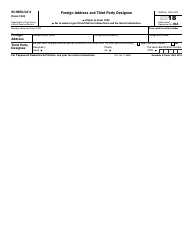

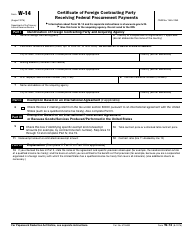

This version of the form is not currently in use and is provided for reference only. Download this version of

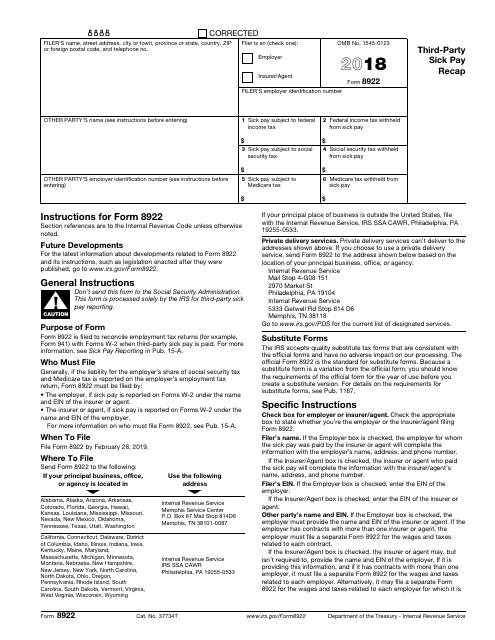

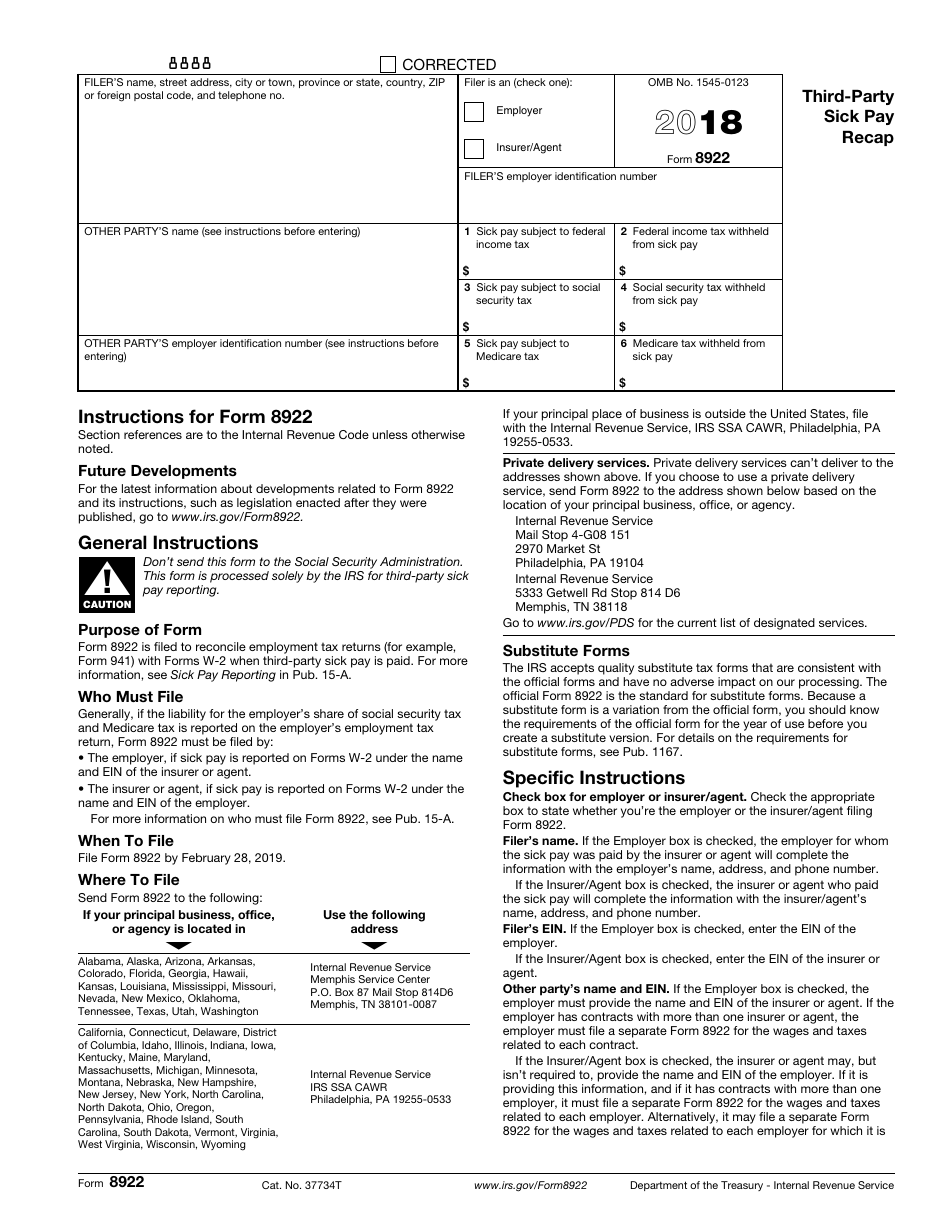

IRS Form 8922

for the current year.

IRS Form 8922 Third-Party Sick Pay Recap

What Is IRS Form 8922?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8922?

A: IRS Form 8922 is used to report third-party sick pay recaps.

Q: When is IRS Form 8922 used?

A: IRS Form 8922 is used when an employer is a third-party sick pay payer and needs to report the sick pay recap to the IRS.

Q: Who is required to file IRS Form 8922?

A: Employers who are third-party sick pay payers are required to file IRS Form 8922.

Q: What information is reported on IRS Form 8922?

A: IRS Form 8922 reports the total amount of sick pay paid during the year and the number of individuals for whom sick pay was paid.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8922 through the link below or browse more documents in our library of IRS Forms.