This version of the form is not currently in use and is provided for reference only. Download this version of

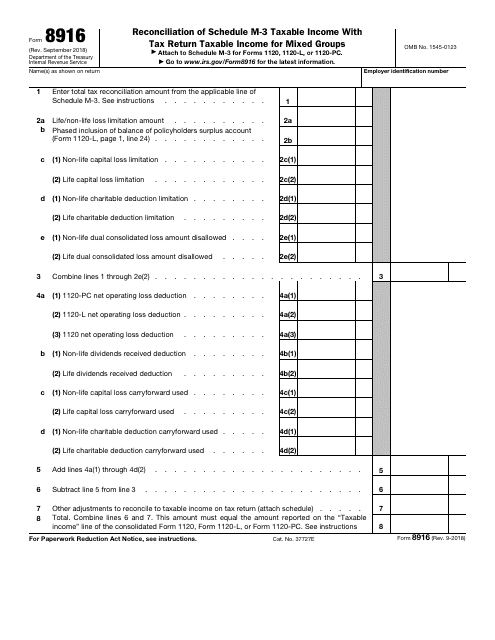

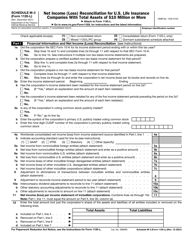

IRS Form 8916

for the current year.

IRS Form 8916 Reconciliation of Schedule M-3 Taxable Income With Tax Return Taxable Income for Mixed Groups

What Is IRS Form 8916?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8916?

A: IRS Form 8916 is a form used to reconcile Schedule M-3 taxable income with tax return taxable income for mixed groups.

Q: What is a mixed group for tax purposes?

A: A mixed group for tax purposes is a group of corporations that includes both domestic and foreign corporations.

Q: Why is reconciliation necessary for mixed groups?

A: Reconciliation is necessary to ensure that the taxable income reported on Schedule M-3 matches the taxable income reported on the tax return for mixed groups.

Q: What is Schedule M-3?

A: Schedule M-3 is a form used by corporations to reconcile book income and tax income.

Q: What is the purpose of Schedule M-3?

A: The purpose of Schedule M-3 is to provide the IRS with detailed information about the differences between a corporation's book income and tax income.

Q: Who is required to file Form 8916?

A: Form 8916 is required to be filed by mixed groups with $50 million or more in assets.

Q: What information is required to complete Form 8916?

A: To complete Form 8916, you need the Schedule M-3 and tax return of the mixed group, along with any additional information required by the form.

Q: What are the penalties for not filing Form 8916?

A: Failure to file Form 8916 can result in penalties imposed by the IRS.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8916 through the link below or browse more documents in our library of IRS Forms.