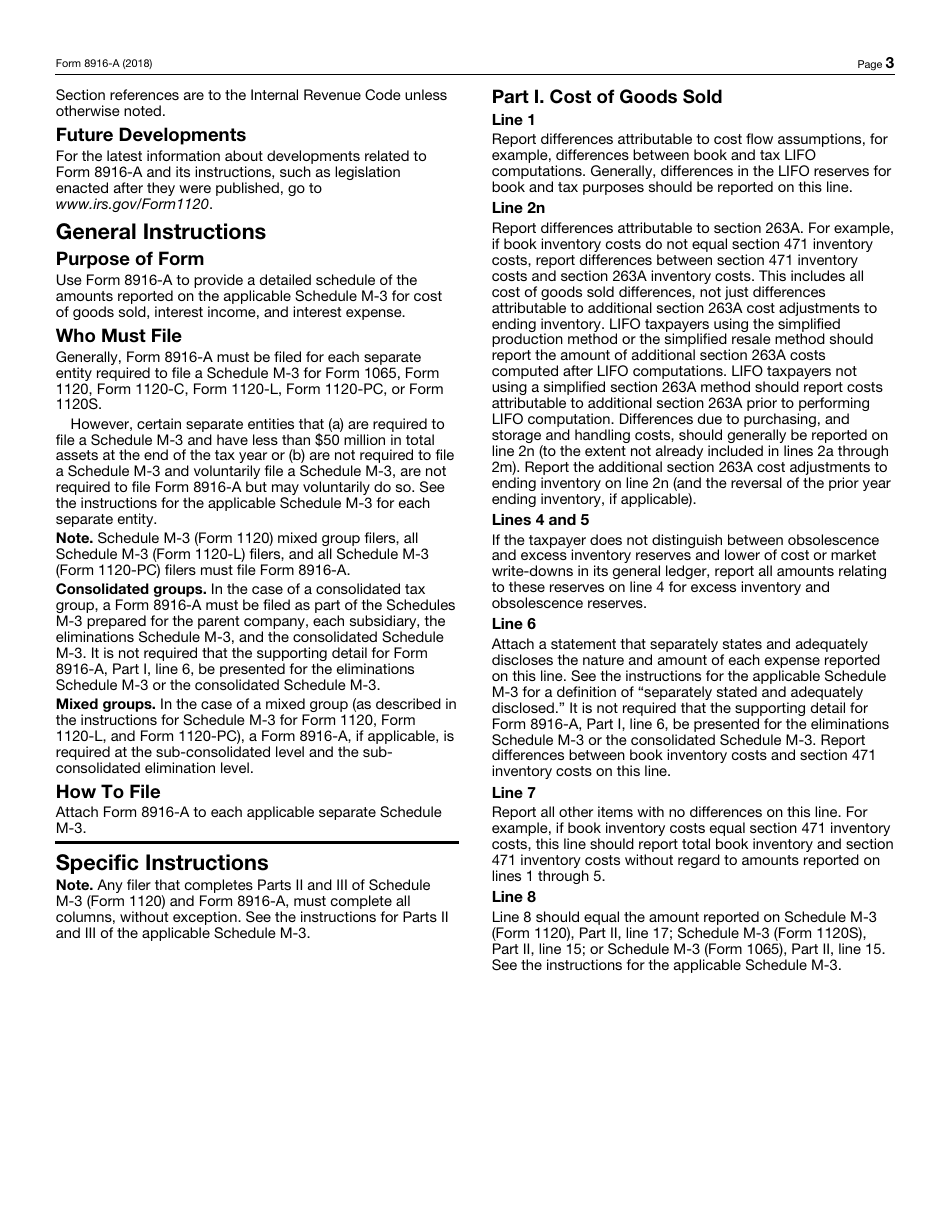

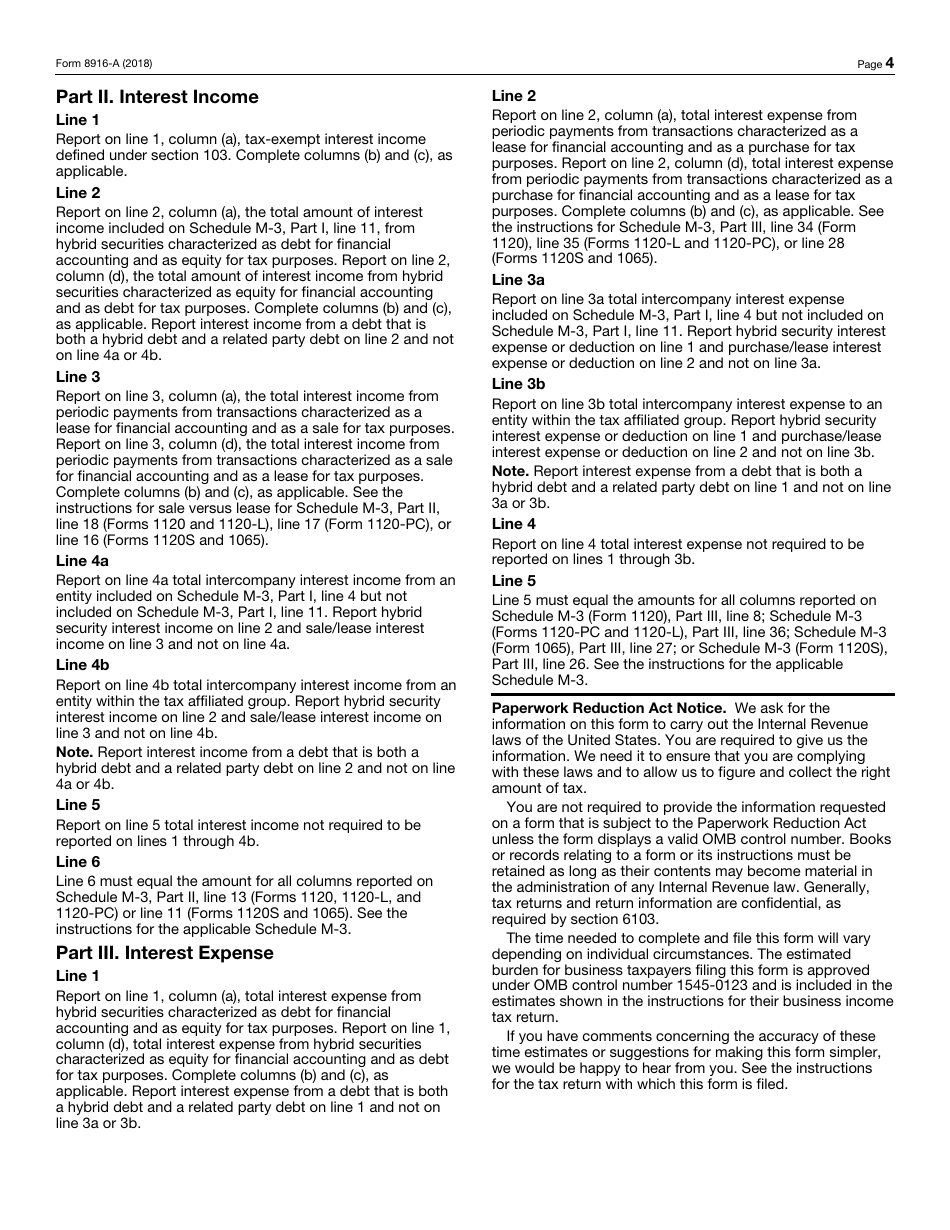

IRS Form 8916-A Supplemental Attachment to Schedule M-3

What Is IRS Form 8916-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8916-A?

A: IRS Form 8916-A is a supplemental attachment to Schedule M-3.

Q: What is the purpose of Form 8916-A?

A: Form 8916-A is used to provide additional information that is required for Schedule M-3.

Q: Who needs to file Form 8916-A?

A: This form is used by certain corporations and partnerships that are required to file Schedule M-3.

Q: When is Form 8916-A due?

A: The due date for Form 8916-A depends on the taxpayer's filing status and tax year. It is recommended to check the instructions of the form or consult a tax professional.

Q: Are there any other forms related to Form 8916-A?

A: Yes, Form 8916 is the main form that is used to calculate the total cost of employer-sponsored health coverage.

Q: What should I do if I have questions about Form 8916-A?

A: If you have specific questions or need assistance with Form 8916-A, it is recommended to consult a tax professional or contact the IRS directly.

Form Details:

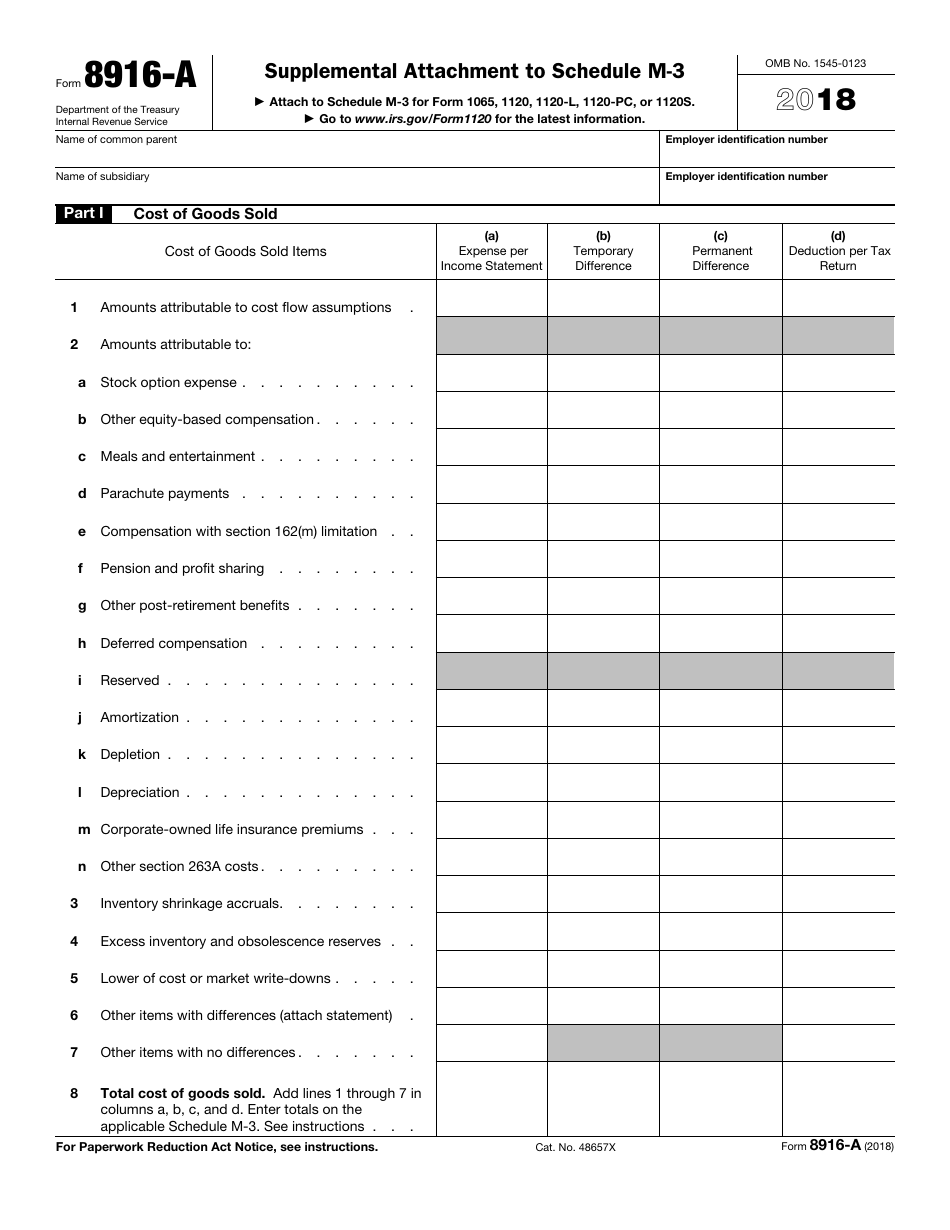

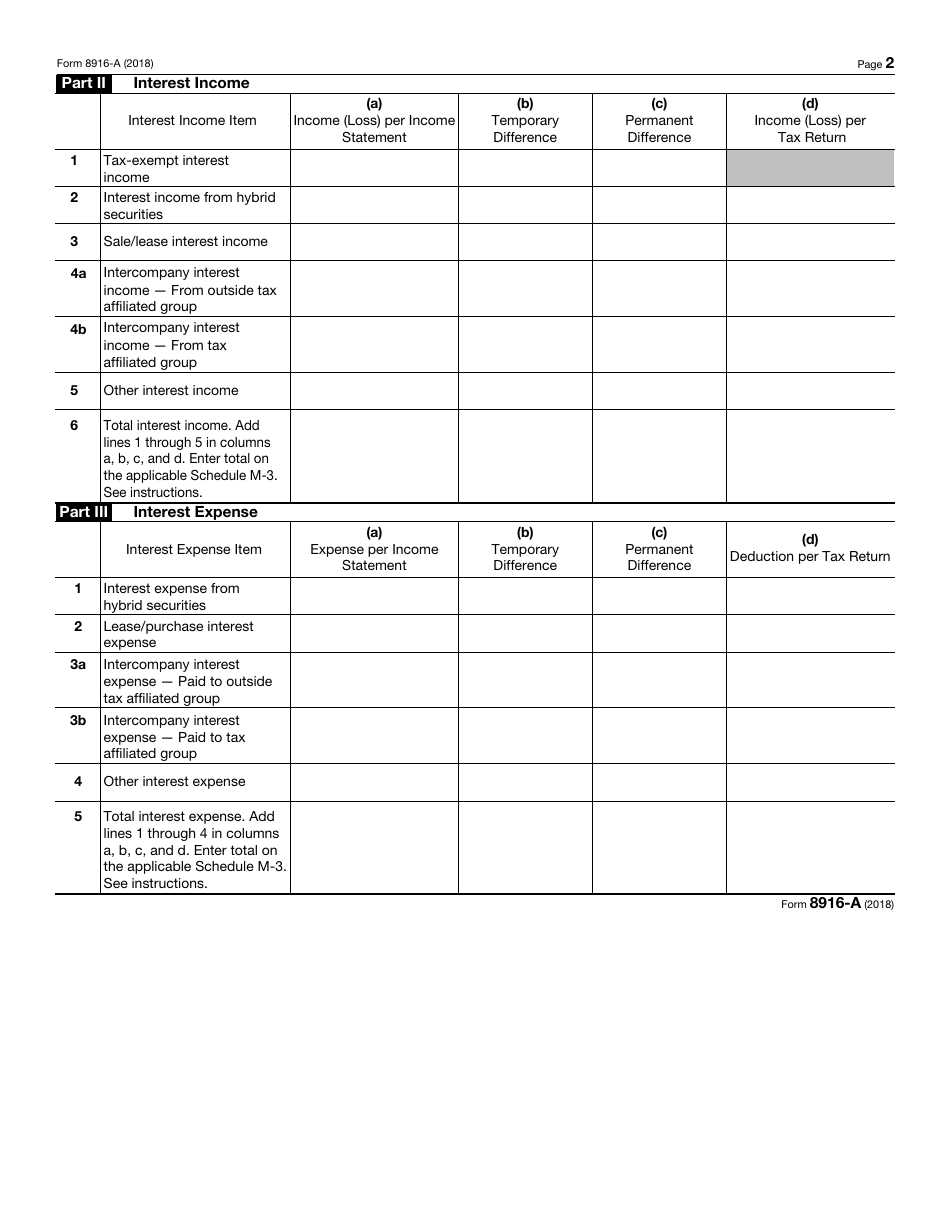

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8916-A through the link below or browse more documents in our library of IRS Forms.