This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 8888

for the current year.

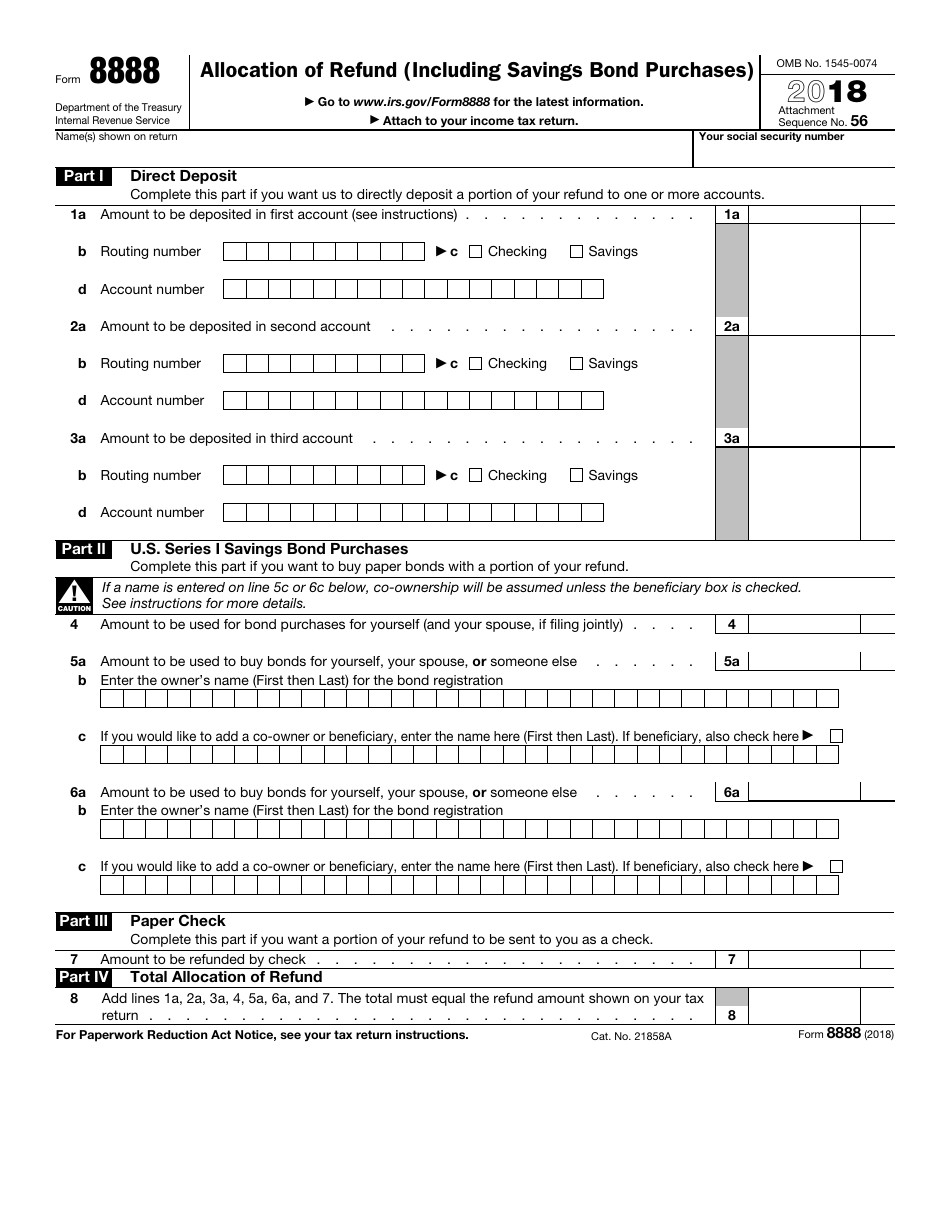

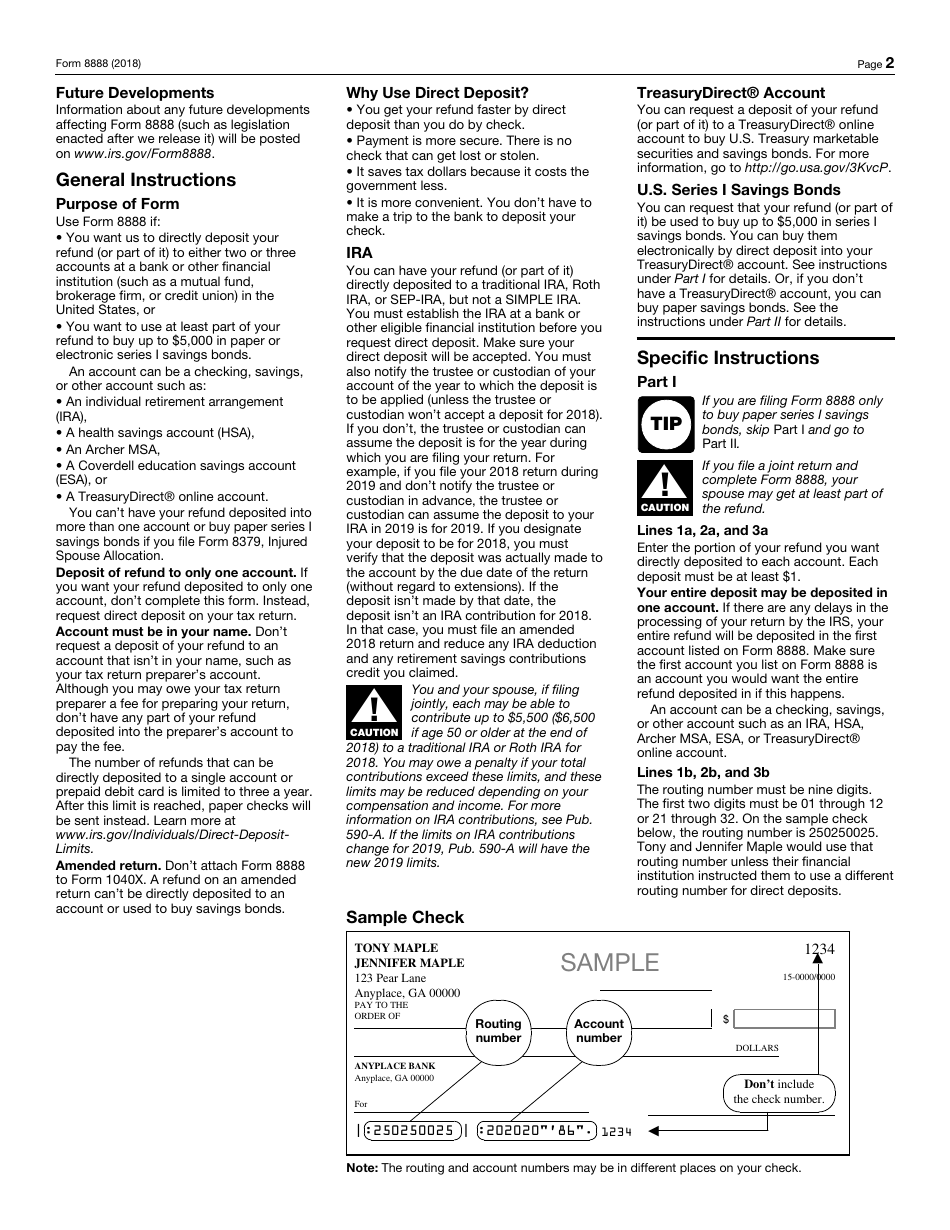

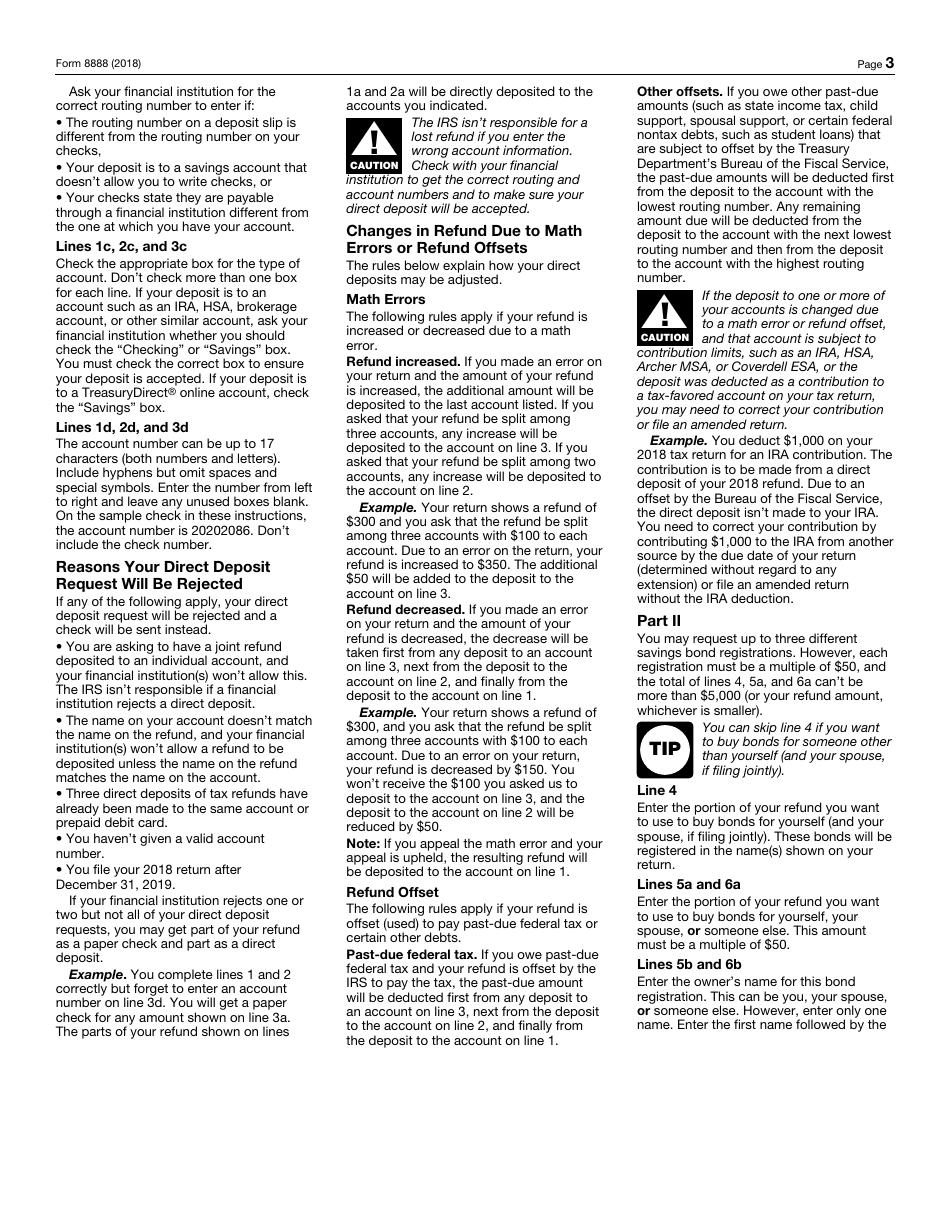

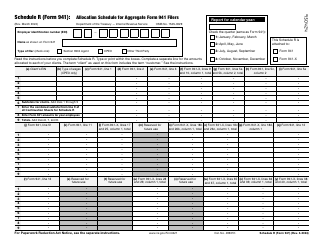

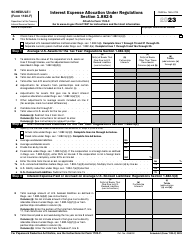

IRS Form 8888 Allocation of Refund (Including Savings Bond Purchases)

What Is IRS Form 8888?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8888?

A: IRS Form 8888 is used to allocate your tax refund to different accounts or investments.

Q: Why would I need to use Form 8888?

A: You would need to use Form 8888 if you want to split your tax refund into multiple accounts, such as a checking account, savings account, or even to purchase savings bonds.

Q: What can I allocate my tax refund to using Form 8888?

A: You can allocate your tax refund to a checking account, savings account, individual retirement arrangement (IRA), health savings account (HSA), or to purchase savings bonds.

Q: Can I use Form 8888 to allocate my tax refund to someone else?

A: No, Form 8888 can only be used to allocate your tax refund to accounts that you own or to purchase savings bonds in your name.

Q: Is there a limit to the number of allocations I can make on Form 8888?

A: No, there is no limit to the number of allocations you can make on Form 8888. You can split your refund into as many accounts as you wish.

Q: Can I use Form 8888 if I am receiving a direct deposit refund?

A: Yes, you can still use Form 8888 to allocate your direct deposit refund to different accounts or investments.

Q: Do I need to attach any documents to Form 8888?

A: No, you do not need to attach any documents to Form 8888. However, you should keep a copy of the form for your records.

Q: When is the deadline to submit Form 8888?

A: The deadline to submit Form 8888 is usually the same as the deadline to file your tax return, which is April 15th (unless that date falls on a weekend or holiday).

Form Details:

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8888 through the link below or browse more documents in our library of IRS Forms.